|

|

|

Noble Capital Markets Senior Research Analyst Michael Kupinski sits down with Engine Media Executive Chairman Tom Rogers and CEO Lou Schwartz for this exclusive interview. Research, News, and Advanced Market Data on GAMEView all C-Suite Interviews

About Engine Media Holdings, Inc. Engine Media Holdings Inc. is traded publicly under the ticker symbol (NASDAQ: GAME) (TSX-V: GAME). The organization is focused on developing premium consumer experiences and unparalleled technology and content solutions for partners in the esports, news and gaming industry. The company’s subsidiaries include Stream Hatchet; the global leader in gaming video distribution analytics; Eden Games , a premium video game developer and publisher with numerous console and mobile gaming franchises; WinView Games, an industry innovator in audience second screen play-along gaming during live events; UMG, an end-to-end competitive esports platform enabling the professional and amateur esports community with tournaments, matches and award nominating content; and Frankly Media, a digital publishing platform empowering broadcasters to create, distribute and monetize content across all channels. Engine Media generates revenue through a combination of direct-to-consumer and subscription fees; streaming technology and data SaaS-based offerings; programmatic advertising and sponsorships. To date, the combined companies’ clients have included more than 1,200 television, print and radio brands, dozens of gaming and technology companies, and have connectivity into hundreds of millions of homes around the world through their content, distribution and technology services. |

Author: Admin

CoreCivic Provides Update on U.S. Marshals Service Contract for the West Tennessee Detention Facility

CoreCivic Provides Update on U.S. Marshals Service Contract for the West Tennessee Detention Facility

BRENTWOOD, Tenn., Sept. 17, 2021 (GLOBE NEWSWIRE) — As has been previously disclosed, CoreCivic, Inc. (NYSE: CXW) (the Company) has a direct contract with the U.S. Marshals Service (USMS) at the 600-bed West Tennessee Detention Facility in Mason, Tennessee that is scheduled to expire on September 30, 2021. The Company recently was provided with a definitive inmate population ramp down plan from the USMS indicating that all inmates will be transferred out of the facility by September 30, 2021. As a result, the Company does not expect the USMS to exercise its renewal option under the existing contract.

The Company has been actively marketing the facility to other government agencies, and in August 2021, the Company submitted a formal response to a government agency’s request for proposal to utilize the West Tennessee Detention Facility. However, the Company can provide no assurances that it will be successful in entering into a new contract with the government agency.

The revenue generated from the USMS at the West Tennessee Detention Facility for the year ended December 31, 2020, and six months ended June 30, 2021, was $18.4 million and $10.2 million, respectively. For the year ended December 31, 2020, the facility incurred a $1.4 million net operating loss, and for the six months ended June 30, 2021, the facility generated net operating income of $0.8 million.

About CoreCivic

CoreCivic is a diversified government solutions company with the scale and experience needed to solve tough government challenges in flexible, cost-effective ways. CoreCivic provides a broad range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America’s recidivism crisis, and government real estate solutions. CoreCivic is the nation’s largest owner of partnership correctional, detention and residential reentry facilities, and believes it is the largest private owner of real estate used by government agencies in the U.S. CoreCivic has been a flexible and dependable partner for government for more than 35 years. CoreCivic’s employees are driven by a deep sense of service, high standards of professionalism and a responsibility to help government better the public good.

Forward-Looking Statements

This press release contains statements as to our beliefs and expectations of the outcome of future events that are “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. These include, but are not limited to, the risks and uncertainties associated with: (i) changes in government policy (including the United States Department of Justice, or DOJ, not renewing contracts as a result of President Biden’s Executive Order on Reforming Our Incarceration System to Eliminate the Use of Privately Operated Criminal Detention Facilities) (two agencies of the DOJ, the United States Federal Bureau of Prisons and the United States Marshals Service, utilize our services), legislation and regulations that affect utilization of the private sector for corrections, detention, and residential reentry services, in general, or our business, in particular, including, but not limited to, the continued utilization of our correctional and detention facilities by the federal government, and the impact of any changes to immigration reform and sentencing laws (we do not, under longstanding policy, lobby for or against policies or legislation that would determine the basis for, or duration of, an individual’s incarceration or detention); (ii) our ability to obtain and maintain correctional, detention, and residential reentry facility management contracts because of reasons including, but not limited to, sufficient governmental appropriations, contract compliance, negative publicity and effects of inmate disturbances; (iii) changes in the privatization of the corrections and detention industry, the acceptance of our services, the timing of the opening of new facilities and the commencement of new management contracts (including the extent and pace at which new contracts are utilized), as well as our ability to utilize available beds; (iv) general economic and market conditions, including, but not limited to, the impact governmental budgets can have on our contract renewals and renegotiations, per diem rates, and occupancy; (v) fluctuations in our operating results because of, among other things, changes in occupancy levels, competition, contract renegotiations or terminations, increases in costs of operations, fluctuations in interest rates and risks of operations; (vi) the duration of the federal government’s denial of entry at the United States southern border to asylum-seekers and anyone crossing the southern border without proper documentation or authority in an effort to contain the spread of COVID-19; (vii) government and staff responses to staff or residents testing positive for COVID-19 within public and private correctional, detention and reentry facilities, including the facilities we operate; (viii) restrictions associated with COVID-19 that disrupt the criminal justice system, along with government policies on prosecutions and newly ordered legal restrictions that affect the number of people placed in correctional, detention, and reentry facilities, including those associated with a resurgence of COVID-19; (ix) whether revoking our real estate investment trust, or REIT, election, effective January 1, 2021, and our revised capital allocation strategy can be implemented in a cost effective manner that provides the expected benefits, including facilitating our planned debt reduction initiative and planned return of capital to shareholders; (x) our ability to successfully identify and consummate future development and acquisition opportunities and our ability to successfully integrate the operations of our completed acquisitions and realize projected returns resulting therefrom; (xi) our ability, following our revocation of our REIT election, to identify and initiate service opportunities that were unavailable under the REIT structure; (xii) our ability to have met and maintained qualification for taxation as a REIT for the years we elected REIT status; and (xiii) the availability of debt and equity financing on terms that are favorable to us, or at all. Other factors that could cause operating and financial results to differ are described in the filings we make from time to time with the Securities and Exchange Commission.

