Digerati Closes Acquisition of NextLevel Internet

Research, News, and Market Data on Digerati Technologies

– Expands Reach of Digerati’s Cloud Communications and Broadband Solutions To Include Strong West Coast Presence, Specifically California –

– Expected to be Accretive to Earnings and Add Over $13 Million in Annual Revenue, Increasing Digerati’s Consolidated Annualized Revenue to $31.5 Million –

– Derek M. Gietzen, President of NextLevel Internet, Joins

the Digerati Executive Management Team –

SAN ANTONIO, TX (GlobeNewswire) – February 8, 2022 – Digerati Technologies, Inc. (OTCQB: DTGI) (“Digerati” or the “Company”), a provider of cloud services specializing in UCaaS (Unified Communications as a Service) solutions for the small to medium-sized business (“SMB”) market, is pleased to announce the completion of the acquisition of San Diego-based NextLevel Internet, Inc. (“NextLevel”), a leading provider of cloud communication and broadband solutions tailored for the SMB market.

The acquisition of NextLevel expands the Company’s growing nationwide footprint and adds a strong West Coast presence with nearly 1,000 SMB clients in California. On a consolidated basis and as a result of this acquisition, Digerati’s operating subsidiaries will now serve over 4,000 business customers and approximately 45,000 users. With the acquisition of NextLevel and based upon annualized results for the quarter ending October 31, 2021, the Company expects its operating subsidiaries in the aggregate will generate approximately $31.5 million in annual revenue. In addition, the NextLevel acquisition is expected to have a positive impact on the consolidated EBITDA and operating income of the Company during FY2022.

“We’re excited about the NextLevel transaction, our largest acquisition to-date, that delivers scale as we continue working towards our corporate goal of uplisting to Nasdaq or NYSE American,” said Arthur L. Smith, Chief Executive Officer of Digerati. “By uniting our companies’ shared vision of providing exceptional client experiences and an amazing corporate culture, we will be well positioned to continue executing on our growth strategy. We particularly like the success and expertise that NextLevel brings in the area of broadband services and the delivery of digital oxygen to the business market.”

Derek Gietzen, President of NextLevel, stated, “We could not have found a better partner than the Digerati Team. We are excited about the synergies that exist across the operating subsidiaries and all of the future opportunities this business combination provides for the NextLevel Team.”

Digerati also announced that Derek M. Gietzen, current President of NextLevel, will remain in that role with the Company and join the Digerati Executive Management Team. Mr. Gietzen is an experienced 20-year telecommunications executive with a track record of managing successful high-growth companies. In addition to achieving consistent double-digit growth at NextLevel, Mr. Gietzen’s passion for creating amazing corporate cultures led NextLevel to being recognized as a certified ‘Great Place to Work in the U.S.’ for each of the last three years.

Mr. Smith commented about the addition of Mr. Gietzen to the Executive Management Team, “Derek is an inspirational leader who is perfectly aligned with our core values and brings the added skills necessary for us to successfully execute on our business plan and on-going M&A strategy. We are confident his contribution will enhance our ability to deliver on our corporate goals and assist us with creating long-term shareholder value.”

QAdvisors, a TMT global investment banking boutique, acted as the financial advisor to NextLevel.

About NextLevel Internet, Inc.

NextLevel Internet is a leading provider of cloud-based Unified Communications and Collaboration (“UC&C”), Contact Center, and Managed Connectivity services. Founded in 1999 and headquartered in San Diego, California, NextLevel offers a full suite of UCaaS services nationwide and operates a high-capacity broadband network with extensive reach and a multi-carrier infrastructure. NextLevel is known for providing amazing client experiences with its managed installation process, backed by a team of experienced engineers and project managers, and its high-touch Client Support and in-house, live-answer tech support representatives.

About Digerati Technologies, Inc.

Digerati Technologies, Inc. (OTCQB: DTGI) is a provider of cloud services specializing in UCaaS (Unified Communications as a Service) solutions for the business market. Through its operating subsidiaries T3 Communications (T3com.com), Nexogy (Nexogy.com), SkyNet Telecom (Skynettelecom.net) and NextLevel Internet (nextlevelinternet.com), the Company is meeting the global needs of small businesses seeking simple, flexible, reliable, and cost-effective communication and network solutions including cloud PBX, cloud telephony, cloud WAN, cloud call center, cloud mobile, and the delivery of digital oxygen on its broadband network. The Company has developed a robust integration platform to fuel mergers and acquisitions in a highly fragmented market as it delivers business solutions on its carrier-grade network and Only in the Cloud™.

