The Last Thing You’ll Ever Need to Read About the Berkshire Hathaway Meeting Until 2021 (Seriously!)

Did you miss Bill Murray’s question at the Berkshire Hathaway annual meeting? The question from the star of Caddyshack occurs at 04:15:32 into the presentation. How about Warren Buffett’s opinion about fudge? That was at 02:31:27 into the meeting.

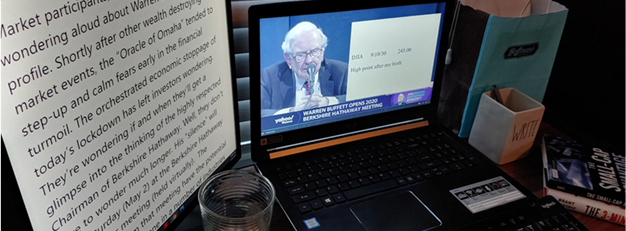

As an investment professional and a writer, I know the power and influence of Buffett’s words. I had intended to watch the whole annual meeting live that Saturday and take notes for future articles. But, weekends don’t always turn out as planned, I watched only the first 20 minutes.

It seems there was a lot I missed. Some of it has already been covered by other financial news and information outlets – topics like selling airline stocks, cash position, etc. But, most of the four and a half-hour meeting could not possibly be covered by the media. And, as is usually the case with Buffett, there were some common-sense investing brilliance and some down-home nuggets to feast on. For example: Do you know how long it’s been since Warren has had a haircut? 02:08:37 Or, what kind of shape Charlie Munger is in? 00:06 All these questions and more can be found in the transcript below, along with the corresponding video.

About the Transcript

Channelchek did not create this transcript. The full four-plus hours were created with impressive accuracy and readability by a transcription company named Rev. I mention this now for three reasons.

- There is a library of financial transcripts on their website that is pure gold if you are a financial professional planning a speech, seminar, or blog post.

- As someone who has used transcription services to have interviews turned into text, this transcript is among the best work I’ve experienced.

- If I placed Rev

as a “Source” at the bottom of this story, as is my usual format, most readers would not see it. They’re a resource I thought readers of this column would find useful.

How to Get the Most out of This Transcript

The first thing I noticed is that it’s 37,000 words long. I realized I had to find a shortcut. My solution was simple; I recommend you try this as well. Copy all of the below text into Microsoft WORD. Then, under “Home,” look for “Find” toward the right on your menu bar. Click “Find” click “Find” again in the dropdown menu, and a Navigation screen should pop-up on the left. Type a search term in the box such as “Bitcoin” or “peanut brittle” and get exactly what was said in both written form and in video.

Enjoy!

Paul Hoffman

Managing Editor

Warren Buffett, Berkshire

Hathaway Annual Meeting, May 2, 2020

Warren Buffett: (00:06)

This is the annual meeting of Berkshire Hathaway. It doesn’t look like an annual meeting. It doesn’t feel exactly like an annual meeting, and it particularly doesn’t feel like an annual meeting because my partner of 60 years, Charlie Munger, is not sitting up here. I think most of the people that come to our meeting really come to listen to Charlie. But I want to assure you, Charlie at 96 is in fine shape. His mind is as good as ever. His voice is as strong as ever, but it just didn’t seem like a good idea to have him make the trip to Omaha for this meeting. Charlie, Charlie is really taking to this new life. He’s added Zoom to his repertoire. So has meetings every day with various people, and he’s just skipped right by me technologically. But that really isn’t such a huge achievement. It’s more like, kind of like stepping over a peanut or something. But nevertheless, I want you to assure you, Charlie is in fine shape, and he’ll be back next year. We’ll try to have everything in the show that we normally have next year.

Warren Buffett: (01:26)

Ajit Jain also, who is the vice chairman in charge of insurance, is safely in New York. Again, it just did not seem worthwhile for him to travel to Omaha for this meeting. But on my left we do have Greg Abel, and Greg is the vice chairman in charge of all operations except insurance. So Greg manages a business that has more than 150 billion in revenues and crosses across dozens of industries and has more than 300,000 employees. He’s been at that job a couple of years, and frankly, I don’t know what I’d be doing today if I didn’t have Ajit and Greg handling the duties that I was doing only about a quarter as well a couple of years ago. So I owe a lot of thanks to Greg, and you’ll get exposed to him more as this meeting goes along.

Warren Buffett: (02:37)

The meeting will be divided into four parts, and in a moment or two, I will talk. Sort of a monologue was slides. I’ve never really used slides before. I’ve taught college classes intermittently but pretty steadily from age 21 to age 88, and I never recall using a single slide. But who says you can’t teach an old dog new tricks? So we’ll see whether you can or not. I’ve got a number of slides, and I would like you to take you through those. The first section, which we’ll start in just a minute, and then we’ll move on to a brief recap of Berkshire’s first quarter results.

Warren Buffett: (03:43)

Now we put those up in the 10Q, which was posted on the internet and berkshirehathaway.com this morning. There’s lots and lots of detail in there, so I’m not going to go through that. I’ll point out one or two things that may be of interest to you, and actually I’ll talk a little bit about what we did on April, which something that is new to Berkshire, be that current. But I’ll give you that. Then we’ll have the formal meeting, which will take maybe 15 or 20 minutes, and from there we’ll go to Becky Quick, who for a couple of hours will grill me and Greg on questions she’s selected from a huge batch that I’m told she’s received. They went to Carroll Lumas and Andrew Ross Sorkin as well as to Becky, but to simplify things. We’ve consolidated all those questions that Becky will ask. Like I say, we’ll go for a couple of hours, and there’s no specified cutoff time present. We’ll just see how things develop.

Warren Buffett: (05:02)

What’s of course on everybody’s mind the last two months or so is what’s going to be the situation in terms of health in the United States and what’s going to be the situation in terms of the economy in the United States in the months and perhaps the years to come. I don’t really have anything to add your knowledge on health. In school, I did okay in accounting, but I was a disaster in biology. I’m learning about these various matters the same way you are.

Warren Buffett: (05:52)

I think, personally I feel extraordinarily good about being able to listen to Dr. Fauci, who I had never heard of a year ago. But I think we’re very, very fortunate as a country to have somebody at 79 years of age who appears to be able to work 24 hours a day and keep a good humor about him and communicate in a very, very straightforward matter about fairly complex subjects and tell you when he knows something and when he doesn’t know something. So I’m not going to talk about any political figures at all or our politics generally this afternoon, but I do feel that I owe a huge debt of gratitude to Dr. Fauci for educating and informing me, actually along with my friend Bill Gates too, as to what’s going on. I know I get it from a straight shooter when I get it from either one of those. So thank you Dr. Fauci.

Warren Buffett: (07:13)

When this hit us, and as I sit here in this auditorium with 17 or 18,000 empty seats. The last time I was here, it was absolutely packed. Creighton was playing Villanova, and there were 17 or 18,000, whatever it holds. It was full, and there wasn’t one person in that crowd. This was in January. There wasn’t one person in that crowd that didn’t think that March madness wasn’t going to occur. It’s been a flip of the switch in a huge way in terms of national behavior, the national psyche. It’s dramatic. When we started on this journey, which we didn’t ask for, it seemed to me that it was an extraordinary wide variety of possibilities on both the health side and on the economic side. There was DEFCON 5 on one side and DEFCON 1 on the other side, and nobody really knows, of course, all the possibilities that there are, and they don’t know what probability factor to stick on them.

Warren Buffett: (08:38)

But in this particular situation, it did seem to me that there was an extraordinary range of things that could happen on the health side and an extraordinary range in terms of the economy. Of course they intersect and affect each other. So they’re bouncing off each other as you go along. I would say, again, I don’t know anything you don’t know about health matters, but I do think the range of possibilities has narrowed down somewhat in that respect. We know we’re not getting a best case, and we know we’re not getting a worst case. The possibility initially of the virus was hard to evaluate, and it’s so hard to evaluate. There’s a lot of things we’ve learned about it, a lot of things we know we don’t know, but at least we know what we don’t know. Some very smart people are working on it, and we’re learning as we go along.

Warren Buffett: (09:47)

But the virus obviously has been very transmissible, but on the good side, it’s not that good, but it is not as lethal as it might have been. We had Spanish flu in 1918 and my dad and four siblings and his parents went through it, and they have a terrific story in the March 15th edition of the Omaha World Herald that you can go to on omaha.com and look up. It’s also on the first page I believe on Google, if you put in Spanish flu Omaha. During that particular time in maybe four months or so, Omaha had 974, I believe, deaths, and that was a half of 1% of the population. That figure wasn’t greatly different than around the country. So you think about half of 1% of the population now you’re talking 1,700, 000 or thereabouts people and fortunately in terms of the worst case, this does not appear to, in fact I think you can almost rule out it being as lethal as the Spanish flu was. But it’s very, very transmissible. Of course we have the problem, we don’t know the denominator in terms of exactly how lethal it is because we don’t know how many people have had it and didn’t know they had it.

