Wednesday, January 12, 2021

Digital, Media & Entertainment Industry

Favorable Fundamental Outlook; Moderating Stock Expectations

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

Overview: A promising fundamental outlook. Looking back on 2021, it was a disappointing year. The advertising recovery was strong, but did not exceed 2019 levels. As we look forward toward 2022, most media executives anticipate a recovery to 2019 levels or higher. We believe that the media stocks will climb the wall of worry in 2022. Stock valuations do not appear to be extended and the fundamental environment appears favorable. As such, we remain constructive on selective media stocks for 2022 but do not expect the same stock performance as in 2021.

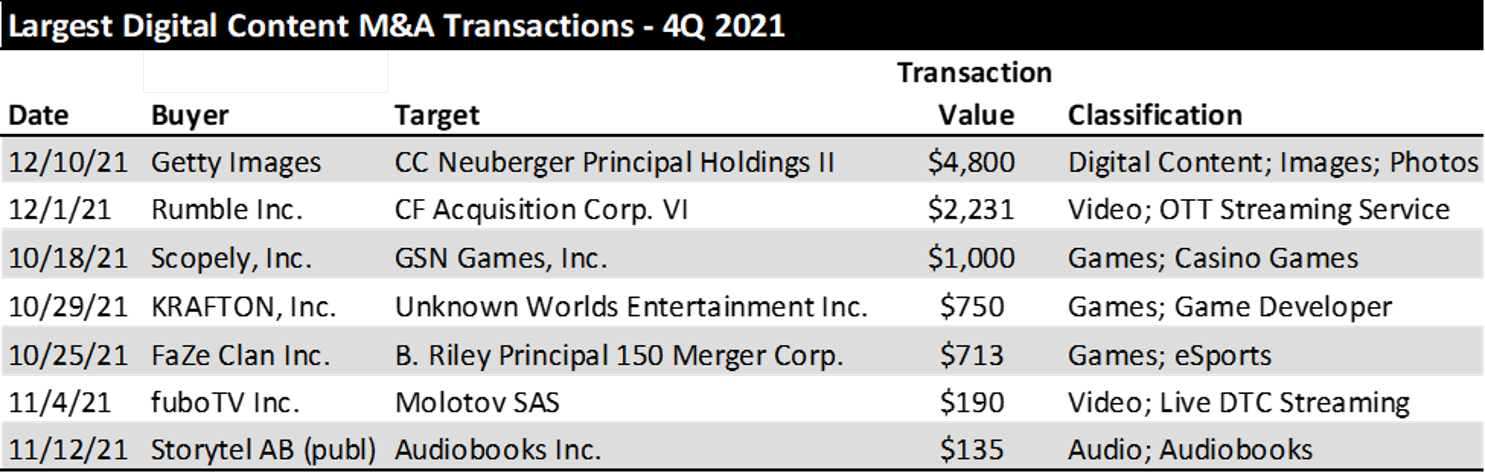

Digital Media: Will there be a turnaround in stock performance? Many stocks in the Internet & Digital Media were “Covid beneficiaries” with increased time spent at home viewing on-demand video content or playing video games. As consumers began to resume their normal lives in 2021, the Covid beneficiaries began to face difficult comparisons.

Esports & IGaming: A victim of earlier success? The average increase for stocks in this sector in 2020 was 117%. But the Noble Esports and IGaming index, which was up 25% through mid-March, finished the year down a similar amount (-29%), reflecting a nearly halving of stock prices in the last 3 quarters of the year, another sector that fell victim to pandemic-related investor enthusiasm. We look for a better performance in 2022.

Television: Will it be a Gray year? The TV stocks started the year nicely, but the performance faded in the second half of the year. This market cap weighted index was heavily influenced by the weak performance of the shares of Viacom and Sinclair Broadcasting. Even the strong 145% gain in the shares of Entravision did not help the index. But, the underperformance of Gray Television (up a moderate 12%) stands out and we question if 2022 could be its year.

