The medtech deal landscape just got a major shake-up with medical technology giant KARL STORZ announcing it will acquire surgical robotics company Asensus Surgical for $0.35 per share in cash. The $775 million transaction represents a significant premium for Asensus shareholders and will create a new leader in robotic surgery systems within KARL STORZ’s vast product portfolio.

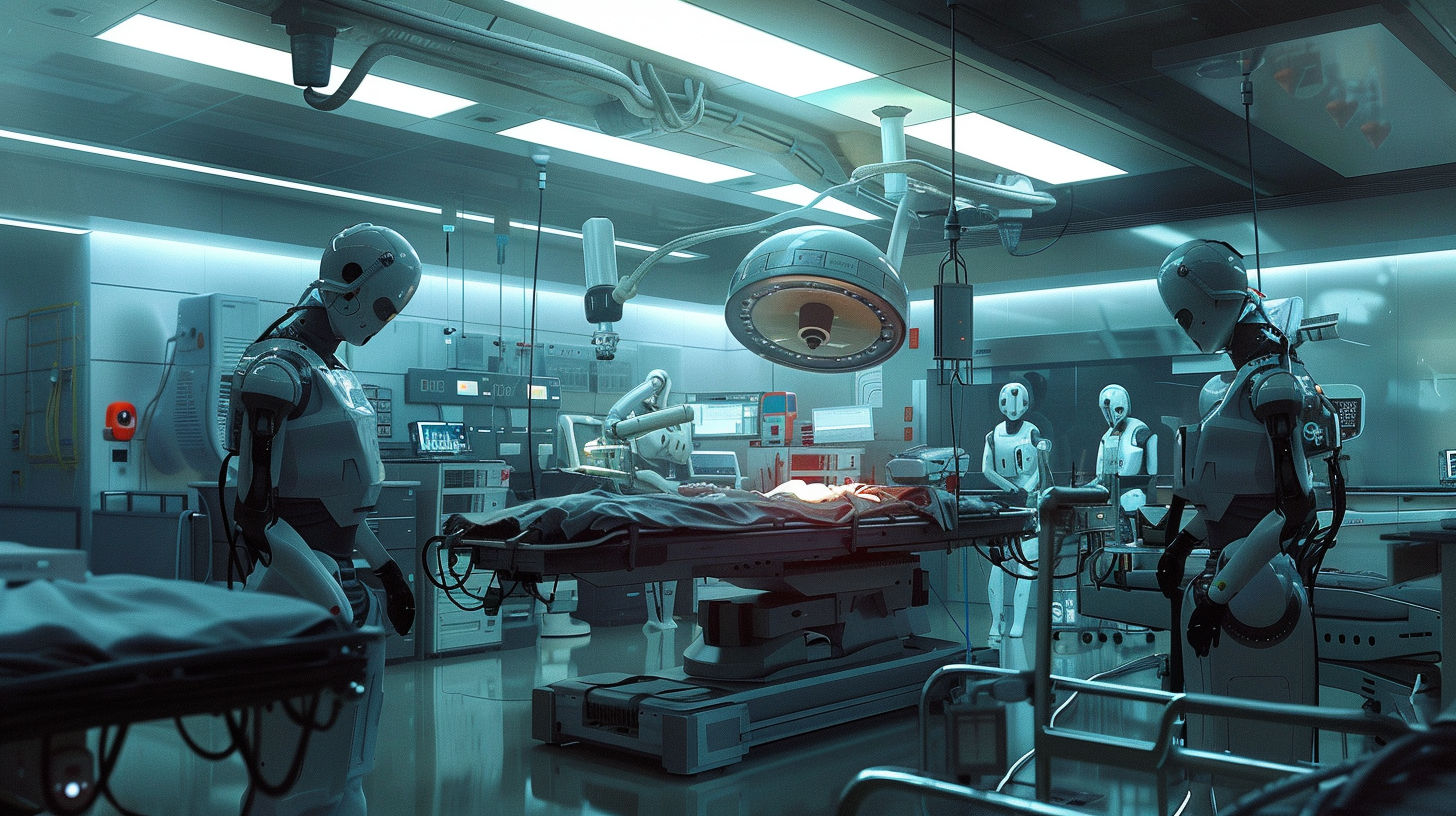

The acquisition highlights the intense interest and competition around next-generation surgical robotics platforms. KARL STORZ is doubling down on the space by bringing Asensus and its augmented intelligence technologies in-house to enhance its robotic surgery offerings, particularly the promising LUNA system Asensus had in development.

For the medtech sector and investors, this high-profile deal carries several implications:

Robotic Surgery Becomes Key Priority

KARL STORZ’s major bet on Asensus signals just how strategically important robotic-assisted surgery has become for medtech companies. The ability to market cutting-edge robotic platforms that improve precision and outcomes is now table stakes in many areas of surgery.

Medtechs involved in supporting technologies like visualization, data integration, and procedural automation should see increased interest and investment from larger players looking to beef up their surgical robotics capabilities. KARL STORZ’s acquisition also puts increased pressure on peers like Intuitive Surgical and Stryker to stay ahead of the innovation curve.

More Consolidation Could Follow

Billion-dollar acquisitions often beget more deals as competitors look to keep pace and buttress their own product portfolios. This could kick off another wave of M&A in the surgical robotics space specifically, with smaller innovative companies becoming prime targets for medtech incumbents.

But beyond just robotics, KARL STORZ’s aggressive move may spur more consolidation across the broader medtech landscape. Major strategic buyers have been a bit apprehensive on M&A recently. This deal could provide a catalyzing force for other medtechs, pharmaceuticals, and life science companies to start getting more acquisitive, especially with several cutting-edge names trading at more attractive valuations.

Public Listing Exits Will Continue

By taking Asensus private, KARL STORZ adds another data point to the growing trend of medtech companies going private or getting acquired by larger players. With the IPO markets effectively shuttered and sustaining a public listing increasingly difficult for many small-to-mid-sized medtechs, a lucrative exit via acquisition could become the preferred route.

Investors may need to adjust expectations and position accordingly. Rather than holding out for the “next big IPO,” top-performing private medtech holdings may deliver the biggest windfall by positioning to get scooped up via M&A premium valuations down the road.

Capital Allocation Will Be Key

The KARL STORZ-Asensus transaction underscores how critically important prudent capital allocation and portfolio management will be for medtech investors. The 67% premium paid by the German firm highlights the potential upside for backing innovative, promising names before they get acquired.

But it also serves as a reminder of the downside risks – making the wrong medtech bets can lead to significant impairment if firms struggle to remain viable acquisition targets or get their technologies to market successfully. Having robust processes to separate the wheat from the chaff across the medtech universe will be paramount moving forward.

KARL STORZ’s acquisition of Asensus represents both an ambitious strategic move for the medical device titan and an intriguing data point for medtech investors to digest. As the broader life science space continues rapidly evolving, this landmark M&A deal provides some insight into the developing landscape that savvy medtech investors will need to navigate adeptly.