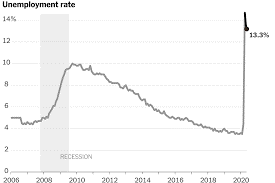

Warren Buffett: (11:36)

But in any event, the range of probabilities on health narrowed down somewhat, I would say the range, the probabilities, or possibilities, and on the economic side are still extraordinarily wide. We do not know exactly what happens when you voluntarily shut down a substantial portion of your society. In 2008 and ’09, our economic train went off the tracks, and there were some reasons why the [inaudible 00:12:23] was weak in terms of the banks and all of that sort of thing. But anyway, this time we just pulled the train off the tracks and put it on a siding, and I don’t really know of any parallel in terms of very, very one of the most important country in the world. Most productive, huge population. In effect sidelining its economy and its workforce and obviously and unavoidably creating a huge amount of anxiety and changing people’s psyche and causing them to somewhat lose their bearings in many cases, understandably.

Warren Buffett: (13:14)

This is quite an experiment and we may know the answer to most of the questions reasonably soon, but we may not know the answers to some very important questions for many years. So it still has this enormous range of possibilities. But even facing that, I would like to talk to you about the economic future of the country because I remain convinced as I have. I was convinced of this in World War II. I was convinced of it during the Cuban missile crisis, 9/11, the financial crisis, that nothing can basically stop America. We faced great problems in the past. We haven’t faced this exact problem. In fact, we haven’t really faced anything that quite resembles this problem, but we faced tougher problems the American miracle, the American magic has always prevailed, and it will do so again.

Warren Buffett: (14:39)

I would like to take you through a little history to essentially my case that if you were to pick one time to be born and one place to be born, and you didn’t know what your sex was going to be, you didn’t know what your intelligence would be. You didn’t know what your special talents or special deficiencies would be. That if you could do that one time, he would not pick 1720, you would not pick 1820, you would not pick 1920. You’d pick today, and you would pick America, and of course the interesting thing about it is that ever since America was organized in 1789 when George Washington took the oath of office, people have wanted to come here. Can you imagine that? For 231 years, there’s always been people that have wanted to come here.

Warren Buffett: (15:52)

My friend, I think I just jumped the gun just a shade. I’m putting up slide on. But I’m going to call from some slides as we go along. But the interesting thing about this country is what is on slide one? Let’s put it up. This is an extraordinarily young country. Now I’m comparing it to a couple of guys that are pretty old, but when you think about the fact that my age, Charlie’s age, our life experience, and then we’ll throw in this young guy over here, Greg Abel, and if our life experiences combined exceed the life of the United States, we are a very, very young country. But what we’ve accomplished is miraculous. Now just think of this. This little spot in history.

Warren Buffett: (16:54)

If we go to slide two, I’ve tried to estimate… Well, let’s go back. Stay with slide two, but the population in 1790, and we had 3.9 million people here. It’s funny, when you look up census figures, you find out that they had a big fire and the Department of Commerce building in 1921, so they lost a lot of the census records. So there’s some things where there’s a few gaps, but there were 3.9 million people in the United States. Actually, I’ve got .6 million. It’s closer to .7 million. There were 700,000 of those people were slaves at the time. But those 3.9 million people were one half of 1% of the population of the planet.

Warren Buffett: (17:57)

If you’d asked any of those 3.9 million people, any of them to imagine what life would be like 231 years later, even the most optimistic person; they could have been drinking heavily and even had a little pot, and they still could not in their wildest dreams have thought that in three lifetimes, Charlie’s mine, and Greg’s, that in that period you would be looking at a country with 280 million vehicles shuffling around its roads. Airplanes, maybe not today so much, but they’ll be back again. They were flying people at 40,000 feet coast to coast, five hours. That great universities would exist in one state after another, and great hospitals systems, and entertainment would be delivered to people in a way nobody could have dreamt of in 1790s. This country in 231 years has exceeded anybody’s dreams.

Warren Buffett: (19:23)

I went to the internet trying to prepare for this, and if you’ll move to the next slide, I tried to find out what was the wealth of the country in 1789, our starting point. I punched in United States wealth. I tried 1789, I tried 1790. I thought it might be a little easier in terms of a round year, and I think four. million or so references came up. I didn’t look at all 4 million, but I can tell you the data collection in those early days on many fronts was not anything like today. You really can’t find what I would consider a reliable figures. You can find out how many mules there were in the country and a few things like that, and try to add them up. But in real estate, when you’re looking at houses or apartment houses or office buildings, they’re each slightly different than each other, but they looked at comparable sales.

Warren Buffett: (20:57)

So it’s hard to find a lot of countries where the wealth has been estimated. But it was interesting to go back and think about the fact that in 1803 we purchased for $15 million, we made the Louisiana purchase. Now that’s a little later than 1789, but that’s the best comp, as they say in real estate. That’s the best combine we could find for land mass, anyway. When we made that purchase, that was equal incidentally to about a quarter, about 800,000 plus square miles. But it was about a quarter of what the lower 48 States now contain. So we bought about a quarter of the lower 48 for those $15 million back in 1803. If you live in Texas and your grandfather is close to dying, and he calls the grandchildren, children around him. In his final words, he always says, ” Don’t sell the mineral rights.” Well, the French sold us the mineral rights on that $15 million deal as well. So we got that whole strip there. We got all of Kansas, essentially all of Oklahoma, and they’ve produced 21 billion barrels of oil for us, a lot of natural gas since the purchase.

Warren Buffett: (22:58)

One of the sidelights is that we paid our 15 million for the Louisiana purchase. We paid 3 million of it, 20% of it. We paid with 200,000 ounces of gold, valued at 15 bucks an ounce, and that three million that the French took. We got South Dakota as part of the Louisiana purchase, and the home state mine up there, before it closed, produced well over 40 million ounces of gold and 40 million ounces of gold, that comes to about $60 billion worth. Like I say, 200,000 ounces took care of 20% of our purchase price. So the Louisiana purchase was a bargain, but it’s what the going price was for 800,000 square miles, I guess, at the time, and three cents an acre. So I decided by playing around with various numbers such as that, that as a reasonable estimate of the worth of the country in 1789, a billion was not crazy figure. Now, if I’d been an academician or something, I would’ve put 1,107,400,000, something like that. I would have made it look respectable. But it’s a wild guess. But it’s not a crazy figure.

Warren Buffett: (24:40)

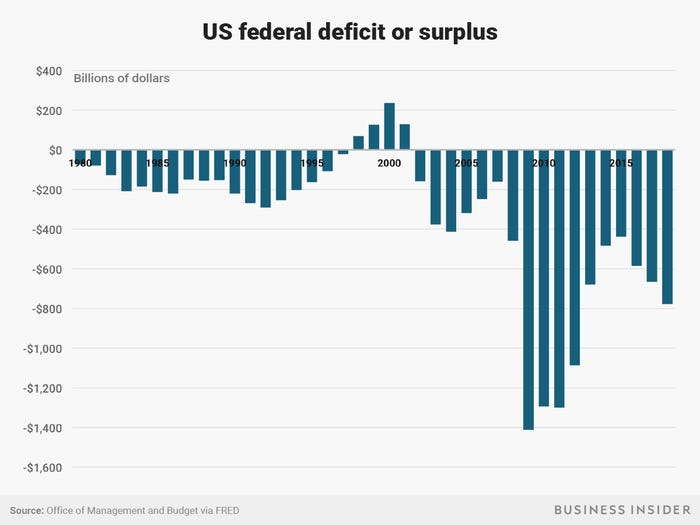

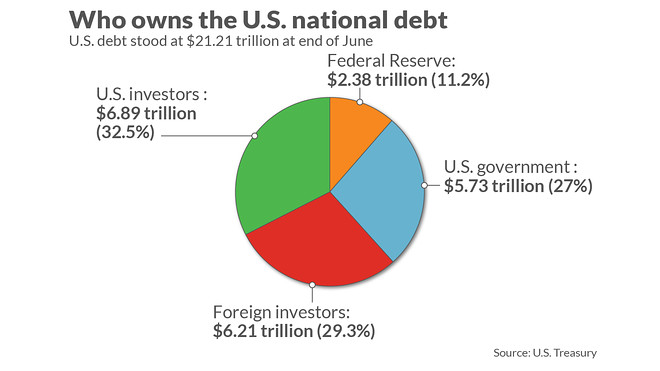

So what has happened, let’s move on to the next slide, to the wealth of the country since then? Here we have some figures that come out pretty regularly. Well, they do come out regularly where the Federal Reserve estimates the net household worth of people in the United States, all all the households in the United States. You can look these up, and you’ll see that there’s 30 trillion of stocks, and I think maybe single family homes. What are there? There’s 82 million or so owner occupied single families, maybe 45 million rental apartments and so on. So you start adding all these up, and the Federal Reserve tells us, and I invite you to look at the data; it’s kind of interesting, that we now in the United States, 231 years later, we have a hundred trillion. We have more than a hundred trillion of household wealth, even though the stock market’s gone down somewhat since the last quarter report.

Warren Buffett: (25:55)

So you say, “Well, we’ve had a lot of inflation, everything.” We actually, in the United States, for the first half of our existence, roughly, we didn’t really have that much inflation. We had inflationary periods and deflationary periods, but the general price level did not changed that dramatically. But I will assume again for this calculation that there’s been 20 for one inflation. It’s way less than that in many commodities, and it’s very hard to measure and talk about equivalent benefits from different kinds of products and so on, and costs. But I think it’s reasonable to say that the United States in real terms has increased in wealth at something in the area of 5,000 for one, which is really, it’s mind blowing. 5,000 for one in real terms, in a country that had a half a percent of the, and a bunch of raw land. But a vision that to accomplish that in 231 years, there’s just no denying that that’s beyond what anybody could have dreamt earlier.

