FenixOro Provides Commentary on Colombian Amendment to Second Law

Research, News, and Market Data on FenixOro Gold

TORONTO, March 01, 2022 (GLOBE NEWSWIRE) — FenixOro Gold Corp. (CSE: FENX; OTCQB: FDVXF; Frankfurt: 8FD) is pleased to provide commentary on recent changes to Colombian law. The Ministry of Environment and Sustainable Development has passed a resolution that amends Ley Segunda (Law 2) of 1959 and effectively removes the requirement for a lengthy change-of-land-use application process. While the changes do not affect FenixOro directly in the short term, the company fully supports these changes and believes they will have a positive impact on responsible mining development while continuing to encourage sound environmental practices in the country.

Paul Harris, Director of the Colombia Gold Symposium in Medellin and ColombiaGold.co, commented: “This development is positive and something that exploration companies in Colombia, and other sectors such as infrastructure, have awaited for many years. It will facilitate the discovery and definition of new deposits of copper and gold in areas where hitherto explorers were unable to drill. Importantly, it does not reduce or otherwise circumvent the environmental permitting requirements to develop a project. Colombia has some of the most exacting environmental standards in the hemisphere, and this ensures that future project developments still have to be made according to international best practice.”

FenixOro CEO John Carlesso stated: “We have always received tremendous support for the Abriaqui gold project from all levels of government in Colombia, and we believe the amendment to Law 2 is a reflection of the commitment to foster economic growth through responsible and environmentally sound mineral resource development. Together with the major infrastructure improvement program currently underway throughout the country, which includes significant upgrades to highways and bridges on the route between Medellin and the Abriaqui project, this signals a willingness on the part of the government to make the permitting process more streamlined and transparent. We believe that in the eyes of investors and major mining companies, Colombia will continue to be seen as a stable jurisdiction for investment for many years to come.”

The Company also announces that it has granted stock options to acquire a total of 3,000,000 common shares of the Company to certain Officers, Directors and Consultants of the Company. The options are exercisable at a price of $0.26 per share and expire five years from the date of grant.

About FenixOro Gold Corp.

FenixOro Gold Corp is a Canadian company focused on acquiring and exploring gold projects with world class exploration potential in the most prolific gold producing regions of Colombia. FenixOro’s flagship property, the Abriaqui project, is the closest project to Continental Gold’s Buritica project. It is located 15 km to the west in Antioquia State at the northern end of the Mid-Cauca gold belt, a geological trend which has seen multiple large gold discoveries in the past 10 years including Buritica and Anglo Gold’s Nuevo Chaquiro and La Colosa. As documented in “NI 43-101 Technical Report on the Abriaqui project Antioquia State, Colombia” (December 5, 2019), the geological characteristics of Abriaqui and Buritica are similar. Since the preparation of this report a Phase 1 drilling program has been completed at Abriaqui resulting in a significant discovery of a high grade, “Buritica style” gold deposit. A Phase 2 drilling program has recently commenced.

FenixOro’s VP of Exploration, Stuart Moller, led the discovery team at Buritica for Continental Gold in 2007-2011. At the time of its latest public report, the Buritica Mine contains measured plus indicated resources of 5.32 million ounces of gold (16.02 Mt grading 10.32 g/t) plus a 6.02 million ounce inferred resource (21.87 Mt grading 8.56 g/t) for a total of 11.34 million ounces of gold resources Buritica began formal production in November 2020 and has expected annual average production of 250,000 ounces at an all-in sustaining cost of approximately US$600 per ounce. Resources, cost and production data are taken from Continental Gold’s “NI 43-101 Buritica Mineral Resource 2019-01, Antioquia, Colombia, 18 March, 2019”). Continental Gold was recently the subject of a takeover by Zijin Mining in an all-cash transaction valued at C$1.4 billion.

Cautionary Statement on Forward-Looking Information

This news release contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation and may also contain statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company’s beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of FenixOro’s control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as “will”, “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, “will occur” or “will be achieved”. The forward-looking information and forward-looking statements contained herein include, but are not limited to information concerning the closing of the Private Placement, and Abriaqui. Although FenixOro believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. In particular, there is no guarantee that Abriaqui will produce viable quantities of minerals, that the Company will pursue Abriaqui or that any mineral deposits will be found, or that the Private Placement will close. The forward-looking information and forward-looking statements contained in this news release are made as of the date of this press release, and FenixOro does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

Neither the Canadian Securities Exchange nor its Market Regulator (as defined in the policies of the Canadian Securities Exchange) accept responsibility for the adequacy or accuracy of this release.

FenixOro Gold Corp

John Carlesso, CEO

Email: info@FenixOro.com

Website: www.FenixOro.com>

Telephone: 1-833-ORO-GOLD

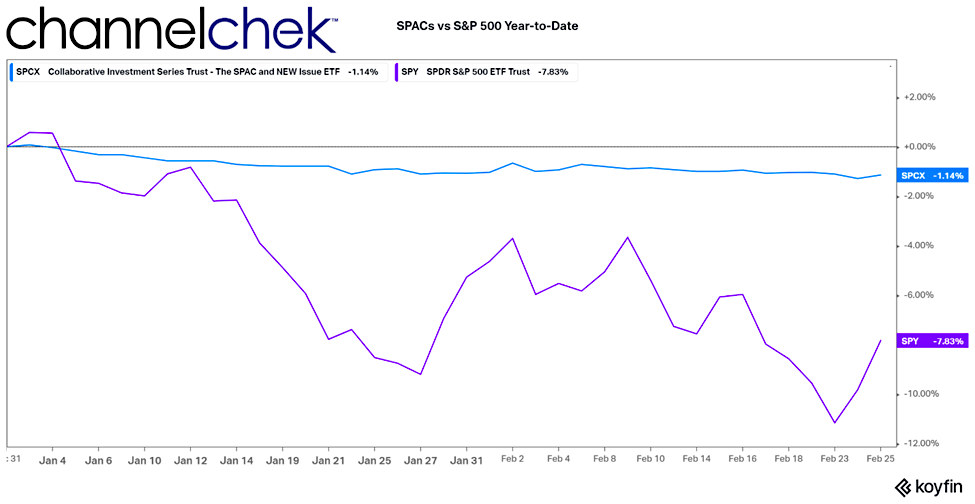

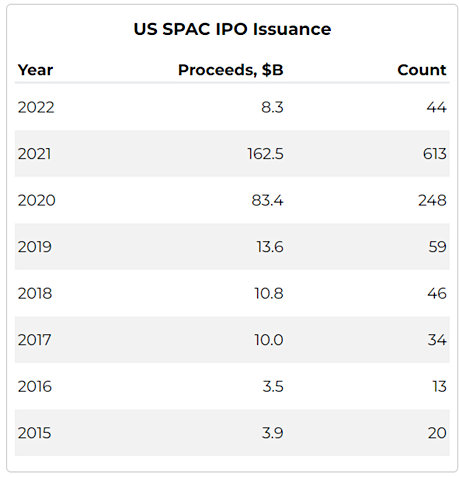

Currently, there are 602 SPACs with 162.4 billion in combined funds looking to find acquisitions. There are SPACs succeeding in finding acquisition targets, tickers like

Currently, there are 602 SPACs with 162.4 billion in combined funds looking to find acquisitions. There are SPACs succeeding in finding acquisition targets, tickers like