Image Credit: Shvets Anna (Pexels)

Wholesale Prices are Still Hot and Passing the Cost Increases on to Final Goods

Last Thursday, while the markets were transfixed on watching a so-called stablecoin on its rapid path down to almost $0.00, the Bureau of Labor Statistics (BLS) released the Producer Price Index Report (PPI). If not for the cryptocurrency distraction, the BLS report may have been the most market impactful data made available so far this May. PPI measures the inputs to manufacturing and services and calculates the average change over time of these production costs. It’s often an indicator of where consumer prices are headed.

For April 2022, year-over-year growth in the producer price inflation data came in at 11%. It has been over 10 percent for five consecutive months. PPI experienced a small drop from March’s year-over-year rate of 11.5 percent but continues to scream that costs are rising at a double-digit pace, at least for those manufacturing goods. The monthly figure was a deceleration from March, but the increase is on a growing base.

Year-over-year changes in the PPI have been over 7 percent for 11 months.

Producer Price Index (PPI)

As with the Consumer Price Index (CPI), the expectations just a few months ago were overly optimistic. Analysts forecast that PPI would moderate significantly in April and signal a downward turn. Instead, the April number disappointed those that were looking for signs of a more transitory rise in prices that then quickly moderate.

The report included some signs that price increases have reduced acceleration, but from a surprisingly high level. Despite the tapered increase, prices are still rising at a historically quick pace. Wholesale food costs rose 1.5% during April from March, this one-month increase is extreme. Even more extreme are shipping and warehousing price increases for the month of 3.6%.

What it Could Mean

There are still no indications that inflationary pressures have reached a peak and will move more toward the Fed’s target of 2% to 3%. And from a policy standpoint, there are concerns that neither the Federal Reserve (US Central Bank), Congress, nor the White House have decided to show plans that decisively wage a battle against the purchasing power erosion of US dollars. So the trend may endure for an extended period.

The Federal Reserve which embraced the stimulative position back in 2008 of adding significant liquidity to the US economy and then expanded its efforts during the government’s reaction to the pandemic starting in 2020 has been a significant catalyst to rising prices. Some analysts fear that its tepid steps do little to extinguish the raging price increases.

After nearly a year of historically relevant elevated inflation rates, the Fed has more or less assured us it will decrease its balance sheet. This would take money out of the system of at least $47.5 billion each month. As compared to the size of the overall economy, these Fed held maturities of US Treasuries and Mortgaged Backed Securities reduce money in the system by a like amount and require non-Fed investors to participate in the rolling of this debt. With consumer inflation running above 8% and 10-year US Treasuries only at 3%, history suggests either interest rates will gravitate upward to compensate investors, or inflation needs to come down. The PPI number on Thursday made it clear that the pipeline of costs that lead to consumer prices has not pulled back by much.

Take-Away

The Fed has raised interest rates twice this year. Word is they will continue to move 50 bp for at least one, probably the next two meetings. In the meantime, the pipeline of rising price inputs to consumer goods hasn’t backed off much. Equity investors view stocks as a natural hedge against inflation. What they do however need to watch is the notion that higher interest rates could cause some money that never wanted to take on risk, may leave the stock market. Fewer investors lead to lower prices.

Managing Editor, Channelchek

Suggested Content

Inflation and the Reflation Trade

|

The Last Time Inflation Was This High Fed Funds Were 14.5%

|

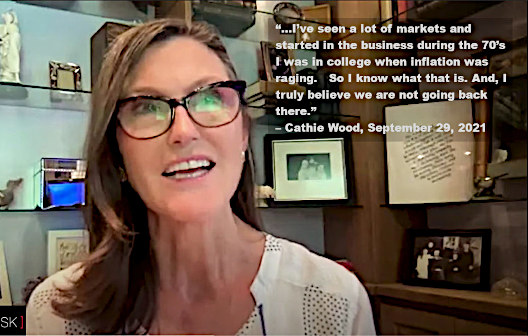

Deflation Not Inflation is Risk Says Cathie Wood

|

The Limits of Government Economic Tinkering (July 2020)

|

Stay up to date. Follow us:

|