Image Credit: Towfiqu barbhuiya (Pexels)

Will the Markets Continue to March Higher in 2022?

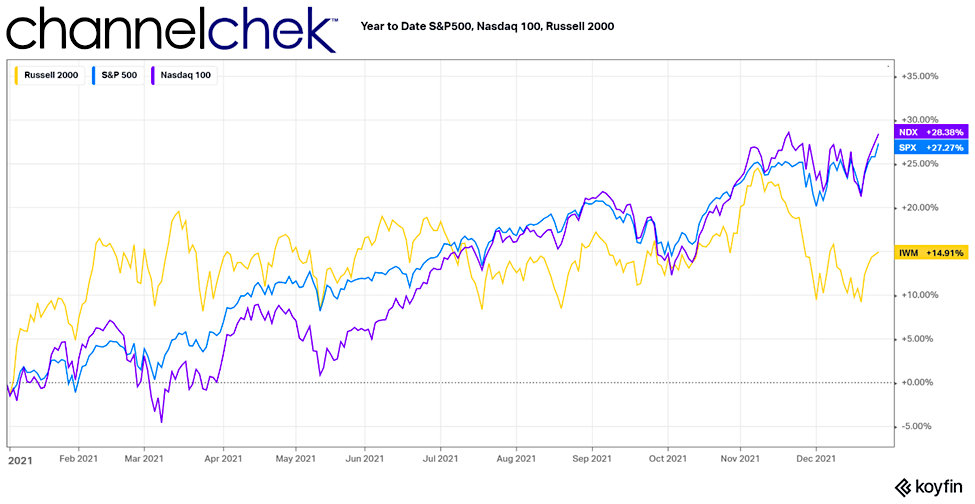

A relentless bull market, Covid variants, supply-chain issues, and inflation are likely to each have a chapter of their own when the story of the market’s strength throughout 2021 is written. With all the concern during 2021 over whether stocks would stay strong, whether disease outbreaks would crush the economic recovery, and the risks of inflation, the outcome is quite positive. Had an investor built a diversified portfolio on January 1, then ignored it the rest of the year, there is a good chance it would have outperformed the historical averages of the major indexes.

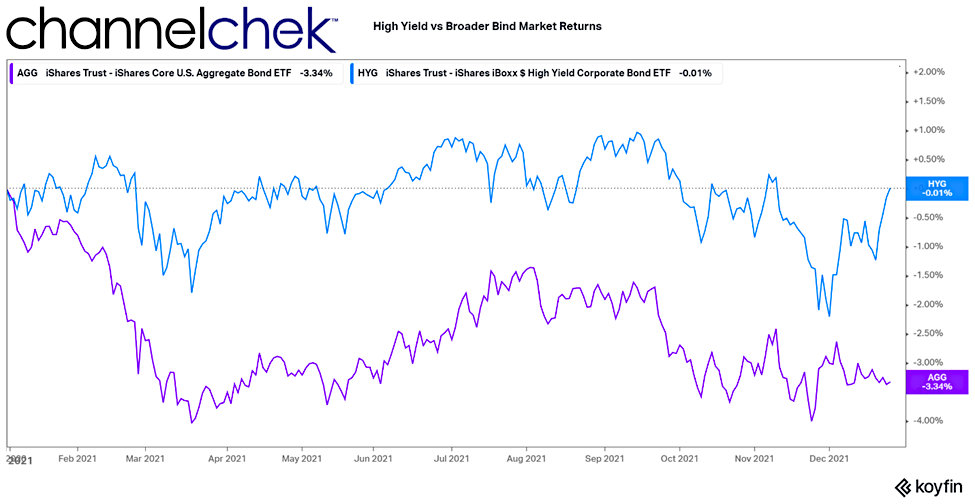

For those who diversified away from equities and decided to play it “safe” in the bond market, many U.S. aggregate bond funds were negative on the year. High yield funds tended to return a paltry return relative to stocks.

Consumer Prices

Inflation started the year as a talking point and ended as the center of attention. The U.S. economy entered 2021, with consumer prices rising at a low 1.4% year-over-year. This was below the Federal Reserve’s long-run target of 2%. If inflation concerned the Fed at all early in the year, it believed it should be a little higher.

Later in the year, supply-chain-related shortages had made it from business news to mainstream news programming. Prices became a normal dinnertime topic after the Dollar Store raised all of their prices. The weakest supply chain links were reported to be at ports where containers with imported goods waited to be put on a truck for delivery to its U.S. destination. Both available drivers and trucks are still well below the current demand level.

Stimulus

Supply and delivery problems were half of the issues that worked their way into producer and consumer prices. Another stimulus bill out of Washington worth $1.9 trillion signed by the new administration (added to the previous $900 billion package, and the $2.1 trillion Cares Act passed the prior year) put an excessive amount of money into the economy. The Fed was supporting borrowing by purchasing Treasury securities at nearly a $1 trillion annual rate, along with nearly $500 billion in agency mortgage-backed securities, which continues to keep mortgage rates well below current inflation. The high level of cash that was pumped into the markets to offset lockdowns and slowdowns, along with the inability to deliver goods on time worked its way into prices. Inflation now stands at the end of the year at close to 7%. This is a rate not seen since 1982.

Easy Money

Although not counted directly in the CPI-U basket of goods, larger homes increased in price 20% or more as people working from home now felt they wanted more space. Early in the year, Fed Chairman Powell called the surge in single-family home prices a “passing phenomenon.”

Along with housing, inexpensive money seemed to drive asset prices up on much more speculative assets. This included collectible non-fungible tokens (NFTs). Few had even heard of an NFT at the start of 2021, but by year-end the stratosphere-level prices had many investors taking notice and many companies entering the space. Low cost of money inflates the value of assets. Cheap, abundant capital can justify all manner of additions to one’s life, from electric vehicles, to stationary computerized bicycles, to speculative cryptocurrencies.

A shortage of computer chips led to a shortage of stand-alone computers and auto and marine engines that rely on these chips. This helped drive up used car and boat prices as much as 10% in one month.

Take-Away

In 2022, one can only guess, much of what drove prices up (new money, supply problems) will diminish. It already seems that a stimulus package that only a couple of months ago had the votes to pass, may not be even close to the expected size first envisioned. With this in mind, money management and investment selection become even more important. One cannot just put their money in a diversified fund and expect it to ride the wave.

The Channelchek platform houses current equity research and well thought out articles that are added to daily. It is a great online source to discover actionable ideas and understand what industry experts are thinking.

Register at no cost now for Channelchek to help stimulate your investor knowledge in 2022.

Suggested Reading:

Why Small Cap Stocks May Outperform Large Caps in 2022

|

Market Index Inclusion and Spikes in a Stock’s Demand

|

Will there be Enthusiasm for Ark Invest’s ESG ETF?

|

ESG Ratings Could Miss Problematic Supply Chain Issues

|

Sources:

https://apps.bea.gov/itable/index.cfm

Stay up to date. Follow us:

|