Exploration and Production: 2021-3Q Review and Outlook

Noble Capital Markets Energy Sector Review – October 2021

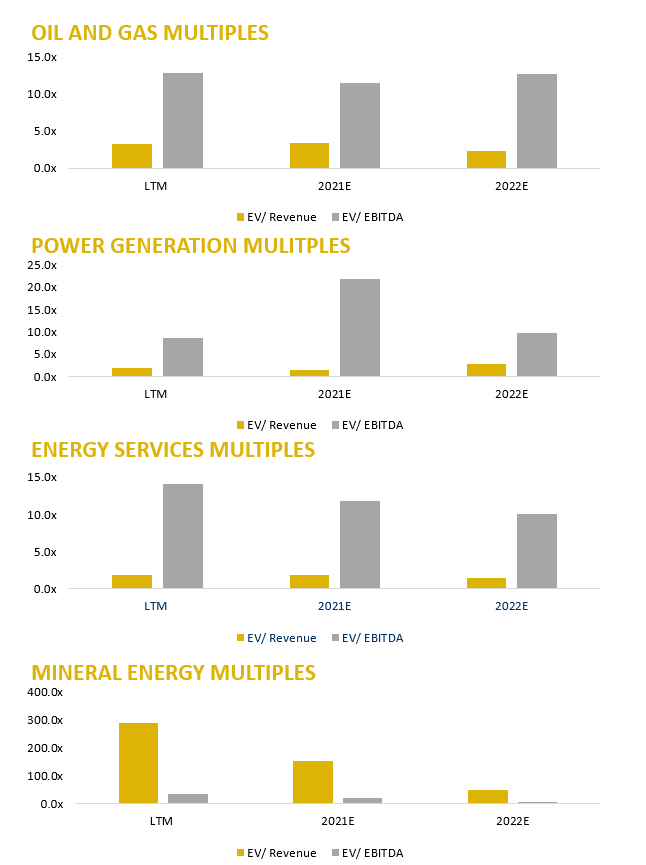

Source: Capital IQ as of 09/30/2021

Source: Energy Information Administration as of 09/30/2021

ENERGY INDUSTRY OUTLOOK

Exploration and Production: 2021-3Q Review and Outlook

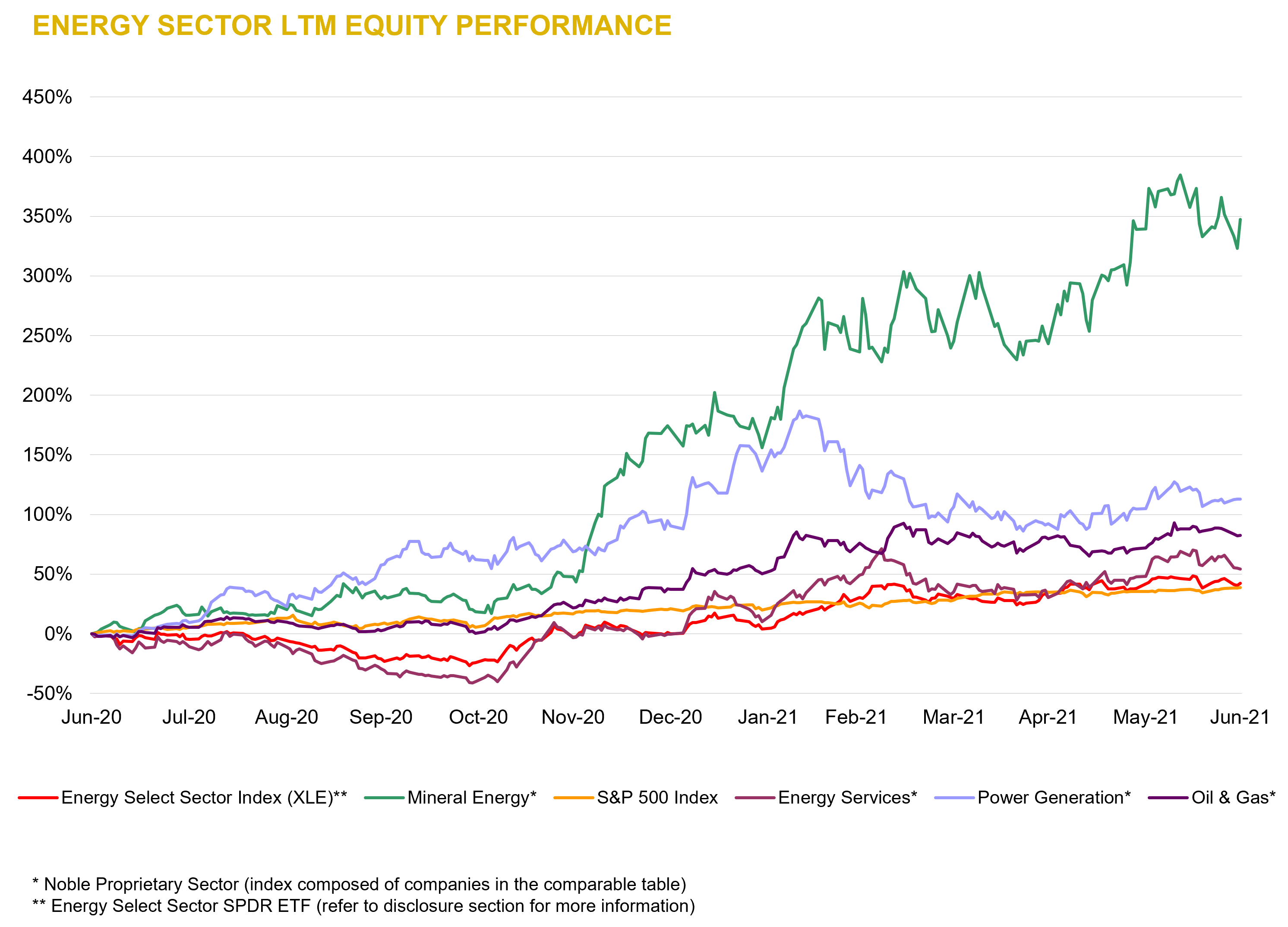

Energy Stocks Performance

Energy stocks, as measured by the XLE Energy Index, declined sharply in the first half of the quarter falling as much as 16%. The second half of the quarter was a different story with the index regaining lost ground and finishing within 0.04 points, or 0.01% of where it began. This is in direct contrast to the S&P 500 Index which rose steadily in July and August before giving back much of its outperformance in September and ending the quarter up a modest 0.85%

