Maple Gold Reports Fall 2021 Drill Results at Douay, Including 4.63 g/t Gold over 6.7 Metres Within 1.54 g/t Gold over 32.2 Metres at the 531 Zone, and Makes Equity Incentive Plan Grants

Research, News, and Market Data on Maple Gold Mines

Vancouver, British Columbia–(Newsfile Corp. – April 5, 2022) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF) (FSE: M3G) (“Maple Gold” or the “Company“) is pleased to report final assay results from the Fall 2021 drill program at the Company’s Douay Gold Project (“Douay” or the “Project”) in Quebec, Canada, which is held by a 50/50 joint venture (the “JV”) between the Company and Agnico Eagle Mines Limited. The JV completed a total of seven (7) holes and roughly 3,420 metres (“m”) under the Fall 2021 drill program, with every hole intersecting multiple intervals of >1 gram per tonne gold (“g/t Au”).

Highlights:

- Drill hole DO-21-316 at the 531 Zone intersected 1.54 g/t Au over 32.2 m (from 430.0 m downhole), including 4.63 g/t Au over 6.7 m within 2.13 g/t Au over 18.9 m.

- DO-21-316 intercepts are located approximately 135 m down-plunge from the best intercept drilled to-date at the 531 Zone (DO-21-310; see news from September 9, 2021) and below the SLR 2022 NI43-101 Mineral Resource Estimate (“SLR 2022”) conceptual pit limits, indicating down-plunge continuity of high-grade mineralized trends and resource expansion potential at depth in the 531 Zone.

- Drill hole DO-21-317 intersected three discrete gold zones: 5.58 g/t Au over 3.0 m (from 258.0 m downhole); 1.62 g/t Au over 16.0 m (from 284.0 m downhole); and 3.42 g/t Au over 8.0 m (from 369.0 m downhole).

- DO-21-317 intercepts are located up-plunge relative to the DO-21-310 intercept and within a different stratigraphic horizon relative to DO-21-316 that is also favourable for gold mineralization, indicating multiple stacked gold zones that remain open.

“Our exploration team has delivered significant drill intercepts every year at the 531 Zone since 2019 when our targeting became supported by 3D modelling,” stated Fred Speidel, VP Exploration of Maple Gold. “These new intercepts further support our belief that there are multiple stacked gold zones with apparent cross-plunges that appear to be structurally controlled. Demonstrated gold mineralization combined with a general lack of drilling has our team excited about the potential for the 531 Zone to deliver additional pit-constrained and underground resources as we continue with larger step-out and deeper drilling in 2022.”