Forward-Looking Statements

The information in this news release includes certain forward-looking statements that are based upon assumptions that in the future may prove not to have been accurate and are subject to significant risks and uncertainties, including statements related to the future financial performance of the Company. Although the Company believes that the expectations reflected in the forward-looking statements, including but not limited to, total customers, annual revenue and EBITDA, uplisting to Nasdaq or NYSE American, and expected positive impact on the consolidated EBITDA and operating income of the Company during FY2022 are reasonable, it can give no assurance that such expectations or any of its forward-looking statements will prove to be correct. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Factors that could cause results to differ include, but are not limited to, execution of growth strategies, product development and acceptance, the impact of competitive services and pricing, general economic conditions, and other risks and uncertainties described in the Company’s periodic filings with the Securities and Exchange Commission. We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Facebook: Digerati Technologies, Inc.

Twitter: @DIGERATI_IR

LinkedIn: Digerati Technologies, Inc.

Investors

The Eversull Group

Jack Eversull

jack@theeversullgroup.com

(972) 571-1624

ClearThink

Brian Loper

bloper@clearthink.capital

(347) 413-4234

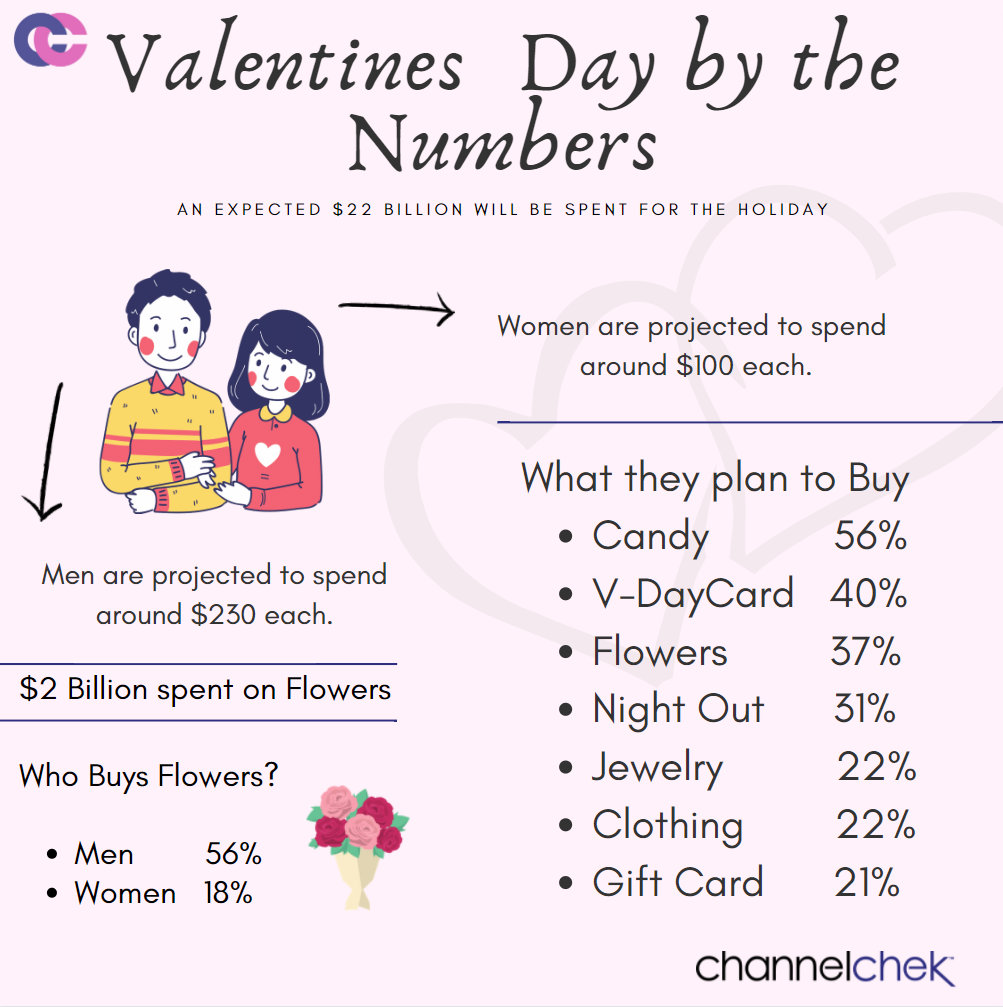

In 2021, men were figured to spend approximately $230 each, while women were believed to have parted with close to $100.

In 2021, men were figured to spend approximately $230 each, while women were believed to have parted with close to $100.