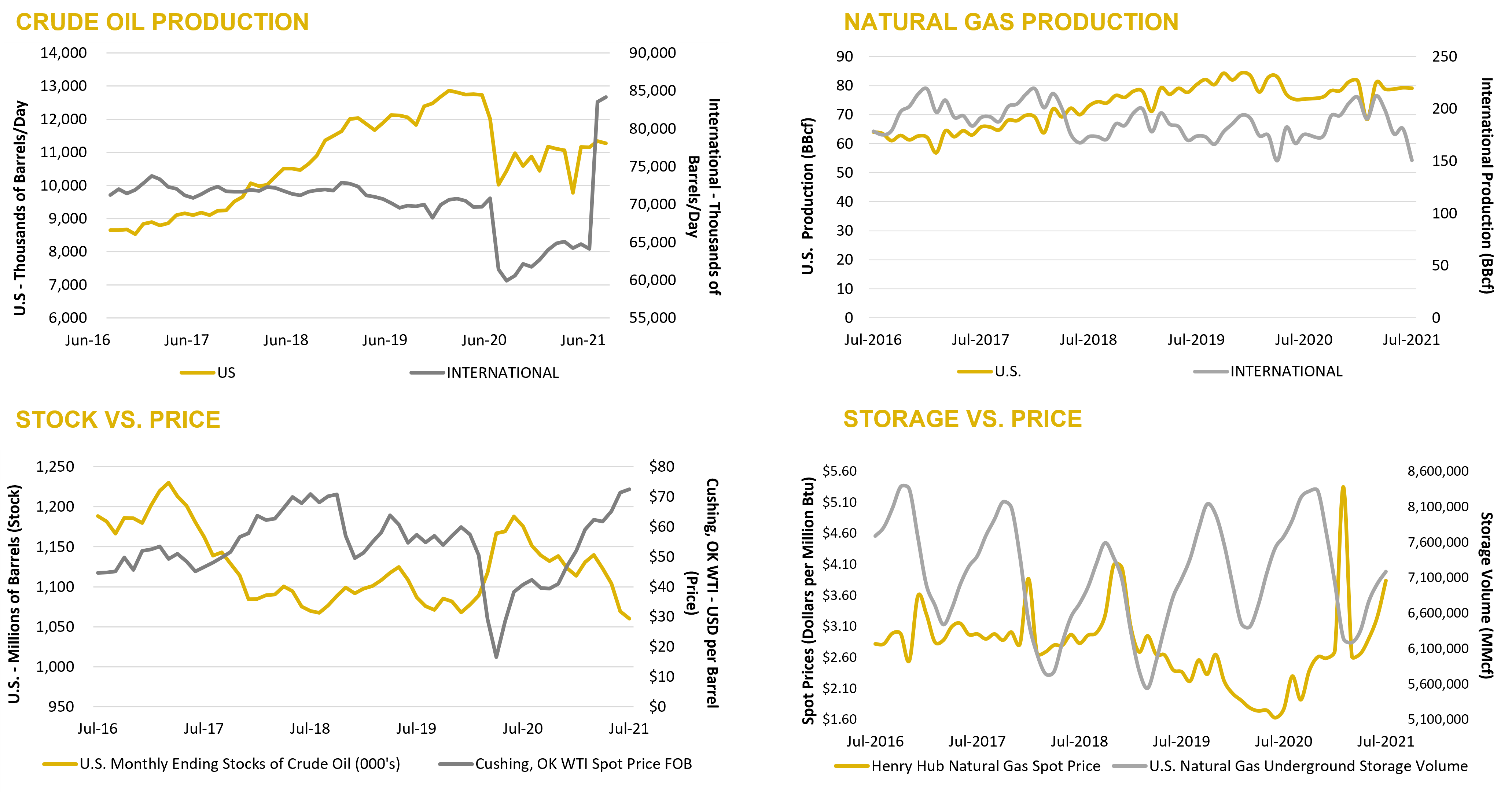

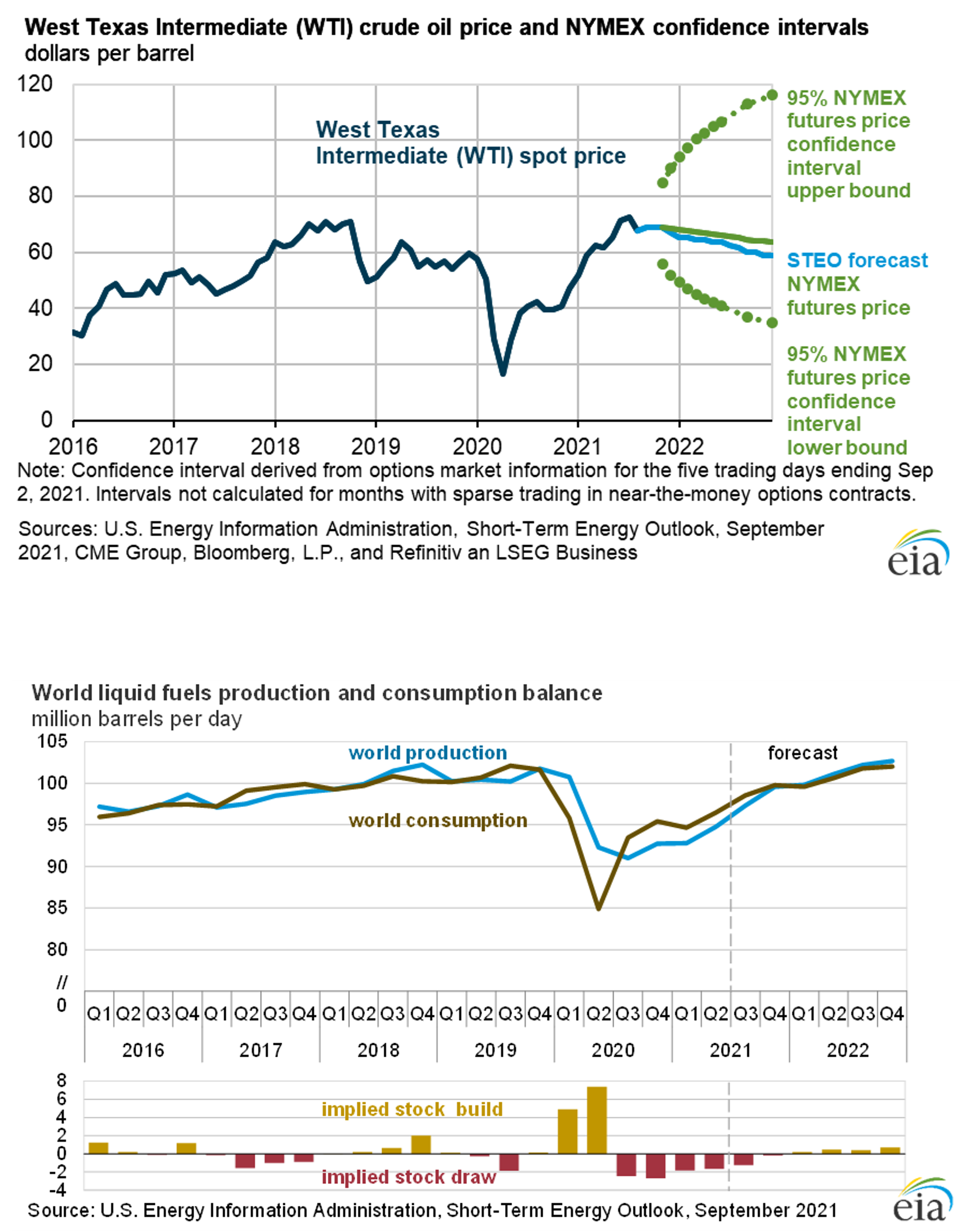

Oil Prices

As one might expect, the XLE Index largely mirrored oil prices. WTI oil prices began the quarter at $75.23/bbl., fell to as low as $62.32/bbl., and then shot up sharply to $75.88/bbl. Prices have surpassed peak levels reached in 2018. One would have to go back to 2014 to find higher oil prices. What’s more, oil prices show no signs of letting up. Drilling rig count has started to increase, but not at a level one would expect for this oil price level. Brent oil prices have also been strong and are close to crossing $80/bbl. The spread between Brent and WTI prices has widened but remain below the traditional spread of around $5/bbl. The WTI oil futures curve shows oil prices declining on the out months but staying above $74/bbl. through December.

High oil prices, combined with improved operating efficiencies mean that production companies are facing very favorable returns on their investment. We look for companies to start reporting strong positive cash flow and to use cash flow to increase drilling and improve balance sheets. We do not expect companies to raise dividend payments given the cyclical nature of recent oil price trends but would not rule out share repurchases if stock prices do not rebound further.