Warren Buffett: (27:31)

But it was not done, and this is important, because we’ve now hit a bump in the road. It was not done without some very, very serious bumps in the road. It was not 231 years of steady progress. In matter of fact, we had been in the birth of this country. We’d been into it, what? 72 years and if we go to the next slide, 1861 we now had about 31 million people. The 1960 cents to showed around 31 million people or thereabouts in the country and four million of them were slaves, and we had never really resolved the very much unfinished business of what was involved in compromises in 1789, and we’ll have more to say about that later. But we had something that not too many countries experienced, and if you had told people in 1789 that in 72 years, you were going to have a division that causes the President of the United States at Gettysburg to say that testing whether that nation, or any nation so conceived and dedicated, can long endure. Imagine the President of the United States wondering aloud whether the country that he was presiding over could long endure, only 72 years or 74 years at Gettysburg, had taken place.

Warren Buffett: (29:37)

So while this marvelous dream was being played out, roughly a third of the way through it, we face this really moment of decision, and we entered into a contest that, if we’ll go to the next slide, I made an estimate. That literally killed roughly 6% of the males in the country who were between 18 and 60. I’m assuming that there were more than 600,000 deaths in the war. I think it’s a reasonable estimate that that 18 to 60 group, males, were by far the great proportion. So imagine 6% of your working prime age males in a country are wiped out in four years. So when we look at the progress of this country and we think of our own problems now, I just ask you to ponder and we’ll move to the next slide. That would be equivalent today to having four million males in that same age group similarly wiped out. So that was one incredible interruption which this country nevertheless worked through while compiling this American dream that is one of the wonders of the world, perhaps the wonder of the world in many senses.

Warren Buffett: (31:46)

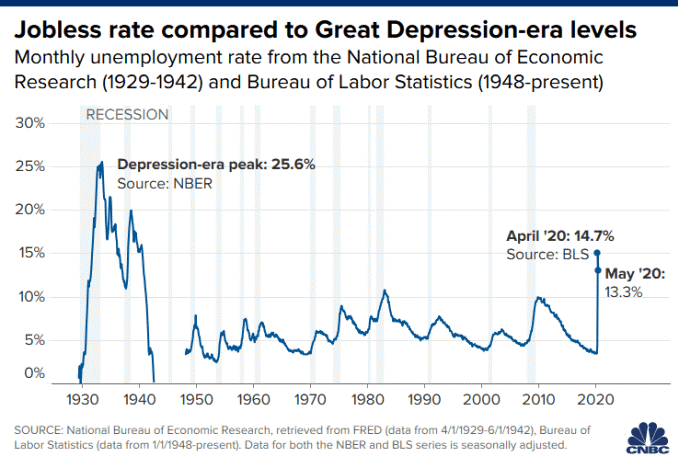

So let’s move on to another crisis of a different sort, that hit the country, and this of course is the 1929 crash, which led to the Great Depression. Here the Dow Jones average, which we’ll use through this. At that time, that’s the one everybody paid attention to, actually. The second most important average at that time, if you look at the papers, was the New York Times average, which has disappeared, and of course the Standard and Poor’s has probably, regardless is a superior yardstick. But the Dow Jones is a perfectly adequate yardstick. On September 3rd, 1929, the Dow Jones average closed at 381.17, and people were very happy and buying stocks on margin that worked wonderfully.

Warren Buffett: (32:55)

The roaring twenties had a good feeling to it with the auto coming of age and the day of air travel coming along and all kinds of new appliances and the telephone getting wider use, believe it or not. Hadn’t really caught on that much prior thereto. But the movies were coming on. It was a happy place. Then, of course, if we go to the next slide, we’ll look at what happened in the couple of months after September 3rd and the Dow Jones average almost got cut in half, and that was pretty impressive until we had this recent situation where in a shorter period of time we lost about a third. But the crash, and there’s a great book about it called The Great Crash by John Kenneth Galbraith. Let me interject one little plug here. There’s a small business in Omaha, and I hate what this-

Warren Buffett: (34:02)

… a small business in Omaha, and I hate what this is truncating this meeting, or changing can so dramatically has done to many of the businesses in Omaha, because I think small business is beneficial, and we’re the beneficiaries of a really … they got a lot of business with the Berkshire meeting, and they’re going to get it in the future, but they suffer during a period like this, and they just had a story about The Bookworm.

Warren Buffett: (34:28)

Well, The Bookworm, if you buy any books that come out of anything I recommend, think about just put in Bookworm in Omaha, and The Great Crash is a wonderful book of mine, John Kenneth Galbraith describes it, but I would like to get into a bit of a personal note which will have some relevance, not too much, but some relevance to the story of the great depression, because in 1929 my dad, who was 26 years of age then, was employed as a security salesman by a local small bank, and he sold stocks and bonds, but mostly he sold stocks.

Warren Buffett: (35:26)

And when stocks fall 48%, and they were selling them to people a few months ago, you really don’t feel like going out and facing those same people, so I think my dad probably liked to do was, they say now, shelter in place, which means stay at home, and there really wasn’t that much in our house, we just had a small yard, it was wintertime anyway, my dad wouldn’t have been puttering on the yard anyway, and the television wasn’t there, and he and my mother got along very well.

Warren Buffett: (36:10)

So under those conditions, if you’ll turn to the next slide, I was born about nine months later, but at that time, I was actually born on August 30th, but the stock market was closed that day, and so I’m using the previous day figures, but I didn’t notice at the time that the market was closed, but the stock market had actually recovered over 20% during that nine and a half month period or thereabout.

Warren Buffett: (36:47)

People did not think in the fall of 1930, they did not think they were in a great depression, they thought it was a recession very much like had occurred at least a dozen times, although not always when stock markets were important, but we’d have many recessions in the United States over that time, and this did not look like it was something dramatically out of the ordinary. For a while, actually for about 10 days after my birth, that’d be [inaudible 00:37:28] and the stock market actually managed to go up all of 1-2% there in those 10 days, but that’s the last day.

Warren Buffett: (37:42)

Well, from that point, if you’ll turn to the next slide, the stock market went from level of 240 to 241, which was a noticeable decline, because if somebody had given me $1,000 on the day I was born, and I’d bought stocks with it, and bought the Dow Average, my $1,000 would have become $170 in less than two years, and that is something that none of us here have ever experienced that we may have had it with one stock occasionally, but in terms of having a broad range of America mark down 83% in two years, and mark down 89% of the peak, that was in September 3rd, 1929, was extraordinary.

Warren Buffett: (38:52)

In that intervening period, less than one year after I was born, just slightly less than one year, my dad went to the bank where he worked and had his account, and of course the bank had a sign out of “closed” and so he had no job, and he had two kids at that point, and his father had a grocery store, but Charlie and I both worked for my grandfather. Charlie worked there in 1940, I worked there in 1941, so we didn’t know each other but my grandfather said to my father that, “Don’t worry about your groceries, Howard,” he says, “I’ll just let your bill run.”

Warren Buffett: (39:33)

That was my grandfather’s word exactly, he cared about his family but he wasn’t going to go crazy, and one of the things as I look back on that period is, and I don’t think the economists generally like to give it that much of a point of importance, but if we’d had the FDIC 10 years earlier, the FDIC started on January 1st, 1934, it was part of the sweeping legislation that took place when Roosevelt came in, but if we’d had the FDIC we would have had a much, much different experience, I believe, in the great depression.

Warren Buffett: (40:24)

People blaming on smooth hall here, and they … I mean, there’s all kinds of things, and the margin requirements in ’29, and all of those things entered into creating a recession, but if you have over 4,000 banks fail, that’s 4,000 local experiences where people save, and save, and save, and put their money away, and then someday they reach for it and it’s gone, and that happens in all 48 states, and it happens to your neighbors, and it happens to your relatives, it has to have an effect on the psyche that’s incredible.

Warren Buffett: (41:15)

So one very, very, very good thing that came out of the depression, in my view, is the FDIC, and it would have been a somewhat different world, I’m sure, if the bank failures hadn’t just rolled across this country, and with people that thought that they were savers find out that they had nothing when they went there and there was a sign that said, “Closed.”

Warren Buffett: (41:49)

Incidentally, the FDIC, I think very few people know this, or at least they don’t appreciate it, but the FDIC has not cost the American tax payer a dime, I mean its expenses have been paid, its losses have been paid all through assessments on banks, it’s been a mutual insurance company of the banks backed by the federal government, and associated with the federal government, but now it holds $100 billion and that consists of premiums that were paid in an investment income on the premiums, plus the expenses, and paying of all the losses, and think of the incredible amount of peace of mind that’s given to people that were not similarly situated when the great depression hit.

Warren Buffett: (42:51)

So the great depression went on, and it lasted a very long time, but it lasted a lot longer in the minds of people than it did actually in its effects. World War II came along, and on sort of an involuntary manner we adopted Keynesianism, we started running fiscal deficits, of course, that were absolutely huge, and took our debt up to a percentage of GDP, which we had never reached before, and never have reached since.