Fall 2021 Drill Program Interpretation and Summary of Results

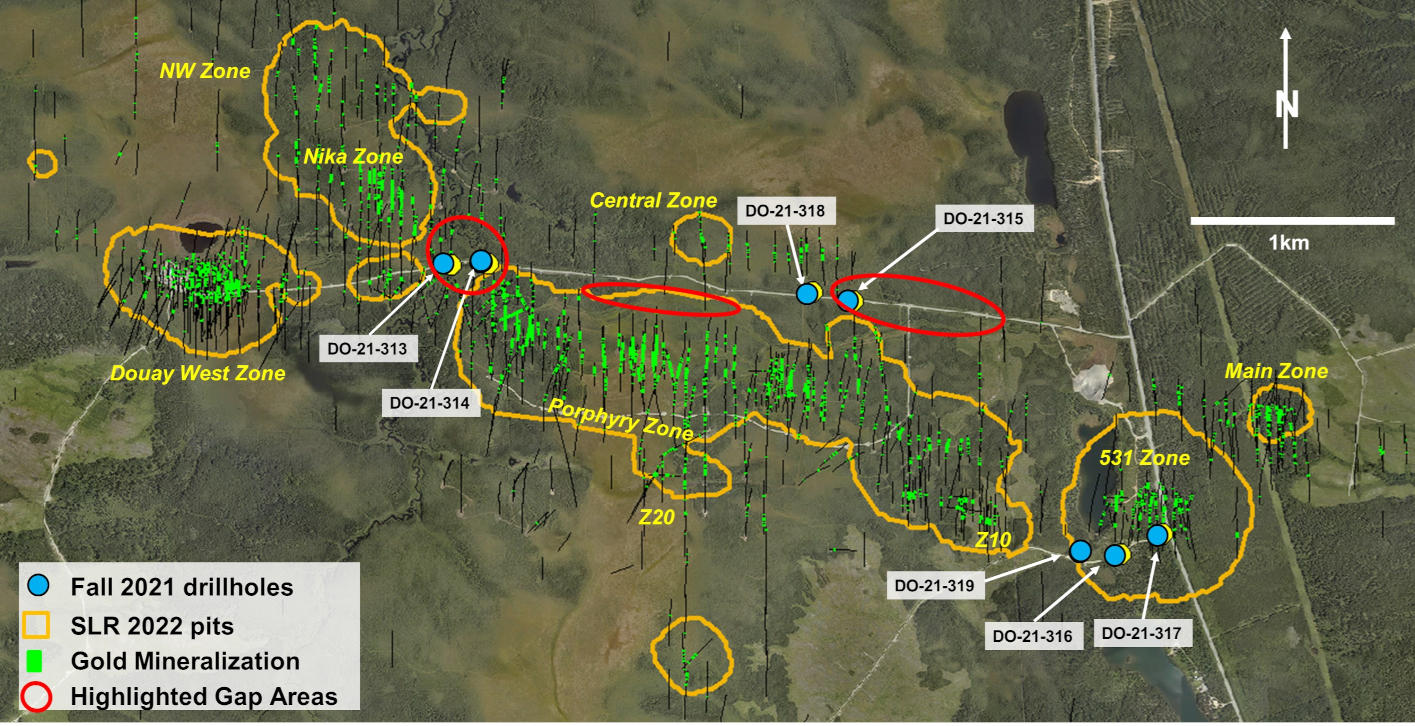

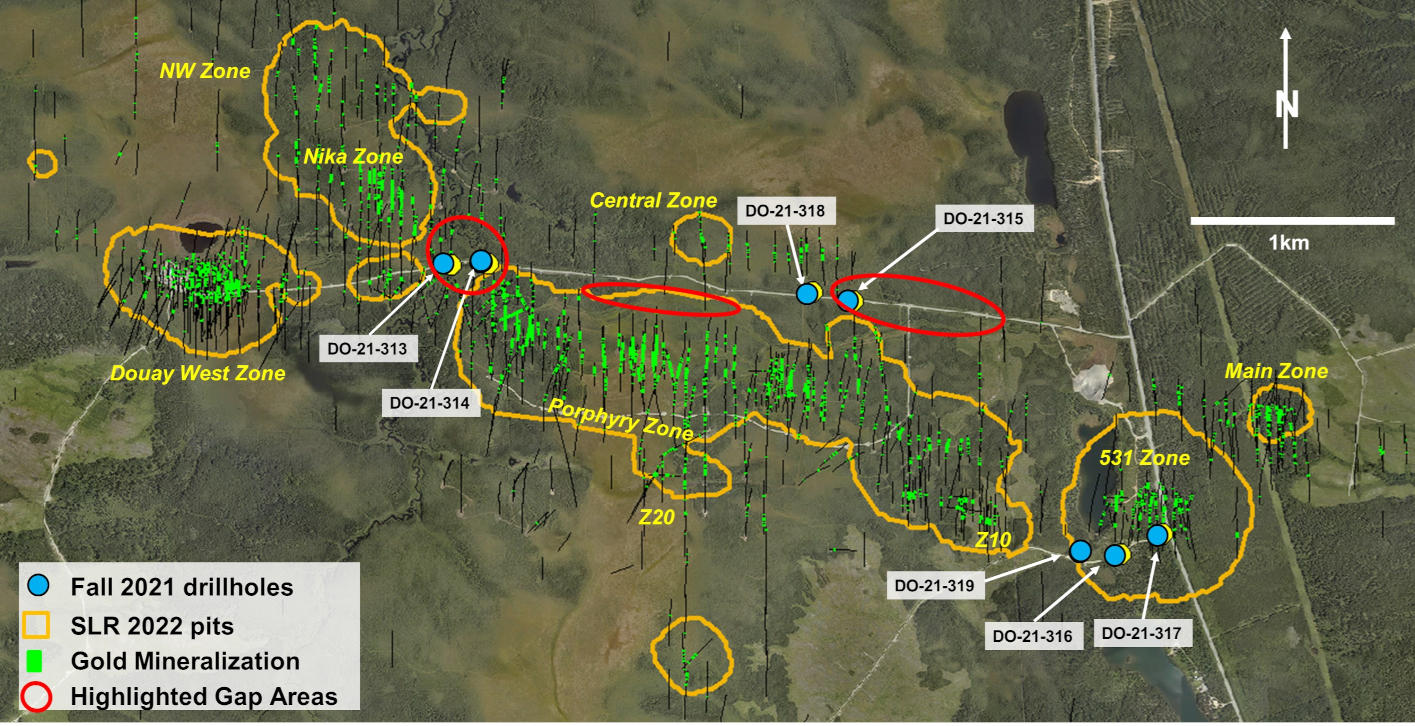

The JV’s Fall 2021 drill program included drilling in three separate areas (see Figure 1 for drill hole locations) outlined below with corresponding objectives:

- 531 Zone (3 holes): Targeting further up-plunge and down-plunge along one of the two main interpreted mineralized trends (see Figure 2).

- Central Zone (2 holes): Located 450 m and 650 m east of the SLR 2022 Central Zone conceptual pit and designed to test the eastern continuity of sediment-hosted gold mineralization and support further drilling along a 700 m drilling gap (see Figure 1).

- Nika Zone / Porphyry Zone Gap Area (2 holes): The Porphyry Zone and Nika Zone are geologically similar and these two drill holes were drilled in the gap area between these two zones and their respective SLR 2022 conceptual pits.

Figure 1: Douay plan view map highlighting Fall 2021 drill hole locations

The 531 Zone has several geological similarities to the Douay West Zone; however, the former has seen significantly less drilling to-date (see Figure 1) and represents an opportunity to expand resources with mineralization remaining open in multiple directions.

