EuroDry Ltd. Reports Results for the Year and Quarter Ended December 31, 2021

News and Market Data on EuroDry Ltd.

ATHENS, Greece, Feb. 09, 2022 (GLOBE NEWSWIRE) — EuroDry Ltd. (NASDAQ: EDRY, the “Company” or “EuroDry”), an owner and operator of drybulk vessels and provider of seaborne transportation for drybulk cargoes, announced today its results for the three- and twelve-month periods ended December 31, 2021.

Fourth Quarter 2021 Highlights:

- Total net revenues of $22.3 million.

- Net income attributable to common shareholders of $15.2 million or $5.38 and $5.32 earnings per share basic and diluted, respectively, inclusive of unrealized gain on derivatives.

- Adjusted net income attributable to common shareholders1 for the quarter of $12.3 million, or, $4.34 and $4.29 per share basic and diluted, respectively. The adjusted net income attributable to common shareholders includes a $0.5m non-cash charge for a “Preferred deemed dividend” resulting from the redemption of the Company’s Series B Preferred Shares.

- Adjusted EBITDA1 was $16.0 million.

- An average of 9.0 vessels were owned and operated during the fourth quarter of 2021 earning an average time charter equivalent rate of $29,157 per day.

- The Company declared a dividend of $0.2 million on its Series B Preferred Shares. The dividend was paid in cash. In addition, as previously announced, in December 2021 the Company redeemed all of its outstanding Series B Preferred Shares at par amounting to $13.6 million.

1Adjusted EBITDA, Adjusted net income/(loss) and Adjusted earnings/(loss) per share are not recognized measurements under US GAAP (GAAP) and should not be used in isolation or as a substitute for EuroDry’s financial results presented in accordance with GAAP. Refer to a subsequent section of the Press Release for the definitions and reconciliation of these measurements to the most directly comparable financial measures calculated and presented in accordance with GAAP.

Full Year 2021 Highlights:

- Total net revenues of $64.4 million.

- Net income attributable to common shareholders of $29.4 million, or $11.63 and $11.53 earnings per share basic and diluted, respectively, inclusive of unrealized loss on derivatives and a loss on debt extinguishment.

- Adjusted net income attributable to common shareholders1 for the period was $30.3 million or $11.98 and $11.88 adjusted earnings per share basic and diluted, respectively. The adjusted net income attributable to common shareholders includes a $0.7m non-cash charge for a “Preferred deemed dividend” resulting from the redemption of the Company’s Series B Preferred Shares.

- Adjusted EBITDA1 was $42.3 million.

- An average of 7.9 vessels were owned and operated during the twelve months of 2021 earning an average time charter equivalent rate of $24,222 per day.

Recent developments

In January 2022, the Company acquired M/V Molyvos Luck, a 57,924 dwt drybulk vessel built in 2014, for $21.2 million. The vessel was majority owned by a third party and has been managed by Eurobulk Ltd., also the manager of the majority of the Company’s vessels. The vessel will be delivered to the Company around the middle of February 2022.The Company will also assume the existing charter of the vessel at $13,250/day until April 2022. The acquisition will be initially financed by the Company’s own funds; a bank loan will be arranged to partly finance the acquisition, using the acquired vessel as collateral.

Aristides Pittas, Chairman and CEO of EuroDry commented:

“We are pleased to report that, in the fourth quarter of 2021, we took advantage of the market levels registering our best quarter on record with more than $15m of net income. We also redeemed all our outstanding Series B Preferred shares reducing our cost of capital and increasing earnings to our common shareholders in 2022 and beyond.