Warren Buffett: (43:35)

So we had an enormous economic recovery, but the minds of people had been so scarred, the memories, parents told their children, 1929 became a symbol in people’s minds, I mean, if you said 1929 it was like saying 1776, or 1492. I mean, everybody knew exactly what you were talking about, and it affected stock prices in a rather remarkable way to the point, if you’ll change to the next slide, it was January 4th of 1951 that the kid who was born on August 30th in 1930 had finished college before the stock market got back to where it was at that earlier time.

Warren Buffett: (44:42)

So take the years from 1920, 1930, or 1929 really into the 1951, or take the year from my birth, 20 years, and bear in mind that the country was only 140 years old when they started, that’s 20 years out of this amazing 231-year lifetime of our country, that was flat out a time of for a long time with no economic growth, and no feeling by people in terms about the wealth of the country, about what American economy was worth, about all these corporations that were doing far, far, far better than they were, all in all, but it took all of that time to restore in the market a price level that was equal to what it was when I was born 20 years earlier.

Warren Buffett: (45:51)

So, if you think about the fact that we’re enduring a few months, and we’ll endure some many more months, and we don’t know how it comes out, and people in the ’30s didn’t know how it was going to come out, but they endured, persevered, prospered, and the American miracle continued. But it’s interesting in that I actually don’t have a slide for the next one, because last night I was thinking after all the slides had been prepared, I was actually thinking about this a little bit, and I remembered that at the start of 1954 the stock market was … the Dow was only at about 280, and I remember 1954 because it was the best year I ever had in the stock market.

Warren Buffett: (46:53)

And the Dow went from essentially what? 280 or thereabout at the start of the year, to a little over 400 at the end of the year, and when it went to 400, as soon as it went across 381, that famous figure from 1929, when it went to 400, and this will be hard for some of you to believe, but everybody wondered, ” Is this 1929 all over again?”

Warren Buffett: (47:33)

And that seems a little farfetched because it was a different country in 1954, but that was the common question, and it actually achieved such a level of worry about whether we were about to jump off another cliff just because the 381 of 1929 had been exceeded, that they held, Senator Fulbright, Bill Fulbright of Arkansas, who became very famous later in terms of the foreign relations committee, but he headed the Senate Banking Committee, and he called a special per special investigation, and he calls it the, what did he call it? The stock market study, but it really, if you read through it, he really was questioning whether we had built another house of cards again, and on this committee, it’s interesting to see the Senate Finance Committee, one of the members was Prescott Bush, the father of George H. W. Bush, and grandfather of George W. Bush, and it had some illustrious names.

Warren Buffett: (48:54)

His committee, in March of 1955, with a Dow of 405, assembled 20 of the best minds in the United States to testify as to whether we were going crazy again, because the market was at 400, the Dow was at 400, and we had gotten in this incredible trouble before, but that was the mindset of the country, it’s incredible.

Warren Buffett: (49:24)

We didn’t really believe America was what it was, and my was, the reason I’m familiar with this 1000-page book that I have here, I found it last night in the library, was that I was working in New York for one of the 20 people that was called down to testify before Senator Fulbright, and he testified right before Bill Martin, who was running the Federal Reserve, testified, and right after General Wood who was running shares testified, theirs was very, very important then, and Bill Martin of course was the fellow that longest running chairman in the history of the Fed, and he’s the one that gave the famous quote about the function of the Fed was to take away the punch balls just when the party started to get really warmed up.

Warren Buffett: (50:17)

But Ben Graham, my boss, sent me over to the public library in New York to gather some information for him, something he could do in five minutes with a computer now, and I dug out something, and he went to testify, and on page 545 of this book, I knew where to look, I didn’t have to go through it all, but the quote which I remember, and I remember because Ben Graham was one of the three smartest people I’ve met in my life, and he was the dean of people in securities business, he wrote the classic Security Analysis book in 1934, he wrote the book that changed my life, Intelligent Investor in 1949, he was unbelievably smart.

Warren Buffett: (51:09)

And when he testified, with the Dow at 404, he had one line in there right toward the start in his written testimony, and he said, “The stock market is high, looks high, it is high, but it’s not as high as it looks.” But he said, “It is high.” And since that time, if we’ll turn to the next slide, of course, we felt the American tailwind at full force, and the Dow, well let’s see, when the Dow was … it went down on Friday, but when we made the slide it was about 24,000 so you’re looking at a market today that has produced $100 for every dollar, all you did was you had to believe in American just by a cross-section of America, you didn’t have to read the Wall Street Journal, you didn’t have to look up the price of your stock, you didn’t have to pay a lot of money in fees to anybody, you just had to believe that the American miracle was intact.

Warren Buffett: (52:16)

But you’d had this testing period between 1929 and well really certainly 1954, as indicated by what happened when it got back up to 380, you had this testing period, and people really they’d lost faith to some degree, they just didn’t see the potential of what America could do. We found that nothing can stop America when you get right down to it, and it’s been true all along, it may have been interrupted.

Warren Buffett: (53:04)

One of the scariest of scenarios, when you had a war with one group of States fighting another group of States, and it may have been tested again in the great depression, and it may be tested now to some degree, but in the end the answer is never bet against America, and that in my view is as true today as it was in 1789, and even was true during the civil war, and the depths of the depression.

Warren Buffett: (53:44)

Now, I’m now about to say something that, and don’t change the slide yet, but I’m now about to say something that some of you will be tempted to argue with me about, but I would make the case that we are imperfect in a great, great, great many ways, but I would say, and if you pull up the next slide, that we are now a better country as well as an incredibly more wealthy country than we were in 1789. We’re far, far, far from what we should be, will be, but we have gone dramatically in the right direction.

Warren Buffett: (54:35)

It’s interesting, in 1776, we said we hold these truths to be self-evident that all men are created equal, endowed by their creator with certain unalienable rights, among these are life, liberty, and pursuit of happiness, and yet 14 years later, a year after we really officially began the country in 1789, adopted a constitution. We found that more than 15% of the people in the country were slaves, and we wrestled with that, but when you say the word self-evident, that sort of sounds like you’re saying any damn fool can recognize that, and you certainly say, he can argue maybe a little bit about life, and the pursuit of happiness, but I don’t see how in the world anybody can reconcile liberty with the idea that 15% of the population was enslaved, and it took us a long time to at least partially correct that.

Warren Buffett: (56:08)

I mean it took a civil war, it took losing 6% of those people, males that were between 18 and 60 years of age, but we’ve moved in the right direction, we’ve got a long ways to go, but we’ve moved in the right direction now. In addition, going back again to that 1776 statement, that all men are created equal, and endowed by their creator, et cetera.

Warren Buffett: (56:42)

I think it was self-evident to the 50% of the population that they were getting a fair deal for over half the lifetime of the country. It took 131 years until women were guaranteed the right to vote for our country’s leaders, and then what’s even more remarkable is that after we adopted them, the 19th amendment, 1920, it took 61 more years until a woman was allowed to join those eight males on the Supreme Court. I grew up thinking that the Supreme Court must have been somewhat … said there had to be nine men, but at 61 years, so took 192 years before Sandra Day O’Connor was appointed to the court, and now you can say that there was a pipeline problem.

Warren Buffett: (58:06)

Half the population may have been women in 1920, but there weren’t half the lawyers, or I think were 10% of the lawyers probably. So you can understand some delay, but 61 years is a long time to go and to pick 33 males in-between. If that was entirely by chance, then the odds against that fewer flipping coins is about eight billion to one, like I said, there was a pipeline problem, but it took us a long, long time, and it’s not done yet, but I think it does give meaning to the fact that we are a better society with a lot of room to go, that we are a better society that existed in 1789.

Warren Buffett: (59:02)

When you go to Colonial Williamsburg, I’ve been there a couple of times, as a matter of fact, I watched the debate between Jimmy Carter and Gerald Ford there in the 1976, and it was not a great time to be black, it was not a great time to be a woman, and both of those categories still certainly got potential for significant improvement in terms of fulfilling that pledge made in 1776 about how we believe that it’s self-evident that all men were created equal, but we have made progress, we are a better society, and we will, as the years go by. If you’ll move to the next slide, and I believe that, and I think, let’s see if I can get these slides in the proper order here. I believe that when you get through evaluating all of the qualitative facts, what we have done toward meeting the aspirations of what we wrote in 1776, what we wrote in 1776 wasn’t a fact, but it was an aspirational document, and we have worked toward those aspirations, and we have a long way to go, but I’ll repeat, if you move to the next slide, that never, never bet against America.

