Data Presented at 2022 International Stroke Congress Suggests Role for Non-invasive Vagus Nerve Stimulation (nVNS) for Treatment of Acute Stroke

News and Market Data on electroCore

Clinical Trial (n=69) suggests safety and feasibility of nVNS for the acute treatment of stroke.

Relative Ischemic Lesion Growth Decreased by 65.9% with nVNS vs. Sham Treatment.

ROCKAWAY, N.J.,

Feb. 09, 2022 (GLOBE NEWSWIRE) —

electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic medicine company, today announced top line data from three abstracts being presented at the American Heart Associations’ 2022

International Stroke Conference (

February 9-11, 2022,

New Orleans) on the possible role of nVNS in the acute treatment of stroke.

The nVNS research presented at the

International Stroke Conference 2022 includes:

Non-invasive Vagus Nerve Stimulation for The Acute Treatment of Ischemic or Hemorrhagic Stroke (TR-VENUS)

In this randomized, sham controlled, multi-center study conducted at nine academic centers in

Turkey, the intent-to-treat (ITT) population included 69 subjects (61 ischemic stroke and eight intracerebral hemorrhage) distributed into three treatment arms: sham (n=25), standard-dose nVNS (7 stimulations over one hour; n=19), and high-dose nVNS (7 stimulations in hour 1 and hour 5; n=25). Every subject in the ITT population received all prespecified treatment stimulations per protocol and 97% of all randomized subjects in the study received their first stimulation less than 6 hours from stroke onset. The study met its primary objective with the composite primary safety endpoint being consistent across the three treatment arms indicating that nVNS was able to be administered safely in this acute stroke population. The study also met all secondary safety and feasibility endpoints. Relative infarct growth, measured by diffusion weighted imaging, in the high dose nVNS group (63.3%) was lower than in the sham group (185.8%; p=0.05) against baseline. Dr. Murat Arasava, one of the primary investigators of the TR-VENUS study and Professor of Neurology at the

Hacettepe University in

Ankara, Turkey commented, “We are pleased to have successfully completed this first trial of nVNS as a possible treatment for acute stroke and believe our data suggests that nVNS may be safe and feasible in both ischemic and hemorrhagic stroke. The efficacy signal suggested by the reduction in relative infarct growth rate in the ischemic population, which needs to be confirmed in larger studies, clearly provides the basis for additional research to further define the role for nVNS for the acute treatment of stroke.”

Non-invasive Vagus Nerve Stimulation in Acute Ischemic Stroke (NOVIS)

NOVIS is a prospective randomized clinical trial with blinded outcome assessment being conducted at the

Leiden University Medical Center (Leiden,

The Netherlands). 150 patients with ischemic stroke are being randomly allocated (1:1) to nVNS for five days in addition to standard treatment versus standard treatment alone. The primary endpoint is the final infarct volume on day five assessed with MRI. This study features a greater number of stimulations over five days than TR-VENUS, and advanced imaging endpoints including measurement of the penumbra, that should provide additional insight and clarity surrounding the role of nVNS for the acute treatment of ischemic stroke. Dr.

Anne van der Meij, from the

Leiden University Medical Center, is presenting the poster at the

International Stroke Conference and commented, “Our study is now more than 50% enrolled and our efficacy endpoints may provide greater definition, and possibly confirmation, of the efficacy of nVNS for the acute treatment of ischemic stroke.”

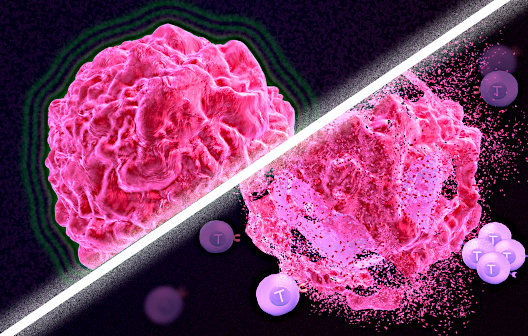

Effect Of Non-invasive Vagus Nerve Stimulation in Hemorrhagic Brain Injury and Permanent Ischemic Stroke in Rats

Dr.

Ilknur Ay of the

Massachusetts General Hospital and

Harvard Medical School presented the results of a pre-clinical study conducted in her lab at the

Athinoula A. Martinos Center for Biomedical Imaging that supports prior evidence that nVNS may have therapeutic potential in ischemic stroke. The lack of adverse events in two different validated models of Intracerebral Hemorrhage in rats shown in this study suggests that nVNS could be safely administered as early as an ambulatory setting before the stroke etiology (ischemic vs. hemorrhagic) has been determined.

Stroke is ranked as the second leading cause of death worldwide with an annual mortality rate of about 5.5 million. The burden of stroke lies not only in its high mortality rate, but in the high morbidity rate as well with up to 50% of stroke survivors being chronically disabled. Stroke is a disease of immense public health importance with serious economic and social consequences. The public health burden of stroke is set to rise over future decades because of demographic transitions of populations across the world. According to the

American Heart Association by 2030, 3.88% of the US population >18 years of age is projected to have had a stroke. Between 2012 and 2030, real (2010$) total direct annual stroke-related medical costs are expected to increase from

$71.55 billion to

$184.13 billion. Real indirect annual costs (attributable to lost productivity) are projected to rise from

$33.65 billion to

$56.54 billion over the same period. Overall, total annual costs of stroke are projected to increase to

$240.67 billion by 2030, an increase of 129%.

