Image Source: Mobilus in Mobil (Flickr)

Will the Definition of Income be Changed to Collect More Income Taxes?

Can one be expected to pay income tax on capital gains when there has not been a realized gain? Senator Ron Wyden of Oregon is the top-ranking member of the Senate’s tax committee; today (October 27), he proposed to tax unrealized capital gains. This places a legislative heavyweight behind getting this dramatic change implemented. Back in February, and again this week, the Secretary of the Treasury, Janet Yellen, proposed this idea. Open opposition to this idea comes from some notable businesspeople, including Elon Musk, who wonders if it is a slippery slope that will eventually impact everyone. Others question how can one properly appraise non-market-oriented investments each year?

Background

In the U.S., capital-gains tax works this way; one purchases a capital asset such as a stock or real estate, the purchase price then becomes the “cost basis.” After it’s sold, the change in value between this cost basis and the sale price is the realized capital gain. In cases where the asset was held for a year or more, its gain is taxed at a 15 to 20 percent rate (depending on the taxpayer’s income). An additional 3.8 percent surtax is added for taxpayers making over $250,000. In effect, the U.S. has a capital-gains tax imposition of between 15 percent and 23.8 percent when an asset is sold at a profit after one year. The rate is higher if it’s sold within a year. Under a year, it is taxed at the owner’s ordinary income tax rate.

If the value of a capital asset increases, but that gain was not realized by a sale, there is no tax event. For assets that are inherited and never sold by the original purchaser, they are valued at the current market at the time of inheritance. Although there is an inheritance tax on large estates, many assets are reset at the current market or replacement value, thus reducing the beneficiary’s cost basis and reducing the magnitude of any potential tax from the pre-inheritance valuation.

Current Proposals

The Secretary of the Treasury who is also a former Chair of the US Federal Reserve Bank, Janet Yellen, proposed a tax on capital gains. She wants investors to pay a tax on the increase in the value of stock every year, even if it is not sold. In an appearance on CNN this week she said, “It would help get at capital gains, which are an extraordinarily large part of the incomes of the wealthiest individuals, and right now escape taxation.” Details of where the lines would be drawn and who the tax would impact were not clear. She was, however, discussing what she refers to as the wealthiest of individuals.

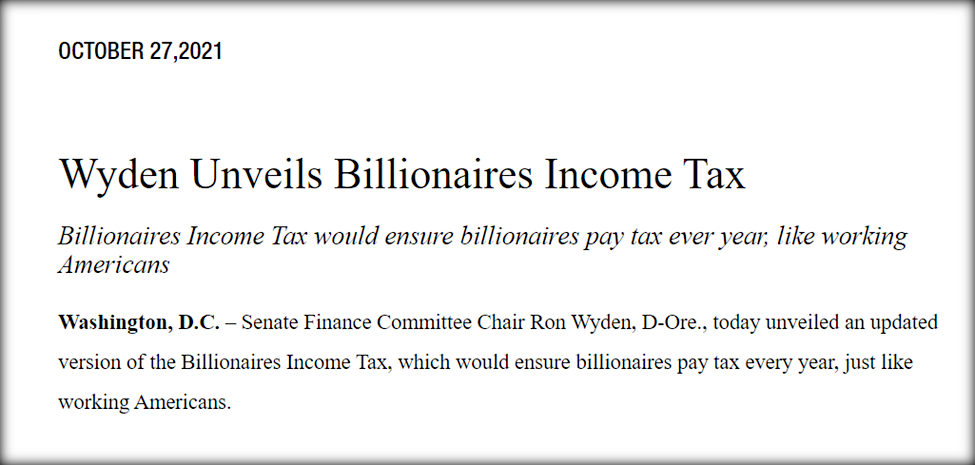

In a Senate Finance Committee news release, Senator Ron Wyden (Oregon) presented what he calls The Billionaires

Income Tax. The release has the tag line:

“Billionaires Income Tax would

ensure billionaires pay tax every year, like working Americans”

Key points of the proposal are, tradable assets like stocks would be marked-to-market every year. Billionaires would pay tax on any gain and take deductions for losses on these assets each year for tax purposes. Those affected would be able to carry losses forward and, in certain circumstances, carry back losses for three years.