Warren Buffett: (01:00:59)

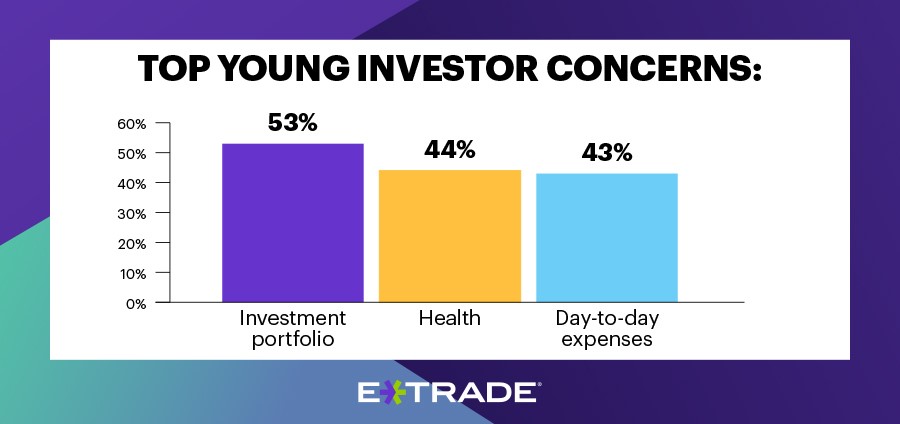

Now, let’s move on now to a much broader subject, what I don’t know. I don’t know, and perhaps with a bias, I don’t believe anybody knows what the market is going to do tomorrow, next week, next month, next year. I know America is going to move forward over time, but I don’t know for sure, and we learned this on September 10th, 2001, and we learned it a few months ago in terms of the virus. Anything can happen in terms of markets, and you can bet on America, but you got to have to be careful about how you bet, simply because markets can do anything.

Warren Buffett: (01:02:15)

On October, whatever it was in 1987, October 11th I believe, a Monday, markets went down 22% in one day. In 1914, they closed the stock market for about four months, after 9/11 closed the market for four days, we hustled to get it going again, but nobody knows what’s going to happen tomorrow. So when they tell you to bet on America, and I tell you that that’s what’s really gotten me through ever since I bought my first stock when I was 11, I mean I caught a huge, huge, huge tailwind in America, but it wasn’t going to blow in my direction every single day, and you don’t know what’s going to happen tomorrow.

Warren Buffett: (01:03:16)

I would like to context to the present news, point out something you may find kind of interesting. If you go to YouTube, you’ll find on June 17th, of 2015, four-plus years ago, you’ll find Sam Nunn, that was one of the people I admire the most in the United States and in the world, enormous patriot and tremendous senator, and he’s carried on thankless work since leaving the Senate, and heading something called the Nuclear Threat Initiative, which most of you haven’t heard of, but I’ve been slightly involved in it, Sam Nunn founded that.

Warren Buffett: (01:04:12)

And, the Nuclear Threat Initiative is simply organizations that are devoted to trying to reduce the chances of something of a nuclear chemical, biological, and now cyber nature, from either malevolent or accidental or whatever may be, from causing deaths to millions of Americans, and among the things that Sam co-founded it, but he’s been the heart and soul of the organization subsequently, and he’s talked about, worried about pandemics along with the nuclear threat for decades, and he’s participated in war games where they play out various scenarios, including malevolent pandemics that could be started by the same kind of nut that sent the anthrax letters around the 9/11, a little after. Sam paired down this YouTube presentation, and I’m sure he’s been on many others I just happened to look this one up, and talked about the dangers of a pandemic, and anybody should listen to Sam Nunn anytime he talks. So he said at that time, “Germs don’t have borders,” which we certainly learned in the last couple of months, and when I clicked on YouTube, if you’ll go to the next, I found out that basically it had 831 views, and this was only a few days ago, I looked it up, but I don’t know whether most of those views have just been the last few days or the last few months, I shouldn’t say, because of the interest in pandemics, but it is hard to think about things that haven’t happened yet. So we can experience, and when something like the current pandemic happens, it’s hard to factor that in, and that’s why you never want to use borrowed money, at least in my view, and then buy into investments.

Warren Buffett: (01:06:58)

And we run Berkshire that way, we run it so that we literally try to think of the worst case of not only just one thing going wrong, but other things going wrong at the same time, maybe partly caused by the first, but maybe independent even of the first. You learned in, I don’t know what grade now, probably earlier than when I went to school, but in fifth or sixth grade, that you can have any series of numbers times zero, and you just need one zero in there and the answer is zero, and there’s no reason to use borrowed money to participate in the American tailwind, but there’s every other reason to participate.

Warren Buffett: (01:07:42)

Now, I can’t resist pointing out that in October of 2019, a large 300-page, I’ve got it right here, a book was brought out, and Johns Hopkins …

Warren Buffett: (01:08:03)

And Johns Hopkins, one of the most respected institutions, country, Nuclear Threat Initiative, NTI, and the Intelligence Group at The Economist collaborated to evaluate the problems of the worldwide preparedness for pandemics, essentially.

Warren Buffett: (01:08:31)

And I think in November, Sam came out to see me with Ernie, more recent former Secretary of Energy who now is the CEO of NTI. He and Sam are co-chairmen, and Beth Cameron who did a lot of work on this report came out to see me. And they gave me in November I believe of last year, they gave me this appraisal. And the opening line, if you’ll turn the page, this is the opening line of this 300-page tome: “Biological threats—natural, intentional, or accidental—in any country can pose risks to global health, international security, and the worldwide economy.”

Warren Buffett: (01:09:24)

And this book was prepared in order to evaluate the preparedness of the various countries and rank them. We ranked pretty well, but all of us got a failing… All of the countries got a failing grade, basically.

Warren Buffett: (01:09:39)

Now, you would think with the prestige of Johns Hopkins and The Economist, along with people like Sam and Ernie, etc., that this would’ve gotten some attention. And, again, Sam… Turn to the next page. Sam and the others went on YouTube on October 24, 2019, and they have racked up, as of a couple days ago, 1,498 views.

Warren Buffett: (01:10:14)

Now, my friend Bill Gates was delivering the same warning at a TED Talk some years back. And he’s gotten a lot more views. But it just says something about the fact that you’re going to get both from the blue, and you can read papers about them, and you can talk about what’ll happen if some, as they used to, the fellows would say, Salomon used to tell me, some 25-sigma event comes along, and they’ll then say that that’ll happen once in the life of the universe. And then it happens to them a couple times in a month, and they go broke.

Warren Buffett: (01:10:52)

