|

|

|

|

Odyssey Elixir CEO Scott Frohman provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoMore info on Odyssey ElixirNobleCon18 Presenting Companies

About Odyssey Based in Fort Lauderdale, Florida, Odyssey Wellness LLC is an emerging, fast-growing RTD functional beverage company. Their innovative and exotic flavor-forward, functional mushroom elixirs are rich in active compounds found in the fruiting body of a mushrooms such as Shitake, Lion’s Mane, Reishi, Turkey Tail, Maitake, Chaga, and Cordyceps. These mushrooms have been revered throughout history as having medicinal qualities. |

|

Global Crossing Airlines (JETMF) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

GlobalX CFO Ryan Goepel provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on JETMFNobleCon18 Presenting Companies

About GlobalX GlobalX is a US 121 domestic flag and supplemental airline flying the Airbus A320 family aircraft. GlobalX flies as an ACMI and charter airline serving the US, Caribbean, and Latin American markets. For more information, please visit www.globalxair.com . |

Cannabis Industry Stimulating Economy to the Tune of $100 Billion

Image credit: RODNAE Productions

The Full Value of Marijuana on the U.S. Economy

Now that the Marijuana Opportunity Reinvestment and Expungement (MORE) Act has passed the House, the debate about the benefits of legalization will rage in the Senate before it votes. There’s no doubt the conversation will include reduced crime, reduced criminal justice costs, public health, and increased tax revenue while stimulating the economy. But, will their measure of economic stimulation and benefit be accurate?

Cannabis as an Economic Stimulant

As the economy has come into sharp focus as of late and impacts most Senator’s constituents, this may be the decider that changes the minds of those on the fence. Economic benefits may trump all others, allowing the bill to get the needed 60 votes, making the Oval Office the last hurdle toward legalization on a national level.

The economic benefit often focused on by state governments is that which is most easily measured, tax revenues. But as those in Washington know, a few extra jobs and a few extra dollars go a long way to stimulate economic growth. In this category, the cannabis industry has a lot to offer the country. Money changing hands for goods and services include the easy to recognize sales and the ancillary benefits of commerce beyond the doors of a dispensary.

