Image Credit: NASA HQ Photo (Flickr)

Musk Confounds Experts in Corporate Governance Best Practices

According to the Chartered Governance Institute, “Good quality, ethical decision-making builds sustainable businesses and enables them to create long-term value more effectively.” So it’s no surprise that the head of start-up Neuralink (Elon Musk) has caused so many governance experts to try to wrap their brains around the decision he and a coworker made to have children together.

Often referred to as the richest man in the world, co-founder of Paypal (PYPL), SpaceX owner, Tesla (TSLA) CEO, and Boring Company President, Elon Musk has proven himself successful at managing unique companies through its growth phase. He’s respected worldwide, and a single snarky tweet from the South African-born American is powerful enough to change the fortunes of investors in crypto and some stocks.

Lately, the 51-year-old has been the subject of debate among those that report on company ESG (environmental, social, governance) standards. No, not because he smoked pot on The Joe Rogan Show, although in his role at SpaceX, the government did have some questions. This debate began after he and a direct report at Neuralink became the parents of twins back in November 2021. Neuralink is a less-known Musk creation with about 300 employees. It is developing chips that connect the human brain directly to machines.

The director-level subordinate has reportedly told coworkers that she was not and is not involved romantically with the boss. She has told them the children with Musk were conceived through in-vitro fertilization (IVF).

To avoid possible conflicts of interest, Neuralink’s employee handbook prohibits dating, “personal relationships,” and “close personal friendships” between employees in a direct supervisory dynamic. This is common language in employees’ agreements with their employer. It’s also considered best practice in corporate governance for those in significant management positions. It’s not uncommon for a “fling” to cost a CEO, or subordinate their job. The chief concern is conflicts of interest, putting the company and its investors first.

Musk Again Has Found a Different Path

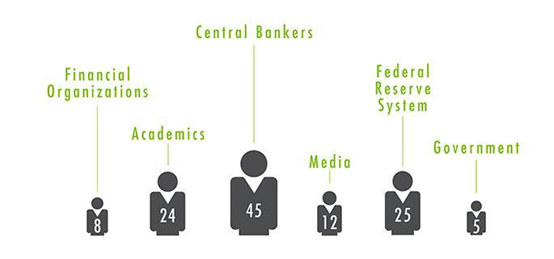

But the reported circumstances surrounding the Neuralink babies are so unusual that Reuters reached out to corporate governance counselors and asked them to review the company policy and circumstances presented by the two involved. This is clearly a situation with many gray areas. There was no agreement amongst the experts, as with many other things that mix business and personal ethics.

Nell Minow, vice chair of corporate governance consultancy ValueEdge Advisors, told Reuters about the Code of Conduct, “Whatever lawyer wrote this language did not contemplate this situation.” Adding the facts appeared to “fall between the cracks” of the policy’s intent to avoid conflicts of interest due to worker relationships.

Four of the corporate governance experts said they believed the two producing children, even through IVF, is a “personal relationship” or “close friendship,” which Neuralink’s code of conduct requires to be disclosed to a “people operations manager.” The code does not define a “close friendship” but defines a personal relationship as one where the individuals have a “continuing relationship of a romantic or intimate nature and who are not married to each other.”

Gabriel Rauterberg, a corporate law professor at the University of Michigan, told Reuters, “You’re layering intimate familial bonds over professional relationships,” he explained, “There is always the worry that someone with greater power will use their professional power in ways that are inappropriate.”

The remaining five corporate governance aficionados either did not think the parents’ arrangement was a breach under the Neuralink policy or were stumped by how far outside the box it was for them.

Joan Heminway, a business professor at the University of Tennessee’s law school, pointed out that one can’t demonstrate that the coworkers are close personally, despite the IVF matter, she said, “That’s the new wrench here.”

Usha Rodrigues, a professor at the University of Georgia’s law school, said the matter “may fall under ‘close friendship’ if there is an ongoing, co-parenting type relationship, but that is subject to interpretation.”

Business as “Usual”

The extent of Musk’s involvement in the life of his young twins is unclear. A court filing shows they asked for the children to take his last name; the parents also listed the same address in Texas.

Neuralink has accepted the new mom’s description that it is a non-romantic relationship, and she continues in her role as director of operations and special projects. The two still function as a team inside the workplace, each running internal and external meetings.

Take Away

It’s difficult not to have an opinion on whether non-romantic parenting is an intimate relationship between coworkers or if such a policy is good corporate governance. Perhaps it is a policy that serves one company best yet would be a disaster imposed on another.

We’d like to know what you think. Leave a comment under this article on Channelchek’s Twitter account, and hit the “Follow” button while you’re there.

Managing Editor, Channelchek

Suggested Content

Elon Musk’s Tesla Bot Raises Serious Concerns – But Probably Not The Ones You Think

|

Why Good Economic Numbers Can Cause a Selloff

|

Should Medical Cannabis Patients be Forbidden from Owning Firearms?

|

Where are Consumers Most Likely to Spend Their Leisure Budget?

|

Sources

https://www.cgi.org.uk/about-us/policy/what-is-corporate-governance

Stay up to date. Follow us:

|