Radio: Several stocks get an “A” for performance in 2021. There were some extraordinary stock performances. Salem Media, increased an extraordinary 194% and led the list of the strongest performer in 2021. In addition, the shares of Townsquare Media increased 100%. We believe that investors should set expectations for moderating stock performances in 2022.

Overview

A Promising Fundamental 2022 Outlook

Looking back on 2021, it was a disappointing year. The advertising recovery was strong, but did not rebound as nicely as one would expect. The level of government stimulus supported the prospect of a very strong economic and advertising recovery. Supply chain issues, waves of Covid infections as variants emerged and vaccine mandates kept workers and businesses in a tepid environment. The important Auto category did not bounce back as the new car supply was hampered by semiconductor chip shortages. Most advertising mediums did not fully recover revenues to 2019 levels as initially hoped given the rebounding economy. As we look forward toward 2022, most media executives anticipate a strong advertising year, fueled by a continued favorable economy, a return of Auto advertising as supply chain issues abate and the influx of Political advertising. This is the year that advertising recovers to exceed 2019 levels. That is the promise of 2022. If it doesn’t recover to above 2019 levels, especially with the influx of Political advertising, there are bigger problems.

Investors already appear concerned about inflation and the prospect of a rising interest rate environment. The Federal Reserve has hinted that there may be as many as 3 interest rate increases in 2022. In the past, consumer cyclicals do not do well during these periods. As such, investors appear to be setting expectations low for market returns. To some degree, media stocks already anticipate the rising interest rate environment. Over the past year, many mediums have underperformed the general market as measured by the S&P 500 Index, with Television stocks particularly disappointing in the fourth quarter. This is very unusual for Television stocks. Typically, TV stocks do well in the year prior to Olympic and election years. But, after an early strong stock performance in the first part of the year, TV stocks faded in the fourth quarter 2021, discussed later in this report. We would note that many of our closely followed media stocks had some of the strongest performance in 2021, beating the general market and outperforming respective media peer sets. We believe that the media stocks will climb the wall of worry in 2022. Stock valuations do not appear to be extended and the fundamental environment appears favorable. As such, we remain constructive on selective media stocks for 2022. Some of our favorites last year lead our favorites for 2022, including Gray Television and E.W. Scripps. In addition, we anticipate a better year for our esports and igaming companies. A list of our favorites are listed later in this report.

Digital Media & Technology

Prior Performance (2020) May Not be Reflective of Future Performance (2021)