CoreCivic takes no responsibility for updating the information contained in this press release following the date hereof to reflect events or circumstances occurring after the date hereof or the occurrence of unanticipated events or for any changes or modifications made to this press release or the information contained herein by any third-parties, including, but not limited to, any wire or internet services.

| Contact: | Investors: Cameron Hopewell – Managing Director, Investor Relations – (615) 263-3024 Media: Steve Owen – Vice President, Communications – (615) 263-3107 |

QuickChek – September 17, 2021

|

CoreCivic Provides Update on U.S. Marshals Service Contract for the West Tennessee Detention FacilityCoreCivic announced the Company does not expect the USMS to exercise its renewal option for the 600-bed West Tennessee Detention Facility in Mason, Tennessee that is scheduled to expire on September 30, 2021 Research, News & Market Data on CoreCivic |

|

Eagle Bulk Shipping Inc. Takes Delivery of M/V Antwerp EagleEagle Bulk Shipping announced that it has taken delivery of its previously announced vessel acquisition, the M/V Antwerp Eagle Research, News & Market Data on Eagle Bulk Shipping |

Stay up to date. Follow us:

|

Eagle Bulk Shipping Inc. Takes Delivery of M/V Antwerp Eagle

Eagle Bulk Shipping Inc. Takes Delivery of M/V Antwerp Eagle

The ship, which was acquired this past May, is a 2015-built, high specification scrubber-fitted SDARI-64 Ultramax vessel built at

Proforma for the one pending vessel acquisition, the Company’s fleet totals 53 ships with an average age of 8.8 years.

About Eagle Bulk Shipping Inc.

Company Contact

Chief Financial Officer

Tel. +1 203-276-8100

Email: investor@eagleships.com

Media Contact

Tel. +1 212-359-2228

Source:

Esports Game Makers Many Profit Centers

Image: Overwatch (Blizzard Entertainment)

Understanding Esports’ Many Income Streams

Gaming is the largest and fastest-growing entertainment vertical in the world. Esports / e-sports / eSports / esports is a high-growth sector of the industry with more ways to generate income than there are alternatives to spell its name. What are they? As with other media outlets, some revenue streams are “straight-line” obvious, like subscriptions. Others, like the value of an audience’s viewing habits, are not as direct. Although each company is different, revenue streams are often from game sales, advertising, audience subscriptions, data and analytics, licensing, and media rights.

There is a great deal of overlap in categorizing these revenue streams. As you’ll discover shortly, game sales may be made through ad sales that offset the product cost, and that data analysis may have a part in all revenue success. A well-run esports/gaming company integrates them all to maximizes all that it has at its disposal.

Data & Analytics

As with other media outlets, knowing who your audience is allows a better marketing effort to bring in advertising dollars. Esports entertainment businesses all do this on one level or another. The more data collected and categorized, the better they’re able to discern viewing habits, categorize popularity changes, determine who tomorrow’s “influencers” will be, maximize partnership opportunities, and capture trends early.

The data itself also has value and can be sold to others that mine it for their own purposes, this includes for discovery of when and how to reach highly refined marketing demographics.

Advertisement Sales

As mentioned above, advertisement sales is a staple revenue stream for companies that provide online games. With audience insights related to sentiment, viewership, demographics, and traffic, esports companies are in an enviable position in that their advertising sales efforts and what the advertiser can expect are more clearly defined than trying to reach the consumer group through other outlets.

Game Sales

It wasn’t long ago that direct game sales to customers were the primary means for any game maker to generate revenue. This still exists, although the trip to GameStop (GME) is no longer necessary as you can go to a website like Steam and buy and download games. The game maker then gives the website a cut and keeps what might be 80% or more of the sale price.

Another variation of “selling” a game is when it’s being subsidized by an ad the purchaser will encounter after the download. This new but common revenue source works like this: The consumer downloads a game from a store (with or without cost to the consumer), the consumer then encounters ads as a result of the download. This concept has become common throughout the online world, specific to gaming; what companies are now doing is developing games whereby watching an ad they collect tools to help score more points playing the game. When implemented correctly, this can be a lucrative part of how a game maker adds to their bottom line.

Ticket Sales

As part of the business of esports, as with other spectator sports, there are tickets sales for live audience participants and entry or subscription fees for viewing online. Stadiums with the capacity to seat 50 to 90 thousand have become filled in the past. As these sports events are of interest globally, online audiences approaching 100 million at world championships is normal. Although there are many businesses involved in organizing, promoting, broadcasting, merchandising, and overall production, the game makers are part of the action and perhaps receive small increments from the value of each spectator. But, with near 100 million spectators to some events, this can add up.

Merchandising

Although much of the merchandising in esports is for teams and leagues, game makers also can benefit from purchasable skins. The term “skin” refers to the way your in-game character looks. Some games have added purchasable skins to make characters look like members of professional esports teams. These in-game sales can add up. In 2017 in-game purchases accounted for more than half of Activision-Blizzard’s revenue, adding up to about $4 billion.

Games like Overwatch, League of Legends, Halo 5, Gears

of War 4, and Call of Duty: Modern Warfare all have this feature allowing people to purchase character and weapon skins. These in-game purchases not only provide a revenue source for game developers, but esports teams themselves can receive a cut of each purchase. This can even help the decision as to which games the teams may become involved competing in. Additionally, if fans want to support a specific streamer, they can use the streamer’s content creator code while purchasing the in-game skins. This process provides that streamer a small cut of the purchase.

Vertical

Integration

As the esports segment grows, those companies most horizontally and vertically integrated have the most control over the synergies of the various revenue streams. Well-run esports companies often have multiple gaming businesses, while also able to capitalize on being a media entity with all of the insights and marketing solutions that can provide.

In a just-released C-Suite interview, the Executive Chairman and the CEO of Engine Media (GAME) were interviewed by the Senior Media Equity Analyst at Noble Capital Markets, Mike Kupinski. Engine Media generates revenue through a combination of direct-to-consumer and subscription fees; streaming technology and data SaaS-based offerings; programmatic advertising, and sponsorships. In response to a question, Executive Chairman Tom Rogers summed up various parts of the industry well as he discussed his own company. Mr. Rogers talked about the many company pieces, which in the case of GAME are in-part data, analytics, advertising, marketing, and IP to support player experiences. It also sells some of the intel as a service, and profits from the easier to understand growth of the gaming business.

The interview provides a clear picture of the potential for this company and others involved in esports.

What Does the Future Hold?

Think of the changes that major league baseball has gone through in your lifetime, now soccer – unlike traditional sports, esports games, outlets, tools and support will need to constantly evolve. Consumers, whether they are gamers or spectators, are the main product, paying attention to their needs is critical. Also, expanding the sport to appeal to as many different demographics as possible will increase the size of the revenue pie from which companies will try to score a larger slice.

