Delta Air Lines Signs 75 Million Gallon Per Year Agreement with Gevo

Research, News, and Market Data on Gevo

ENGLEWOOD, Colo., March 22, 2022 (GLOBE NEWSWIRE) — Gevo, Inc. (NASDAQ: GEVO) has signed a “take-or-pay” agreement with Delta Air Lines, Inc. (NYSE: DAL) to supply 75 million gallons of sustainable aviation fuel (SAF) per year for seven years (the “Agreement”). Based on current assumptions, including those around future pricing of commodities and the future values of certain environmental benefits, Gevo estimates that the Agreement should generate approximately $2.8 billion of revenue, inclusive of the value from environmental benefits, for Gevo over the seven-year term of the Agreement.

The Agreement replaces the existing agreement signed with Delta in 2019 to purchase 10 million gallons per year and bolsters Delta’s commitment to incorporating SAF into its operations.

“On behalf of the entire team at Gevo, I want to congratulate our partners at Delta for their leadership in continuously pushing the aviation industry towards net-zero emissions. Delta makes for a great customer, recognizing that big change is needed. I also appreciate their faith in what we are doing at Gevo. Net-zero jet fuels matter. We expect production from our first Net-Zero plant to begin in 2025. To meet the demand that we now have under contract, we need to develop and build more than one Net-Zero plant. This is a happy problem to have,” said Patrick R. Gruber, Ph.D., Gevo’s Chief Executive Officer.

“Net-Zero Fuels are made by using low-carbon feedstocks produced with climate-smart agricultural practices and by eliminating fossil-based energy from the business system as much as possible. In addition, our customers depend on us to count carbon at every step of the process,” said Paul D. Bloom, Ph.D., Gevo’s Chief Carbon Officer, and Chief Innovation Officer. Dr. Bloom continued, “By accurately accounting for carbon emissions using Argonne National Laboratories GREET model along with our Verity Tracking platform we will provide confidence to our customers like Delta that scientifically robust and transparent methods are used to meet and measure their sustainability goals. We want to create a win-win value proposition for every participant in the SAF supply chain by tracking all carbon intensity benefits in our SAF.”

“SAF is a critically important lever we have available today to help our industry reduce the lifecycle carbon emissions from aviation fuel,” said Kelly Nodzak, Delta’s Director of Global Jet Fuel Procurement. “That’s why we are working to develop the market and a broader understanding of the effectiveness of SAF, which can reduce lifecycle emissions up to 80 percent when used in pure form compared to fossil jet fuels.”

“With the right policies and incentives in place, we can unlock a future where sustainable aviation fuel is a viable climate solution that benefits air travel and beyond,” said Amelia DeLuca, Delta’s Vice President of Sustainability. “SAF production creates good-paying jobs in manufacturing, improves the environmental quality for all, and fosters rural economic opportunity for feedstocks and pathways. It will help us protect the planet we share and the places we call home.”

Gevo has remained focused on sustainability at every stage of production. Gevo has developed two alcohol-to-jet pathways that can utilize various low-carbon feedstocks grown using sustainable agriculture. These feedstocks can then be converted, in some cases, to high-value nutritional products and energy-dense liquid hydrocarbons, including SAF. Gevo’s production processes will incorporate renewable energy, including wind turbines, biogas, and combined heat and power systems (CHP) to increase efficiency and reduce carbon intensity to net-zero levels, which the customer can then pass on through the fuel.

The Agreement is subject to certain conditions precedent, including Gevo developing, financing and constructing one or more production facilities to produce the SAF contemplated by the Agreement. A copy of the Agreement between Delta and Gevo has been filed with the U.S. Securities and Exchange Commission on Form 8-K.

About Gevo

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel, and diesel fuel, that when burned, have the potential to yield net-zero greenhouse gas emissions when measured across the full life cycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their life cycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low-carbon products such as gasoline components, jet fuel, and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Learn more at Gevo’s website: www.gevo.com

About Delta Air Lines

Delta’s commitment to sustainability is about joining arms to create a better world. The airline’s ambitious commitment to carbon neutrality from March 2020 onward is coming to fruition with swift impact through immediate actions, coupled with long-term investments to combat climate change. These investments will drive innovation, advance clean air travel technologies, accelerate the reduction of carbon emissions and waste, and establish a path to a more sustainable future. As a company driven by purpose, we hold ourselves to a high standard of producing sustainable, responsible financial results while investing in healthy communities, maintaining a diverse and inclusive workforce, and protecting natural environments. These values drive our overall approach to Environmental, Social, and Governance (ESG) sustainability and responsibility.