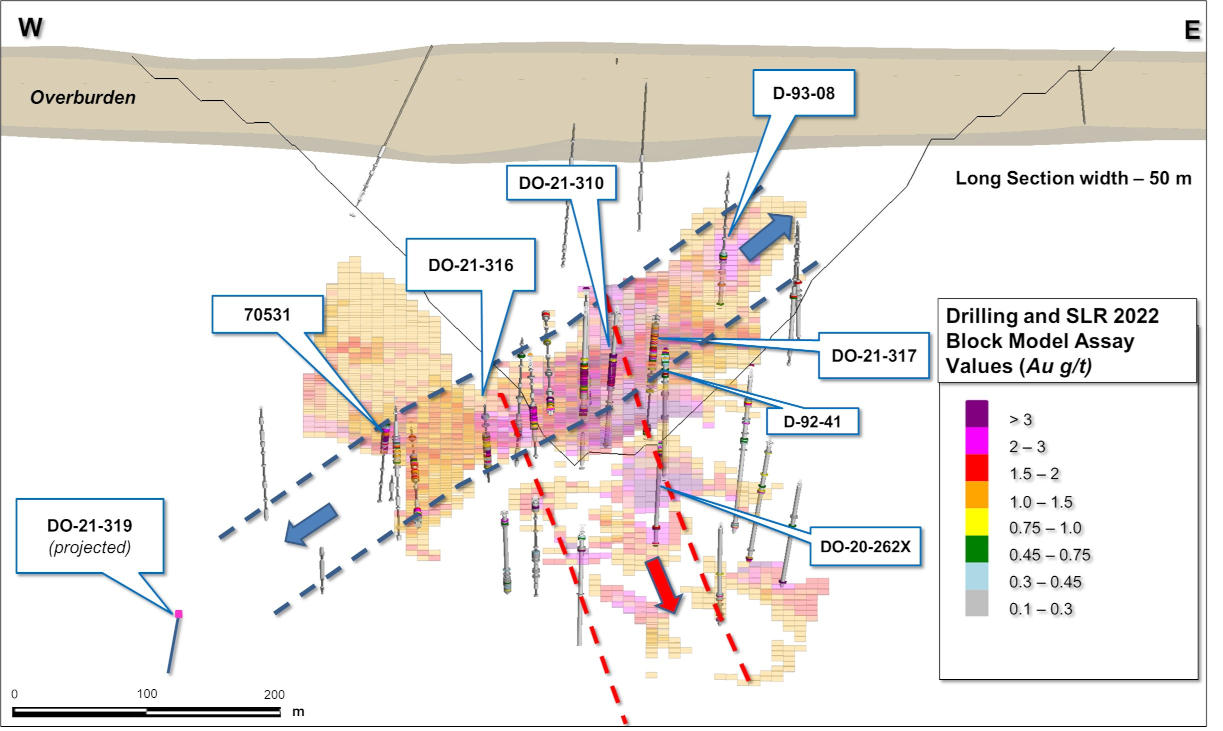

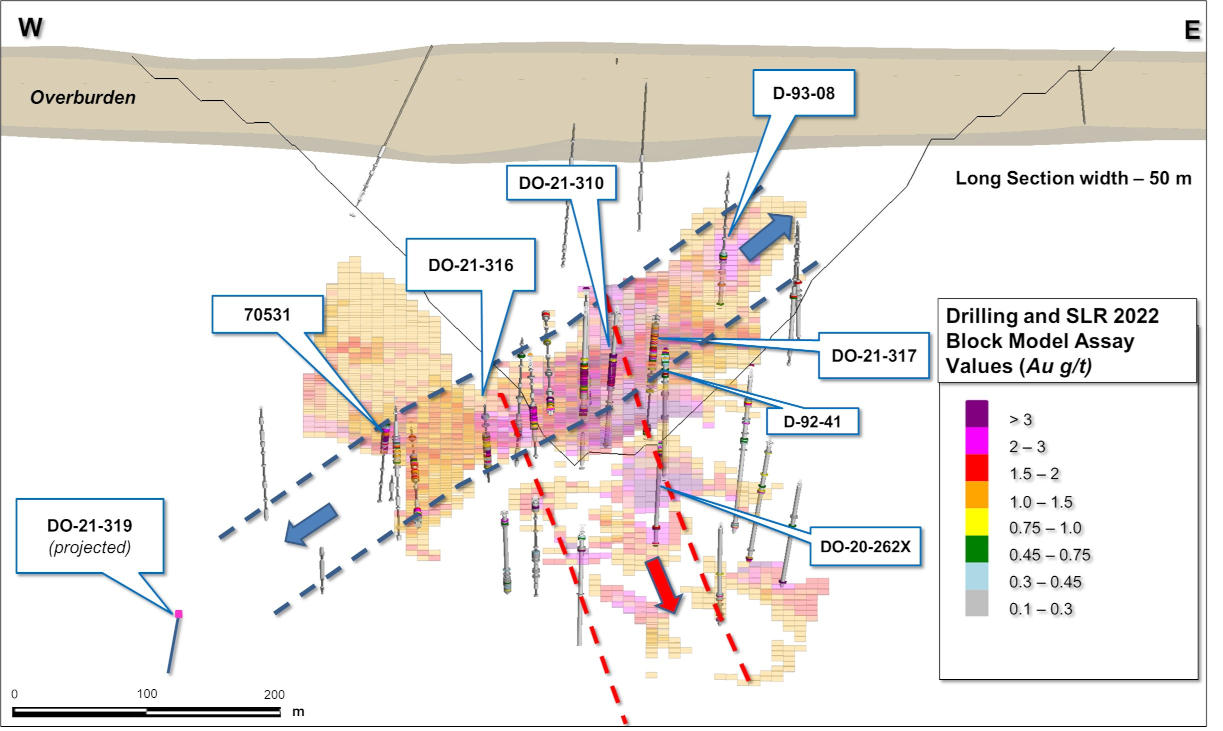

Figure 2: North-looking 531 Zone section (50 m total width) with SLR 2022 resource blocks and drill hole locations.

Figure 2 shows gold mineralization extending down-plunge over 300 m from D-93-08 through DO-21-317 to beyond DO-21-316 and then to 70531 (the original 531 Zone discovery hole). Mineralization remains open along both trends (blue and red arrows) at the 531 Zone. Apart from historical drillholes D-92-41 (2.0 g/t Au over 22.9 m) and D-93-08 (1.52 g/t Au over 13.7m), there is no drilling up-plunge to test at shallower depths on this section (see Figure 2 above) leaving mineralization open toward surface. DO-21-319 (2.12 g/t Au over 2.20 m, including 3.56 g/t Au over 1.5 m and 1.44 g/t Au over 5 m, including 2.47 g/t Au over 2.0 m) was an approximately 160 m step-out drill hole (mostly off section in Figure 2) that appears to have just intersected the lower edge of westerly-plunging mineralization in this area, which warrants follow-up drilling.