Suggested Content:

C-Suite Interview / Engine Media Holdings (September 2021)

|

Advertising Results are Becoming a Guessing Game

|

Ad Tech – Back in the Saddle, Riding High

|

What A Tolerant Fed Implies For Media Stocks

|

Sources:

https://enginemediainc.com/#about

https://www.youtube.com/watch?v=oCiKVXQXkKA

https://www.aikenhouse.com/post/how-do-esports-organizations-make-money

https://newzoo.com/insights/articles/newzoo-games-market-numbers-revenues-and-audience-2020-2023/

https://www.insiderintelligence.com/insights/esports-ecosystem-market-report/

https://www.pwc.com/gx/en/industries/technology/publications/monetising-esports.html

https://www.videogames.org.au/skin-betting/

Stay up to date. Follow us:

|

Is Masterworks the Robinhood of the Art Collecting World?

Image Credit: *lingling*, (Flickr)

A New Platform Lets You Buy Shares of Blue-Chip Paintings – But is Art a Wise Investment?

In the fall of 2018, a Banksy work, “Love is in the Bin,” sold for US$1.4 million.

Now the original buyer has put the work up for sale, and it’s expected to fetch over $5 million – that would amount to a return of more than 250% on the original investment.

What if, instead of the art market’s being the sole purview of the deep-pocketed, everyday people could buy shares of a pricy piece of art and sell the shares as they please?

That’s exactly what a new platform, Masterworks, seeks to do.

Art investment funds have existed for over a century. Masterworks, however, has put a new twist on an old practice in that the platform allows individuals to buy shares of specific artworks in $20 increments. Investors can then sell these shares in an easy-to-use secondary market or wait until Masterworks sells the piece and receive pro-rata proceeds.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of Kathryn Graddy Dean, Brandeis International Business School, and Fred and Rita Richman, Distinguished Professor in Economics, Brandeis University. |

For nearly 10 years, I’ve taught a course on economics and the arts with art historian Nancy

Scott. In this course, we spend time discussing the history and profitability of art investing, both in theory and in practice.

For those thinking of purchasing art purely for investment purposes, it’s important to understand how art investment funds have traditionally worked, and whether experts believe it’s a good investment.

The French Pool Their Resources

An early art investment fund was called The Skin of the Bear (La Peau de l’Ours), which was based in France during the beginning of the 20th century.

The name comes from a French fable that contains the aphorism “never sell the skin of the bear before you’ve actually killed it” – the French equivalent of “don’t count your chickens before they hatch” – and it alludes to the fact that investing in art can be a risky endeavor.

Partly intended as a means to support emerging post-impressionist artists, such as Picasso, Matisse and Gauguin, the fund was run as a syndicate in which a small number of partners each contributed identical amounts to purchase a collection of paintings. Businessman, art critic and collector Andre Level managed the fund and arranged the paintings’ sale. After the paintings were sold, he received 20% of the sale price for his work. The artists received 20% of the fund’s profits on top of the money they received from the original sale. The investors would then receive the rest in equal proportions.

This concept – returning a proportion of the sale price to the artist – is known as the droit de suite, or artist’s resale right. Versions of this are now law in most parts of the Western world other than the United States.

This first art fund was a success. It created demand for new artworks and supported innovative impressionist and modern artists, while providing a sizable return to its original investors.

Not All Funds are Equal

Another famous investment in art was made by the British Rail Pension Fund.

This fund was established in 1974 to manage a small proportion of the company’s employee retirement holdings, and the objective was to buy works of art over the course of 25 years before selling them off. The fund earned 11.3% in compound returns annually, but because of high inflation during much of that period, the actual gains were much lower.

Other notable art funds ended up as failures. Banque Nationale de Paris’ art fund sold its investment in 1999 at a loss and a fund run by British art dealer Taylor Jardine Ltd. did the same in 2003. Britain’s Department of Trade shut down The Barrington Fleming Art Fund in 2001 after determining it was set up under fraudulent circumstances. And Fernwood Art Investments, founded by former Merrill Lynch manager Bruce Taub, failed to even launch after Taub was found guilty of embezzling his investors’ funds in 2006.

Nonetheless, there are art funds that are still in operation, such as Anthea and The Fine Art Group, and, of course, banks and auction houses have long described investing in art as a suitable diversification strategy for the wealthy.

But what do economists say about art as an investment?

Is it Really a ‘Floating Crap

Game’?

Economic theory suggests that, by definition, investing in art could provide lower returns than investing in stocks. That’s because it’s thought of as a passion investment. Like investing in sports memorabilia, jewelry or coins, part of the return to investing in art ought to be the intrinsic enjoyment of the objects themselves. The total return consists of the monetary return and the enjoyment of ownership.

As stocks do not, for most people, provide this enjoyment value, the monetary returns to investing in these financial instruments should, in theory, be greater than the monetary returns to investing in art.

But it’s important to actually analyze the numbers.

One of the very first papers on the monetary return of art investing was published in 1986 and written by the late eminent economist William Baumol.

The title? “Unnatural Investment: Or Art as a Floating Crap Game.”

Baumol estimated the long-run inflation-adjusted returns to investing in art, over a 300-year period, to be just 0.6%. Some researchers have since estimated higher returns. For example, work by Yale finance professor Will Goetzmann and economists Jiangping Mei and Mike Moses found inflation-adjusted returns of 2% over 250 years and 4.9% over 125 years, respectively. Estimated returns vary based on the time period, sample and methodology.

Furthermore, these studies don’t include transaction fees, which, when it comes to art, can be sizable, thanks to the hefty commissions charged by the auction houses or private dealers for serving as the middlemen. They also don’t take into account sample selection; paintings that plummet in value often can’t be sold at auction.

Both the Goetzmann and the Mei and Moses studies, however, estimate that the performance of the stock market doesn’t seem to be correlated with returns on art investments. So there may be some benefit to investing in art as a way to diversify your portfolio.

Art for All?

Masterworks, however, is a bit different from the traditional art funds discussed above. Investors are buying shares of a single piece of art, rather than investing in a fund that includes multiple works. The price of entry is much lower, and, as long as there are willing buyers for the share of artwork, investors aren’t locked into the fund for a particular time period. Investors can earn a return just by selling shares that go up in value, without waiting for the artwork itself to be sold.