Natural Gas Prices

The rise in oil prices is impressive, but it pales in comparison to the jump in natural gas prices. Henry Hub gas prices rose 53% during the quarter and are now trading at a level of $5.619/mcf. One would have to go back to 2008 to find natural gas prices this high. Interestingly, the rise has come during the normally quiet summer months. The race to refill storage units that began in March has been negatively impacted by tepid drilling activity combined with high gas demand due to hot weather this summer. Natural gas future prices rise through the high-demand months of winter. The January contract, for example, trades at $5.85/mcf.

Source: Michael Heim 10/04/2021; Energy Information Agency (EIA)

Source: Capital IQ as of 09/30/2021

Longer-term energy trends

Energy sources in the United States are undergoing a significant transformation away from carbon-based fuels. While this should not be a surprise to anyone, it is worth taking a long-term view of energy consumption to highlight how the transformation has accelerated in recent years. Coal consumption has been replaced by renewable, nuclear, and natural gas. Worth noting, petroleum consumption, which grew dramatically in the last 50 years, has maintained the levels reached at the end of the century. We believe this trend will continue with petroleum providing a smaller portion of the overall energy picture, but not necessarily declining in absolute value.

Outlook

The rebound in oil and natural gas prices came faster than expected and is staying higher than we would have expected. We have been adjusting our models to reflect higher prices but are maintaining our long-term oil price forecast of $50 per barrel and $2.50 per mcf. Energy companies should start reporting positive cash flow at these prices and increasing drilling budgets.

Our near-term outlook for energy stocks remains positive. Wells being drilled today at current prices are generating cash flow to repay drilling costs in a matter of months, not years. We expect companies to report favorable results for the next few quarters. Longer-term, we have concern that oil demand will be constrained by power generation competition from renewable energy and decreased demand for gasoline and diesel due to a growth in electric vehicles. At the same time, increased supply from OPEC and continued drilling productivity will eventually mean lower energy prices. However, the near-term returns are so favorable, we believe investors will be amply rewarded before such a time arrives. We recommend investor shift their attention to companies with active drilling programs and a plethora of drilling options.

Source: Michael Heim 10/04/2021; Energy Information Agency (EIA)