A second, roughly perpendicular trend or “cross-plunge”, currently less defined but consistent with the typical easterly-plunging mineralization at Douay, is supported by current geological interpretations and the distribution of SLR 2022 resource blocks. This trend is also open to depth with very little drilling (red arrow), but does include DO-20-262X, one of the most significant holes drilled at 531 Zone (see news releases from June 5, 2019 and March 16, 2020).

The DO-21-316 intercept (1.54 g/t Au over 32.2 m, including 2.13 g/t Au over 18.9 m and 4.63 g/t Au over 6.70 m) is hosted in bleached, massive, and relatively homogenous brecciated mafic intrusive that is geologically similar to the previously reported DO-21-310 intercept (8.8 g/t Au over 28 m) located approximately 135 m up-plunge. The DO-21-317 intercepts (5.58 g/t Au over 3.0 m; 1.62 g/t Au over 16.0 m; and 3.42 g/t Au over 8.0 m) are hosted in altered and mineralized fenitized basalts or interflow sediments, also favourable for gold, and are interpreted as additional stacked gold zones.

The altered mafic (and to a lesser degree sedimentary) host rocks, as observed in drill core, point to the possibility of an additional alkaline intrusive complex beneath the 531 Zone. The JV’s ongoing and planned drilling in 2022 includes larger step-out and deeper drilling to target areas with significant resource expansion potential. Drill testing the 531 Zone at greater depths continues to rank high on the JV’s priority list.

Central Zone drilling intersected multiple narrow zones of mostly sediment-hosted gold mineralization, including multi-gram intercepts in both drill holes. DO-21-318 intersected 2.53 g/t Au over 4.0 m (from 286.0 m downhole); DO-21-315 intersected 1.25 g/t Au over 4.0m (from 260.0 m downhole) and 4.24 g/t Au over 1.0 m (from 362.0 m downhole). Collectively, these two holes confirm that gold mineralization continues well to the east of the current SLR 2022 Central Zone conceptual pit and support drilling still further to the east along a 700 m drilling gap.

Drilling in the Nika Zone intersected multiple broad intervals of lower-grade mineralization in a gap area with very limited drilling between the Nika and Porphyry Zones (see Figure 1 and Table 1). This gap area has a similar magnetic signature as the centre of the Nika Zone (some 500 m to the northwest) where hole DO-21-282X intersected 1.58 g/t Au over 132 m (see news release from May 26, 2021). Given the general lack of drilling within this gap area, and particularly the presence of near-surface gold mineralization starting at top of bedrock, the results will be further interpreted with the aim of vectoring in towards larger near-surface concentrations of >1 g/t Au mineralization.