But like the traditional art funds, investors in shares of art sold by Masterworks will make money if the price of their artwork goes up, and lose their money if it goes down.

Ultimately, Masterworks seems innovative and fun. The format will likely appeal to a younger generation of investors, many of whom may have started investing small amounts through apps such as Robinhood ($HOOD).

The site is easy to navigate and could provide some enjoyment – even I was tempted to dabble in buying some shares.

But should you hope to get rich from investing in art? Probably not.

Furthermore, unlike Skin of the Bear, it doesn’t necessarily benefit emerging artists. Masterworks focuses on established works with a track record, by artists such as Banksy, Andy Warhol and Claude Monet, to name a few.

That being said, Masterworks could bring investing in art to a mass audience. But, caveat emptor: Art is a risky investment.

Suggested Reading:

AMC Theaters Now Accepts 4 Cryptocurrencies

|

Is it Proper to Yell “Market Crash” on a Crowded Message Board?

|

Making Sense of Non-Fungible Tokens

|

NFT Collectible Marketplace for DRAFTKINGS

|

Stay up to date. Follow us:

|

Cathie Wood Clears Way to Invest in Bitcoin ETFs from Canada

Canadian Bitcoin ETFs May Be Cathie Wood’s Solution

For every problem, there is a solution, and it looks like Cathie Wood may have finally found her answer. Here’s the problem. Wood, who is the founder of ARK Invest and the high-profile Chief Investment Officer of the company that has as its tagline: We Invest Solely In Disruptive

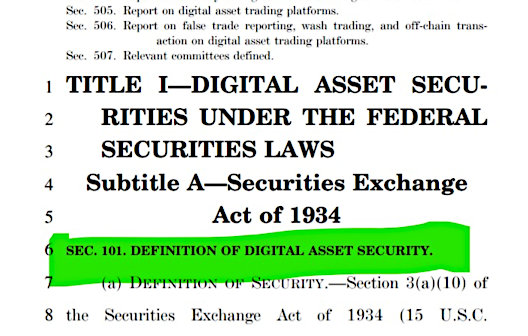

Innovation would like to more readily be able to gain exposure to Bitcoin through ETFs. The problem is, the U.S. Securities and Exchange Commission has not approved Cryptocurrency ETFs, so there are none in existence among the investment companies overseen by the SEC.

ARK BTC.X History

Over the past eight years, the SEC has rejected or delayed more than a dozen Bitcoin Exchange Traded Fund applications. The reasons given are concerns over sharp volatilities and potential risks of market manipulation. Back in June of this year, along with the company Swiss-based 21Shares, ARK Invest filed to create a Bitcoin ETF of their own to be called ARK 21Shares Bitcoin ETF. The joint filing is one of the delayed decisions.

The SEC has been dragging its feet on any Cryptocurrency ETFs and has not approved any. SEC Chair Gary Gensler says they’re studying all the ramifications and how the underlying coins or futures contracts may provide higher and lower levels of investor protection. Nothing sounds imminent in terms of a decision by the SEC, and it doesn’t even sound certain that there will be an ETF approved that invests directly in Bitcoin or other cryptocurrencies.

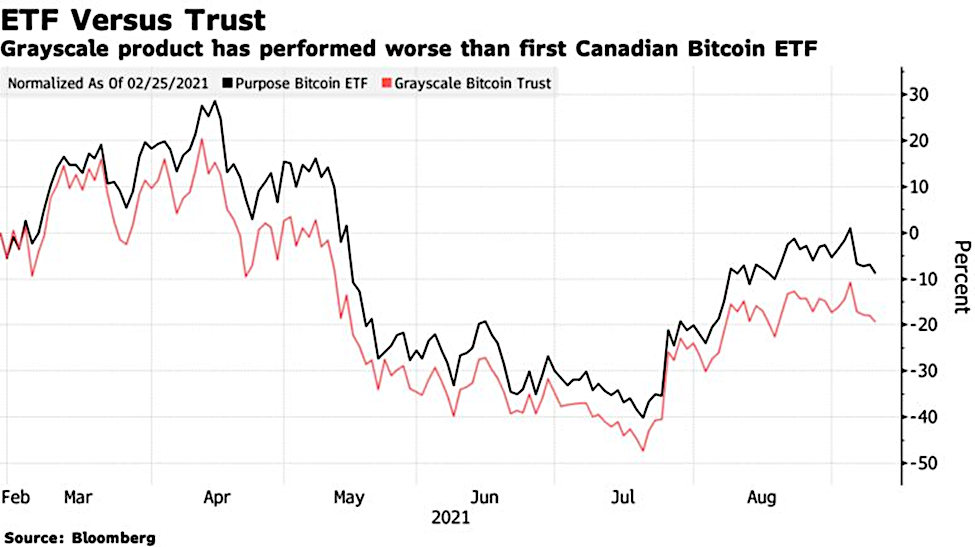

One of Wood’s funds, The ARK Next Generation Internet ETF, already holds a significant amount of Bitcoin through a closed-end Grayscale Bitcoin Trust (GBTC). This trust owns coins that are held at a third-party custodian. The Grayscale Trust doesn’t track Bitcoin’s exchange rate tick-for-tick. Initially, the Grayscale Trust, which currently has $30 billion in assets, outperformed actual bitcoin and traded at as much as a 20% premium. This is because it became the preferred alternative as an asset that can be held more easily in many investment accounts, such as the ARK Next Generation Internet ETF.

Wood’s ETF currently has 5.5% of its assets——worth about $314 million——in the Grayscale fund, which is its second-largest holding only behind Tesla (TSLA).

Current

Solution

Canada and Europe both moved ahead, allowing fund managers to offer Bitcoin and Ethereum in an ETF wrapper. In February, Grayscale began underperforming Bitcoin and underperforming the first Canadian Bitcoin ETF.

Wood’s asset-management company, ARK Invest, revised the prospectus of the $5.7 billion ARK Next Generation Internet ETF so the fund can hold cryptocurrencies via Canadian ETFs. Given all the uncertainties, it might be wise to diversify crypto holdings through the Canadian ETFs. Others have made similar moves. Recently, the $1.3 billion Amplify Transformational Data Sharing ETF (BLOK), which is actively managed and mainly invests in blockchain-related businesses, also bought shares in three Canadian Bitcoin ETFs.

Take-Away

The diversification Bitcoin offers relative to other “disruptive innovations” is high. The volatility also presents a unique opportunity. As U.S. fund managers like those at ARK Invest seek to provide an above-average return for their investors, they will find workarounds to gain the exposure they believe is best. These workarounds are at times more costly than a direct holding or one that is domestic.