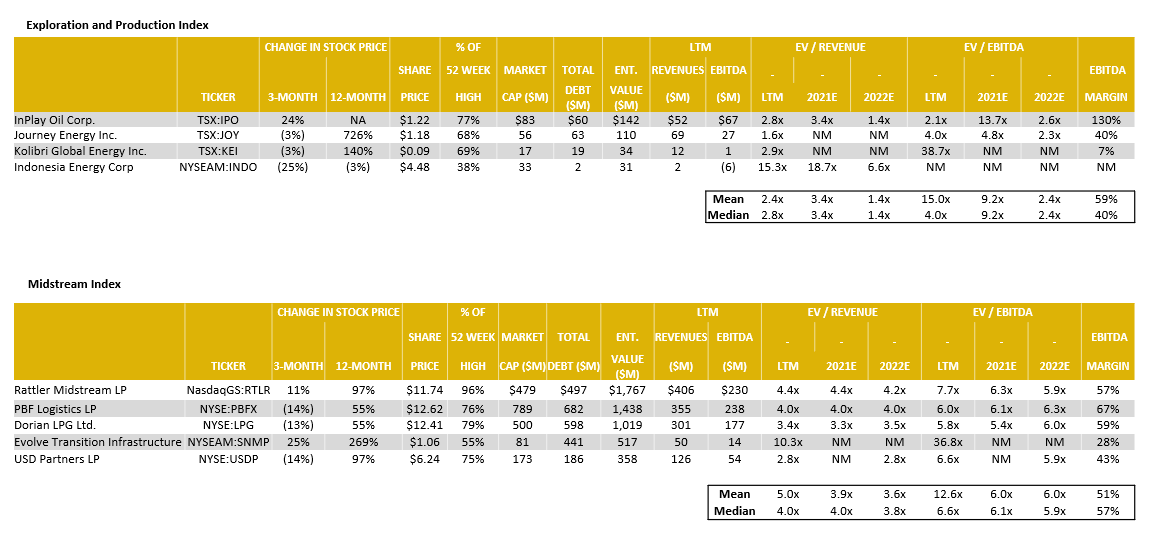

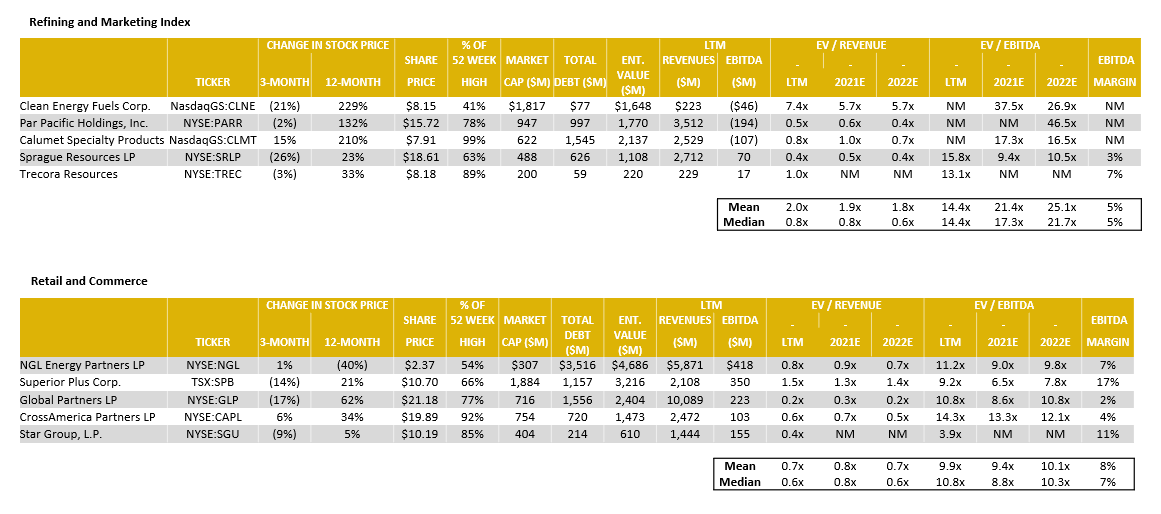

Oil & Gas – Comparable Tables

Source: Capital IQ as of 09/30/2021

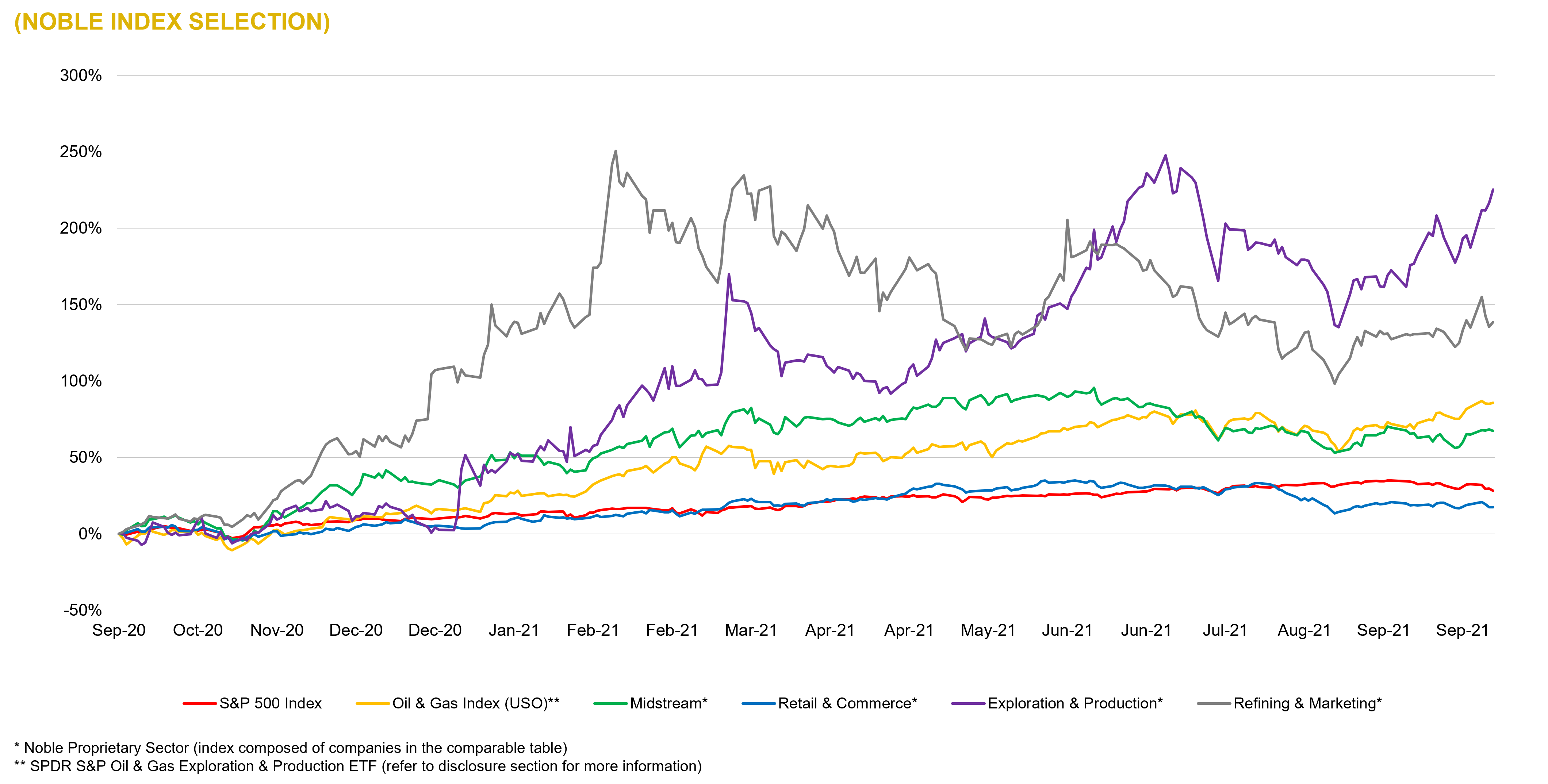

Oil & Gas – LTM Equity Performance

Source: Capital IQ as of 09/30/2021

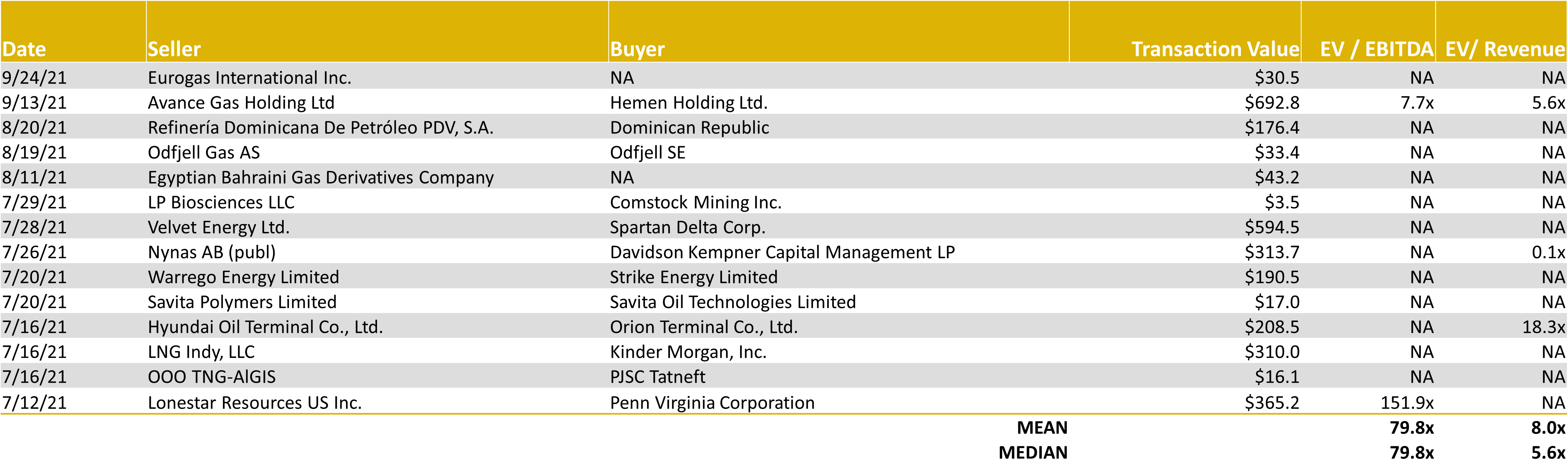

Oil & Gas – 2021-3Q Global M&A Activity

Source: Capital IQ as of 09/30/2021

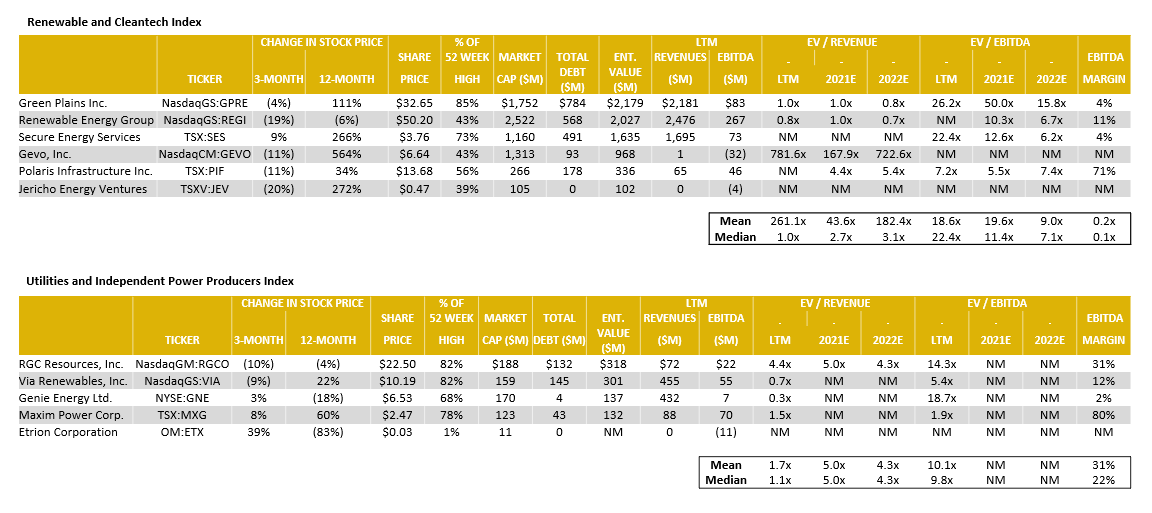

Power Generation – Comparable Tables

Source: Capital IQ as of 09/30/2021

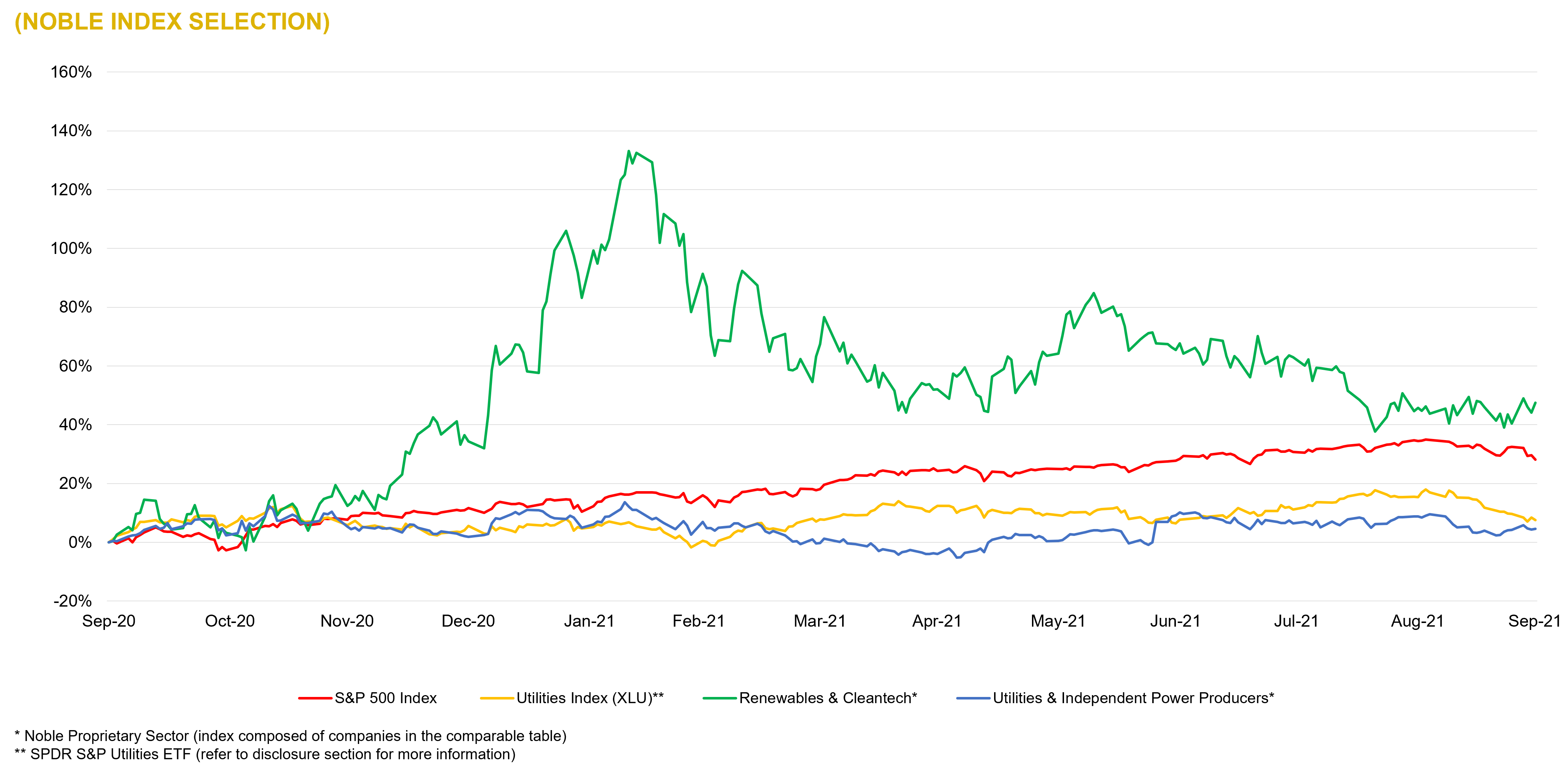

Power Generation – LTM Equity Performance

Source: Capital IQ as of 09/30/2021

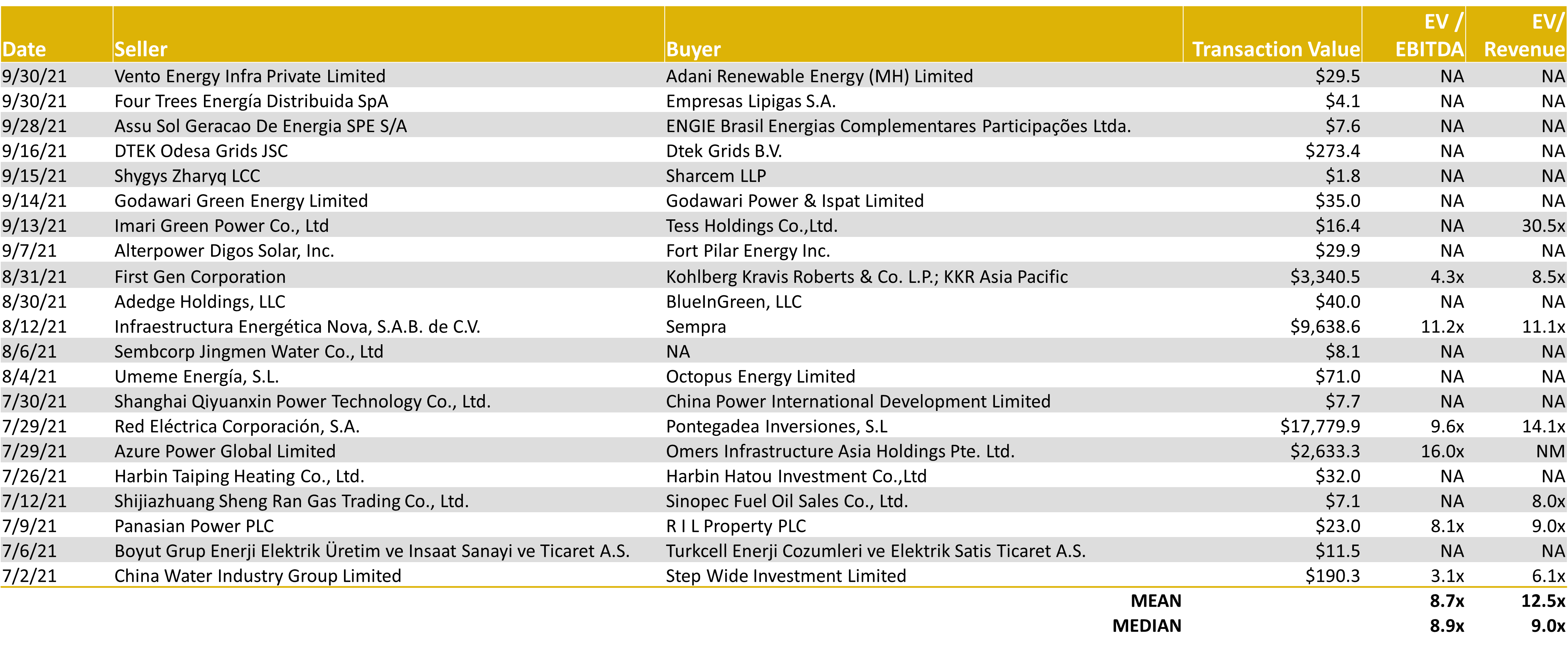

Power Generation – 2021-3Q Global M&A Activity

Source: Capital IQ as of 09/30/2021

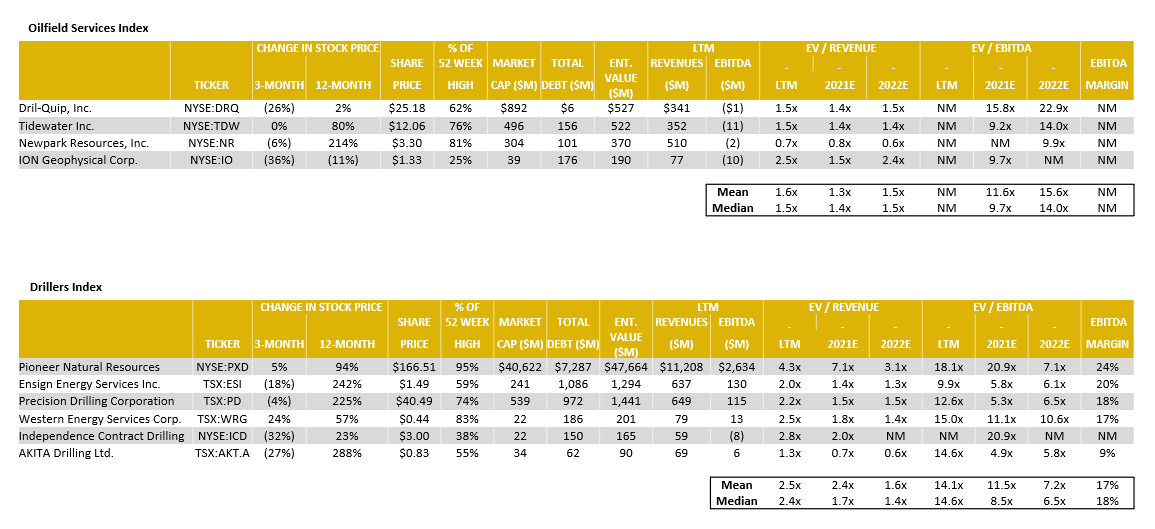

Energy Services – Comparable Tables

Source: Capital IQ as of 09/30/2021

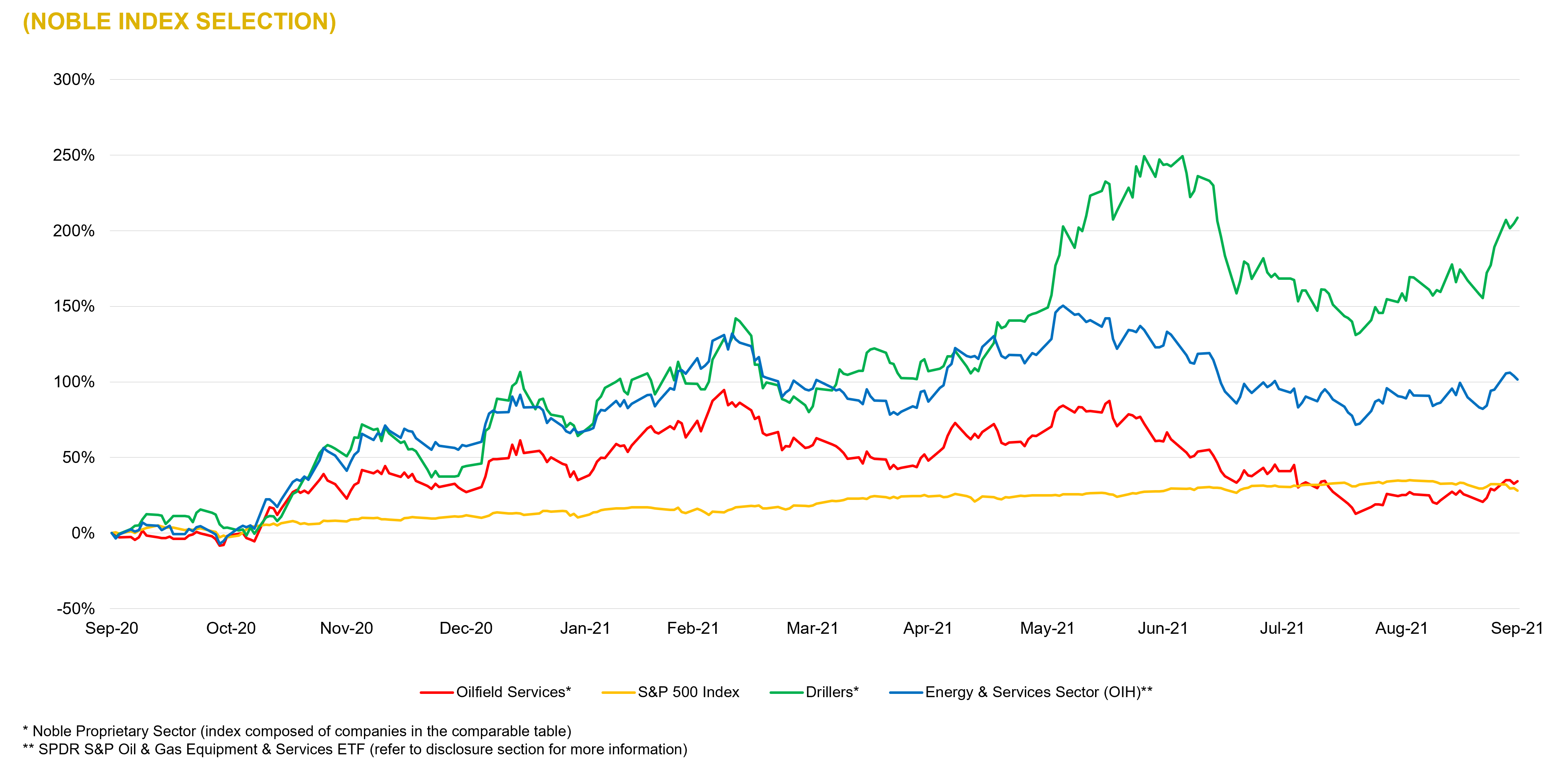