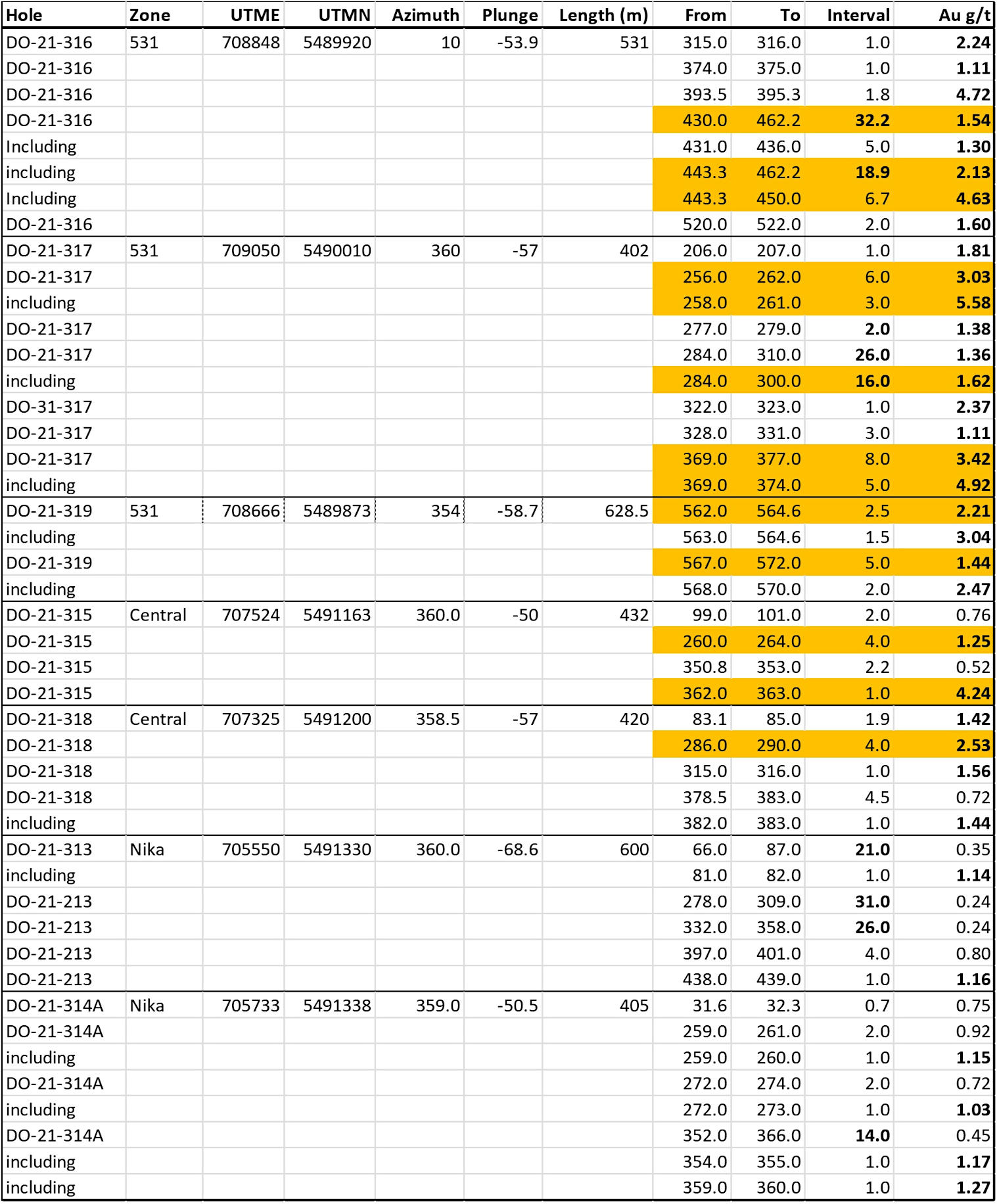

Complete Fall 2021 drill program results at Douay are included in Table 1 below.