In the case of ETFs, the ease with which they can be bought and sold and if ever approved in the U.S., used in fund management or qualified retirement accounts, may cause them to trade at a premium to the assets they hold. We won’t know this for sure if the SEC continues to hold off on making a decision.

Suggested Reading:

Will the SEC Allow ETFs to Own Cryptocurrency?

|

Coinbase Receives an Enforcement Letter from the SEC

|

What’s in the Surprise Cryptocurrency Bill

|

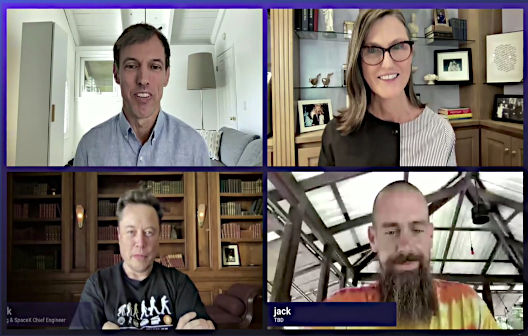

Elon Musk, Jack Dorsey, and Cathie Wood Drop Bombshells at Bitcoin Conference

|

Sources:

https://www.sec.gov/Archives/edgar/data/0001869699/000119312521201955/d165184ds1.htm

Stay up to date. Follow us:

|

Release – Eagle Bulk Shipping Inc. Takes Delivery of MV Antwerp Eagle

Eagle Bulk Shipping Inc. Takes Delivery of M/V Antwerp Eagle

The ship, which was acquired this past May, is a 2015-built, high specification scrubber-fitted SDARI-64 Ultramax vessel built at

Proforma for the one pending vessel acquisition, the Company’s fleet totals 53 ships with an average age of 8.8 years.

About Eagle Bulk Shipping Inc.

Company Contact

Chief Financial Officer

Tel. +1 203-276-8100

Email: investor@eagleships.com

Media Contact

Tel. +1 212-359-2228

Source:

Release – CoreCivic Provides Update on U.S. Marshals Service Contract for the West Tennessee Detention Facility

CoreCivic Provides Update on U.S. Marshals Service Contract for the West Tennessee Detention Facility

BRENTWOOD, Tenn., Sept. 17, 2021 (GLOBE NEWSWIRE) — As has been previously disclosed, CoreCivic, Inc. (NYSE: CXW) (the Company) has a direct contract with the U.S. Marshals Service (USMS) at the 600-bed West Tennessee Detention Facility in Mason, Tennessee that is scheduled to expire on September 30, 2021. The Company recently was provided with a definitive inmate population ramp down plan from the USMS indicating that all inmates will be transferred out of the facility by September 30, 2021. As a result, the Company does not expect the USMS to exercise its renewal option under the existing contract.

The Company has been actively marketing the facility to other government agencies, and in August 2021, the Company submitted a formal response to a government agency’s request for proposal to utilize the West Tennessee Detention Facility. However, the Company can provide no assurances that it will be successful in entering into a new contract with the government agency.

The revenue generated from the USMS at the West Tennessee Detention Facility for the year ended December 31, 2020, and six months ended June 30, 2021, was $18.4 million and $10.2 million, respectively. For the year ended December 31, 2020, the facility incurred a $1.4 million net operating loss, and for the six months ended June 30, 2021, the facility generated net operating income of $0.8 million.

About CoreCivic

CoreCivic is a diversified government solutions company with the scale and experience needed to solve tough government challenges in flexible, cost-effective ways. CoreCivic provides a broad range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America’s recidivism crisis, and government real estate solutions. CoreCivic is the nation’s largest owner of partnership correctional, detention and residential reentry facilities, and believes it is the largest private owner of real estate used by government agencies in the U.S. CoreCivic has been a flexible and dependable partner for government for more than 35 years. CoreCivic’s employees are driven by a deep sense of service, high standards of professionalism and a responsibility to help government better the public good.

Forward-Looking Statements

This press release contains statements as to our beliefs and expectations of the outcome of future events that are “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from the statements made. These include, but are not limited to, the risks and uncertainties associated with: (i) changes in government policy (including the United States Department of Justice, or DOJ, not renewing contracts as a result of President Biden’s Executive Order on Reforming Our Incarceration System to Eliminate the Use of Privately Operated Criminal Detention Facilities) (two agencies of the DOJ, the United States Federal Bureau of Prisons and the United States Marshals Service, utilize our services), legislation and regulations that affect utilization of the private sector for corrections, detention, and residential reentry services, in general, or our business, in particular, including, but not limited to, the continued utilization of our correctional and detention facilities by the federal government, and the impact of any changes to immigration reform and sentencing laws (we do not, under longstanding policy, lobby for or against policies or legislation that would determine the basis for, or duration of, an individual’s incarceration or detention); (ii) our ability to obtain and maintain correctional, detention, and residential reentry facility management contracts because of reasons including, but not limited to, sufficient governmental appropriations, contract compliance, negative publicity and effects of inmate disturbances; (iii) changes in the privatization of the corrections and detention industry, the acceptance of our services, the timing of the opening of new facilities and the commencement of new management contracts (including the extent and pace at which new contracts are utilized), as well as our ability to utilize available beds; (iv) general economic and market conditions, including, but not limited to, the impact governmental budgets can have on our contract renewals and renegotiations, per diem rates, and occupancy; (v) fluctuations in our operating results because of, among other things, changes in occupancy levels, competition, contract renegotiations or terminations, increases in costs of operations, fluctuations in interest rates and risks of operations; (vi) the duration of the federal government’s denial of entry at the United States southern border to asylum-seekers and anyone crossing the southern border without proper documentation or authority in an effort to contain the spread of COVID-19; (vii) government and staff responses to staff or residents testing positive for COVID-19 within public and private correctional, detention and reentry facilities, including the facilities we operate; (viii) restrictions associated with COVID-19 that disrupt the criminal justice system, along with government policies on prosecutions and newly ordered legal restrictions that affect the number of people placed in correctional, detention, and reentry facilities, including those associated with a resurgence of COVID-19; (ix) whether revoking our real estate investment trust, or REIT, election, effective January 1, 2021, and our revised capital allocation strategy can be implemented in a cost effective manner that provides the expected benefits, including facilitating our planned debt reduction initiative and planned return of capital to shareholders; (x) our ability to successfully identify and consummate future development and acquisition opportunities and our ability to successfully integrate the operations of our completed acquisitions and realize projected returns resulting therefrom; (xi) our ability, following our revocation of our REIT election, to identify and initiate service opportunities that were unavailable under the REIT structure; (xii) our ability to have met and maintained qualification for taxation as a REIT for the years we elected REIT status; and (xiii) the availability of debt and equity financing on terms that are favorable to us, or at all. Other factors that could cause operating and financial results to differ are described in the filings we make from time to time with the Securities and Exchange Commission.

