Image Credit: Chris Bowman (Flickr)

Social Security and Pension Cost of Living Increases Next Year Will be Largest Since 1981

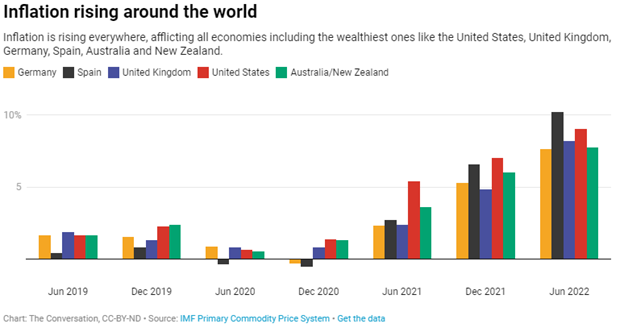

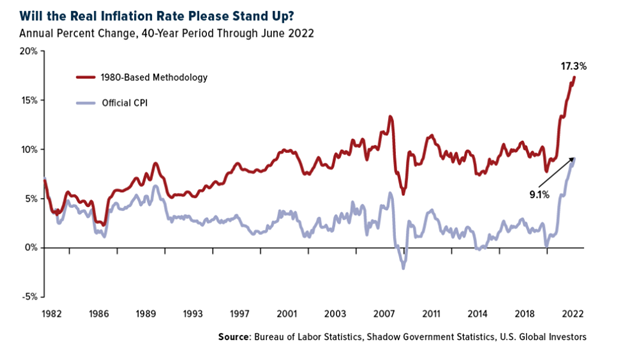

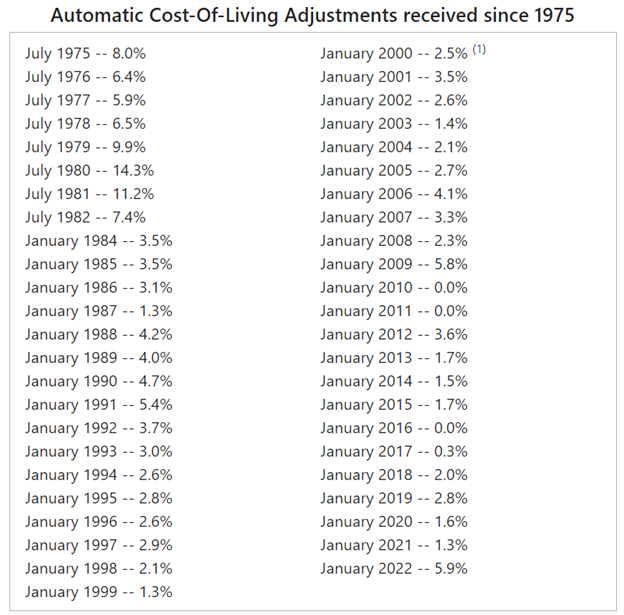

A 9.6% COLA increase in wages in 2023? That’s what retirees can expect from Social Security if the inflation rate doesn’t recede in August and September. This would be the highest cost-of-living increase in more than four decades. The increases are based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) measured from the third quarter of the last year to the current third quarter. COLA is to ensure that the purchasing power of Social Security and Supplemental Security Income (SSI) benefits is not eroded by inflation.

Here’s How 2022-2023 COLA Works

The CPI-W is determined by the Bureau of Labor Statistics (BLS), which is part of the Department of Labor (DOL). It is the legal measure used by the Social Security Administration to calculate COLAs.

Social Security checks get an inflation adjustment each year based on the index. In determining the cost of living adjustment, the Social Security Administration (SSA) compares the average figures for July, August, and September to the index’s average level over the same annualized monthly average a year earlier.

The July CPI-W data, released Wednesday (August 10), rose 9.1% during the past 12 months. That is slightly higher than the more talked about “headline inflation” number, which is CPI-U or the Consumer Price Index for All Urban Consumers. CPI-U YoY rose 8.5% year-to-date.

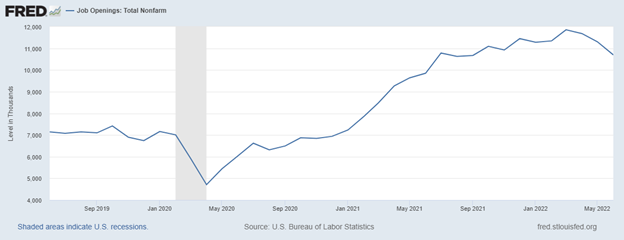

If inflation remains at the current level, on average, over August and September, the approximately 70 million retirees and disabled people who receive Social Security benefits will experience payment increases of 9.6% beginning January 2023. With a COLA of 9.6%, the average monthly Social Security check for retired workers would rise by about $160 in 2023, to $1,829 in January from $1,669 this year.

Source: SSA.gov

Compared to 2022

Last October, when the COLA for 2022 was announced, federal retirees received a 5.9% increase in Social Security payments. The Civil Service Retirement System (CSRS) annuities that use the same COLA calculation have been benefitting the same. The Federal Employees Retirement System (FERS) annuities received a 4.9% increase starting in January 2022. At that time, this was the largest COLA increase in 40 years. The 2023 increase is almost certain to surpass 5.9%.

The actual 2023 COLA will be calculated in mid-October. At that time, the average for July, August, and September will have all become official; from there, the actual COLA calculation is easy. In 2022 this led to a combined pay raise of over $68 billion for those receiving Social Security.

The Bureau of Labor Statistics is scheduled to release the August CPI-W on September 13 and September data on October 13. The SSA will issue the official COLA announcement for the following year soon after.

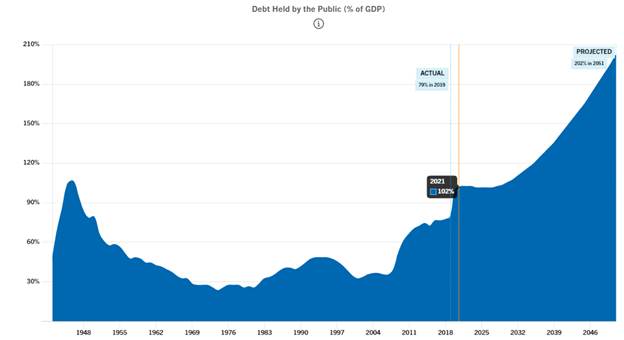

Next year’s COLA increase is likely to speed up the calculated date of insolvency for the Social Security trust fund. The current expectation by the Committee for a Responsible Federal Budget, which predicts insolvency, is 2034. This is a year earlier than it had been previously forecast.

Managing Editor, Channelchek

Suggested Content

With Inflation Pushing Up the COLA on Social Security, Investing Where Seniors Spend Could Pay Off!

|

What a $75.6 Billion COLA Could Mean to Investors

|

Are Consumer Price Increases Negatively Correlated to Stock Market Price Levels?

|

Why Cathie Wood Thinks We Will Emerge from A Recession More Quickly than Others

|

Sources

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.bls.gov/schedule/news_release/cpi.htm

https://www.crfb.org/issue-area/social-security

Stay up to date. Follow us:

|