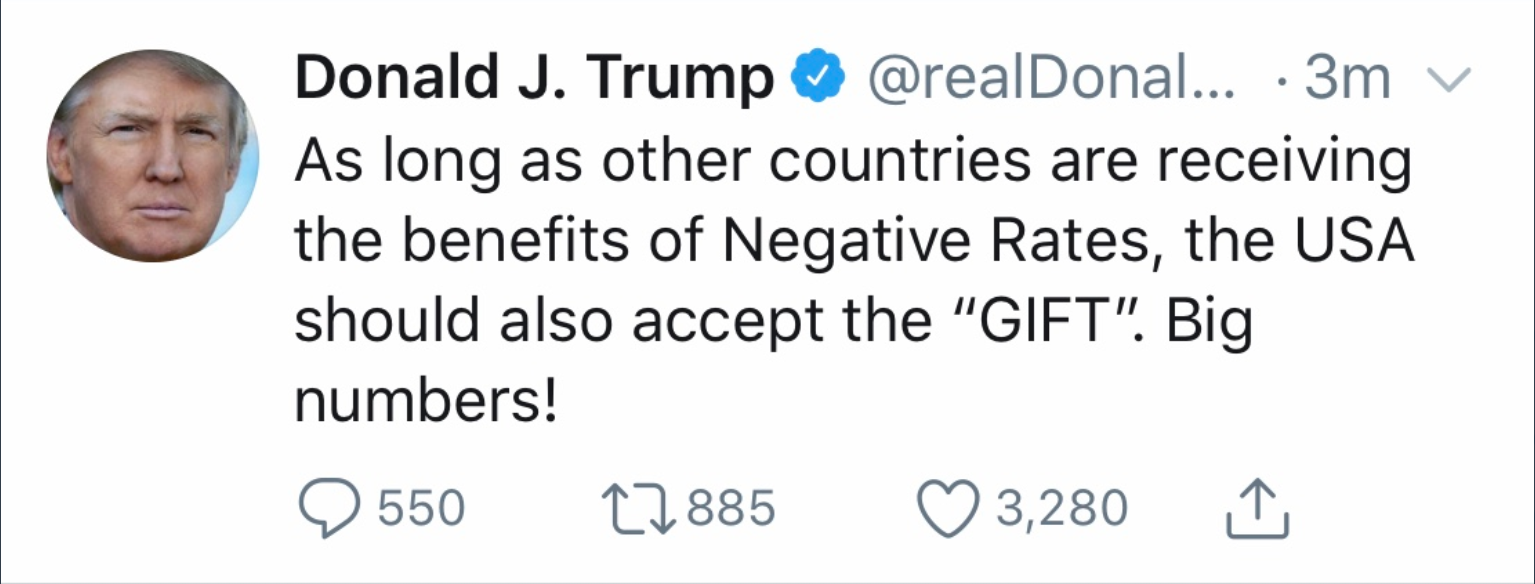

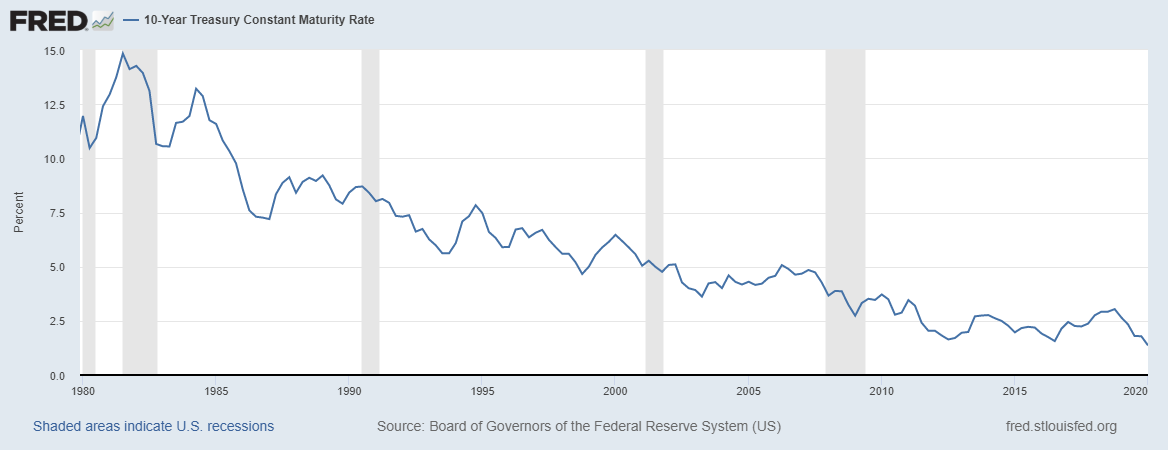

You just don’t know what’s going to happen. You know, at least in my view, you know that America’s tailwind is not exhausted. You’re going to get a fine result if you own equities over a long period of time. And the idea that equities will not produce better results than the 30-year Treasury bond, which yields one and a quarter percent now, it’s taxable income. It’s the aim of the Federal Reserve to have 2% a year inflation. Equities are going to outperform that bond. They’re going to outperform Treasury bills. They’re going to outperform that money you’ve stuck under your mattress.

Warren Buffett: (01:11:41)

I mean, they are a enormously sound investment as long as they’re an investment and they’re not a gambling device or something that you think you can safely buy on margin or whatever it may be.

Warren Buffett: (01:12:03)

It’s interesting that stocks offer, which, and stocks are a… We always look at stocks as just being a part of a business. I mean, stocks are a small part of a business. If in 1789 you’d saved a small amount of money and it wasn’t easy to save, you might’ve bought with those savings, you might’ve bought a tiny, tiny plot of property.

Warren Buffett: (01:12:39)

Maybe you bought a house that could be rented to somebody, but you didn’t really have the chance to buy in with 10 different people who were developing businesses, and who were presumably putting their own money in, and that would have the American tailwind behind. And of the 10, a reasonably high percentage would succeed in a way and earn decent returns, but those are the choices. You might have had to do with savings.

Warren Buffett: (01:13:23)

And they started offering bonds originally. And there again you got a limited return. But the return in those days may have been 5% or 6% or something of the sort. But you can’t buy risk-free bonds. I mean, the yardstick for me is always the U.S. Treasury. And when somebody offers you quite a bit more than the U.S. Treasury, there’s usually a reason. There’s much more risk.

Warren Buffett: (01:13:50)

But going back to stocks, people bring the attitude to them too often that because they are liquid and quoted minute by minute that it’s an important that you develop an opinion on them minute by minute. Now, that’s really foolish when you think about. And that’s something Graham taught me in 1949, I mean, that single thought, that stocks were parts of businesses and not just little things that moved around on charts or… Charts were very popular in those days, and whatever it may be.

Warren Buffett: (01:14:28)

Imagine for a moment that you decided to invest money now, and you bought a farm. And the farmland around here, let’s say you bought 160 acres, and you bought it at x per share, or per acre. And the farmer next to you had 160 identical acres, same contour, same quality, soil quality, so it was identical. And that farmer next door to you was a very peculiar character because every day that farmer with the identical farm said, “I’ll sell you my farm, or I’ll buy your farm at a certain price,” which he would name.

Warren Buffett: (01:15:29)

Now, that’s a very obliging neighbor. I mean, that’s got to be a plus to have a fellow like that with the next farm. You don’t get that with farms, you get it with stocks. You want 100 shares of General Motors, and then on Monday morning, somebody will buy you 100 shares or sell you another 100 shares at exactly the same price. And that goes on, I don’t know, five days a week.

Warren Buffett: (01:15:58)

But just imagine if you had a farmer doing that. When you bought the farm, you looked at what the farm would produce. That was what went through your mind. You were saying to yourself, “I’m paying x dollars per acre. I think I’ll get so many bushels of corn or soybeans on average, some years good, some years bad. And some years the price will be good. Some years the price will be bad,” etc.

Warren Buffett: (01:16:19)

But you think about the potential of the farm, and now we get this idiot that buys the farm next to you, and on top of that, he’s sort of a manic depressive and drinks, maybe smokes a little pot. So his numbers just go all over the place. Now, the only thing you have to do is to remember that this guy next door is there to serve you and not to instruct you. You bought the farm because you thought the farm had the potential. You don’t really need a quote on it. If you bought in with John D. Rockefeller or Andrew Carnegie, and da, da, da, da, there were never any quotes. Well, there were quotes later on, but basically you bought into the business. And that’s what you’re doing when you buy stocks. But you get this added advantage that you do have this neighbor who you’re not obliged to listen to at all who is going to give you a price every day. And he’s going to have his ups and downs. And maybe he’ll name a selling price that they’ll buy at, and in which case you sell if you want to.

Warren Buffett: (01:17:34)

Or maybe he’ll name a very low price, and you’ll buy his farm from him. But you don’t have to. And you don’t want to put yourself in a position to where you have to. So stocks have this enormous inherent advantage of people yelling out prices all the time to you, and many people turn that into a disadvantage. And of course many people can profit in one way or another from telling you that they can tell you what this farmer’s going to yell out tomorrow or next… your neighboring farmer’s going to yell out tomorrow, or next week, or next month.

Warren Buffett: (01:18:11)

There’s huge money it. So people tell you that it’s important, and they know, and that you should pay a lot of attention to their thoughts about what price changes should be, or you tell yourself that there should be this great difference. But the truth is, if you owned the businesses you liked prior to the virus arriving, it changes prices, and it changes, but nobody’s forcing you to sell. And if you really like the business, and you like the management you’re in with, and the business hasn’t fundamentally changed, and I’ll get to that a little when I report on Berkshire, which I will soon, I promise, the stocks have an enormous advantage. And you can bet on America.

Warren Buffett: (01:19:06)

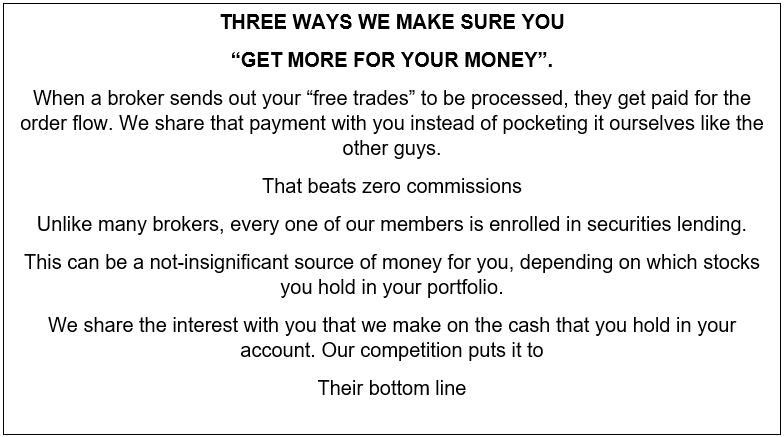

But you can’t bet unless you’re willing and have an outlook to independently decide that you want to own a cross section of America, because I don’t think most people are in a position to pick single stocks; a few may be, but on balance, I think people are much better off buying a cross section of America and just forgetting about it. If you’d done that, if I’d done that when I’d got out of college, it’s all I had to do to make 100 for 1 and then collect dividends on top of it, which increased, would increase substantially over time.

Warren Buffett: (01:19:43)

The American tailwind is marvelous. American business represents, and it’s going to have interruptions, and you’re not going to foresee the interruption, and you don’t want to get yourself in a position where those interruptions can affect you either because you’re leveraged or because you’re psychologically unable to handle looking at a bunch of numbers.

Warren Buffett: (01:20:09)

If you really had a farm, and you had this neighbor, and one day he offered you $2,000 an acre, and the next day he offers you $1,200 an acre, and maybe the day after that he offers you $800 an acre, are you really going to feel that at $2,000 an acre when you had evaluated what the farm would produce, are you going to let this guy drive you into thinking, “I better sell because this number keeps coming in lower all the time”? It’s a very, very, very important matter to bring the right psychological approach to owning common stocks.

Warren Buffett: (01:20:51)

But I will tell you, if you bet on America and sustain that position for decades, you’re going to do better than, in my view, far better than owning Treasury securities or far better than following people who tell you that what the farmer’s going to yell out next… There’s huge amounts of money that people pay for advice they really don’t need and for advice where the person giving it could be very well-meaning in it and believe their own line. But the truth is that you can’t deliver superior results to everybody by just having them trade around a business.

Warren Buffett: (01:21:39)

If you bought into a business, it’s going to deliver what the business produces. And the idea that you’re going to outsmart the person next to you, or the person advising you can outsmart the person sitting next to you is, well, it’s really the wrong approach.