Energy Services – LTM Equity Performance

Source: Capital IQ as of 09/30/2021

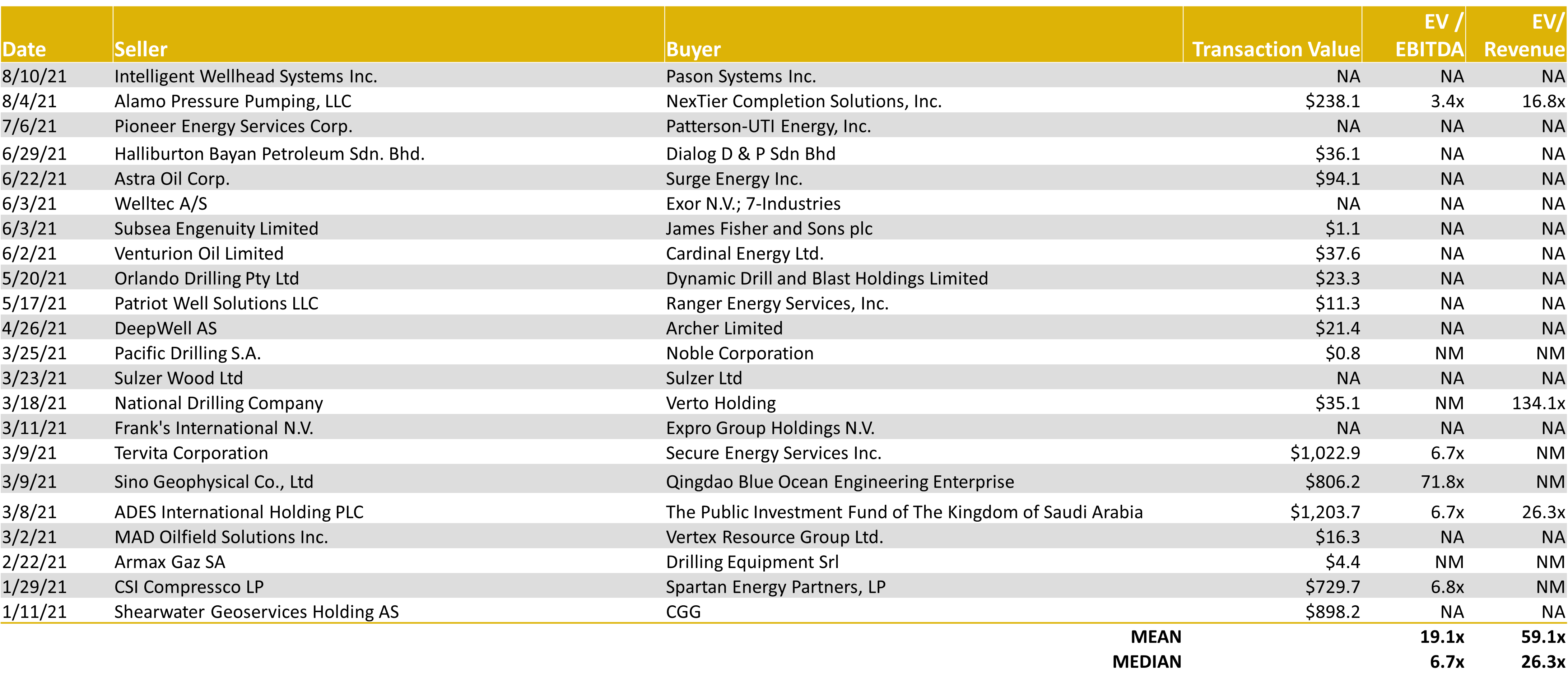

Energy Services – YTD Global M&A Activity

Source: Capital IQ as of 09/30/2021

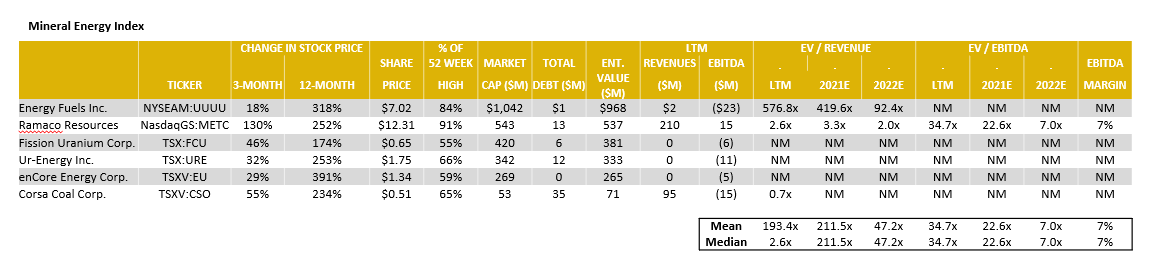

Mineral Energy – Comparable Tables

Source: Capital IQ as of 09/30/2021

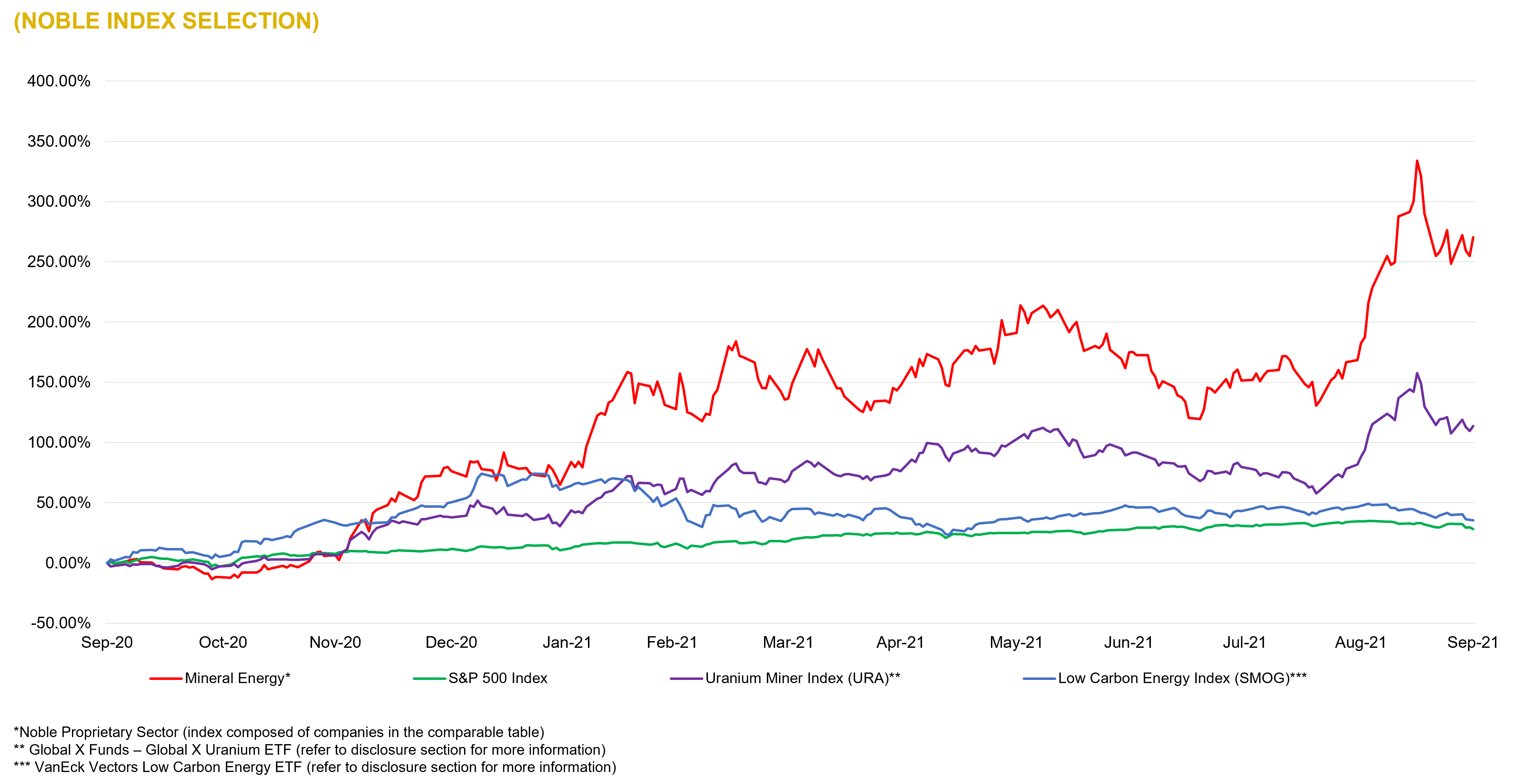

Mineral Energy – LTM Equity Performance

Source: Capital IQ as of 09/30/2021

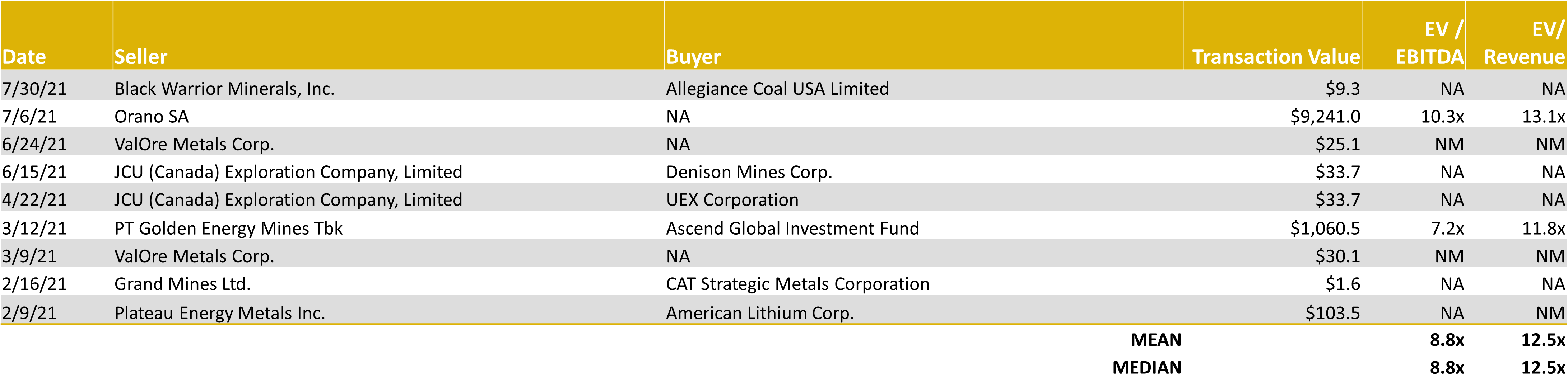

Mineral Energy – YTD Global M&A Activity

Source: Capital IQ as of 09/30/2021

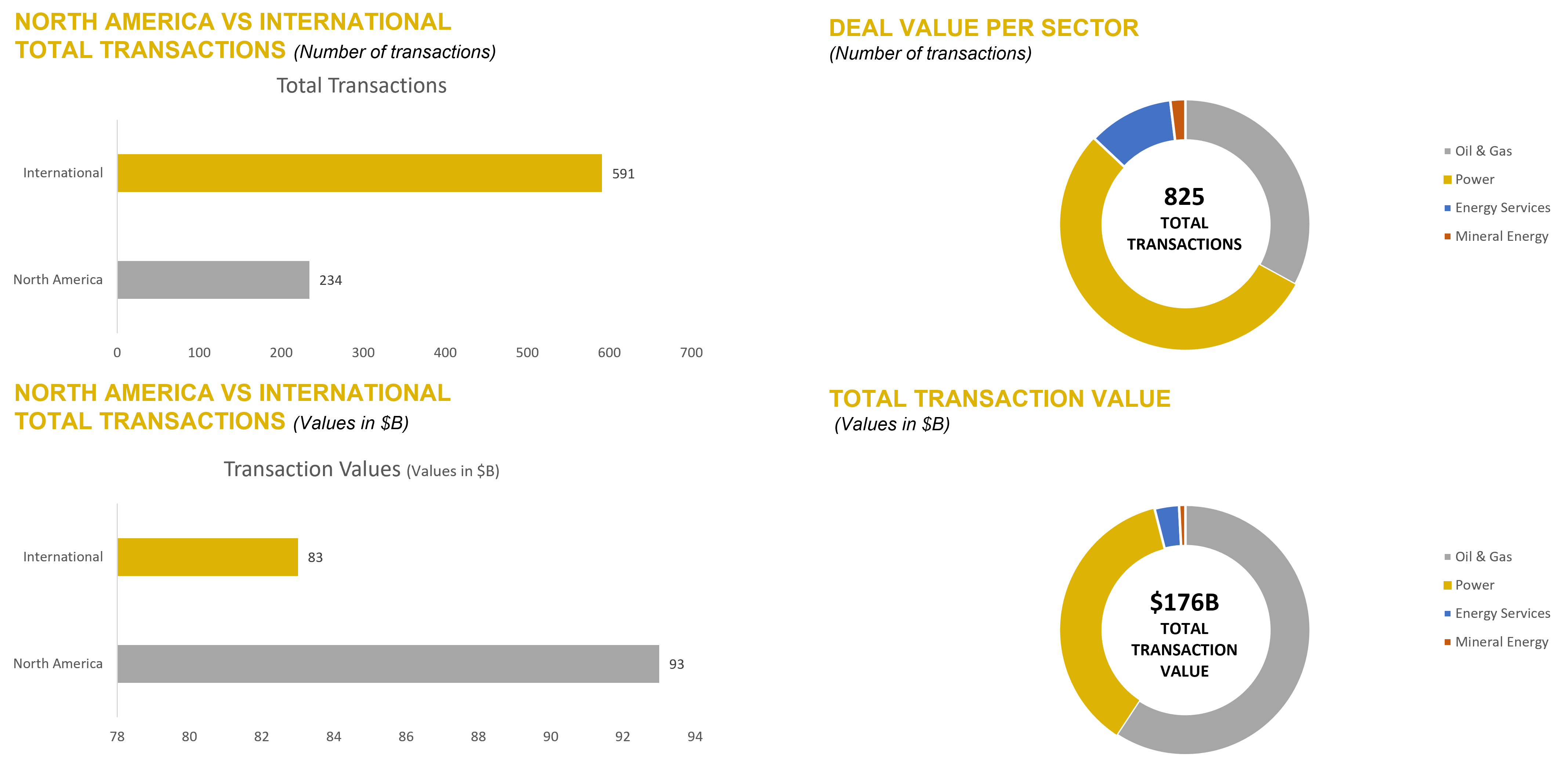

LTM Energy – YTD Energy Industry M&A Summary

Source: Capital IQ as of 09/30/2021

NOBLE QUARTERLY HIGHLIGHTS

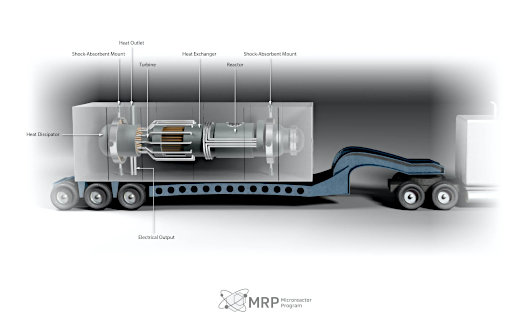

Jericho Energy Ventures (TSXV:JEV)

Industry: Energy – Green energy

