Analyst Sees Evidence these Sectors are Just Beginning to Benefit from Reduced Mandates

Has the door finally been kicked open on the post-pandemic trade?

While investors are watching inflation numbers and interest rates, there is an underlying story that could be very meaningful to the services and hospitality sectors. New York just announced it is lifting much of its indoor mask mandate as it joins a growing list of states that are speeding toward allowing individual choice. The impact of ever more consumers venturing out to restaurants, bowling alleys, vacation destinations, bars, etc., and then opening their wallets, may finally be creating an oversized opportunity. As the covid trade is seen unwinding and the post covid possibilities are presenting themselves, spending will shift, and so should investments.

In a research note released by Bank of America’s economist, Anna Zhou writes that credit card spending overall has seen “a noticeable uptick in the last two weeks.” Card spending was up 20.2% above the levels recorded the same week (ending Feb. 5) of 2020 and up 12.3% compared with the same week in 2021. Zhou reports this spending included an “across the board improvement in spending for airlines, lodging, entertainment services, and restaurants. Within the categories, entertainment spending climbed from 20% below the 2020 level to just 5% below. Restaurants and bars rose from 10% above 2020 levels to 18% above. The note indicated that gyms are also seeing improvements and any sector that benefits from older Americans with reduced fears for their safety could see increased traffic.

The data and insights offer an indication that the rotation toward the industries mentioned by Zhou may be in for a boom period regardless of how the rest of the market behaves. As the last months of winter play out, people are likely to escalate their playtime in ways they have been prevented from for two full years.

There are hundreds of stocks in B of A’s category list. Below are four interesting companies that are each unique to their categories and may belong on your watchlist.

Travelzoo (Nasdaq Global: TZOO) is a media company that provides travel, entertainment, and local deals to its 30 million members worldwide. The company distributes travel “deals” through its Travelzoo website, newsletters, and smartphone apps. In addition, it provides travel content to third-party websites and media outlets. The company benefits from over 2,000 travel-related advertisers including airlines, hotels, cruise lines, vacation packages, tour operators, attractions, rental car companies, restaurants, spas, and tourism-related companies.

Read the most recent Noble Capital Markets research

on TZOO including price targets.

Bowlero Corp. (NYSE: BOWL) is the worldwide leader in bowling entertainment. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. Bowlero Corp. is also home to the Professional Bowlers Association, which it acquired in 2019. BOWL is the completed SPAC of Isos Acquisition Corp.

Read the most recent Noble Capital Markets research

on BOWL including price targets.

RCI Hospitality Holdings, Inc. (Nasdaq: RICK) through its subsidiaries, owns and operates gentlemen’s clubs and sports bars/restaurants within two segments Nightclubs and Bombshells. It also operates a communications company serving adult nightclubs and the adult retail products industry. The Company operates approximately 48 establishments that offer live adult entertainment, and/or restaurant and bar operations.

Read the most recent Noble Capital Markets research

on Rick including price targets.

FAT Brands (NASDAQ: FAT) is a leading global franchising company that acquires, markets, and develops fast-casual, quick-service, casual dining, and polished casual dining concepts around the world. The Company currently owns 17 restaurant brands: Round Table Pizza, Fatburger, Marble Slab Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Great American Cookies, Hot Dog on a Stick, Buffalo’s Cafe & Express, Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises over 2,300 units worldwide.

Read the most recent Noble Capital Markets research on

FAT including price targets.

Take-Away

It’s impossible to know if this wave of consumers that feel more comfortable stepping from their homes will grow or if another surprise will cause them to be hesitant to treat themselves to a night of entertainment, dinner, or recreation. However, the trend toward opening the doors appears stronger than it has been since the start of lockdowns.

Bank of America economist Anna Zhou included in her note, “Overall, we expect consumers to further unleash their spending power in the coming months as the services sector continues to reopen.”

Managing Editor, Channelchek

Suggested Content

Bowlero Corp – C-Suite Interview (Video)

|

Fat Brands Virtual Roadshow (Video)

|

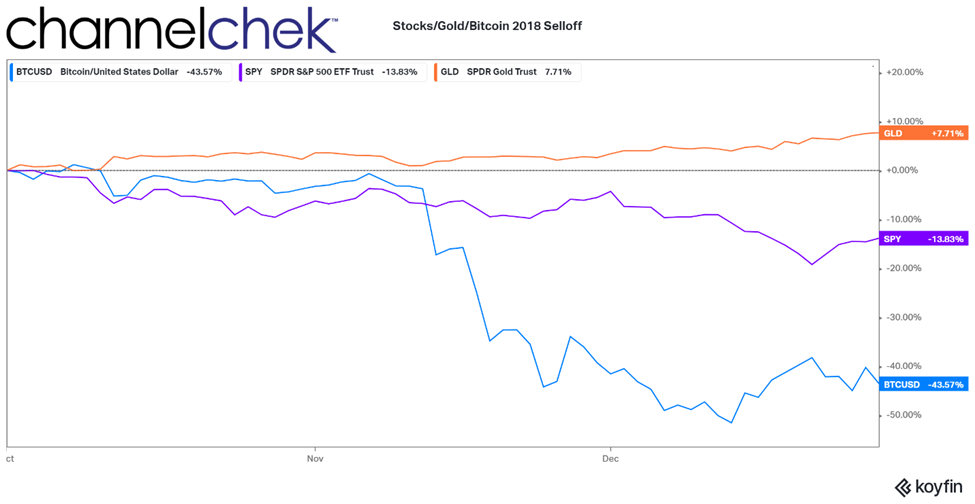

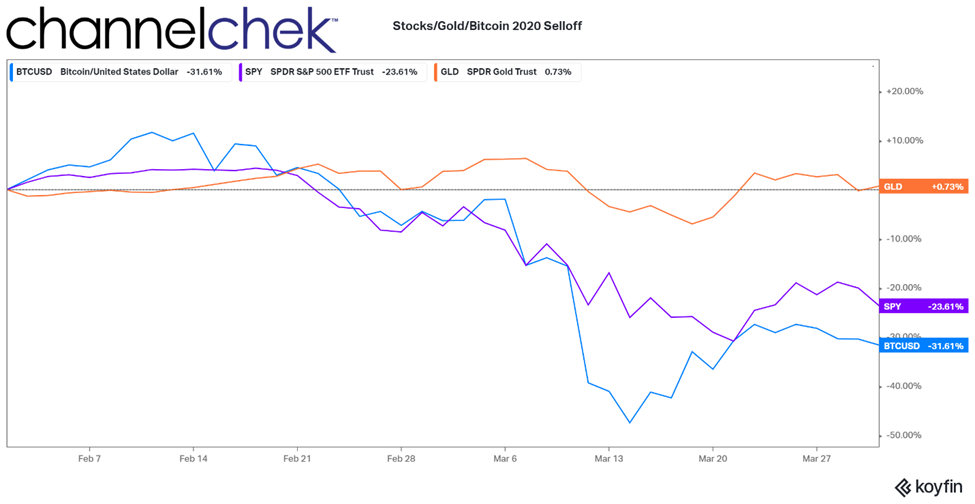

Why Good Economic Numbers Can Cause a Selloff

|

Money Supply is Like Caffeine for Stocks

|

Sources

https://www.npr.org/2022/02/09/1079555193/new-york-new-jersey-end-mask-mandate-ending

https://channelchek.vercel.app/aux/(expanded:check-channels)

Stay up to date. Follow us:

|