Non-tradable assets like real estate or business interests would not be taxed annually. When someone of high net worth sells non-tradable assets, they would pay capital gains tax, plus an interest charge. The interest charge, or “deferral recapture amount,” is the amount of interest that would be due on the tax owed if the asset had been marked to market each year and the tax had been deferred until sale. The interest rate is the applicable federal short-term rate plus one point. The AFR is currently 0.22 percent, so the interest rate applied would be 1.22 percent.

The proposal contains rules to transition to the changed income tax. For example, the first time those impacted have their tradable assets marked-to-market, they may elect to pay the newly incurred tax over five years. They may also elect to treat up to $1 billion of tradable stock in a single corporation as a non-tradable asset. This will ensure that the proposal does not affect the ability of an individual who founds a successful company to maintain their controlling interest because they’d be forced to sell a portion to pay taxes.

Source: U.S. Senate Committee on Finance Bulletin, October 27, 2021

Opposition

Those opposed argue that a declining market could potentially reduce taxes collected. Others wonder how non-tradeable assets can appropriately be marked-to-market, and question if an entire industry of appraisers will be born in order to serve accountants and the IRS needs.

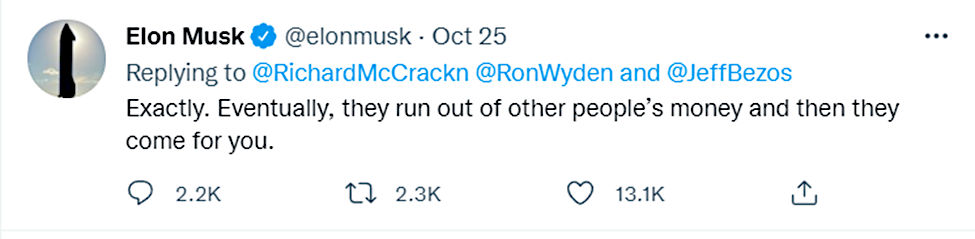

The richest man in the world, U.S. Citizen and immigrant businessman Elon Musk would surely be included and taxed differently. He showed his opposition when he tweeted his thoughts in response to a tweet directed at him along with the second richest man, Jeff Bezos.

Musk seems to believe that although it’s called the “Billionaires Income Tax” those without as many zeros after their net worth may also be impacted if the idea of taxing unrealized gains becomes accepted.

There is also concern over how this could impact stock prices. Taxing a non-cash asset leaves the challenge of where the cash will come from. It also reduces the incentive to hold stocks for very long periods of time. The combination of these two, if the proposal becomes a reality, could weigh on the stocks with the greatest gains.

Why Now?

There are a number of expensive proposals coming out of the nation’s capital. These include the Social Spending Bill, converting our energy grid to something less dependent on fossil fuels, infrastructure spending, and funding for stimulus and other projects.

The question is paying for these enormously expensive projects. The richest 400 families in the country have become thought of as a source for various reasons; chief among them is the average voter is indifferent to taxes that don’t directly impact them.

Take-Away

In an attempt to find a means to pay for expensive projects, there are proposals coming from Washington to increase taxes. One proposal that is being brought to the forefront, separate from a “wealth tax,” is the idea of collecting taxes based on the change in the market value of assets rather than realized capital gains. If implemented, this would have implications far beyond the few hundred families directly impacted. The financial markets and real estate may feel some weight. The reasons are that money would have to come from the liquidation of something to pay the required taxes, also the attractiveness of long holding times is lowered, and alternative investments, perhaps offshore, may become more tax efficient.

Suggested Reading:

Is Biden Tightening the Reins on Large Companies?

|

Federal Marijuana Laws are Half-In/Half-Out Says Justice Clarence Thomas

|

Paying for Infrastructure Spending

|

The Era of Flying Cars May Have Just Dawned

|

Sources:

https://www.finance.senate.gov/chairmans-news/wyden-unveils-billionaires-income-tax

https://www.finance.senate.gov/imo/media/doc/Billionaires%20Income%20Tax%20-%20One%20Pager.pdf

https://www.nytimes.com/2021/10/26/us/politics/democrats-billionaires-tax.html

Stay up to date. Follow us:

|