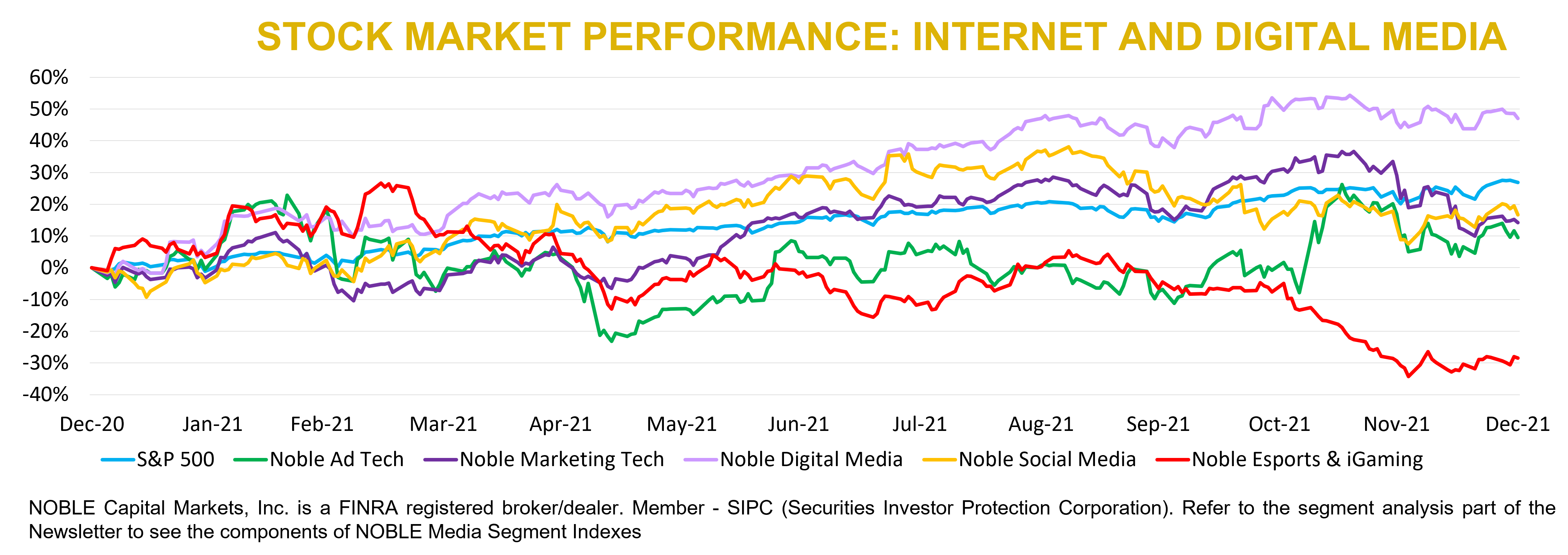

When it comes to investing, it is often said that “prior performance may not be reflective of future performance”, and that was certainly the case in 2021. Stocks in the Internet and Digital Media sectors performed well in 2021, but not nearly as well as the broader market (the S&P 500), which finished the year up 27%. Only the Noble’s Digital Media Index (+47%), outperformed the S&P 500, while stocks in the Social Media (+17%), Mar Tech (+14%), Ad Tech (+10%) and eSports & Gaming (-29%) Indices underperformed. In many respects, Internet and Digital Media stocks were victims of their own success. In 2020, when the S&P 500 finished up 16%, Noble’s Ad Tech (+178%), Mar Tech (+65%), Social Media (+41%) and Digital Media (+38%) Indices all significantly outperformed the S&P 500 (NOTE: Noble added the eSports & Gaming sector in 1Q 2021).

Many stocks in the Internet & Digital Media were “Covid beneficiaries” and benefited from increased time spent at home viewing on-demand video content or playing video games. As consumers began to resume their normal lives in 2021, the Covid beneficiaries began to face difficult comparisons. Zoom Communications (ZM) is the poster boy for this effect: shares of Zoom increased nearly 400% in 2020, but fell by 46% in 2021.

Noble’s Internet & Digital Media indices are market cap weighted, so their performance is often driven by the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google). Interestingly, only Google (GOOG: +65%) and Apple (APPL: +34%) outperformed the S&P 500 in 2021, with Facebook (FB: +23%), Netflix (NFLX: +11%) and Amazon (AMZN: +2%) failing to keep pace.

Noble’s market cap weighted Digital Media Index performed well primarily on the strength of Google’s shares, despite only 3 of the 11 stocks in the index increasing for the year. A few of high-fliers in 2020 failed to repeat in 2021. For example, FuboTV (FUBO) saw its shares increase by 214% in 2020, but came back to earth in 2021 (-45%). Spotify saw a similar trend, with shares increasing by 110% in 2020, only to fall by 26% in 2021.