Warren Buffett: (01:21:57)

So find businesses. Get a cross section. And in my view, for most people, the best thing to do is to own the S&P 500 index fund. People will try and sell you other things because there’s more money in it for them if they do. And I’m not saying that that’s a conscious act on their part.

Warren Buffett: (01:22:21)

Most good salespeople believe their own baloney. I mean, that’s part of being a good salesperson. And I’m sure I’ve done plenty of that in my life too, but it’s very human if you keep repeating something often enough. That’s why lawyers have the witnesses keep saying things over and over again, that by the time they get on the witness stand, they’ll believe it whether it was true in the first place or not.

Warren Buffett: (01:22:44)

But you are dealing with something fundamentally advantageous, in my view, in only common stocks. I will bet on America the rest of my life. And I hope my successors at Berkshire do it. Now, we do it in two different ways. We do it by buying entire businesses, and we buy parts of businesses.

Warren Buffett: (01:23:09)

And I would like to emphasize that… Well, I’d like to give you a few figures that will tie in from our activities in the first quarter and also what we’ve done in April. We are not right about… We do try to pick the businesses that we think we understand. We don’t buy the S&P 500. And we like to buy the entire businesses when we buy them, but we don’t get a chance to do that very often. Most of the best businesses are not available for sale in their entirety.

Warren Buffett: (01:23:53)

But we don’t mind in the least buying partial interest in businesses. And we would rather own 6% or 7% or 8% of a wonderful company and regard it as a partnership interest, essentially, in that company. And then we get an opportunity to do that through marketable securities. And sometimes we get more opportunities than others.

Warren Buffett: (01:24:24)

And with that, I hope I’ve convinced you to bet on America. Not saying that this is the right time to buy stocks if you mean by “right,” that they’re going to go up instead of down. I don’t know where they’re going to go in the next day, or week, or month, or year. But I hope I know enough to know, well, I think I can buy a cross section and do fine over 20 or 30 years. And you may think that’s kind of, for a guy, 89, that that’s kind of an optimistic viewpoint. But I hope that really everybody would buy stocks with the idea that they’re buying partnerships in businesses and they wouldn’t look at them as chips to move around, up or down.

Warren Buffett: (01:25:20)

So we will just now take a quick look. And I see we’ve got the Becky’s email address. So if you have questions on what I’ve said or other things, you can email these questions. And she is back there probably sort of a madhouse trying to handle questions coming in and pick out the ones she’s going to prioritize. But feel free to, anything I’ve talked about so far, to send a long to her, and we’ll keep her address up when I later hold the formal part of the meeting too.

Warren Buffett: (01:26:03)

Very briefly in terms of Berkshire, in the first quarter, if you’ll put up… Do we have the slides on that? There we are. Our operating earnings were… And there’s much more about this in the 10-Q, and it’s really not worth spending any real time on. But the operating earnings for the first quarter have no meaning whatsoever in terms of forecasting what’s going to happen the next year.

Warren Buffett: (01:26:34)

And I don’t know the consequences of shutting down the American economy. I know eventually it will work, whatever we do. We may make mistakes. We will make mistakes, and during this talk and later on, I’m not going to be second- guessing people on this because nobody knows for sure what any alternative action would produce or anything short.

Warren Buffett: (01:27:06)

But what we do know is that for some period, certainly during the balance of the year, but it could go on a considerable period of time, who knows, but our operating earnings will be less, considerably less than if the virus hadn’t come along. I mean, that’s just it. It hurts some of our businesses a lot. I mean, you shut down. Some of our businesses effectively have been shut down.

Warren Buffett: (01:27:41)

It affects others much less. Our three major businesses of insurance and the BNSF railroad, railroad and our energy business, those are our three largest by some margin. They’re in a reasonably decent position. They will spend more than their depreciation. So some of the earnings will go, along with depreciation, will go toward increasing fixed assets.

Warren Buffett: (01:28:13)

But basically these businesses will produce cash even though their earnings decline somewhat. And if we’ll go to part two, at Berkshire, we keep ourselves in an extraordinary strong position. We’ll always do that—that’s just fundamental. We insure people. We’re a specialist to some extent and a leader. It’s not our main business, but we sell structured settlements. That means somebody gets in a terrible accident, usually an auto accident, and they’re going to require care for 10, 30, 50 years.

Warren Buffett: (01:29:03)

And their family or their lawyer is wise enough, in our view, to rather than take some big cash settlement to essentially arrange to have money paid over the lifetime of the individual to take care of their medical wills, bills, or whatever it may be. And we’re large. We’ve got many, many, many people that in effect have staked their well-being on the promises of Berkshire to take care of them for, like I say, I mean, 50 years or longer into the future.

Warren Buffett: (01:29:42)

And, now, I would never take real chances with money, of other people’s money under any circumstances. Both Charlie and I come from a background where we ran partnerships. I started mine in 1956 for really seven either actual family members or the equivalent. And Charlie did the same thing six years later. And we never, neither one of us, I think, I know I didn’t, and I’m virtually certain the same is true of Charlie, neither one of us ever had a single institution investment with us.

Warren Buffett: (01:30:23)

I mean, every single bit of money we managed for other people was from individuals, people with faces attached to them, or entities, or money with faces attached to them. So we’ve always felt that our job is basically that of a trustee, and hopefully a reasonably smart trustee in terms of what we were trying to accomplish. But the trustee aspect has been very important. And it’s true for the people with the structured settlements. It’s true for up and down the line. But it’s true for the owners very much too. So we always operate from a position of strength.

Warren Buffett: (01:31:07)

Now, I show on the slide that’s up, I show our… Well, let’s go back one. Yeah. I show our net, our cash and Treasury bill position on March 31st. And you might look at that and say, “Well, you’ve got $125 billion or so in cash and Treasury bills. And you’ve got…” At least at that point, we had about, I don’t know, $180 billion or so in equities.

Warren Buffett: (01:31:43)

And you can say, “Well, that’s a huge position to have in Treasury bills versus just $180 billion in equities.” But we really have far more than that in equities because we own a lot of businesses. We own 100% of the stock of a great many businesses, which to us are very similar to the marketable stocks we own. We just don’t own them all. They don’t have a quote on them.

Warren Buffett: (01:32:05)

But we have hundreds of billions of wholly owned businesses. So our $124 billion is not some 40% or so cash positions, it’s far less than that. And we will always keep plenty of cash on hand, and for any circumstances, with a 9/11 comes along, if the stock market is closed, as it was in World War I—it’s not going to be, but I didn’t think we were going to be having a pandemic when I watched that Creighton-Villanova game in January either.

Warren Buffett: (01:32:44)

So we want to be in a position at Berkshire where… Well, you remember Blanche DuBois in A Streetcar Named Desire? That goes back before many of you. But she said she didn’t want them. In Blanche’s case, she said that she depended on the kindness of strangers. And we don’t want to be dependent on the kindness of friends even because there are times when money almost stops. And we had one of those, interestingly enough. We had it, of course, in 2008 and ’09.

Warren Buffett: (01:33:32)

But right around in the day or two leading up to March 23rd, we came very close but fortunately we had a Federal Reserve that knew what to do, but money was… investment-grade companies were essentially going to be frozen out of the market.

Warren Buffett: (01:34:03)

CFOs all over the country had been taught to sort of maximize returns on equity capital, so they financed themselves to some extent through commercial paper because that was very cheap and it was backed up by bank lines and all of that. And they let the debt creep up quite a bit in many companies.

Warren Buffett: (01:34:22)

And then of course they had the hell scared out of them by what was happening in markets, particularly the equity markets. And so they rushed to draw down lines of credit. And that surprised the people who had extended those lines of credit; they got very nervous. And the capacity of Wall Street to absorb a rush to liquidity that was taking place in mid-March was strained to the limit to the point where the Federal Reserve, observing these markets, decided they had to move in a very big way.

Warren Buffett: (01:35:13)

We got to the point where the U.S. Treasury market, the deepest of all markets, got somewhat disorganized. And when that happens, believe me, every bank and CFO in the country knows is, and they react with fear. And fear is the most contagious disease you can imagine; it makes the virus look like a piker.

Warren Buffett: (01:35:41)

And we came very close to having a total freeze of credit to the largest companies in the world who were depending on it. And to the great credit of Jay Powell, I’ve always had Paul Volcker up on a special place, special pedestal in terms of Federal Reserve chairman over the years. We’ve had a lot of very good Fed chairmen, but Paul Volcker, I had him at the top of the list. And I’ll recommend another, but Paul Volcker died about, I don’t know, less than maybe a year ago or a little less.

Warren Buffett: (01:36:18)

But not much before he died, he wrote a book called Keeping at it. And if you call my friends at the Bookworm, I think you’ll enjoy reading that book. Paul Volcker was a giant in many ways. He was a big guy too. He and Jay Powell, couldn’t see more in temperament or anything, but Jay Powell, in my view, in the Fed board belong up there on that pedestal with him because they acted in the middle of March, probably somewhat instructed by what they’d seen in 2008 and ’09. They reacted in a huge way and essentially allowed what’s happened since that time to play out the way it has.

Warren Buffett: (01:37:17)

And then March, when the market had essentially frozen, closed a little after mid-month, ended up, because the Fed took these actions on March 23rd, it ended up being the largest month for corporate debt issuance I believe in history. And then April followed through with even a larger month. And you saw all kinds of companies grabbing everything, coming to market and spreads actually narrow then. And every one of those people that issued bonds in late March and April, I sent a thank you letter to the Fed because it would not have happened if they hadn’t operated with really unprecedented speed and determination.