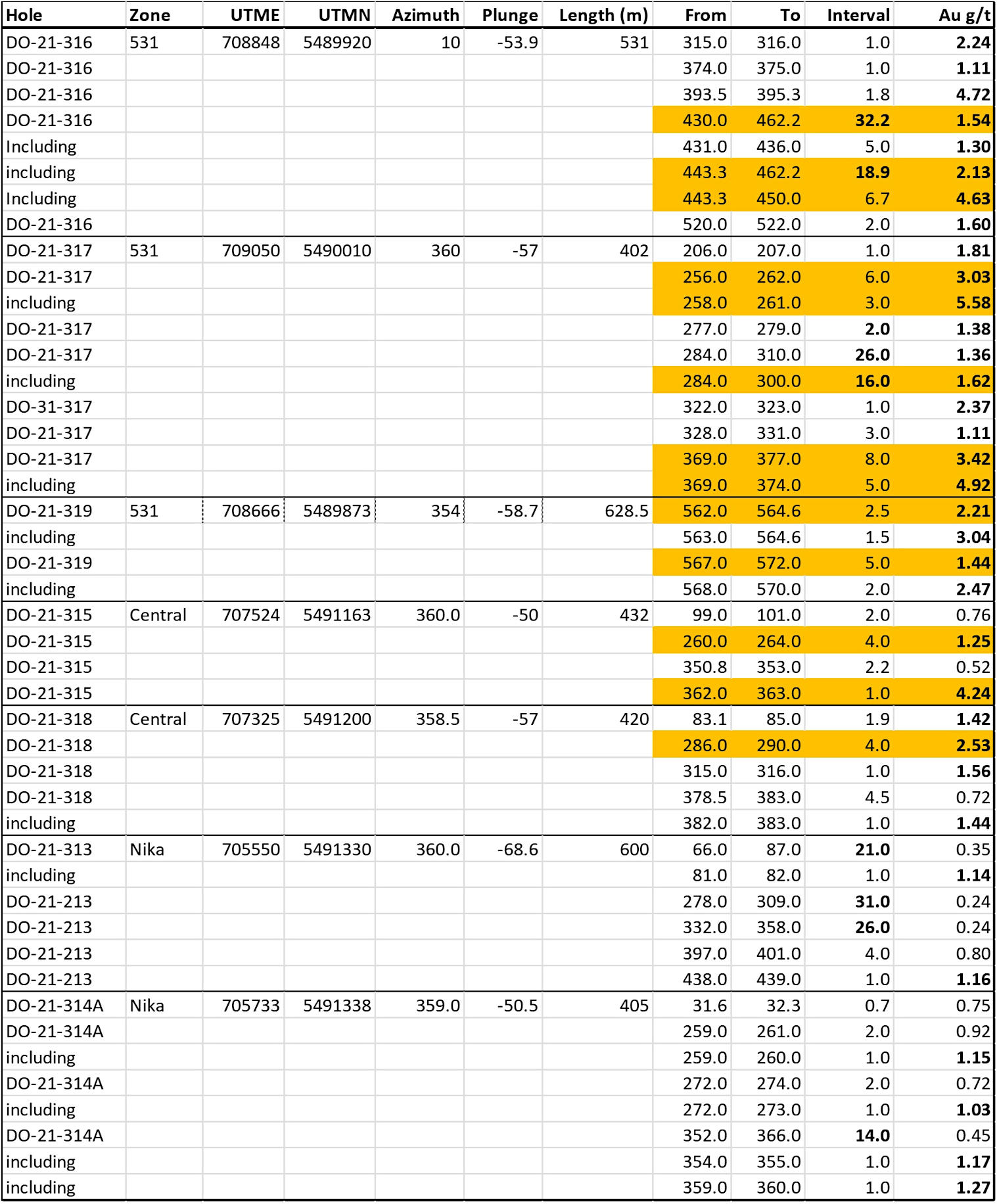

Table 1 – Summary of Fall 2021 Drill Program Results at Douay

Notes: All intervals are downhole core lengths. True widths estimated to be approximately 70-90% of core lengths.

Annual Equity Incentive Plan Grants

Pursuant to its Equity Incentive Plan (the “Plan”) dated December 17, 2020 and the policies of the TSX Venture Exchange, the Company has granted stock options (“Options”), Restricted Share Units (“RSUs”) and Deferred Share Units (“DSUs”) to certain employees, officers and directors of the Company.

Options to purchase an aggregate of 3,500,000 common shares of the Company (each, a “Common Share”) were granted, with an exercise price of $0.42 per Common Share. Each Option grant vests one-third on the date of the grant, one-third 12 months from the date of the grant and one-third 24 months from the date of the grant. Once vested, each Option is exercisable into one Common Share for a period of five years from the date of the grant.

The Company also granted a total of 3,530,000 RSUs and 900,000 DSUs. Each RSU grant vests one-third on April 30, 2022, one-third 12 months from the date of the grant and one-third 24 months from the date of the grant. Once vested, each RSU and DSU entitles the holder thereof to receive either one Common Share, the cash equivalent of one Common Share or a combination of cash and Common Shares, as determined by the Company, net of applicable withholdings.

Further details regarding the Plan are set out in the Management Information Circular of the Company filed on May 19, 2021, which is available on SEDAR.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

Quality Assurance (QA) and Quality Control (QC)

The JV implements strict Quality Assurance (“QA”) and Quality Control (“QC”) protocols at Douay covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drillhole surveying; core transport to the Douay Camp; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to ALS laboratories in Val-d’Or, QC; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the Company’s QA/QC webpage at www.maplegoldmines.com.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

Executive Vice-President

Cell: 778.686.6836

Email: jlang@maplegoldmines.com

Mr. Kiran Patankar

SVP, Growth Strategy

Cell: 604.935.9577

Email: kpatankar@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This press release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.