CoreCivic takes no responsibility for updating the information contained in this press release following the date hereof to reflect events or circumstances occurring after the date hereof or the occurrence of unanticipated events or for any changes or modifications made to this press release or the information contained herein by any third-parties, including, but not limited to, any wire or internet services.

| Contact: | Investors: Cameron Hopewell – Managing Director, Investor Relations – (615) 263-3024 Media: Steve Owen – Vice President, Communications – (615) 263-3107 |

Lineage Cell Therapeutics (LCTX) – OpRegen Data Update Adds To Evidence of Efficacy

Thursday, September 16, 2021

Lineage Cell Therapeutics (LCTX)

OpRegen Data Update Adds To Evidence of Efficacy

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel cell therapies for unmet medical needs. Lineage’s programs are based on its robust proprietary cell-based therapy platform and associated in-house development and manufacturing capabilities. With this platform Lineage develops and manufactures specialized, terminally differentiated human cells from its pluripotent and progenitor cell starting materials. These differentiated cells are developed to either replace or support cells that are dysfunctional or absent due to degenerative disease or traumatic injury or administered as a means of helping the body mount an effective immune response to cancer. Lineage’s clinical programs are in markets with billion dollar opportunities and include three allogeneic (“off-the-shelf”) product candidates: (i) OpRegen®, a retinal pigment epithelium transplant therapy in Phase 1/2a development for the treatment of dry age-related macular degeneration, a leading cause of blindness in the developed world; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of acute spinal cord injuries; and (iii) VAC, an allogeneic dendritic cell therapy platform for immuno-oncology and infectious disease, currently in clinical development for the treatment of non-small cell lung cancer. For more information, please visit www.lineagecell.com or follow the Company on Twitter @LineageCell.

Robert LeBoyer, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Additional Data Released: Lineage Cell released additional data from its Phase 1/2a clinical trial testing OpRegen, its retinal pigment epithelium (RPE) cell transplant. The full data presentation is scheduled for the Annual Scientific Meeting of the Retina Society on September 30. The new data was from patients who have been followed for at least 9 months from their treatment and shows both durable improvements in function and cellular structure. We believe it supports our expectations for product efficacy and our investment thesis for the stock.

Study Design. The Phase 1/2a trial tests OpRegen, an allogenic RPE cell transplant product for dry age-related macular degeneration (dry AMD). The trial has a total of 24 patients, with three cohorts totaling 12 patients to demonstrate safety, followed by a fourth cohort of 12 patients to demonstrate efficacy. Patients in Cohort 4 had dry AMD with areas of geographic atrophy (GA) where RPE cells …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Energy Fuels Establishes the San Juan County Clean Energy Foundation with Potential to Contribute Millions to Local Communities

Energy Fuels Establishes the San Juan County Clean Energy Foundation with Potential to Contribute Millions to Local Communities

BLANDING, Utah, Sept. 16, 2021 /CNW/ – At its recent open house showcasing its uranium and rare earth businesses for local and national dignitaries and industry leaders, Energy Fuels Inc. (“Energy Fuels” or the “Company”) announced the establishment of the San Juan County Clean Energy Foundation, a fund specifically designed to contribute to the communities surrounding Energy Fuels’ White Mesa Mill in Southeastern, Utah.

This week, Energy Fuels deposited $1 million into the Foundation and anticipates providing ongoing annual funding equal to 1% of the Mill’s future revenues, providing funding to support the local economy and local priorities. The Foundation will focus on supporting education, the environment, health/wellness, and economic advancement in the City of Blanding, San Juan County, the White Mesa Ute Community, the Navajo Nation and other area communities.

“The communities that surround our facility deserve to share in the benefits of the Mill’s clean energy future,” said Mark Chalmers, CEO of Energy Fuels. “Uranium, which is the fuel for carbon-free, emission-free baseload nuclear power, is one of the cleanest forms of energy in the world. The rare earth’s we are now producing are used for the manufacture of permanent magnets for electric vehicles, wind turbines and other clean energy and modern technologies, and the thorium and other radioisotopes we are evaluating for recovery from our rare earth and uranium processing streams have the potential to provide the isotopes needed for emerging targeted alpha therapy cancer-fighting therapeutics. The very heart of our business – uranium and rare-earth production and recycling – helps us play a big part in addressing global climate change, reducing air pollution, and making the world a cleaner and healthier place. We see San Juan County as becoming a critical minerals hub for the U.S., and we believe the Foundation is truly the best way to make an impact and difference in the lives of those who work alongside us as we pursue these goals.”

Company executives met with local community members to better understand and identify how the Foundation will strategically support the local communities and how to best structure the Foundation.

“Energy Fuels has long been a major contributor to not only the employment base of the community but also for the well-being and prosperity of this region,” said Blanding’s Mayor Joe B. Lyman. “Over the last year, the Company has met with local community members to understand and identify needs in the area. The formation of the Foundation is a culmination of these efforts and the beginning of a long-term commitment to improve the quality of life for everyone in the San Juan County area to help us reach our full potential.” To ensure that the Foundation’s contributions are well-planned and correspond to the specific needs and aspirations of the communities, the Foundation will have a community-based Advisory Board to help it determine the best allocation for the funds.

“The processing of rare earths at the White Mesa Mill, in addition to processing and recycling uranium, is one of the best opportunities I have seen in my entire 40+ year career, as electric vehicles, renewable energy systems, and other clean energy and advanced technologies drive demand,” continued Mr. Chalmers. “And, the potential to also extract isotopes that can be used to fight cancer is a very important added opportunity. Investing back into the San Juan County community will give us the opportunity to help support and catalyze sustainable economic and community development, beyond good jobs and more tax revenues.”

With a population of a little more than 3,000 people, Blanding is the most populous city in San Juan County. Economic contributors include mineral processing, mining, agriculture, local commerce, tourism, and transportation. The community is also a gateway to nearby natural, cultural and archaeological resources. Energy Fuels’ rare earth initiative will only involve mineral processing, and it is not expected to involve any new mining in the region.

Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8?to major nuclear utilities. Energy Fuels also produces vanadium from certain projects, as market conditions warrant, as well as rare earth carbonate. With corporate offices in?Lakewood, Colorado, near?Denver, and all of its assets and employees in?the United States, Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in?Utah, the Nichols Ranch in-situ recovery (ISR) Project in?Wyoming, and the Alta Mesa ISR Project in?Texas. Energy Fuels is a publicly traded company on the NYSE under the trading symbol “UUUU,” and its common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is?www.energyfuels.com

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information may relate to future events or future performance of Energy Fuels. All statements in this release, other than statements of historical facts, with respect to Energy Fuels’ objectives and goals, as well as statements with respect to its beliefs, plans, objectives, expectations, anticipations, estimates, and intentions, are forward-looking information. Specific forward-looking statements in this discussion include, but are not limited to, the following: any expectation as to future production of uranium at the Mill; any expectation as to future production of rare earth products at the Mill; any expectation as to future production of thorium and other radioisotopes for use in emerging targeted alpha therapies; any expectation as to future revenues at the Mill; any expectation that San Juan County will become a critical minerals hub for the U.S.; any expectation as to any ongoing annual funding for the Foundation or the longevity of the Foundation; any expectation that the Foundation will provide the potential to contribute millions to local communities; any expectation as to the manner in which the Foundation will distribute or invest its funds; and any expectation that the Foundation’s money will help support and catalyze sustainable economic and community development, beyond good jobs and more tax revenues. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “intends”, “anticipates” or “believes”, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: commodity prices; processing difficulties and upsets; available supplies of monazite sands; the capital and operating costs associated with the recovery of uranium, rare earth products, thorium and other radioisotopes at the Mill; licensing, permitting and regulatory delays; litigation risks; competition from others; market factors, including future demand for and prices realized from the sale of uranium, rare earth products, and thorium or other radioisotopes produced at the Mill; and any changes that may be made to the structure, funding or term of the Foundation if the Company determines at any time that the Foundation is not achieving its objectives or to better meet its objectives. Forward-looking statements contained herein are made as of the date of this news release, and Energy Fuels disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law.

SOURCE Energy Fuels Inc.

Energy Fuels Hosts Mining, Environmental and Political Heavyweights to Showcase Uranium Activities and Introduce Production of Rare Earths at its Blanding, Utah Facility

Energy Fuels Hosts Mining, Environmental and Political Heavyweights to Showcase Uranium Activities and Introduce Production of Rare Earths at its Blanding, Utah Facility

Shipments of commercial quantities of rare earths from Energy Fuels’ White Mesa Mill in Blanding represent a milestone in the creation of a new supply chain reducing dependence on foreign suppliers, while boosting significant economic potential to the area

BLANDING, Utah, Sept. 16, 2021 /CNW/ – Energy Fuels’ President and CEO, Mark Chalmers is hosting business, community and industry heavyweights in Blanding, Utah to introduce the commencement of production and shipments of an intermediate rare earth element (“REE”) product, called mixed rare earth carbonate (“RE Carbonate”), at its Utah-based White Mesa Mill (the “Mill”). Approximately 15 containers of RE Carbonate (300 tonnes of product) produced at the Mill is being shipped to Europe where it will be processed into separated rare earth oxides and other value-added RE compounds, thereby creating a new U.S. to Europe RE supply chain along with new opportunities and financial benefits for the surrounding communities. The Mill will be producing rare earths as a complement to its established uranium production business.

The Company will also showcase its U.S. industry-leading uranium production capabilities. Energy Fuels has been the largest producer of uranium in the U.S. for the past several years, boasting more uranium production facilities, mines and capacity than any other U.S. company. The White Mesa Mill is the largest uranium production facility in the US and America’s only operating uranium mill. Uranium is seeing increased interest recently, as it is the fuel for nuclear energy, which is the largest source of clean, carbon free energy in the U.S.

REEs are necessary in the production of hundreds of everyday and specialty items with a wide range of consumer applications, including cell phones, computer hard drives, electric and hybrid vehicles, and flat screen monitors and televisions. They also have significant national defense uses including electronic displays, guidance systems, lasers, and radar and sonar systems. Furthermore, with the global push to reduce greenhouse gas emissions, the expansion of green technologies such as solar and wind will continue to play a critical role, and REEs are a fundamental raw material used in the manufacturing of these clean energy sources. There are currently no U.S. companies producing separated REE oxides or any other advanced or value-added REE compounds, thereby making the US 100% dependent on the importation of these critical materials. Energy Fuels is determined to reverse that reliance and lessen the risk of disruption to the clean energy economy and our national defense.

“This is an exciting time for all of us at Energy Fuels in both the uranium and rare earth sectors,” said Chalmers. “We believe the San Juan County community will benefit greatly from this rare earth initiative, as it will offer not only a safe, environmentally sensible, and domestically-generated product, but it will also stimulate local employment and be an economic boost to the area.” The White Mesa Mill is currently one of the largest private employers in the county, and it is estimated that this new rare earth effort could result in an investment of hundreds of millions of dollars into the facility, which could translate into 100+ jobs in the region—one of the largest reinvestments this region has seen in decades. “In addition to the economic benefits to Utah, restoring rare earth production to the United States will greatly benefit the entire U.S. economy and manufacturing sector by providing a domestic source of clean energy materials produced to the highest global standards for environmental protection, sustainability and human rights, while also allowing for source validation and tracking from mining through final end-use applications,” added Chalmers. “With the increased demand for rare earths—up to a fivefold demand increase over the next 10 years—we will need all hands-on deck. Combined with the current resurgence in uranium, rare earths represent a truly an immense opportunity for San Juan County, the State of Utah, and the United States as a whole.”

This move by Energy Fuels comes at a time when the Biden administration has made it a priority to reestablish the rare earths industry in the US. Currently, China dominates every aspect of the REE industry from mining to the manufacturing of REE magnets. In the early 1990’s, China produced 38% of world’s REEs, the US produced 33%, Australia produced 12%, and Malaysia and India produced a combined five percent with several smaller countries making up the rest (Source: What are rare earth elements, and why are they important? | American Geosciences Institute). However, a significant shift in those percentages occurred, and by 2011 97% of the world’s REEs were produced in China. While China is expected to continue as the dominant player in the global REE industry, Energy Fuels believes it can create a low-cost, secure domestic alternative for end-users seeking diversity of supply and competition.