Warren Buffett: (01:38:10)

And we’ll know the consequences of swelling the Fed’s balance sheet. You can look at the Fed’s balance sheet. They put it out every Thursday. It’s kind of interesting reading if you’re sort of a nut like me. But it’s up there on the Internet every Thursday. And you’ll see some extraordinary changes there in the last six or seven weeks.

Warren Buffett: (01:38:35)

And like I say, we don’t know what the consequences of that, and nobody does exactly. And we don’t know what the consequences of what they undoubtedly will have to do. But we do know the consequences of doing nothing. And that would’ve been the tendency of the Fed in many years past, not doing nothing, but doing something inadequate. But more [inaudible 01:39:00] brought the whatever it takes to Europe and the Fed, then with March, sort of did whatever it takes, squared, and we owe them a huge thank you.

Warren Buffett: (01:39:16)

But we’re prepared at Berkshire. We always prepare on the [ad 01:39:20], on the basis that maybe the Fed will not have a chairman that acts like that. And we really want to be prepared for anything. So that explains some of the $124 billion in cash and bills. We don’t need it all.

Warren Buffett: (01:39:39)

But we never want to be dependent on not only the kindness of strangers but the kindness of friends. Now, in the next slide, we have the what we did in equities, and these numbers are tiny when you get right down to it. I mean, for having $500 billion or so in net worth and… I mean, not net worth, but in market value at the start of the year or something close to that. We bought in $1.7 billion of stock, and our purchases were a couple of billion more than our sales of equities.

Warren Buffett: (01:40:26)

But as you saw in the previous slide, we had operating earnings of $5, almost $6 billion. So we did very little in the first quarter. And then I’ve added in another figure, which I wouldn’t normally present to you. But I want to be sure that if I’m talking to you about investments and stocks more than I usually have, I want you to know what Berkshire’s actually doing. Now, you’ll see in the month of April that we net sold $6 billion or so of securities.

Warren Buffett: (01:41:07)

And that’s basically, that isn’t because we thought the stock market was going to go down or anything of this order because somebody changes their target price or they change this year’s earnings forecast. I just decided that I’d made a mistake in evaluating. That was an understandable mistake. It was a probability-weighted decision when we bought that, we were getting an attractive amount for our money when investing across the airlines business.

Warren Buffett: (01:41:43)

So we bought roughly 10% of the four largest airlines, and we probably… This is not 100% of what we did in April, but we probably paid $7 or $8 billion and then somewhere between $7 and $8 billion to own 10-

Warren Buffett: (01:42:03)

And somewhere between seven and eight billion to own 10% of the four large companies in the airline business, and we felt for that, we were getting a billion dollars roughly of earnings. Now we weren’t getting a billion dollars of dividends, but we felt our share of the underlying earnings was a billion dollars and we felt that that number was more likely to go up than down over a period of time. It would be cyclical obviously, but it was as if we bought the whole company. But we bought it through the New York Stock Exchange, and we can only effectively buy 10% roughly of the four. And we treat it mentally exactly as if we were buying a business. And it turned out I was wrong about that business because of something that was not in any way the fault of four excellent CEOs.

Warren Buffett: (01:43:01)

I mean, believe me, no joy being a CEO of an airline, but the companies we bought are well managed. They did a lot of things right. It’s a very, very, very difficult business because you’re dealing with millions of people every day, and if something goes wrong for 1% of them, they are very unhappy. So I don’t envy anybody the job of being CEO of an airline, but I particularly don’t enjoy being it in a period like this, where essentially nobody… People have been told basically not to fly. I’ve been told not to fly for a while. I’m looking forward to flying them. May not fly commercial, but that’s another question. The airline business, and I may be wrong and I hope I’m wrong, but I think it changed in a very major way, and it’s obviously changed in the fact that there’re four companies are each going to borrow perhaps an average of at least 10 or 12 billion each.

Warren Buffett: (01:44:11)

You have to pay that back out of earnings over some period of time. I mean, you’re 10 or $12 billion worse off if that happens. And of course in some cases they’re having to sell stock or sell the right to buy a stock at these prices. And that takes away from the upside down. And I don’t know whether it’s two or three years from now that as many people will fly as many passenger miles as they did last year. They may and they may not, but the future is much less clear to me, [inaudible 00:02:52], how the business will turn out through absolutely no fault of the airlines themselves. That’s something that was a low probability event happened, and it happened to hurt particularly the travel business, the hotel business, cruise business, the theme park business, but the airline business in particular. And of course the airline business has the problem that if the business comes back 70% or 80%, the aircraft don’t disappear.

Warren Buffett: (01:45:26)

So you’ve got too many planes, but it didn’t look that way when the orders were placed a few months ago, when arrangements were made. But the world changed for airlines and I wish them well, but it’s one of the businesses we have. We have businesses we own directly that are going to be hurt significantly. The virus will cost Berkshire money. It doesn’t cost money because of our stock. And various other businesses moves around. I mean, if XYZ, which say is one of our holdings and we own it as a business and we liked the business. The stock was down 20 or 30 or 40%. We don’t feel we’re poor in that situation. We felt we were poor in terms of what actually happened to those airline businesses just as if we don’t a hundred percent of them.

Warren Buffett: (01:46:23)

So that explains those sales, which are relatively minor, but I want to make sure that nobody thinks that involves a market prediction. And that pretty well wraps it up for Berkshire. So now we move into the formal part of the meeting, which will be followed by a fairly extended question and answer period if there are a lot of questions with Becky. And while we’re doing this formal part of the meeting, it’s not too exciting. So feel free to leave whatever you’re viewing this through, and if you want to send questions to Becky, we’ll keep her contact information up on the screen. Or if you want to fix yourself a sandwich or do anything else, we will now move… Or you can pay attention to the formal part of the meeting. But we will do this, and it won’t take too long, and then we will move on to the question and answer meeting.

Warren Buffett: (01:47:42)

So with that, I will call the meeting to order. And this follows the script, if you can’t tell by what I’m saying. I’m Warren Buffett, chairman of the board of directors of the company, and I welcome you to this 2020 annual meeting of shareholders. Marc Hamburg is secretary of Berkshire Hathaway, and he will make a written record of the proceedings. Dan Jaksich has been appointed inspector of elections at this meeting. He will certify to the count of votes cast in the election for directors and the motions to be voted upon at this meeting.

Warren Buffett: (01:48:20)

The name proxy holders for this meeting are Walter Scott and Marc Hamburg. Does the secretary have a report of the number of Berkshire shares outstanding entitled to vote and represented at the meeting?

Marc Hamburg: (01:48:30)

Yes I do. As indicated in the proxy statement that accompanied this note, the notice of this meeting that was sent to all shareholders of record on March 4th, 2020, the record date for this meeting, there were 699,123 shares of class A Berkshire Hathaway common stock outstanding, with each share entitled to one vote on motions considered at the meeting, and 1,382,352, 370 shares of class B Berkshire Hathaway common stock outstanding, with each share entitled to one 10000th of one vote on motions considered at the meeting. Of that number, 472,037 class A shares and 834,802,274 class B shares are represented at this meeting by proxies returned through Thursday evening, April 30th.

Warren Buffett: (01:49:32)

Thank you. That number represents a quorum, and we will therefore directly proceed with the meeting. First order of business will be a reading of the minutes of the last meeting of shareholders. I recognize Miss Debbie Bosanek who will put some motion before the meeting.

Debbie Bosanek: (01:49:46)

I move that the reading of the minutes of the last meeting of shareholders be dispensed with and the minutes be approved.

Warren Buffett: (01:49:53)

Do I hear a second?

Speaker 3: (01:49:54)

I second the motion.

Warren Buffett: (01:49:56)

The motion is carried. The next item of business is to elect directors. I recognize Ms. Debbie Bosanek to place a motion before the meeting with respect to election of directors.

Debbie Bosanek: (01:50:08)

I move that Warren Buffett, Charles Munger, Gregory Abel, Howard Buffett, Stephen Burke, Kenneth Chenault, Susan Decker, David Gottesman, Charlotte Guyman, Ajit Jain, Thomas Murphy, Ronald Olson, Walter Scott, and Meryl Witmer be elected as directors.

Speaker 3: (01:50:29)

I second the motion.

Warren Buffett: (01:50:31)

It has been moved in second of that Warren Buffett, Charles Munger, Gregory Abel, Howard Buffett, Steve Burke, Ken Chenault, Susan Decker, David Gottesman, Charlotte Guyman, Ajit Jain, Tom Murphy, Ron Olson, Walter Scott, and Meryl Witmer be elected as directors. The nominations are ready to be acted upon. Mr. Jaksich, When you’re ready, you may give your report.

Dan Jaksich: (01:50:58)

My report is ready. The ballot of the proxy holders in response to proxies that were received through last Thursday evening cast not less than 543,203 votes for each nominee. That number exceeds a majority of the number of the total votes of all class A and class B shares outstanding. The certification required by Delaware law of the precise count of the votes will be given to the secretary to be placed with the minutes of this meeting.

Warren Buffett: (01:51:27)