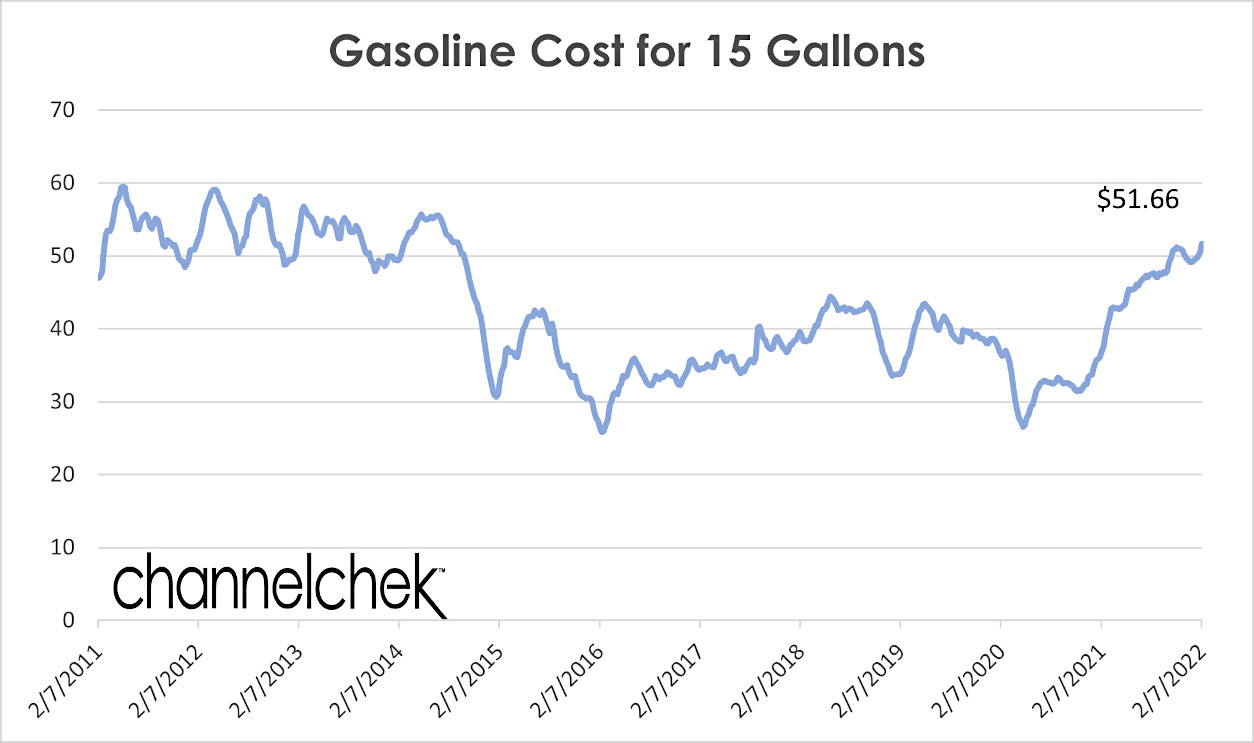

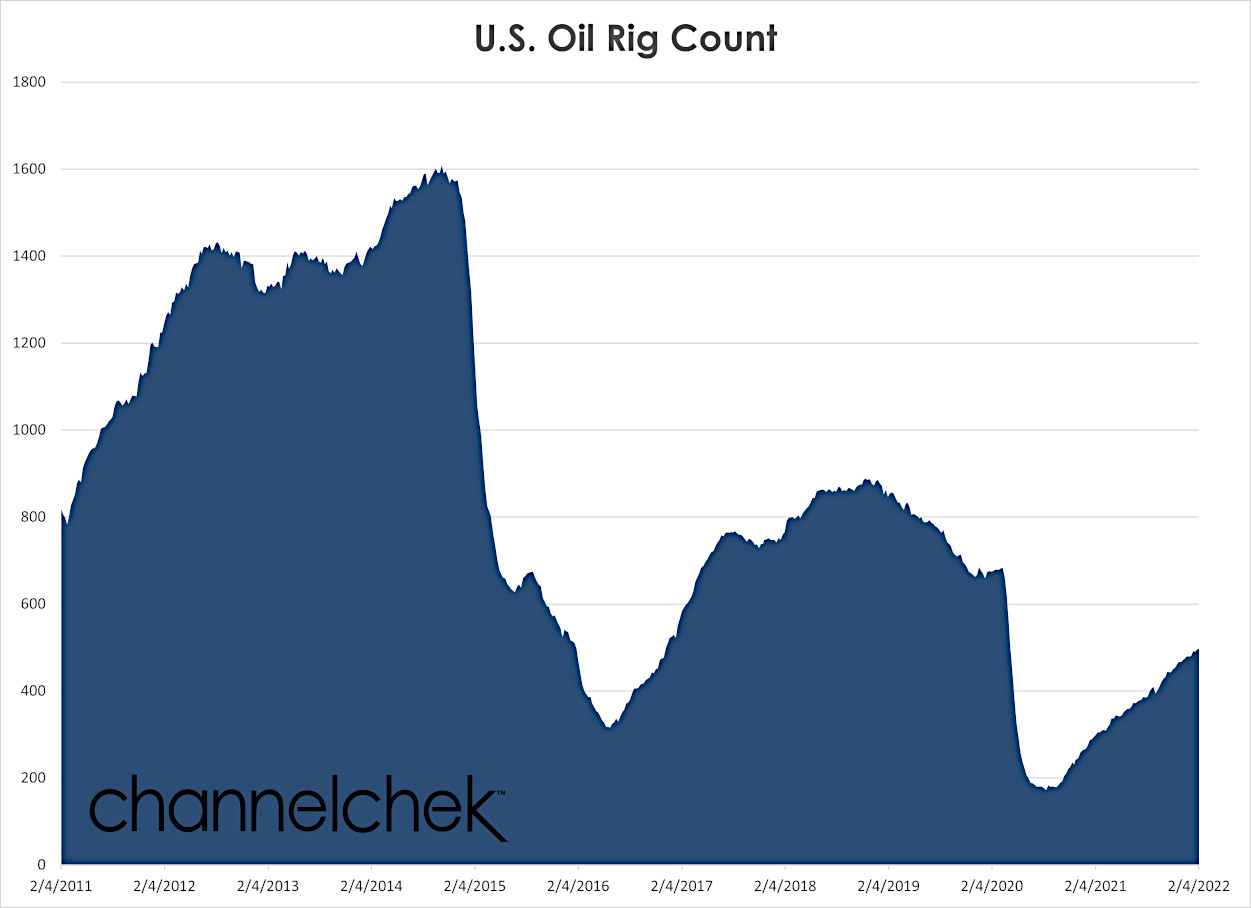

“During the quarter, drybulk spot earnings, after peaking in October 2021 when they registered their highest level since early 2010, subsequently retreated by about 35% in November and December, while in January 2022 they retreated by approximately another 30%; at the same time, after initially retreating too, one-year time rates recovered during December 2021 and January 2022 suggesting that there are expectations amongst the market participants that the spot earnings’ retreat, a cyclically common effect during the first couple of months of every year, is only temporary. Even at their present levels though, spot earnings are at high levels relative to the last decade.

“Despite the market strength during 2021, the orderbook remained at historically low levels. This suggests minimal fleet growth over the next 2-3 years, likely, leading to higher rates in the rest of 2022 if trade increases even at just historically average levels. Within this framework of expectations, we have expanded our fleet acquiring our tenth vessel, M/V Molyvos Luck, which will further position us to take advantage of expected market increases.