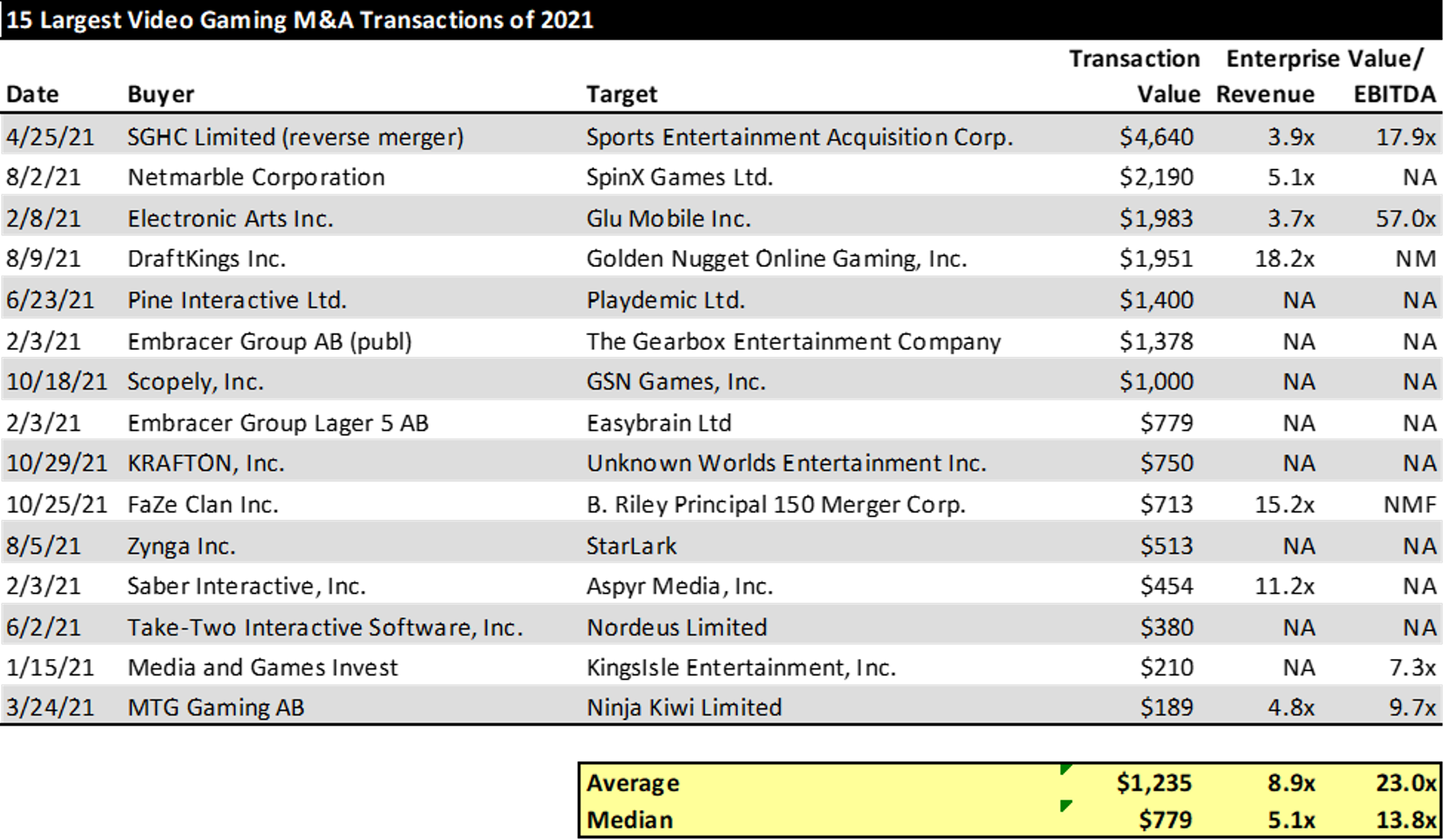

Noble’s eSports & Gaming Index shared similar traits as the Digital Media sector, only the sector experienced both a boom and bust in the same year. The index was up 25% through mid-March, only to finish the year down a similar amount (-29%), reflecting a nearly halving of stock prices in the last 3 quarters of the year. While Noble only created this index in 2021, we note that the average increase for stocks in this sector in 2020 was 117%. Again, another sector that fell victim to pandemic-related investor enthusiasm.

As Figure #1 Sports Betting/iGaming Company Comparables illustrate, the stock valuations of some of our favorite plays appear compelling and trading below industry averages. Our favorite plays for 2022 include Engine Media, Esports Entertainment, and Motorsport Games.

