FINNAIR AND GEVO ENTER INTO

SUSTAINABLE AVIATION FUEL SALES AGREEMENT FOR 7 MILLION GALLONS OF PER YEAR

OVER FIVE YEARS

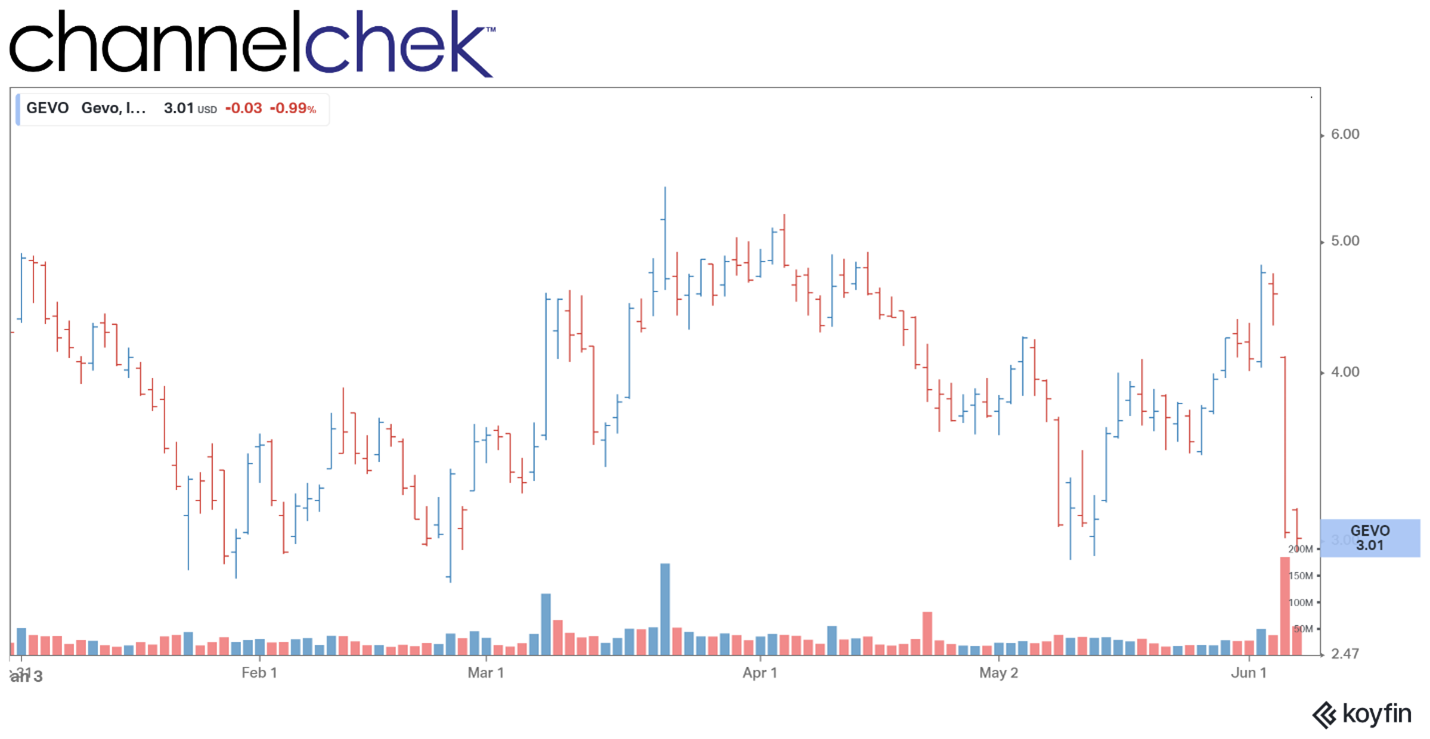

ENGLEWOOD, Colo., June 21, 2022 (GLOBE NEWSWIRE) — Gevo, Inc. (NASDAQ: GEVO) is pleased to announce a new fuel sales agreement with Finnair. The Agreement outlines the details for the purchase of 7 million gallons per year of sustainable aviation fuel (SAF) for five years from Gevo’s commercial operations. Deliveries of the SAF by Gevo are expected to begin in 2027. The expected value for the Agreement to be $192 million over the five-year period, inclusive of the value from environmental benefits for Gevo.