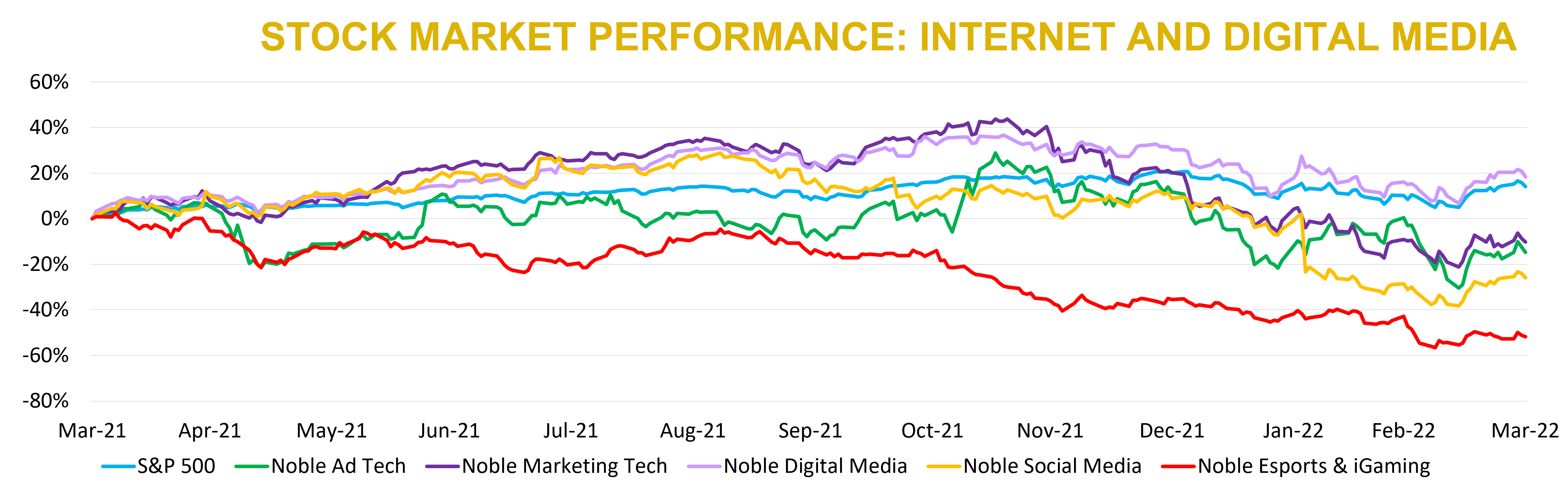

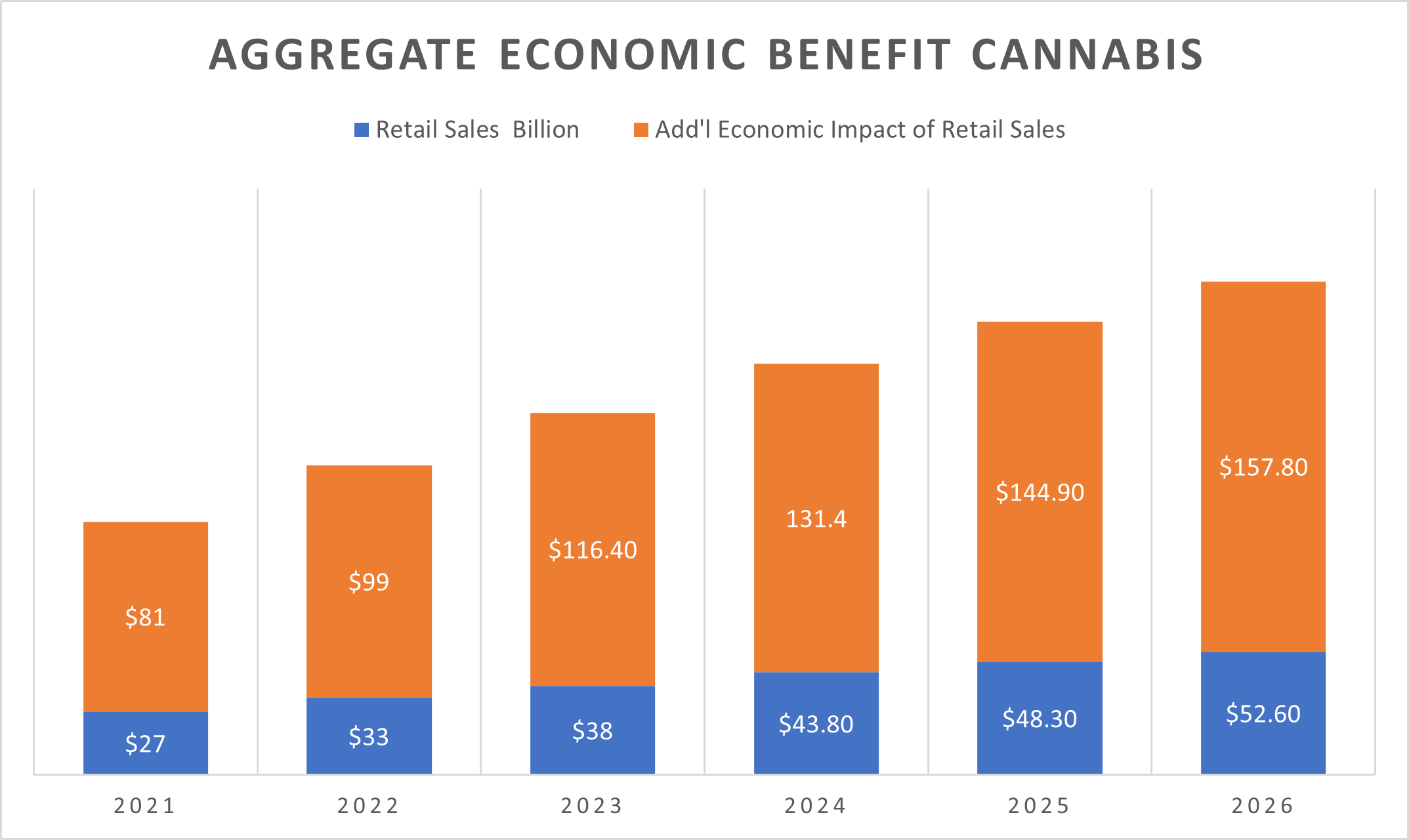

Cannabis Industry’s Forecasted Benefit on U.S. Economy 2021-26

Data Source: MJBizfactbook

Marijuana Industry’s Impact (Beyond Sales)

Using data compiled by MJBizDaily, the total U.S. economic impact of marijuana sales that don’t include direct sales themselves, in 2022 is expected to rise 20% to reach $99 billion this year. And under the best estimates exceed $155 billion in 2026.