Figure #1

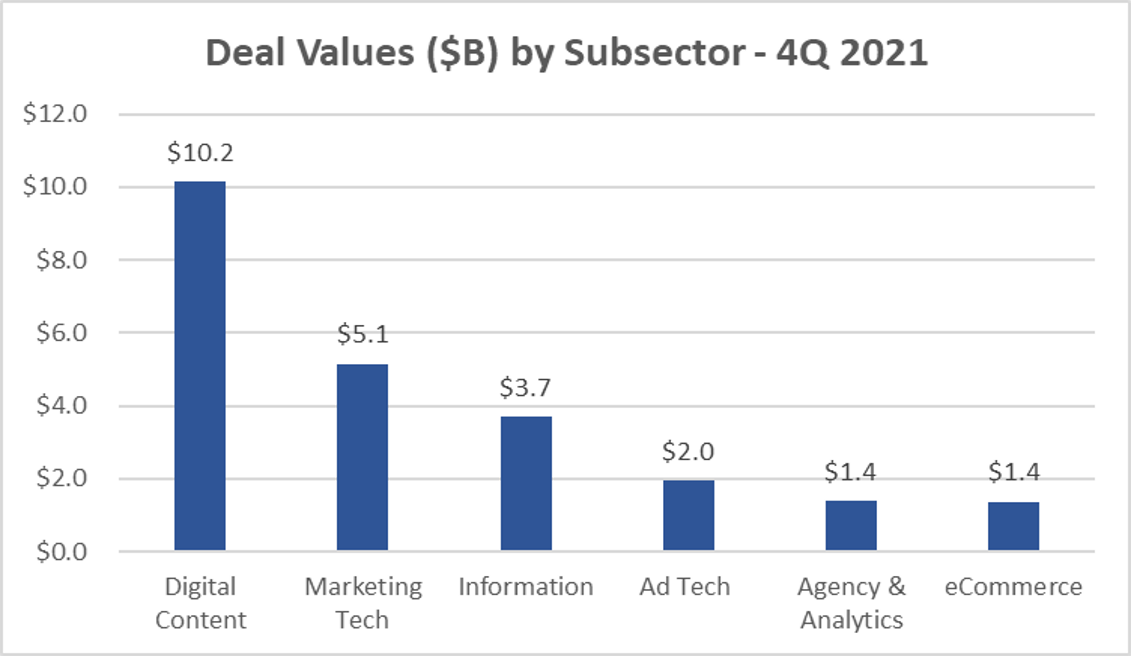

In general, Noble’s Internet & Digital Media Indices finished the year rather poorly as illustrated in Figure #2 12-Month Digital Stock Performance. In 4Q21, the S&P 500 finished up 11%. Only Noble’s Ad Tech Index outperformed the broader market, increasing by 18%. Indices that underperformed the broader market include Digital Media (+6%), Mar Tech (-3%), Social Media (-6%), and eSports & Gaming (-24%). We would note that every stock in the Social Media and eSports & Gaming sectors fell during the fourth quarter of 2021.

We attribute much of the weakness in these indices to the Fed’s pivot to a more hawkish stance on inflation, first during the September meeting, and again in mid-December, when it opined that it no longer considered inflation transitory and would double the pace of tapering (reducing bond purchases) and signaling three rate hikes in 2022. Investors appear to have responded by moving into large cap defensive names at the expense of smaller cap growth companies. Companies that are not yet profitable were hit hardest.

Within the Ad Tech industry, one of our favorites had an extraordinary year, Harte Hanks, up an impressive 176%. We believe that the company is still early in its turnaround and that there is significant upside in the shares. As such, we remain constructive on the HHS shares in 2022.