Finnair is a member of oneworld® Alliance, and this Agreement falls under the purview of a memorandum of understanding (MoU) that oneworld and Gevo signed in April 2022, laying the groundwork for the 14 world-class airlines in the alliance to purchase 200 million gallons of SAF per year, from Gevo’s commercial operations. The Agreement with Finnair will broaden Gevo’s range of airline partners and grow its global footprint with its sustainable fuel products, and also supports our efforts in pursuit of our stated goal of producing and commercializing a billion gallons of SAF by 2030.

“Gevo was founded on the principle of building sustainability into every step of our process,” said Dr. Patrick R. Gruber, Gevo’s Chief Executive Officer. “But it is not static—it’s always improving: We’re constantly incorporating new developments at every stage of our business system to reduce our carbon intensity. This is expected to make the renewable energy carried in our advanced renewable fuels even more impactful as they help to lower our customers’ carbon scores.”

Finnair uses an extensive toolkit to achieve emission reductions – using sustainable aviation fuels, reducing the weight of aircraft, developing fuel-efficient flight methods, offsetting, and engaging customers in reducing aviation emissions. Finnair is also actively exploring the possibilities of introducing new technologies into its operations.

“Finnair has ambitious emissions reduction targets: by the end of 2025, we intend to halve the level of net emissions from 2019 and achieve carbon neutrality latest by the end of 2045. SAF plays an important role for reaching these targets,” says Eveliina Huurre, SVP Sustainability at Finnair.

Gevo’s process is designed to create multiple efficiencies by allowing the same acre of farmland to produce SAF from corn using atmospheric carbon while simultaneously adding high-value nutritional products to the food chain.

“Finnair knows the future will be built on renewable energy, and our SAF delivers renewable energy in a drop-in fuel that is expected to make an impact right away,” said Dr. Gruber. “Because its fungible, this SAF is expected to reduce the carbon intensity in any flight proportional to the blend used to fill up the aircraft.”

The Agreement with Finnair is subject to certain conditions precedent, including Gevo developing, financing, and constructing one or more production facilities to produce the SAF contemplated by the Agreement.

About Gevo

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel and diesel fuel, that when burned have potential to yield net-zero greenhouse gas emissions when measured across the full life cycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their life cycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low-carbon products such as gasoline components, jet fuel and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Gevo believes that the Argonne National Laboratory GREET model is the best available standard of scientific-based measurement for life cycle inventory or LCI.

Learn more at Gevo’s website: www.gevo.com

About Finnair

Finnair is a network airline, specialising in connecting passenger and cargo

traffic between Asia, North America and Europe. Sustainability is at the heart

of everything we do – ?Finnair intends to reduce its net emissions by 50% by

the end of 2025?from the 2019 baseline?and achieve carbon neutrality latest by

the end of 2045. Finnair is a member of the oneworld alliance. Finnair Plc’s

shares are quoted on the Nasdaq Helsinki stock exchange.

Learn more about Finnair here: finnair.com

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, without limitation, including Gevo’s technology, the agreement with Finnair, Gevo’s ability to develop, finance and construct one or more production facilities to produce the SAF contemplated by the Agreement with Finnair, the timing of Gevo producing the SAF for Finnair, Gevo’s estimate of the expected value of the Agreement with Finnair, the oneworld Alliance, Gevo’s production of SAF, the attributes of Gevo’s products, Gevo’s ability to create net-zero carbon intensity products, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2021, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Media Contact

Heather L. Manuel

+1 303-883-1114

IR@gevo.com