A Positive COVID-19 Response: From Photos to Pharmaceuticals Drives KODK

On July 27th, the U.S. International Development Finance Corporation signed a letter of intent to provide a $765 million loan to Eastman Kodak Company to support the launch of Kodak Pharmaceuticals. Kodak Pharmaceuticals will produce critical pharmaceutical components that have been identified as essential but have lapsed into chronic national shortage, according to the release. Just 10% of the bulk components used to produce generic pharmaceuticals are produced in the U.S. Fully operational, Kodak Pharmaceuticals will have the capacity to produce up to 25% of active pharmaceutical ingredients used in non-biologic, non-antibacterial generic pharmaceuticals.

COVID Market Mania

Although one does not really think of pharmaceuticals and Kodak together, during the pandemic, the company, using its expertise in chemicals and advanced materials, has shifted some of its production capacity to making isopropyl alcohol for hand sanitizer and face masks using the company’s ESTAR film base.

On the news, KODK shares jumped more than 200% Tuesday and were up 318% Wednesday. At one point during the day Wednesday, the shares were up 650%. After trading in the $2-$4 range since mid-2019, KODK shares soared as high as $60 before closing Wednesday at $33.20. The shares rose so fast on Wednesday, they tripped 20 NYSE circuit breakers!

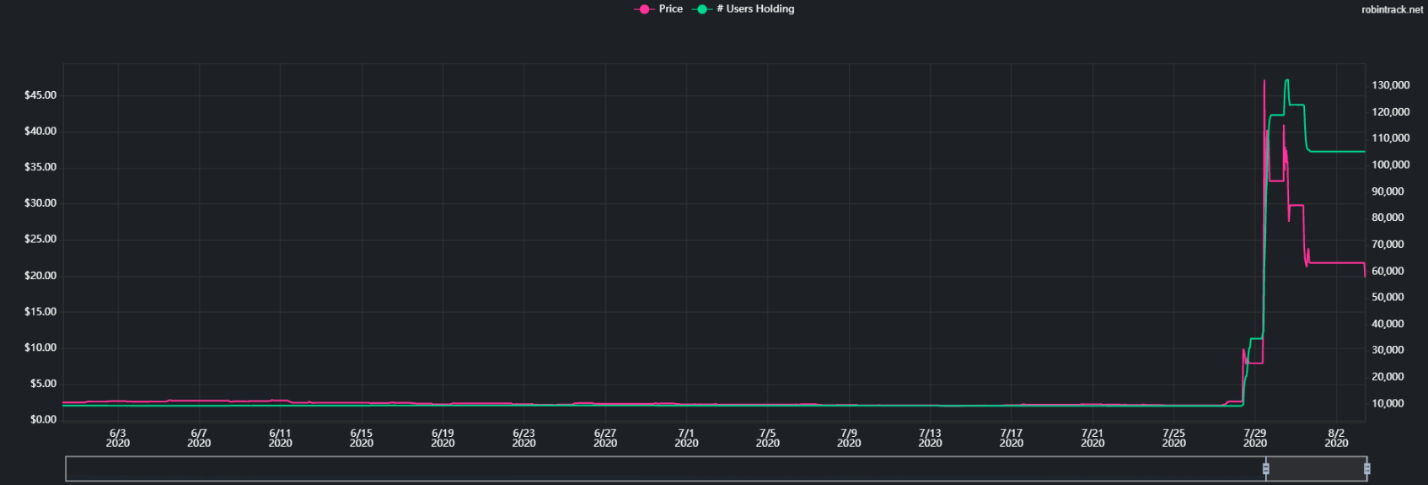

Chart shows increased Robinhood user’s holding vs. price of $KODK, June 1 through morning of August 3, 2020. Source: Robintrack

Small Online Traders Add Up

Volume went from a normal couple hundred thousand shares per day to over 275 million shares on both Tuesday and Wednesday, or six times the actual number of outstanding shares.

Robinhood traders were actively involved in the frenzy — The number of Robinhood accounts holding KODK shares exploded from under 10,000 on Monday to over 119,000 on Wednesday.

It’s Early

Although the announcement has generated a nearly unprecedented feeding frenzy, sometimes the Devil is in the details and it pays to read the fine print. Kodak and the International Development Corporation (DFC) only signed a Letter of Intent. The LOI indicates Kodak has successfully completed DFC’s initial screening but will be followed by standard due diligence before financing is formally committed. Second, it will take three

and a half years to build out the new production capacity, according to Kodak CEO Jim Continenza.

Suggested Reading:

Investment Portfolios are Checked Twice as Often by Millennials

The Supply of Cash and Stock Prices

Has Robinhood, the Online Brokerage Disruptor, Been Disrupted?

Enjoy Premium

Channelchek Content at No Cost

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

- https://www.dfc.gov/media/press-releases/dfc-sign-letter-interest-investment-kodaks-expansion-pharmaceuticals?CID=exit&idhbx=dfcrelease

- https://www.kodak.com/en/company/press-release/q1-2020-financial-results

- https://www.cnn.com/2020/07/29/investing/kodak-stock-rally-defense-protection-act/index.html

- https://markets.businessinsider.com/news/stocks/kodak-stock-price-movement-after-skyrocketing-1200-percent-2-days-2020-7-1029450808#

- https://seekingalpha.com/article/4362200-eastman-kodak-trump-administration-bailout-sparks-epic-rally-get-short-momentum-starts-to

- https://seekingalpha.com/article/4361685-eastman-kodak-resurrects-covidminus-19-play

- https://seekingalpha.com/article/4346858-eastman-kodak-company-kodk-on-q1-2020-results-earnings-call-transcript?part=single