Jericho Energy Ventures (JEV) is focused on advancing the low-carbon energy transition with investments in hydrogen technologies, energy storage, carbon capture and new energy systems. JEV’s wholly owned subsidiary, Hydrogen Technologies, delivers patented, zero-emission boiler technology to the $30 Billion Commercial & Industrial heat and steam industry in addition to its investment in H2U’s electrocatalyst and low-cost electrolyser platform. JEV also owns and operates producing oil and gas assets in the US Mid-Continent, predominantly in Oklahoma.

3rd Quarter News Highlights:

July 22, 2021: Jericho Energy Ventures Co-Leads Investment into Hydrogen Catalyst Discovery Platform. Jericho’s USD$1.5 million Co-Lead investment is joined by Dolby Family Ventures, Hess Corporation (NYSE: HES) and Motus Ventures – with a total Series A raise of approximately USD$7 million. H2U intends to use this funding to support the start-up and development of its proprietary electrocatalyst discovery process and machinery.

Yangarra Resources Ltd. (TSX:YGR)

Industry: Energy – Oil and gas; Exploration and production

Yangarra Resources Ltd. is a junior oil and gas company engaged in the exploration, development and production of natural gas and oil with operations in Western Canada, with a focus on Central Alberta, where the Company has extensive infrastructure and land holdings.

3rd Quarter News Highlights:

September 28, 2021: Yangarra Resources Ltd. reached a new 52-Week high of $1.88 CAD. A record that tells how investors in the Oil and Gas space are valuing companies as a response of recent oil price surges and other diverse industry constraints. The analysts’ consensus rated the stock as a “Hold” and the average price target is $1.59 CAD as of the date posted.

Bonterra Energy Corp. (TSX:BNE)

Industry: Energy – Oil and gas; Exploration and production

Bonterra Energy Corp. is a conventional oil and gas corporation with operations in Alberta, Saskatchewan and British Columbia, focused on its strategy of long-term, sustainable growth and value creation for shareholders.

3rd Quarter News Highlights:

August 16, 2021: Bonterra Energy announced the appointment of Stacey McDonald to the Board of Directors. Ms. McDonald brings more than 16 years of experience across the energy and finance sectors and counts with broad track record in financial analysis and the oil and gas industry. Ms. McDonald will serve as a member of the Corporation’s Audit, Compensation, and Governance & Nominating Committees.

Source: Company Press Releases

DOWNLOAD THE FULL REPORT (PDF)

Noble Capital Markets Energy Newsletter Q3 2021

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this newsletter, please contact >Francisco Penafiel

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter