Ten years ago 15% of Ad Money was Spent on Internet Ads, Guess what that Percentage is Today?

Soap operas, magazines, TV sports, local radio; they all allow niche target-advertising. But, their slice of the advertising-dollar pie is shrinking precipitously. This trend has been in place for a while and still accelerating. Traditional ways to reach motivated buyers are losing out to the newer competitors for ad-dollars. In 2020, this has become even more complicated.

The days of scanning through newspapers for sales or dentist office magazines to learn more about a product are almost nostalgic. Ad-Targeting is much more refined in the new digital world. With a more accurate dataset of consumer likes and dislikes, online advertising has leaped to the forefront of marketing strategies. Marketers have recognized the consumer trends and have adapted to meet them; targeted digital advertisements allows them to be significantly more strategic.

Advertising Spending Trends

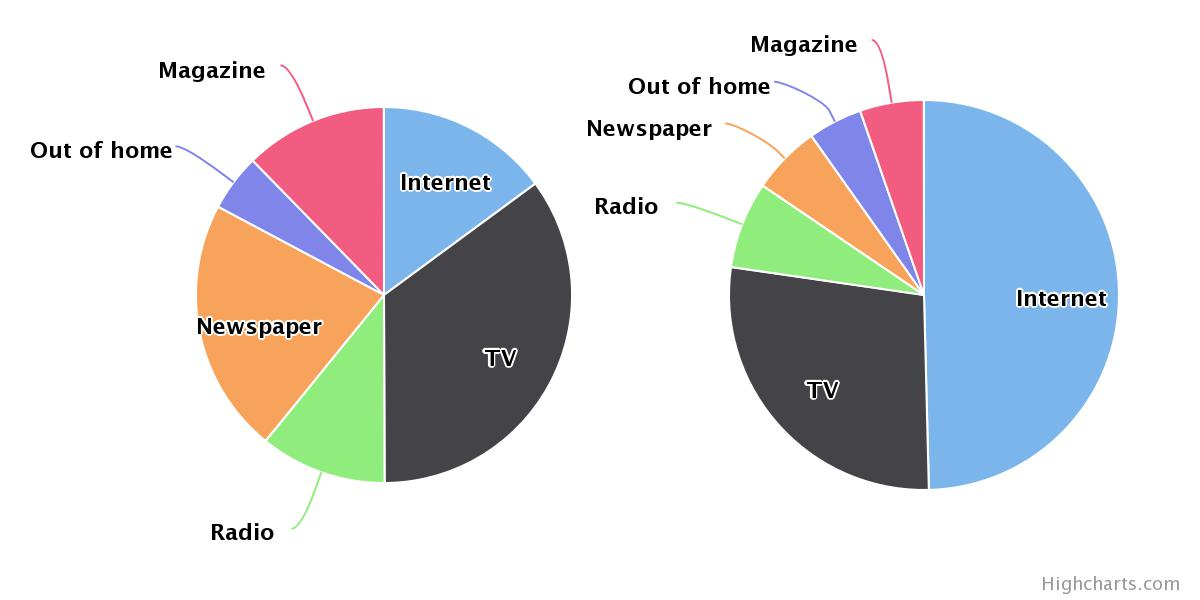

A bit over a decade (2009), the internet represented only 15% of all U.S. ad spending.

Total dollars spent: $117 Billion

TV: 39% of ad spending

Print Media: 34% of ad spending

Internet: 15%

Today (2020), more is spent on internet advertising alone than all U.S. ad spending of ten years earlier.

Total dollars spent: $263 Billion (est.)

TV: 28%

Print Media: 11%

Internet: 53%

Share of U.S. Ad Spending by Medium, 2009 (left) vs. 2019 (right)

Internet ad spending captured nearly half of ad dollars in 2019, up from about 15 percent a decade ago.

2020 and Beyond

The average social media user spends 2-plus hours a day browsing their feeds. The larger social media providers are monitoring people’s usage, likes, and dislikes. This creates a massive smart-platform for target-marketing products. The platforms continue to update and improve their methods, including increasingly higher levels of sophisticated algorithms—essentially artificial intelligence to connect a to users in their niche. The relevance of ads that users encounter is now superior to that they would see or hear from more traditional outlets. The big providers, Facebook, Snapchat, Twitter, and Instagram, all offer promoted advertisements that pop up on users’ pages while they scroll their feed. On average, users connect with three or more of their social media accounts a day.

Social Media ad spending is forecast to increase by 20% to $43 billion in 2020. Television advertising has been hard hit, not by social media competition, but by the lack of aired sports competitions. With the postponement of 2020 Summer Olympics $1.2 billion, the cancellation of March Madness and sports in general, the NBA and NHL playoff cancellation could cost $2 billion, and the seasons could cost around $700 million. New estimates forecast that U.S. TV advertising spending will decline between 22.3% and 29.3%, mostly due to the curtailment of sports programs.

Google ad revenue is projected to be $39.5 Billion in 2020; this is down by 5.3% from 2019. The decrease is a direct result of the steps to curtail the coronavirus, which shut many businesses down and caused others to go into “safety mode” by cutting their spending. However, spending is expected to rebound at unprecedented rates, up 20% in 2021 as businesses begin to restart.

Ad spending on podcasts is forecast to grow 15% from 2019 to around $3.4 B by year-end. Around 40% of Americans now listen to podcasts on a monthly basis. Companies are adapting to new sectors to reach new markets.

Take-Away

Although 2020 has provided some one-time reshuffling of ad-dollar resources, the trend toward social media platforms is firmly in place. This is worth noting if you manage a media company, adapting and changing business models may put you in a position to take advantage of these changes. Investors may find undervalued traditional media companies that have been tossed out with others– those that a bit of research indicate are making smart moves. As for social media outlets, it looks like advanced data-driven technology is giving them their day in the sun.

Suggested Reading:

Will Broadcast Mergers and Acquisitions Surge?

More Accurate than Polls to Gauge Election Outcomes

Enjoy the Benefits of Premium Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://en.wikipedia.org/wiki/Television_consumption

Picture: Etrade advertisement from the day after Superbowl February 2009.