“Overall, we are committed to continue growing EuroDry focusing on the middle size range of drybulk carriers. Our increased liquidity and low leverage ratio provide us with significant firepower to pursue our strategy.”

Tasos Aslidis, Chief Financial Officer of EuroDry commented: “The net revenues of the fourth quarter of 2021 increased significantly compared to the same period of 2020 as a result of the time charter equivalent rates our vessels earned during the quarter which were higher by 171% compared to the average time charter equivalent rates our vessels earned in the fourth quarter of 2020.

“Total daily vessel operating expenses, including management fees, general and administrative expenses but excluding drydocking costs, averaged $6,324 per vessel per day during the fourth quarter of 2021 as compared to $6,258 per vessel per day for the same quarter of last year, and $6,456 per vessel per day for the entire year of 2021 as compared to $6,211 per vessel per day for the same period of 2020. This increase is mainly due to increased crewing costs in 2021 compared to 2020, resulting from difficulties in crew rotation due to COVID-19 related restrictions.

“Adjusted EBITDA during the fourth quarter of 2021 was $16.0 million versus $1.8 million in the fourth quarter of last year. As of December 31, 2021, our outstanding debt (excluding the unamortized loan fees) was $79.4 million, while unrestricted and restricted cash was $29.5 million. As of the same date, our scheduled debt repayments including balloon payments over the next 12 months amounted to about $14.1 million (excluding the unamortized loan fees).”

Fourth Quarter 2021 Results:

For the fourth quarter of 2021, the Company reported total net revenues of $22.3 million representing a 248% increase over total net revenues of $6.4 million during the fourth quarter of 2020 which was the result of the increased average time charter equivalent rate our vessels earned and the higher number of vessels operating in the fourth quarter of 2021 compared to the same period of 2020. The Company reported a net income for the period of $16.0 million and a net income attributable to common shareholders of $15.2 million, as compared to a net loss of $0.3 million and a net loss attributable to common shareholders of $0.7 million for the same period of 2020. For the fourth quarter of 2021, voyage expenses, net amounted to income of $0.2 million resulting from gain on bunkers as compared to voyage expenses of $0.1 million in the same period of 2020. Vessel operating expenses were $3.7 million for the fourth quarter of 2021 as compared to $2.9 million for the same period of 2020. The increase is mainly attributable to the increased number of vessels operating in the fourth quarter of 2021 compared to the corresponding period in 2020. Depreciation expenses for the fourth quarter of 2021 amounted to $2.3 million, as compared to $1.7 million for the same period of 2020. This increase is due to the higher number of vessels operating in the fourth quarter of 2021 as compared to the same period of 2020. General and administrative expenses increased to $0.9 million in the fourth quarter of 2021, as compared to $0.6 million in the fourth quarter of 2020 due to higher legal and insurance expenses.

Interest and other financing costs for the fourth quarter of 2021 increased to $0.7 million as compared to $0.5 million for the same period of 2020. The increase is mainly due to the higher average outstanding debt of the period compared to the same period of 2020. For the three months ended December 31, 2021, the Company recognized a gain on four interest rate swaps of $0.2 million and a realized gain on FFA contracts of $1.4 million, as compared to a marginal loss on three interest rate swaps and a marginal gain on FFA contracts for the same period of 2020.

On average, 9.0 vessels were owned and operated during the fourth quarter of 2021 earning an average time charter equivalent rate of $29,157 per day compared to 7.0 vessels in the same period of 2020 earning on average $10,761 per day.

Adjusted EBITDA for the fourth quarter of 2021 was $16.0 million compared to $1.8 million achieved during the fourth quarter of 2020.

Basic and diluted earnings per share attributable to common shareholders for the fourth quarter of 2021 was $5.38 calculated on 2,827,316 basic and $5.32 calculated on 2,860,357 diluted weighted average number of shares outstanding, compared to basic and diluted loss per share of $0.31 for the fourth quarter of 2020, calculated on 2,285,601 basic and diluted weighted average number of shares outstanding.

Excluding the effect on the income attributable to common shareholders for the quarter of the change in fair value of derivatives, the adjusted earnings attributable to common shareholders for the quarter ended December 31, 2021 would have been $4.34 and $4.29 per share basic and diluted, respectively, compared to adjusted loss of $0.34 per share basic and diluted for the quarter ended December 31, 2020. Usually, security analysts do not include the above item in their published estimates of earnings per share.

Full Year 2021 Results:

For the full year of 2021, the Company reported total net revenues of $64.4 million representing a 189% increase over total net revenues of $22.3 million during the twelve months of 2020, as a result of the increased average time charter equivalent rate our vessels earned in the twelve months of 2021 compared to the same period of 2020. The Company reported a net income for the period of $31.2 million and a net income attributable to common shareholders of $29.4 million, as compared to a net loss for the period of $5.9 million and a net loss attributable to common shareholders of $7.5 million, for the twelve months of 2020. For the twelve months of 2021, voyage expenses, net amounted to income of $0.8 million resulting from gain on bunkers as compared to voyage expenses of $0.3 million in the same period of 2020. Vessel operating expenses were $13.6 million for the twelve months of 2021 as compared to $11.6 million for the same period of 2020. The increase is attributable to the increased number of vessels operating in 2021 compared to the corresponding period in 2020, as well as to the increased crewing costs for our vessels compared to the same period of 2020, resulting from difficulties in crew rotation due to COVID-19 related restrictions, and the increase in hull and machinery insurance premiums. Depreciation expenses for the twelve months of 2021 were $7.7 million compared to $6.6 million during the same period of 2020, mainly due to the increase in the cost base of certain of our vessels due to the recent installation of ballast water management systems and the higher number of vessels operating in the same period.

On average, 7.9 vessels were owned and operated during the twelve months of 2021 earning an average time charter equivalent rate of $24,222 per day compared to 7.0 vessels in the same period of 2020 earning on average $9,387 per day. In the twelve months of 2020, three vessels underwent special survey for a total cost of $2.3 million, while there were no vessels undergoing drydocking in the twelve months of 2021. General and administrative expenses increased to $2.6 million during the twelve months of 2021 as compared to $2.3 million in the last year due to higher legal and insurance expenses.

Interest and other financing costs for the twelve months of 2021 remained unchanged at $2.3 million compared to the same period of 2020. For the twelve months ended December 31, 2021, the Company recognized a $0.3 million gain on four interest rate swaps and a $4.1 million realized loss on FFA contracts as compared to a loss on derivatives of $0.8 million for the same period of 2020, comprising of a $0.3 million loss on FFA contracts and a $0.5 million loss on three interest rate swaps. For the twelve months ended December 31, 2021, loss on debt extinguishment was $1.6 million and related to the conversion of part of our related party loan, amounting to $3.3 million, into common shares of the Company. The difference between the share price less the conversion price was reflected in loss on debt extinguishment. No such case existed in 2020.

Adjusted EBITDA for the twelve months of 2021 was $42.3 million compared to $3.7 million achieved during the twelve months of 2020.

Basic and diluted earnings per share attributable to common shareholders for the twelve months of 2021 was $11.63, calculated on 2,528,507 basic and $11.53, calculated on 2,548,950 diluted weighted average number of shares outstanding compared to basic and diluted loss of $3.28 per share for the twelve months of 2020, calculated on 2,275,062 basic and diluted weighted average number of shares outstanding.

Excluding the effect on the earnings attributable to common shareholders for the year of the change in fair value of derivatives and the loss on debt extinguishment, the adjusted earnings attributable to common shareholders for the year ended December 31, 2021 would have been $11.98 and $11.88 per share basic and diluted, respectively, compared to an adjusted loss of $3.04 per share basic and diluted for 2020. As previously mentioned, usually, security analysts do not include the above item in their published estimates of earnings per share.

Fleet Profile:

The EuroDry Ltd. fleet profile is as follows:

| Name |

Type |

Dwt |

Year Built |

Employment(*) |

TCE Rate ($/day) |

| Dry Bulk Vessels |

|

|

|

|

|

| EKATERINI |

Kamsarmax |

82,000 |

2018 |

TC until Mar-22 |

Hire 106% of the Average Baltic

Kamsarmax P5TC index*** |

| XENIA |

Kamsarmax |

82,000 |

2016 |

TC until Aug-22 |

Hire 105% of the Average Baltic Kamsarmax P5TC index*** |

| ALEXANDROS P. |

Ultramax |

63,500 |

2017 |

TC until Mar-22

+

Gross Ballast Bonus |

$26,000

+

$600,000 |

| GOOD HEART |

Ultramax |

62,996 |

2014 |

TC until Oct-22 |

$25,000 |

| MOLYVOS LUCK |

Supramax |

57,924 |

2014 |

TC until April-22 |

$13,250 |

| EIRINI P |

Panamax |

76,466 |

2004 |

TC until Apr-22 |

Hire 99%

of Average

BPI** 4TC |

| STARLIGHT |

Panamax |

75,845 |

2004 |

TC until Oct-22 |

Hire 98.5%

of Average

BPI** 4TC |

| TASOS |

Panamax |

75,100 |

2000 |

TC until Feb-22 |

$15,750 |

| PANTELIS |

Panamax |

74,020 |

2000 |

TC until Feb-22 |

$30,250 |

| BLESSED LUCK |

Panamax |

76,704 |

2004 |

TC until Apr-22 |

$19,500 |

| Total Dry Bulk Vessels |

10

|

726,555 |

|

|

|

Note:

(*) Represents the earliest redelivery date

(**) BPI stands for the Baltic Panamax Index; the average BPI 4TC is an index based on four time charter routes.

(***) The average Baltic Kamsarmax P5TC Index is an index based on five Panamax time charter routes.

Summary Fleet Data:

| |

3 months, ended

December 31, 2020 |

3 months, ended

December 31, 2021 |

12 months, ended

December 31, 2020 |

12 months, ended

December 31, 2021 |

| FLEET DATA |

|

|

|

|

| Average number of vessels (1) |

7.0 |

|

9.0 |

|

7.0 |

|

7.9 |

|

| Calendar days for fleet (2) |

644.0 |

|

828.0 |

|

2,562.0 |

|

2,873.9 |

|

| Scheduled off-hire days incl. laid-up (3) |

19.9 |

|

– |

|

71.1 |

|

– |

|

| Available days for fleet (4) = (2) – (3) |

624.1 |

|

828.0 |

|

2,490.9 |

|

2,873.9 |

|

| Commercial off-hire days (5) |

0.0 |

|

1.8 |

|

0.0 |

|

1.8 |

|

| Operational off-hire days (6) |

0.7 |

|

4.5 |

|

7.8 |

|

12.6 |

|

| Voyage days for fleet (7) = (4) – (5) – (6) |

623.4 |

|

821.7 |

|

2,483.1 |

|

2,859.5 |

|

| Fleet utilization (8) = (7) / (4) |

99.9 |

% |

99.2 |

% |

99.7 |

% |

99.5 |

% |

| Fleet utilization, commercial (9) = ((4) – (5)) / (4) |

100.0 |

% |

99.8 |

% |

100.0 |

% |

99.9 |

% |

| Fleet utilization, operational (10) = ((4) – (6)) / (4) |

99.9 |

% |

99.5 |

% |

99.7 |

% |

99.6 |

% |

| |

|

|

|

|

| AVERAGE DAILY RESULTS |

|

|

|

|

| Time charter equivalent rate (11) |

10,761 |

|

29,157 |

|

9,387 |

|

24,222 |

|

| Vessel operating expenses excl. drydocking expenses (12) |

5,257 |

|

5,227 |

|

5,317 |

|

5,538 |

|

| General and administrative expenses (13) |

1,001 |

|

1,097 |

|

894 |

|

918 |

|

| Total vessel operating expenses (14) |

6,258 |

|

6,324 |

|

6,211 |

|

6,456 |

|

| Drydocking expenses (15) |

760 |

|

– |

|

888 |

|

34 |

|

(1) Average number of vessels is the number of vessels that constituted the Company’s fleet for the relevant period, as measured by the sum of the number of calendar days each vessel was a part of the Company’s fleet during the period divided by the number of calendar days in that period.

(2) Calendar days. We define calendar days as the total number of days in a period during which each vessel in our fleet was in our possession including off-hire days associated with major repairs, drydockings or special or intermediate surveys or days of vessels in lay-up. Calendar days are an indicator of the size of our fleet over a period and affect both the amount of revenues and the amount of expenses that we record during that period.

(3) The scheduled off-hire days including vessels laid-up are days associated with scheduled repairs, drydockings or special or intermediate surveys or days of vessels in lay-up.

(4) Available days. We define available days as the total number of days in a period during which each vessel in our fleet was in our possession net of scheduled off-hire days incl. laid up. We use available days to measure the number of days in a period during which vessels were available to generate revenues.

(5) Commercial off-hire days. We define commercial off-hire days as days a vessel is idle without employment.

(6) Operational off-hire days. We define operational off-hire days as days associated with unscheduled repairs or other off-hire time related to the operation of the vessels.

(7) Voyage days. We define voyage days as the total number of days in a period during which each vessel in our fleet was in our possession net of commercial and operational off-hire days. We use voyage days to measure the number of days in a period during which vessels actually generate revenues or are sailing for repositioning purposes.

(8) Fleet utilization. We calculate fleet utilization by dividing the number of our voyage days during a period by the number of our available days during that period. We use fleet utilization to measure a company’s efficiency in finding suitable employment for its vessels and minimizing the amount of days that its vessels are off-hire for reasons such as unscheduled repairs or days waiting to find employment.

(9) Fleet utilization, commercial. We calculate commercial fleet utilization by dividing our available days net of commercial off-hire days during a period by our available days during that period.

(10) Fleet utilization, operational. We calculate operational fleet utilization by dividing our available days net of operational off-hire days during a period by our available days during that period.

(11) Time charter equivalent, or TCE, is a measure of the average daily net revenue performance of our vessels. Our method of calculating TCE is determined by dividing time charter revenue and voyage charter revenue net of voyage expenses by voyage days for the relevant time period. Voyage expenses primarily consist of port, canal and fuel costs that are unique to a particular voyage, which would otherwise be paid by the charterer under a time charter contract, or are related to repositioning the vessel for the next charter. TCE is a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company’s performance despite changes in the mix of charter types (i.e., spot voyage charters, time charters, pool agreements and bareboat charters) under which the vessels may be employed between the periods. Our definition of TCE may not be comparable to that used by other companies in the shipping industry.

(12) Daily vessel operating expenses, which include crew costs, provisions, deck and engine stores, lubricating oil, insurance, maintenance and repairs and management fees are calculated by dividing vessel operating expenses by fleet calendar days for the relevant time period. Drydocking expenses are reported separately.

(13) Daily general and administrative expense is calculated by dividing general and administrative expenses by fleet calendar days for the relevant time period.

(14) Total vessel operating expenses, or TVOE, is a measure of our total expenses associated with operating our vessels. TVOE is the sum of vessel operating expenses, management fees and general and administrative expenses; drydocking expenses are not included. Daily TVOE is calculated by dividing TVOE by fleet calendar days for the relevant time period.

(15) Drydocking expenses include expenses during drydockings that would have been capitalized and amortized under the deferral method divided by the fleet calendar days for the relevant period. Drydocking expenses could vary substantially from period to period depending on how many vessels underwent drydocking during the period. The Company expenses drydocking expenses as incurred.

Conference Call and Webcast:

Tomorrow, February 10, 2022 at 10:00 a.m. Eastern Time, the Company’s management will host a conference call and webcast to discuss the results.

Conference Call details:

Participants should dial into the call 10 minutes before the scheduled time using the following numbers: 1 (877) 553-9962 (US Toll Free Dial In), 0(808) 238- 0669 (UK Toll Free Dial In) or +44 (0) 2071 928592 (Standard International Dial In). Please quote “EuroDry” to the operator.

Audio webcast – Slides Presentation:

There will be a live and then archived webcast of the conference call and accompanying slides, available through the Company’s website. To listen to the archived audio file, visit our website http://www.eurodry.gr and click on Company Presentations under our Investor Relations page. Participants to the live webcast should register on the website approximately 10 minutes prior to the start of the webcast.

A slide presentation on the Fourth Quarter 2021 results in PDF format will also be available 10 minutes prior to the conference call and webcast accessible on the company’s website (www.eurodry.gr) on the webcast page. Participants to the webcast can download the PDF presentation.

EuroDry Ltd.

Unaudited Consolidated Condensed Statements of Operations

(All amounts expressed in U.S. Dollars – except number of shares)

| |

Three Months Ended

December 31, |

Three Months Ended

December 31, |

Twelve Months Ended

December 31, |

Twelve Months Ended

December 31, |

| |

2020

|

2021

|

2020

|

2021

|

| |

(unaudited) |

(unaudited) |

| Revenues |

|

|

|

|

| Time charter revenue |

6,799,433 |

|

23,742,568 |

|

23,594,678 |

|

68,506,729 |

|

| Commissions |

(387,802 |

) |

(1,422,430 |

) |

(1,305,717 |

) |

(4,064,903 |

) |

Net revenues |

6,411,631 |

|

22,320,138 |

|

22,288,961 |

|

64,441,826 |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

| Voyage expenses |

90,995 |

|

(215,676 |

) |

285,132 |

|

(755,998 |

) |

| Vessel operating expenses |

2,858,415 |

|

3,671,848 |

|

11,603,414 |

|

13,565,092 |

|

| Drydocking expenses |

489,250 |

|

149 |

|

2,275,258 |

|

97,094 |

|

| Vessel depreciation |

1,651,870 |

|

2,261,055 |

|

6,556,256 |

|

7,656,638 |

|

| Related party management fees |

527,135 |

|

655,974 |

|

2,018,800 |

|

2,350,747 |

|

| General and administrative expenses |

644,708 |

|

908,492 |

|

2,291,244 |

|

2,638,427 |

|

| Total Operating expenses |

(6,262,373 |

) |

(7,281,842 |

) |

(25,030,104 |

) |

(25,552,000 |

) |

| |

|

|

|

|

| Operating income / (loss) |

149,258 |

|

15,038,296 |

|

(2,741,143 |

) |

38,889,826 |

|

| |

|

|

|

|

| Other income / (expenses) |

|

|

|

|

| Interest and other financing costs |

(467,958 |

) |

(662,050 |

) |

(2,331,998 |

) |

(2,339,023 |

) |

| Loss on debt extinguishment |

– |

|

– |

|

– |

|

(1,647,654 |

) |

| Gain / (loss) on derivatives, net |

31,547 |

|

1,624,371 |

|

(790,359 |

) |

(3,765,619 |

) |

| Foreign exchange (loss) / gain |

(10,010 |

) |

6,450 |

|

(18,455 |

) |

5,807 |

|

| Interest income |

53 |

|

21 |

|

4,094 |

|

10,484 |

|

| Other (expenses) / income, net |

(446,368 |

) |

968,792 |

|

(3,136,718 |

) |

(7,736,005 |

) |

| Net (loss) / income |

(297,110 |

) |

16,007,088 |

|

(5,877,861 |

) |

31,153,821 |

|

| Dividend Series B Preferred shares |

(418,197 |

) |

(240,640 |

) |

(1,573,874 |

) |

(1,085,902 |

) |

| Preferred deemed dividend |

– |

|

(545,287 |

) |

– |

|

(665,287 |

) |

| Net (loss) / income attributable to common shareholders |

(715,307 |

) |

15,221,161 |

|

(7,451,735 |

) |

29,402,632 |

|

| (Loss) / earnings per share, basic |

(0.31 |

) |

5.38 |

|

(3.28 |

) |

11.63 |

|

| Weighted average number of shares, basic |

2,285,601 |

|

2,827,316 |

|

2,275,062 |

|

2,528,507 |

|

| (Loss) / earnings per share, diluted |

(0.31 |

) |

5.32 |

|

(3.28 |

) |

11,53 |

|

| Weighted average number of shares, diluted |

2,285,601 |

|

2,860,357 |

|

2,275,062 |

|

2,548,950 |

|

EuroDry Ltd.

Unaudited Consolidated Condensed Balance Sheets

(All amounts expressed in U.S. Dollars – except number of shares)

| |

December 31,

2020

|

|

December 31,

2021 |

|

| |

|

|

|

| ASSETS |

(unaudited) |

|

| Current Assets: |

|

|

|

| Cash and cash equivalents |

938,282 |

|

|

26,847,426 |

|

| Trade accounts receivable, net |

1,528,055 |

|

|

775,035 |

|

| Other receivables |

460,209 |

|

|

1,242,803 |

|

| Inventories |

1,385,280 |

|

|

770,342 |

|

| Restricted cash |

1,518,036 |

|

|

459,940 |

|

| Prepaid expenses |

226,033 |

|

|

314,397 |

|

| Total current assets |

6,055,895 |

|

|

30,409,943 |

|

| |

|

|

|

| Fixed assets: |

|

|

|

| Vessels, net |

99,305,990 |

|

|

128,492,819 |

|

| Long-term assets: |

|

|

|

| Derivatives |

– |

|

|

210,113 |

|

| Restricted cash |

2,150,000 |

|

|

2,220,000 |

|

| Total assets |

107,511,885 |

|

|

161,332,875 |

|

| |

|

|

|

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Long term bank loans, current portion |

13,793,754 |

|

|

13,949,720 |

|

| Trade accounts payable |

1,074,518 |

|

|

855,825 |

|

| Accrued expenses |

704,508 |

|

|

852,442 |

|

| Derivatives |

456,133 |

|

|

289,430 |

|

| Deferred revenue |

246,125 |

|

|

1,514,543 |

|

| Due to related companies |

2,984,759 |

|

|

244,587 |

|

| Total current liabilities |

19,259,797 |

|

|

17,706,547 |

|

| |

|

|

|

| Long-term liabilities: |

|

|

|

| Long term bank loans, net of current portion |

37,318,084 |

|

|

64,702,947 |

|

| Derivatives |

393,899 |

|

|

– |

|

| Total long-term liabilities |

37,711,983 |

|

|

64,702,947 |

|

| Total liabilities |

56,971,780 |

|

|

82,409,494 |

|

| |

|

|

|

| Mezzanine equity: |

|

|

|

|

|

| Series B Preferred shares (par value $0.01, 20,000,000 preferred shares authorized, 16,606 and nil shares issued and outstanding, respectively) |

15,940,713 |

|

|

– |

|

| |

|

|

|

| Shareholders’ equity: |

|

|

|

| Common stock (par value $0.01, 200,000,000 shares authorized, 2,348,216 and 2,919,191 issued and outstanding, respectively) |

23,482 |

|

|

29,192 |

|

| Additional paid-in capital |

53,048,060 |

|

|

67,963,707 |

|

| (Accumulated deficit) / retained earnings |

(18,472,150 |

) |

|

10,930,482 |

|

| Total shareholders’ equity |

34,599,392 |

|

|

78,923,381 |

|

| Total liabilities, mezzanine equity and shareholders’ equity |

107,511,885 |

|

|

161,332,875 |

|

| |

|

|

|

EuroDry Ltd.

Unaudited Consolidated Condensed Statements of Cash Flows

(All amounts expressed in U.S. Dollars)

| |

Twelve Months Ended

December 31,

|

|

Twelve Months Ended

December 31, |

| 2020 |

|

2021 |

| |

|

|

| Cash flows from operating activities: |

|

| Net (loss) / income |

(5,877,861 |

) |

|

31,153,821 |

|

| Adjustments to reconcile net (loss) / income to net cash provided by operating activities: |

|

|

| Vessel depreciation |

6,556,256 |

|

|

7,656,638 |

|

| Amortization and write off of deferred charges |

140,704 |

|

|

298,328 |

|

| Loss on debt extinguishment |

– |

|

|

1,647,654 |

|

| Share-based compensation |

245,922 |

|

|

230,644 |

|

| Change in the fair value of derivatives |

545,859 |

|

|

(770,715 |

) |

| Changes in operating assets and liabilities |

714,654 |

|

|

(1,078,842 |

) |

| Net cash provided by operating activities |

2,325,534 |

|

|

39,137,528 |

|

| |

|

|

| Cash flows from investing activities: |

|

|

Cash paid for vessel acquisitions |

– |

|

|

(36,776,733 |

) |

| Cash paid for vessel improvements |

(611,106 |

) |

|

(44,879 |

) |

| Net cash used in investing activities |

(611,106 |

) |

|

(36,821,612 |

) |

| |

|

|

| Cash flows from financing activities: |

|

|

| Redemption of Series B Preferred shares |

– |

|

|

(16,606,000 |

) |

| Proceeds from issuance of common stock, net of commissions paid |

– |

|

|

9,975,312 |

|

| Preferred dividends paid |

(713,552 |

) |

|

(1,086,854 |

) |

| Offering expenses paid |

– |

|

|

(219,826 |

) |

| Loan arrangement fees paid |

– |

|

|

(760,500 |

) |

| Proceeds from related party loan |

– |

|

|

6,000,000 |

|

| Proceeds from long term bank loans |

– |

|

|

70,700,000 |

|

| Repayment of related party loan |

– |

|

|

(2,700,000 |

) |

| Repayment of long term bank loans |

(5,524,000 |

) |

|

(42,697,000 |

) |

| Net cash (used in) / provided by financing activities |

(6,237,552 |

) |

|

22,605,132 |

|

| |

|

|

| Net (decrease) / increase in cash, cash equivalents and restricted cash |

(4,523,124 |

) |

|

24,921,048 |

|

| Cash, cash equivalents and restricted cash at beginning of year |

9,129,442 |

|

|

4,606,318 |

|

| Cash, cash equivalents and restricted cash at end of year |

4,606,318 |

|

|

29,527,366 |

|

| Cash breakdown |

|

|

|

|

|

| Cash and cash equivalents |

938,282 |

|

|

26,847,426 |

|

| Restricted cash, current |

1,518,036 |

|

|

459,940 |

|

| Restricted cash, long term |

2,150,000 |

|

|

2,220,000 |

|

| Total cash, cash equivalents and restricted cash shown in the statement of cash flows |

4,606,318 |

|

|

29,527,366 |

|

EuroDry Ltd.

Reconciliation of Adjusted EBITDA to Net (loss) / income to

(All amounts expressed in U.S. Dollars)

| |

Three Months Ended

December 31, 2020 |

Three Months Ended

December 31, 2021 |

Twelve Months Ended

December 31, 2020 |

Twelve Months Ended

December 31, 2021 |

| Net (loss) / income |

(297,110 |

) |

16,007,088 |

|

(5,877,861 |

) |

31,153,821 |

|

| Interest and other financing costs, net (incl. interest income and loss on debt extinguishment) |

467,905 |

|

662,029 |

|

2,327,904 |

|

3,976,193 |

|

| Vessel depreciation |

1,651,870 |

|

2,261,055 |

|

6,556,256 |

|

7,656,638 |

|

| Unrealized loss on Forward Freight Agreement derivatives |

3,630 |

|

– |

|

134,010 |

|

– |

|

| Loss / (gain) on interest rate swap derivatives |

12,670 |

|

(2,881,372 |

) |

540,405 |

|

(468,810 |

) |

| Adjusted EBITDA |

1,838,965 |

|

16,048,800 |

|

3,680,714 |

|

42,317,842 |

|

Adjusted EBITDA Reconciliation:

EuroDry Ltd. considers Adjusted EBITDA to represent net (loss) / income before interest, income taxes, depreciation, unrealized loss on Forward Freight Agreements (FFAs) and loss / (gain) on interest rate swaps. Adjusted EBITDA does not represent and should not be considered as an alternative to net (loss) / income, as determined by United States generally accepted accounting principles, or GAAP. Adjusted EBITDA is included herein because it is a basis upon which the Company assesses its financial performance because the Company believes that this non-GAAP financial measure assists our management and investors by increasing the comparability of our performance from period to period by excluding the potentially disparate effects between periods of, financial costs, unrealized loss / (gain) on FFAs and loss / (gain) on interest rate swaps, and depreciation. The Company’s definition of Adjusted EBITDA may not be the same as that used by other companies in the shipping or other industries.

EuroDry Ltd.

Reconciliation of Net (loss) / income to Adjusted net (loss) / income

(All amounts expressed in U.S. Dollars – except share data and number of shares)

| |

Three Months Ended

December 31, 2020 |

Three Months Ended

December 31, 2021 |

Twelve Months Ended

December 31, 2020 |

Twelve Months Ended

December 31, 2021 |

| Net (loss) / income |

(297,110 |

) |

16,007,088 |

|

(5,877,861 |

) |

31,153,821 |

|

| Change in fair value of derivatives |

(56,502 |

) |

(2,960,106 |

) |

545,859 |

|

(770,715 |

) |

| Loss on debt extinguishment |

– |

|

– |

|

– |

|

1,647,654 |

|

| Adjusted net (loss)/ income |

(353,612 |

) |

13,046,982 |

|

(5,332,002 |

) |

32,030,760 |

|

| Preferred dividends |

(418,197 |

) |

(240,640 |

) |

(1,573,874 |

) |

(1,085,902 |

) |

| Preferred deemed dividend |

– |

|

(545,287 |

) |

– |

|

(665,287 |

) |

| Adjusted net (loss) / income attributable to common shareholders |

(771,809 |

) |

12,261,055 |

|

(6,905,876 |

) |

30,279,571 |

|

| Adjusted (loss)/ earnings per share, basic |

(0.34 |

) |

4.34 |

|

(3.04 |

) |

11.98 |

|

| Weighted average number of shares, basic |

2,285,601 |

|

2,827,316 |

|

2,275,062 |

|

2,528,507 |

|

| Adjusted (loss) / earnings per share, diluted |

(0.34 |

) |

4.29 |

|

(3.04 |

) |

11.88 |

|

| Weighted average number of shares, diluted |

2,285,601 |

|

2,860,357 |

|

2,275,062 |

|

2,548,950 |

|

Adjusted net (loss) / income and Adjusted (loss) / earnings per share Reconciliation:

EuroDry Ltd. considers Adjusted net (loss) / income to represent net (loss) / income before unrealized (gain) / loss on derivatives which include FFAs and interest rate swaps, and loss on debt extinguishment. Adjusted net (loss) / income and Adjusted (loss) / earnings per share is included herein because we believe it assists our management and investors by increasing the comparability of the Company’s fundamental performance from period to period by excluding the potentially disparate effects between periods of unrealized (gain) / loss on derivatives and loss on debt extinguishment, which may significantly affect results of operations between periods. Adjusted net (loss) / income and Adjusted (loss) / earnings per share do not represent and should not be considered as an alternative to net (loss) / income or (loss) / earnings per share, as determined by GAAP. The Company’s definition of Adjusted net (loss) / income and Adjusted (loss) / earnings per share may not be the same as that used by other companies in the shipping or other industries.

About EuroDry Ltd.

EuroDry Ltd. was formed on January 8, 2018 under the laws of the Republic of the Marshall Islands to consolidate the drybulk fleet of Euroseas Ltd into a separate listed public company. EuroDry was spun-off from Euroseas Ltd on May 30, 2018; it trades on the NASDAQ Capital Market under the ticker EDRY.

EuroDry operates in the dry cargo, drybulk shipping market. EuroDry’s operations are managed by Eurobulk Ltd., an ISO 9001:2008 and ISO 14001:2004 certified affiliated ship management company and Eurobulk (Far East) Ltd. Inc., which are responsible for the day-to-day commercial and technical management and operations of the vessels. EuroDry employs its vessels on spot and period charters.

The Company has a fleet of 10 vessels, including 5 Panamax drybulk carriers, 2 Ultramax drybulk carrier, 2 Kamsarmax drybulk carriers and one Supramax drybulk carrier. EuroDry’s 10 drybulk carriers have a total cargo capacity of 726,555 dwt.

Forward Looking Statement

This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events and the Company’s growth strategy and measures to implement such strategy; including expected vessel acquisitions and entering into further time charters. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “hopes,” “estimates,” and variations of such words and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to changes in the demand for dry bulk vessels, competitive factors in the market in which the Company operates; risks associated with operations outside the United States; and other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Visit our website www.eurodry.gr

| Company Contact |

Investor Relations / Financial Media |

Tasos Aslidis

Chief Financial Officer

EuroDry Ltd.

11 Canterbury Lane,

Watchung, NJ07069

Tel. (908) 301-9091

E-mail: aha@eurodry.gr |

Nicolas Bornozis

Markella Kara

Capital Link, Inc.

230 Park Avenue, Suite 1536

New York, NY10169

Tel. (212) 661-7566

E-mail: eurodry@capitallink.com |