Learn more at the Delta Air Lines website: www.delta.com/

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, without limitation, including the Agreement, Delta’s purchase of SAF from Gevo, Gevo’s ability to produce SAF, Gevo’s estimate of the revenue that might be generated from the Agreement, Gevo’s ability to produce SAF and other fuels with a net-zero carbon intensity, Gevo’s technology, Gevo’s development, financing and construction of production facilities to produce SAF, the attributes of Gevo’s products, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations, and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2021, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Gevo Investor and Media Contact

Heather L. Manuel

+1 720-418-0085

IR@gevo.com

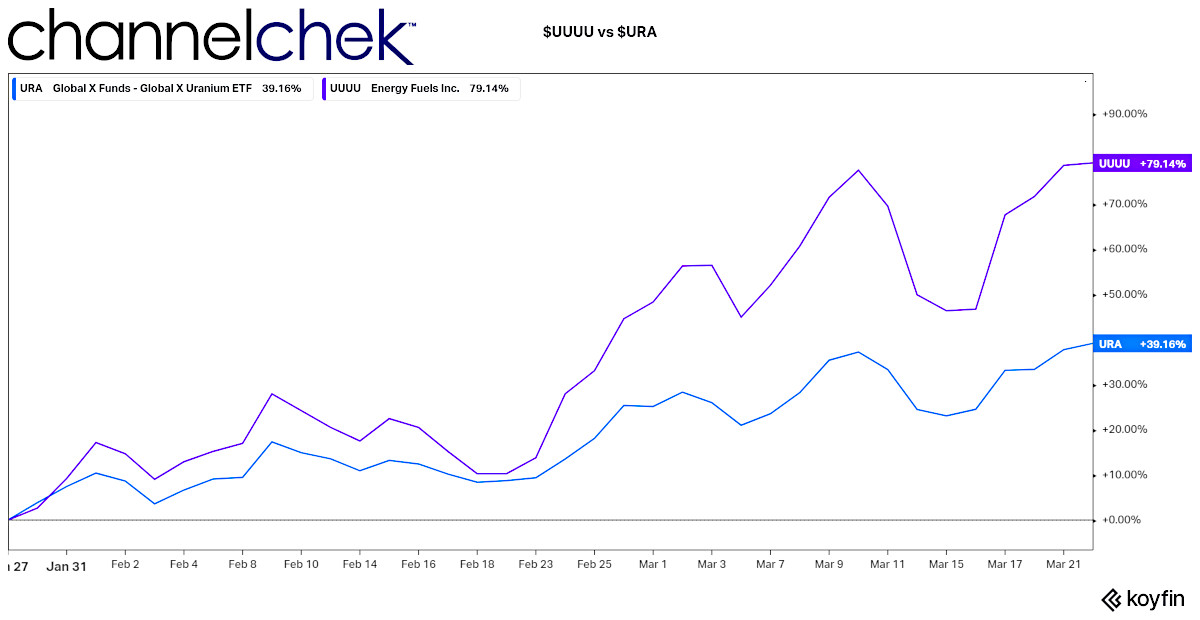

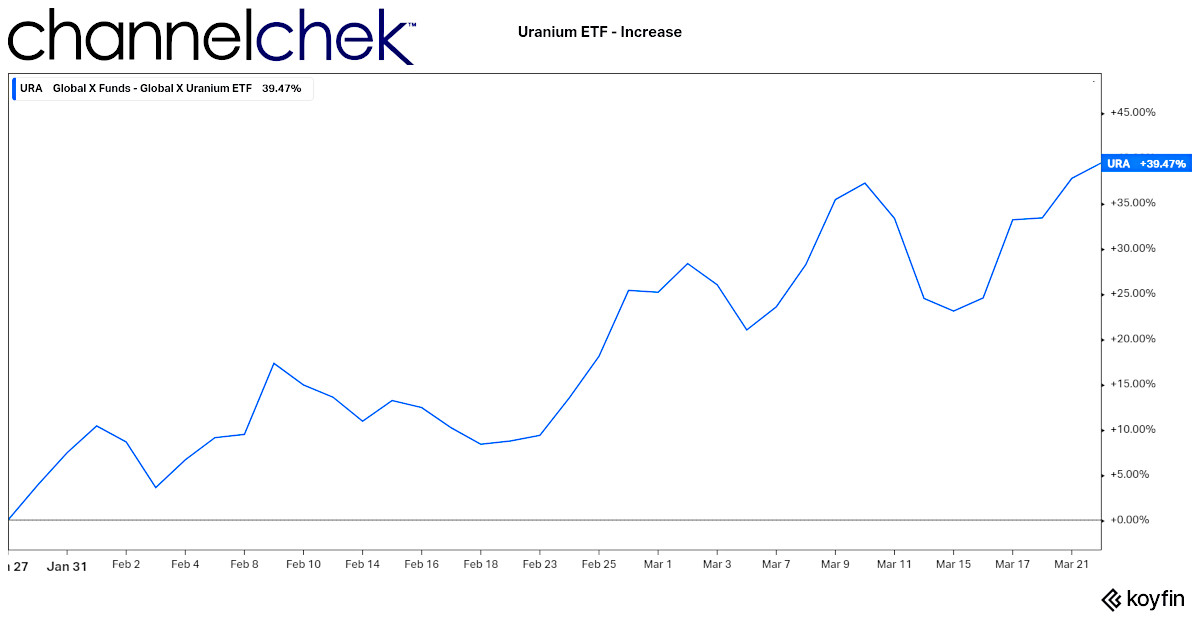

Using $URA as price proxy, Price increase since January 27, 2022

Using $URA as price proxy, Price increase since January 27, 2022