Image Crediit: Rick (flickr)

How Difficult Will it be for the Fed to Control Inflation?

The financial markets have a paradigm shift to contend with. This includes stocks, bonds, commodities, and cryptocurrency. For decades, the U.S. Central Bank was concerned with managing to avoid a deflationary spiral, any inflationary risk was minimal. The tide has turned, and those nominated and presumed to be filling the top two spots at the Fed now list inflation fighting as a priority.

Inflation’s

Impact on Market Moves

Generally speaking, in order for an investor to want to be involved in a stock or other investment it’s in part because they expect the outcome will place them even with or ahead of future price growth. Even at the most conservative end of the investment spectrum, U.S. Treasuries, and bank overnight lending rates, those involved demanded returns higher than the future expected level of inflation. When deflation was the expectation, rates below the recent inflation reports were accepted and had little difficulty attracting capital.

Yield/Inflation

Comparison

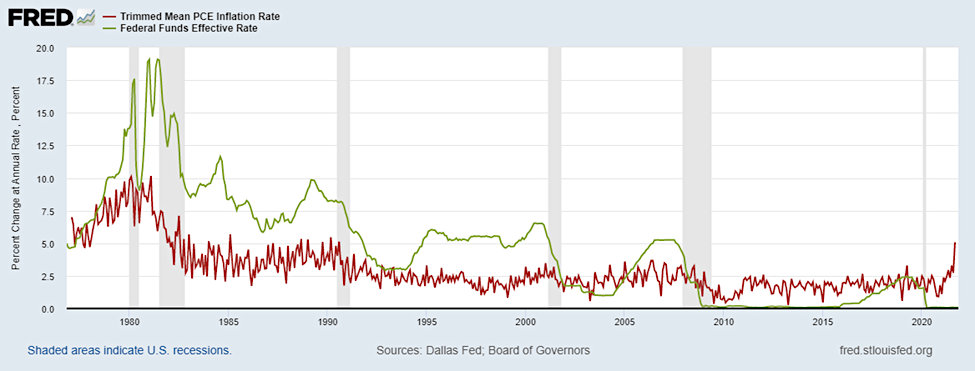

The chart below covers November 1976 through September 2021. It compares the inflation rate with overnight Fed Funds. The inflation measure used here is the conservative Trimmed PCE Inflation

Rate, which includes personal consumption expenditures (PCE) and only half the food and energy component (trimmed). This is typically lower than the consumer price index, which measures a basket of goods rather than what is actually consumed during the period. The trimmed PCE Inflation rate takes into account that people can substitute goods if one price goes up. The second line in the chart is the base overnight lending rate that banks charge each other to close out each day with the required reserves. This level is typically the lowest data point on the entire yield curve.

Even in this most conservative comparison, we see that the Fed Funds rate (green line) trades well above the inflation rate (red line). For this 45 year period, inflation averaged 3%, while the overnight interest rate averaged 4.72%. This is 58% higher. Fed funds is not a rate set by the market, it’s orchestrated through the Fed’s monetary policy. Currently, the Fed’s targeted rate is 0.00%-0.25%. The most recent Trimmed PCE number is from September at 5.08% (the last point on chart).

Even at the high end of today’s overnight target (0.25%), inflation averaged 4.83% above Fed Funds. So while overnight interest rates have been historically 58% higher, currently, inflation is 2083% higher.

To stay within historic norms the Fed Funds target would be 7.75%-8.00%.

Plight of

the Fed

Outside of the U.S., countries are experiencing a resurgence of Covid-19. Some are responding with lockdowns and other steps that are sure to lower economic output and consumption. The U.S. has not experienced this yet, but the possibility looms over economic activity and projections for the future. The economy is not at full employment and is considered too frail for the Fed to start tapping the economic brakes. However, with inflation’s high potential to linger or grow, the Fed shouldn’t be tapping the brakes, they should be jumping on them. This, of course, presumes that reeling in inflation is among their top priorities, as they have stated.

Plight of

the Treasury

The coming month of December will bring with it a lot of give-and-take between the two parties in Congress and the U.S. Secretary of the Treasury Janet Yellen. The problem is the United States is expected to run out of cash by mid-December. Without cash, it can’t pay its bills, it can’t pay employees, and won’t be able to retain reserve currency status. It would probably even suffer a severe drop in its credit rating if it defaulted on its debts.

This debt ceiling struggle has happened before; negotiations to raise the debt ceiling are common each year. This year is a bit different because, with the advent of the pandemic, Congress voted to suspend the debt ceiling until August 1, 2021. At that time, it was reinstated to $28.5 trillion. At its most basic, it allows the U.S. Treasury to go deeper in debt. While the wrestling match will go on before passing, either a stop-gap measure or a new ceiling could cause volatility in the markets.

Another concern is the cost of the debt. Congress could pass a debt ceiling limit that impacts the amount borrowed, but the amount paid back is impacted by prevailing interest rates when issued. Should, for example, rates rise to their more historical norm of 1.75% the rate of expected inflation, the cost of servicing new debt could increase to 20 times what it is now.

Take-Away

For decades investors were unconcerned about inflation or the erosive impact on spending power. Interest rates were brought down to help prop up an economy that had been challenged at times during these years. Because inflation was low, the Fed had room to do this. The mindset of investors should begin to include inflation and the Fed using tools to fight inflation. There will be a different impact on the various asset classes; for instance, stocks are considered a good hedge against inflation, bonds prices go down as rates tick up naturally or through Fed policy implementation.

The paradigm shift toward a Fed fighting inflation will take some more time to adopt than others. What is important to note in the tricky balance all of the policy-makers are contending with. There probably won’t be abrupt or surprising moves as policy adjusts.

Managing Editor, Channelchek

Suggested Reading:

The Last Time Inflation Was This High Fed Funds Were 14.5%

|

The Detrimental Impact of Fed Policy on Savers

|

Will Small Cap Stocks Outperform in 2022?

|

Does Insider Selling Indicate Bearishness on the Company

|

Sources:

https://home.treasury.gov/system/files/136/Debt-Limit-Letter-to-Congress_20211119.pdf

https://www.cbo.gov/publication/57371

Stay up to date. Follow us:

|