Headquartered in Lakewood, Colorado, Energy Fuels currently plans to ramp up to process up to at least 15,000 tons of monazite per year at its White Mesa Mill. This amount of monazite contains roughly 50% of current U.S. rare earth demand, along with significant quantities of uranium, which will be recovered for use in domestic nuclear energy production. “Energy Fuels and our partner, Neo Performance Materials, have made significant steps toward restoring critical U.S. and European rare earth supply chains,” added Chalmers. “We are strategically seeking to increase our rare earth carbonate production in the coming years, since we first started acquiring monazite ore produced in the State of Georgia earlier this year.”

Successfully producing REEs, and physically delivering the first containers of RE Carbonate to Neo for separation, is an important achievement, not only for Energy Fuels, but also for the U.S. government and its efforts to restore critical rare earth supply chains. This is also good news for end-users of rare earth products in the U.S., Europe, Japan and elsewhere who seek alternative sources of rare earths produced in the U.S. and Europe that adhere to the highest global regulations and standards of environmental protection and sustainability as well as keeping a close eye on human rights.

Because monazite contains naturally occurring radioactive elements, including uranium, the White Mesa Mill is the ideal location to process this valuable material. The Mill will recover the uranium from the monazite, which will be used for the generation of clean nuclear energy. The Mill is also evaluating the recovery of thorium which has potential uses in advanced nuclear technologies along with medical isotopes needed for emerging targeted alpha cancer therapies. In addition, the monazite that is received from Georgia contains over 50% REEs, which means Energy Fuels can recover large quantities of REEs while generating relatively tiny amounts of waste. “We have an exceptional track record of environmental protection and regulatory compliance at the Mill. We also have a lot of experience in safely handling and working responsibly with low-level, natural radioactive elements contained in a variety of uranium ores and recycled alternate feed materials,” stated Curtis Moore, Energy Fuels’ VP of Marketing and Corporate Development. “Monazite sand contains roughly the same percentage of uranium as the ore found in mines in the Four Corners’ region. So, we know we will responsibly process it for the recovery of the raw materials needed for various clean energy and advanced technologies. The safety of our community and our employees is and will always remain paramount. We also are evaluating how we can do more for our local communities, particularly local Navajo, Ute, and other Native American communities.”

“Energy Fuels recognizes the lingering distrust in communities that witnessed and experienced the health and environmental impacts from historic Cold War uranium mining operations, which continue to impact perceptions. We are deeply committed to addressing the world’s most pressing environmental issues, while advancing toward the electrification of the world economy. We believe that unlocking the value of domestically produced monazite and the domestic production of rare earths, combined with our existing uranium business, is a significantly positive step.” Energy Fuels has and continues to be profoundly committed to responsible and modern mining and production, and all U.S. uranium and REE production is done to the highest global standards for environmental protection and human rights.

About Energy Fuels: Energy Fuels is a leading US-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels also produces vanadium for certain projects, as market conditions warrant, as well as rare earth carbonate. With corporate offices are in Lakewood, Colorado, near Denver, and all of its assets and employees in the United States, Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch ISR Project in Wyoming, and the Alta Mesa ISR Project in Texas. Energy Fuels’ website is www.energyfuels.com.

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information may relate to future events or future performance of Energy Fuels. All statements in this release, other than statements of historical facts, with respect to Energy Fuels’ objectives and goals, as well as statements with respect to its beliefs, plans, objectives, expectations, anticipations, estimates, and intentions, are forward-looking information. Specific forward-looking statements in this discussion include, but are not limited to, the following: any expectation as to future production of uranium at the Mill; any expectation as to future production of rare earth products at the Mill or creation of a new U.S. to Europe supply chain; any expectation as to the Company’s ability to increase rare earth carbonate production; any expectations as to increased demand for rare earths; any expectation as to future production of thorium and other radioisotopes for use in emerging targeted alpha therapies; any expectation as to future revenues at the Mill; any expectation that San Juan County or Utah will realize significant economic benefits or that the Company’s rare earth initiative will create 100+ jobs; any expectation that Energy Fuels will reverse America’s reliance on imports or lessen the risk of disruption for critical minerals; any expectation that Energy Fuels will create a low-cost, secure domestic alternative for end-users seeking diversity of supply and competition. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “continues”, “forecasts”, “projects”, “predicts”, “intends”, “anticipates” or “believes”, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements include risks associated with: commodity prices; processing difficulties and upsets; available supplies of monazite sands; the capital and operating costs associated with the recovery of uranium, rare earth products, thorium and other radioisotopes at the Mill; licensing, permitting and regulatory delays; litigation risks; competition from others; market factors, including future demand for and prices realized from the sale of uranium, rare earth products, and thorium or other radioisotopes produced at the Mill. Forward-looking statements contained herein are made as of the date of this news release, and Energy Fuels disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law.

SOURCE Energy Fuels Inc.

QuickChek – September 16, 2021

|

Neovasc Announces FDA Approval of COSIRA-II Clinical TrialNeovasc announced that it has received FDA approval for the Investigational Device Exemption (“IDE”) regarding the COSIRA-II IDE Clinical Trial |

|

Ayala Pharmaceuticals Presents Preliminary Clinical Data from the Ongoing Phase 2 ACCURACY TrialAyala Pharmaceuticals announced new preliminary clinical data from the 6mg cohort of its ongoing Phase 2 ACCURACY trial Research, News & Market Data on Ayala Pharmaceuticals |

|

Pro Football Retired Players Association Announces Partnership with Esports Entertainment Group for Its Gridiron Gaming InitiativeEsports Entertainment Group announced it has signed a partnership agreement with the Pro Football Retired Players Association Research, News & Market Data on EEG |

|

Energy Fuels Establishes the San Juan County Clean Energy Foundation with Potential to Contribute Millions to Local CommunitiesEnergy Fuels announced the establishment of the San Juan County Clean Energy Foundation, a fund specifically designed to contribute to the communities surrounding Energy Fuels’ White Mesa Mill in Southeastern, Utah Energy Fuels Hosts Mining, Environmental and Political Heavyweights to Showcase Uranium Activities and Introduce Production of Rare Earths at its Blanding, Utah FacilityEnergy Fuels announced the commencement of production and shipments of an intermediate rare earth element product, called mixed rare earth carbonate, at its Utah-based White Mesa Mill Research, News & Market Data on Energy Fuels |

Stay up to date. Follow us:

|