To measure and forecast the industry’s economic impact, the data team at MJBizDaily analyzed similar industries, consulted with economists, and then calculated and applied a standard multiplier of 2.8 on projected recreational and medical marijuana retail sales. The nature of a new and unique industry adds a greater element of unknown compared to forecasting other industries, but the methodology was well thought out and the measurements and factors created are as accurate as possible.

Beyond straight retail sales, which are also projected on the chart above, the industry includes farming, manufacturing, marketing, and hospitality. Marijuana production starts with agriculture at the farm. Economists use a multiplier of 1.9 on agricultural components. This equates to $11 billion for the U.S. economy, just in this category. To put it in a way that more visually shows the benefit, for every $10 consumers or patients spend at marijuana retail locations, an additional $18 will be injected into the economy.

That higher economic benefit comes from the day-to-day needs increased and then satisfied by workers in the cannabis industry, and then the further impact that includes spending on life’s necessities such as housing, transportation, entertainment, and more. Not very different than the massive impact that the stimulus checks had during the pandemic, money multiplies across the economy as it is spent and then put in someone else’s hands for their use.

Take-Away

Cannabis, as with other industries, has an impact on many other sectors that make its overall economic impact far greater than simply measuring the sales of cannabis. While the Senate and the President will consider many factors in deciding whether the MORE Act should become law, the overall positive economic impact should not be understated.

Managing Editor, Channelchek

Suggested Reading

Marijuana Hits the House This Spring

|

Cannabis Bill Proposed by Republican House Member Softer on Marijuana Taxes

|

The Future of Cannabis Crosses Many Industries

|

Cannabis Customers Served by the Ice Cream Truck Delivery Model

|

Sources

https://thehill.com/news/house/3256370-house-approves-bill-legalizing-marijuana/

https://mjbizdaily.com/wp-content/uploads/2022/04/2022-economic-impact-1.webp

https://mjbizdaily.com/marijuana-industry-will-add-nearly-100-billion-to-us-economy-in-2022/

Stay up to date. Follow us:

|

Release – Entravision Announces Participation in NobleCon18

Entravision Announces Participation in NobleCon18

Research, News, and Market Data on Entravision

SANTA MONICA, Calif.–(BUSINESS WIRE)– Entravision (NYSE: EVC), a leading global advertising solutions, media and technology company, today announced its participation in NobleCon18, Noble Capital Markets’ eighteenth annual investor conference, to be held April 19-21, 2022 in Hollywood, Florida. Chris Young, Chief Financial Officer and Treasurer, is scheduled to present on Wednesday, April 20, 2022 at 2:00 p.m. ET and will participate in meetings with investors throughout the day.

The presentation will be webcast live over the Internet, and a link to the live webcast and replay will be available on Entravision’s Investor Relations website at investor.entravision.com.

About Entravision Communications Corporation

Entravision is a leading global advertising solutions, media and technology company connecting brands to consumers. Our dynamic portfolio includes digital, television and audio offerings. Digital, our largest revenue segment, is comprised of four business units: our digital sales representation business; Smadex, our programmatic ad purchasing platform; our branding and mobile performance solutions business; and our digital audio business. Through our digital sales representation business, we connect global media companies such as Meta, Twitter, TikTok and Spotify with advertisers in primarily emerging growth markets worldwide. Smadex is our mobile-first demand side platform, enabling advertisers to execute performance campaigns using machine learning. We also offer a branding and mobile performance solutions business, which provides managed services to advertisers looking to connect with global consumers, primarily on mobile devices, and our digital audio business provides digital audio advertising solutions for advertisers in the Americas. In addition to digital, Entravision has 49 television stations and is the largest affiliate group of the Univision and UniMás television networks. Entravision also manages 46 primarily Spanish-language radio stations that feature nationally recognized, Emmy award-winning talent. Shares of Entravision Class A Common Stock trade on the NYSE under ticker: EVC. Learn more about our offerings at entravision.com or connect with us on LinkedIn and Facebook.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220412005385/en/