Eric Liebler, Senior Vice President of Neurology for electroCore, commented, “We congratulate all of the investigators, patients and sites that have first in human study suggesting a role for nVNS in treatment of acute stroke. If effective, nVNS would represent a breakthrough treatment that could be safely deployed much earlier, more safely and more easily than current stroke treatments. As time to treatment is considered one of the most critical factors in the acute treatment of stroke, the ability to treat as early as in an ambulatory setting, before the type of stroke (ischemic or hemorrhagic) is confirmed by imaging, would represent a significant advance in the treatment of stroke. We look forward to the anticipated full publication of the TR-VENUS study in a peer reviewed journal later this year and the completion of the NOVIS study in 2023.”

About electroCore, Inc.

electroCore, Inc. is a commercial stage bioelectronic medicine company dedicated to improving patient outcomes through its non-invasive vagus nerve stimulation therapy platform, initially focused on the treatment of multiple conditions in neurology. The company’s current indications are the preventive treatment of cluster headache and migraine, the acute treatment of migraine and episodic cluster headache, the acute and preventive treatment of migraines in adolescents, and paroxysmal hemicrania and hemicrania continua in adults.

For more information, visit www.electrocore.com.

About gammaCore™

gammaCore™ (nVNS) is the first non-invasive, hand-held medical therapy applied at the neck as an adjunctive therapy to treat migraine and cluster headache through the utilization of a mild electrical stimulation to the vagus nerve that passes through the skin. Designed as a portable, easy-to-use technology, gammaCore can be self-administered by patients, as needed, without the potential side effects associated with commonly prescribed drugs. When placed on a patient’s neck over the vagus nerve, gammaCore stimulates the nerve’s afferent fibers, which may lead to a reduction of pain in patients.

gammaCore (nVNS) is FDA cleared in the United States for adjunctive use for the preventive treatment of cluster headache in adult patients, the acute treatment of pain associated with episodic cluster headache in adult patients, and the acute and preventive treatment of migraine in adolescent (ages 12 and older) and adult patients, and paroxysmal hemicrania and hemicrania continua in adult patients. gammaCore is CE-marked in the European Union for the acute and/or prophylactic treatment of primary headache (Migraine, Cluster Headache, Trigeminal Autonomic Cephalalgias and Hemicrania Continua) and Medication Overuse Headache in adults.

gammaCore is contraindicated for patients if they:

- Have an active implantable medical device, such as a pacemaker, hearing aid implant, or any implanted electronic device

- Have a metallic device, such as a stent, bone plate, or bone screw, implanted at or near the neck

- Are using another device at the same time (e.g., TENS Unit, muscle stimulator) or any portable electronic device (e.g., mobile phone)

Safety and efficacy of gammaCore have not been evaluated in the following patients:

- Adolescent patients with congenital cardiac issues

- Patients diagnosed with narrowing of the arteries (carotid atherosclerosis)

- Patients who have had surgery to cut the vagus nerve in the neck (cervical vagotomy)

- Pediatric patients (less than 12 years)

- Pregnant women

- Patients with clinically significant hypertension, hypotension, bradycardia, or tachycardia

For more information, please visit gammaCore.com

Forward-Looking Statements

This press release and other written and oral statements made by representatives of electroCore may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements about electroCore’s business prospects and clinical and product development plans (including with respect to enrollment in ongoing studies); its pipeline or potential markets for its technologies; the timing, outcome and impact of regulatory, clinical and commercial developments; the issuance of

U.S. and international patents providing expanded IP coverage; the possibility of future business models and revenue streams from the company’s potential use of nVNS for the acute treatment of stroke and hemorrhagic brain injury, the potential of nVNS generally and gammaCore in particular and other statements that are not historical in nature, particularly those that utilize terminology such as “anticipates,” “will,” “expects,” “believes,” “intends,” other words of similar meaning, derivations of such words and the use of future dates. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the ability to raise the additional funding needed to continue to pursue electroCore’s business and product development plans, the inherent uncertainties associated with developing new products or technologies, the ability to commercialize gammaCore™, the potential impact and effects of COVID-19 on the business of electroCore, electroCore’s results of operations and financial performance, and any measures electroCore has and may take in response to COVID-19 and any expectations electroCore may have with respect thereto, competition in the industry in which electroCore operates and overall market conditions. Any forward-looking statements are made as of the date of this press release, and electroCore assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Investors should consult all of the information set forth herein and should also refer to the risk factor disclosure set forth in the reports and other documents electroCore files with the

SEC available at www.sec.gov.

Investors:

Rich Cockrell

CG Capital

404-736-3838

ecor@cg.capital

or

Media Contact:

Jackie Dorsky

electroCore

908-313-6331

jackie.dorsky@electrocore.com