The Positive Sentiment Toward Gold Has a Large Tailwind

The number of countries bringing more of their gold reserves back within their own borders and in many cases buying additional gold has been on a strong uptrend. Why is this something investors should pay attention to, why is the trend accelerating, and who may benefit from the increased gold repatriation and hoarding? We explore these questions below and look for insights that investors may consider for their own portfolios.

During the first three months of 2023, central banks bought a combined 228 tonnes, the most ever seen in the first quarter of any year, according to the World Gold Council. This followed what is a record year in 2022, during which 1,136 tonnes of gold worth near $70 billion were added to the central banks’ reserves. Compared to the 450 tonnes bought during 2021, this 152% year-on-year increase might be worth paying attention to.

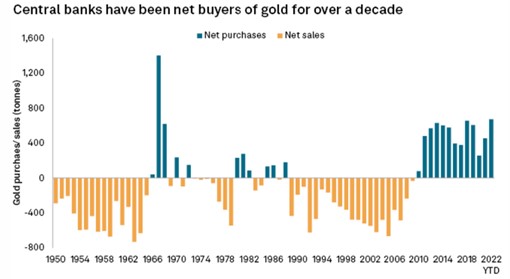

But the central banks aren’t just buying gold; they are also bringing what they currently own home. The number of countries that are repatriating gold reserves is high and rising. The methodical central banks’ accumulation of gold, “as far as we can tell, is unprecedented, given they’ve mostly been sellers throughout history,” wrote Mining.com in a recent analysis of the trend. “But the recent transactional trend, in particular over the past 30 years, illustrates a dramatic shift in the official attitude towards gold.”

In a global economy fraught with more uncertainty than in most periods, it makes sense that central banks looking to combat yield volatility and inflation risk see gold as a safe-haven asset. There is substantial verification of this in a thorough survey of central banks released last week. According to Invesco Global Sovereign Asset Management, more than 85% of the 85 sovereign wealth funds and 57 central banks that took part in the Invesco survey now believe that inflation will be higher in the current decade than in the last.

Countries that are also repatriating gold reserves are on the increase as central bankers look to reduce risk and moderate yield volatility and inflations erosion, they see gold as a safe-haven asset, according to the survey. There is also a fear of the unsettled war in Ukraine and the steps nations are willing to take. Last year’s freezing of almost half of Russia’s $640 billion of gold and forex reserves by the West in response to the invasion of Ukraine also appears to have created a move toward less trust. The survey showed a “substantial share” of central banks were concerned by the precedent that had been set. Almost 60% of respondents said it had made gold more attractive, while 68% were keeping reserves at home compared to 50% in 2020.

The Invesco survey also revealed 7% believe rising US debt is also a negative for the $US dollar, although most still see it as the most solid choice as the world’s reserve currency. Those that see China’s yuan as a potential contender fell to 18%, from 29% last year. Nearly 80% of the 142 institutions surveyed see geopolitical tensions as the biggest risk over the next decade, while 83% cited inflation as a concern over the next 12 months, Reuters reported.

Why Increase Exposure to Gold?

Central banks hold gold because it is expected to hold its value through turbulent times and, unlike currency, it does not rely on any issuer or government. It also enables central banks to diversify away from assets like US Treasury bonds and other dollar-exposed assets.

Central banks have been hoarding gold for well over a decade, even during periods when the global economy was considered stable and healthy.

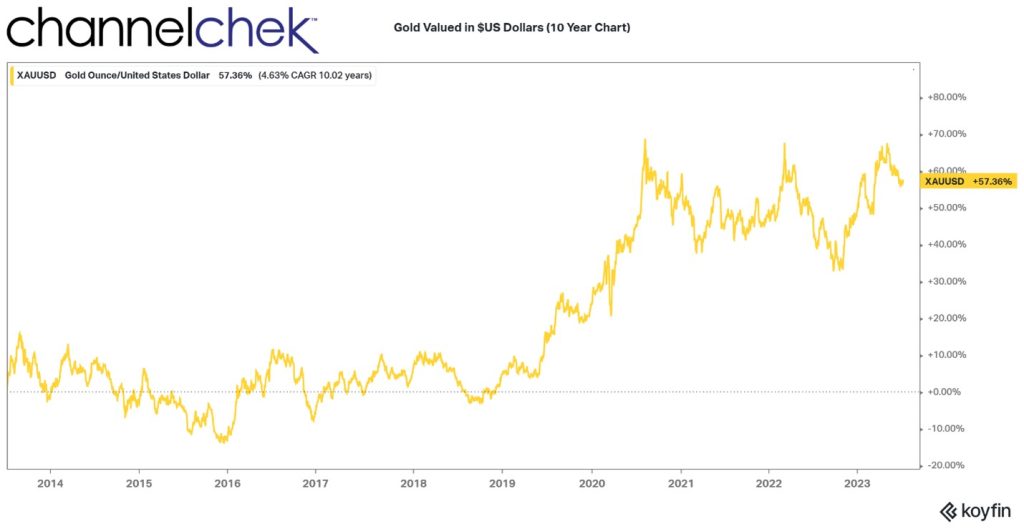

When it comes to shifting values of assets, the power of the US Federal Reserve, or the combined power of central banks in countries like China, Germany, Switzerland, the Netherlands, etc. it is important to understand their unique ability to move the needle. They try not to disrupt markets in their moves, but it still stands to reason that investing alongside, or mirroring, what the world’s central banks are doing has limited downside, and a huge tailwind toward the upside.

Take Away

Central banks throughout the world are buying additional stores of gold and bringing some of what they already own outside of their borders home for safer keeping. Mirroring central banks, with at least a modest allocation, in a year that already has an above-average stock market, yet is still full of the uncertainty, is something for investors to consider.

Exposure to gold need not mean buying gold buillion or gold coins; investors also get exposure by owning stock in gold mining companies, gold exchange-traded funds (ETF) and mutual funds, gold royalty companies, or gold futures and options.

Publicly traded equities of gold producers may offer the simplest and most attractive way to invest given the disproportionate percentage impact higher commodity prices may have on a company’s bottom line and valuation for a given percentage increase in the commodity itself.

Managing Editor, Channeclhek

Sources

https://www.gold.org/goldhub/data

https://www.mining.com/web/gold-revaluation-the-hidden-motive-behind-central-banks-gold-buying/

https://www.mining.com/web/who-are-behind-the-gold-and-silver-buying-part-ii/

https://www.invesco.com/igsams/en/home.html

https://finance.yahoo.com/news/countries-repatriating-gold-wake-sanctions-000745573.html