Christopher T. Young

Chief Financial Officer

Entravision

310-447-3870

Kimberly Esterkin

Addo Investor Relations

310-829-5400

evc@addo.com

Source: Entravision Communications Corporation

Green Jet Fuels Succeed in a Couple of More Huge Milestones

Image Credit: Pavel Vanka (Flickr)

Jumbo Aircraft Using 100% Plant-Based Fuel on Long-Range Flight is Now Reality

The environmental future and aviation future are on the same flight path. Airbus just completed another historic milestone that puts commercial flights using only renewables closer to their destination. For the first time, an Airbus 380 “superjumbo” conducted a three-hour flight propelled by 100 % recycled cooking oil as fuel in its engines. The flight was then repeated using a mix of plant-based products. The length of the flights and duration make this a significant achievement.

The superjumbo is a double-decker plane and has room for 545 people. A version used for testing was used for this historic experiment. The “green” fuel flight began at Airbus’s hometown of Toulouse, France, and was completed on the East coast in the city of Nice.

Four days later, Airbus repeated the test when the aircraft’s Rolls Royce Trent 900 engine was fed again with a mixture of non-fossil fuels, including recycled cooking oil and agricultural residues.

Over the past year, Airbus has flown three different types of test aircraft, each having landed without incident using sustainable aircraft fuel. The huge A380, now joins the company’s A319 and A350 planes, that have flown on similar fuels.

Reduces Carbon Dioxide by 80 Percent

Commercial airlines like Air France, Lufthansa and Singapore Airlines use the 309 ton plane for long flights. With an Airbus 380’s range of 9300 miles, the eco-minded jet fuel would reduce carbon dioxide emissions by as much as 80 % on passenger flights to distant destinations.

In addition to environmental savings, Airbus, and presumably, other manufacturers can be enthusiastic that the eco-fuel is up to three percent more efficient than traditional jet fuel. With a consumption of 8.75 gallons of cooking oil per mile, over many miles, the range increases somewhat. However, the fuel that is not yet manufactured in scale costs as much as five times more than regular aviation fuels.

This means either more costly commercial airline tickets in the very first years or state subsidies funded by taxes until producing the fuel commercially gets fully off the ground. This has been done for other eco-energy sectors, including wind, solar, and EVs.

Other Green Aviation News

Eco-friendly jet fuels are being manufactured by companies like Gevo ($GEVO). The aircraft fuel manufacturer is building a huge green plant in South Dakota to make fuels from non-carbon sources. The plant won’t be producing cash flow until 2024. However, Gevo, Inc. has a strategic alliance with Axens North America, Inc. for ethanol-to-jet technology and sustainable aviation fuel commercial project development.

On March 25 Delta Air Lines signed a contract with Gevo which is a “take-or-pay” agreement with Delta to supply 75 million gallons of sustainable aviation fuel (SAF) per year for seven years.

Earlier in the fall of 2021, Chevron signed a deal to jointly invest in building and operating one or more facilities that would process corn to produce sustainable aviation fuel with GEVO.

Current research from Noble Capital Markets for the green fuel company GEVO is available on Channelchek at no cost.

Take-Away

The Air Transport Association (IATA) is the industry’s leading business trade association. The IATA has a stated aim to fly carbon neutral by 2050. Tests being undertaken by plane manufacturers like Airbus moves the world closer to accomplishing this goal. Plant-based fuel manufacturers like GEVO are working to ramp up production, which could help lower the costs to become more practical.

Managing Editor, Channelchek

Suggested Reading

Lithium Inflation and Availability Concerns Elon Musk

|

Hydrogen Powered Transportation May Include Planes by 2025

|

History Being Made in Net-Zero Passenger Flights

|

How does the Gates Buffett Natrium Reactor Work?

|

Sources

https://investors.gevo.com/news/delta-air-lines-signs-75-million-gallon-per-year-agreement-with-gevo

Stay up to date. Follow us:

|

Release – Cocrystal Pharma Reports Favorable Preliminary Data from Phase 1 Initial Cohorts with CC-42344, a Novel, Broad-Spectrum Influenza A antiviral