Figure #2 12-Month Digital Stock Performance

Broadcasting

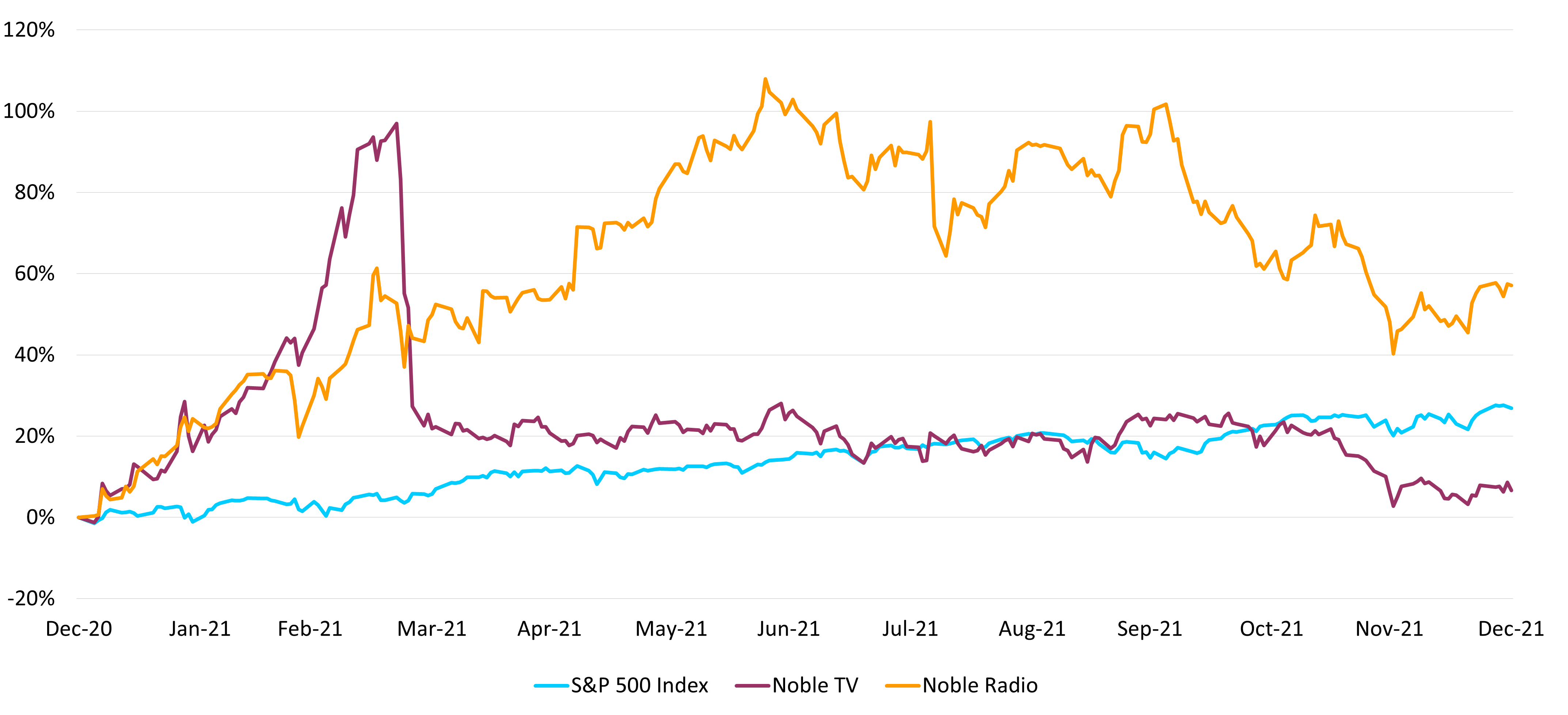

Broadcasting stocks had a difficult Fourth Quarter as Figure #3 Quarter Broadcast Performance illustrates. Both the Noble Radio and Noble Television Indices declined from the start of the quarter, as both indices suffered from the Fed comments in September to a more hawkish stance on inflation. Interestingly, the Radio stocks held up better than the TV stocks.

Figure #3 Quarter Broadcast Stock Performance

Broadcast TV

Will it be a Gray year?

As Figure #4 12-Month Broadcast Stock Performance illustrates, the TV stocks started the year nicely, but the performance faded in the second half of the year. This market cap weighted index was heavily influenced by the weak performance of the shares of Viacom and Sinclair Broadcasting, both were down near 20% for the year. Notably, the average TV stock was up 31% for the year, which is more in line with the historic performance for the group in the year prior to an Olympic and election year. For the past 20 years, the TV stocks gain an average 22% in the odd number year. Furthermore, there were some notable stock performance stand outs. Entravision (EVC) led the stock performance for the year up a remarkable 145%. The extraordinary performance was driven by the company’s digital transformation through attractive acquisitions.

As we look forward toward 2022, we believe that the fundamental environment for the TV broadcasters appears favorable. In our view, the key auto advertising category should gain traction as supply issues abate. In addition, a rising interest rate environment may actually serve to increase auto advertising as dealerships step up efforts to get consumers in the door and to build brand awareness. Furthermore, the industry should benefit from the influx of Political advertising. While all indications are that Political advertising will exceed 2020 levels, we are still somewhat cautious about that prospect, but expect an outsized Political advertising year, nonetheless. One of our current favorites in the industry did not perform as well in 2021, namely Gray Television (GTN), which increased a moderate 12% in 2021. We believe that the shares may have underperformed due to the fog of acquisitions. In our view, the company has an incredible platform to participate in the influx of Political advertising. In addition, the company has an enviable history of integrating acquisitions and outperforming the fundamentals of the industry. As Figure #5 Broadcast TV Company Comparables illustrate, the shares of GTN trade below its peer averages. As such, the GTN shares lead the list of favorites for 2022. The remaining favorites include E.W. Scripps (SSP) and Entravision (EVC).

Figure #4 12-Month Broadcast Stock Performance

Figure #5

Radio

An “A” for performance

The Radio stocks had an extraordinary year as investors regained confidence that the industry will still be around. The Noble Radio Index increased 57% for the full year 2021, nicely outperforming the general market, as measured by the S&P 500 Index, which was up 28%. During the depths of the pandemic in 2020, some broadcasters tripped debt covenants creating concern that some high profile companies will need to be reorganized. As such, the Radio stocks rebounded as the economy and advertising environment improved and as companies sought debt covenant waivers or refinanced. The Noble Radio index is market weighted. As such, there were some extraordinary stock performances that exceeded the Noble Index in 2021. Salem Media, one of our closely followed stocks, increased an extraordinary 194% and led the list of the strongest performer in 2021. In addition, the shares of Townsquare Media increased 100%.

We do not look for such extraordinary stock performances to recur in 2022. The fourth quarter stock performance highlights some of the issues that investors will need to grapple with. The Noble Radio index decreased 22% in the fourth quarter reflecting concern over a rising interest rate environment and the prospect of a slowing economy. Many in the industry still have significant debt leverage. As such, concern over the economy and the advertising environment likely will have an outsized impact on the industry. We believe that 2022 will be a year of moderating revenue trends, and, likely moderating stock price performances. Nonetheless, we believe that there will be a generally favorable environment for Radio stocks and room for attractive upside appreciation potential. Most radio broadcasters are likely to continue to expand into areas of faster revenue and cash flow growth, namely Digital, with some moving well beyond advertising supported media. As Figure #6 Broadcast Radio Company Comparables illustrate, many of the stocks trade at compelling stock valuations, with some of our favorites trading below industry averages. Our current favorites include Townsquare Media, Cumulus Media and Salem Media.

Figure #6

The following companies are mentioned in this report and the link to the respective reports, which contain important disclosures, are available:

Cumulus Media (CMLS)

Engine Media (GAME)

Entravision (EVC)

Esports Entertainment (GMBL)

E.W. Scripps (SSP)

Gray Television (GTN)

Harte Hanks (HHS)

Motorsport Games (MSGM)

Salem Media (SALM)

Townsquare Media (TSQ)

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results.

Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Director of Research. Senior Equity Analyst specializing in Media & Entertainment. 34 years of experience as an analyst. Member of the National Cable Television Society Foundation and the National Association of Broadcasters. BS in Management Science, Computer Science Certificate and MBA specializing in Finance from St. Louis University.

Named WSJ ‘Best on the Street’ Analyst six times.

FINRA licenses 7, 24, 66, 86, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

94% |

32% |

| Market Perform: potential return is -15% to 15% of the current price |

7% |

4% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same.

Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

150 East Palmetto Park Rd., Suite 110

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 24375