Cocrystal Pharma Reports Favorable Preliminary Data from Phase 1 Initial Cohorts with CC-42344, a Novel, Broad-Spectrum Influenza A antiviral

Research, News, and Market Data on Cocrystal Pharma

CC-42344 administered

orally as a single 100 mg or 200 mg dose in healthy adults showed a

favorable safety and pharmacokinetic profile

BOTHELL, Wash., April

12, 2022 (GLOBE NEWSWIRE) — Cocrystal Pharma, Inc. (Nasdaq: COCP) (“Cocrystal” or the “Company”) reported preliminary results of a Phase 1 study with CC-42344, demonstrating a favorable safety and pharmacokinetic profile. CC-42344 is a broad-spectrum oral antiviral for the treatment of pandemic and seasonal influenza A with a novel mechanism of action.

The ongoing Phase 1 clinical trial plans to enroll 56 healthy adults. Results from the first two single-ascending dose 100 mg and 200 mg cohorts showed a favorable pharmacokinetic profile of CC-42344. To date, CC-42344, has demonstrated excellent oral bioavailability, dose-dependent plasma exposures, and a half-life supportive of oral daily dosing. The Phase 1 study is designed to evaluate CC-42344 administered in single-ascending and multiple-ascending doses. Cocrystal expects to report full results from the study in 2022.

“Today’s update reinforces Cocrystal’s progress in developing best-in-class antiviral medicines. Influenza is one of the most serious worldwide public health threats. Important concerns remain about the emergence of pandemic strains and resistance to available drugs. We are encouraged by the safety and pharmacokinetic profile observed to date with single oral doses of CC-42344 and look forward to initiating the next portion of the trial,” said Sam Lee, Ph.D., Cocrystal’s President and co-interim CEO. “Based on a novel mechanism of action and high barrier to resistance, we believe CC-42344 could provide a potentially best-in-class oral candidate for the treatment of pandemic and seasonal influenza infection.”

About CC-42344

CC-42344 is an oral PB2 inhibitor that blocks an essential step of viral replication and was discovered using Cocrystal’s proprietary structure-based drug discovery platform technology. It is specifically designed to be effective against all significant pandemic and seasonal influenza A strains and to have a high barrier to resistance due to the way the virus’ replication machinery is targeted. CC-42344 targets the influenza polymerase, an essential replication enzyme with several highly essential regions common to multiple influenza strains, including pandemic strains. In vitro testing showed CC-42344’s excellent antiviral activity against influenza A strains, including pandemic and seasonal strains, as well as against strains resistant to Tamiflu® and Xofluza™, while also demonstrating favorable pharmacokinetic and safety profiles.

About Cocrystal

Pharma, Inc.

Cocrystal Pharma, Inc. is a clinical-stage biotechnology company discovering and developing novel antiviral therapeutics that target the replication process of influenza viruses, coronaviruses (including SARS-CoV-2), hepatitis C viruses and noroviruses. Cocrystal employs unique structure-based technologies and Nobel Prize-winning expertise to create first- and best-in-class antiviral drugs. For further information about Cocrystal, please visit www.cocrystalpharma.com.

Cautionary Note

Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our plans to enroll 56 new subjects for the Company’s influenza A Phase 1 study, expectations of reporting full results of the study later in 2022, and the potential of CC-42344 to be a best-in-class candidate for the treatment of seasonal and pandemic influenza. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events. Some or all of the events anticipated by these forward-looking statements may not occur. Important factors that could cause actual results to differ from those in the forward-looking statements include, but are not limited to, the risks and uncertainties arising from any future impact of the COVID-19 pandemic and the Russian invasion of Ukraine on the Australian and global economy and on our Company, including supply chain disruptions and our continued ability to proceed with our programs, including our influenza A program, the ability of the contract research organization to recruit patients into clinical trials, the results of future preclinical and clinical studies, and general risks arising from clinical trials. Further information on our risk factors is contained in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2021. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

Investor Contact:

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com

Media Contact:

JQA Partners

Jules Abraham

917-885-7378

Jabraham@jqapartners.com

Source: Cocrystal Pharma, Inc.

Alvopetro Energy (ALVOF) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Alvopetro Energy provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoResearch News and Advanced Market Data on ALVOFNobleCon18 Presenting Companies Alvopetro Energy Ltd.’s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé natural gas field and our strategic midstream infrastructure. |