The Data Supporting Small-Caps Should Attract Money from Former Mega-Cap-Only Investors

When I see an investment statistic that reads, “in the past, this has happened 100% of the time,” I not only take note for my own portfolio consideration, I share it with my more risk-averse investment friends. It’s now mid-January, and like many investors, I have read dozens of 2023 forecasts and projections. I value the ones where the forecaster likely has skin in the game (i.e.: not many economists), and I am more highly interested in those that support forecasts with stats (ie: most economists). I came across a stat of ‘100% of the time’ from a trusted source that has skin in the game – this is certainly share-worthy.

Source

Each month Royce Investment Partners publishes an interview-style update between founder Chuck Royce and Co-CIO Frank Gannon. It’s always full of statistics and probability analysis. It never fails to be interesting and very often worthwhile. Investment decisions based on hard data from the past are less speculative, this doesn’t always make the investment a win, but it lowers the need for guessing. And if the stats are based on a large enough sample period, confidence to act overrides underlying opinion or emotions. The most recent publication from Royce Associates, LLC offers very compelling data.

The update includes a look at the stock market trends of late last year and why they’re confident small-cap stocks can achieve a positive return that could outpace larger-cap sectors. Especially for those companies whose underlying data meet criteria that they also explain.

Rear Looking View

The two were able to put the challenges for many investors last year in context by first talking about how infrequently bonds and stocks have gone down in the same year. This left 60/40 investors without anything to be happy about. Then they switched to small cap versus large cap, which they say was the third worst year for both the small-cap Russell 2000 Index, which fell 20.4%, and the Russell 1000 Index, which declined 19.1%. The third worst since each index’s inception at the end of 1978. According to the Royce update, “only two years had lower returns—and it was the same two years for both indexes—2008 during the Financial Crisis and 2002 through the worst year of the Internet Bubble.”

Forward-Looking View

As indicated above, Royce Associates believes small-cap is well positioned for positive returns and long-term comparative performance. The argument is hinged mainly on valuation but also on past behavior.

Valuation, they explain, even after last year’s sell-off, “remained near its lowest rate in 20 years compared to large-cap’s, based on our preferred valuation metric of the median last 12 months’ enterprise value to earnings before taxes (LTM EV/EBIT).” Royce recognized that accompanying the worldwide equity sell-off, many small-cap stocks were taken lower unrelated to financial fundamentals and/or operational expertise. “We have often been struck by the contrast between the more confident—albeit cautious—outlooks from the many management teams we’ve met with and the fatalistic headlines we see almost every day,” they explain.

A High Probability of Positive Small-Cap Performance Ahead?

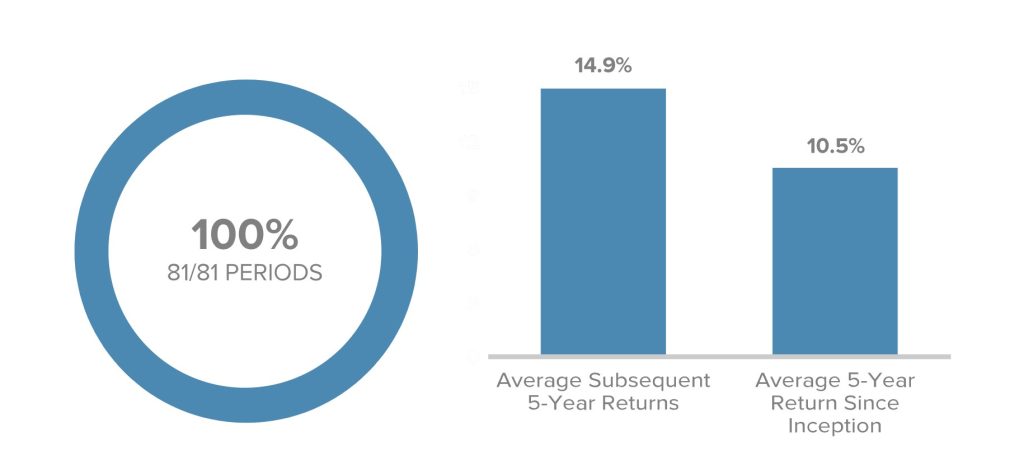

Average Subsequent Five-Year Annualized Performance for the Russell 2000 in Trailing Five-Year Return Ranges of less than 5% from 12/31/83 through 12/31/22:

Frank Gannon says, “small-cap’s historical performance patterns show that below-average longer-term return periods have been followed by those with above-average longer-term returns—and the subsequent periods have enjoyed positive returns most of the time.” Drilling down to the numbers of the market’s current state, he says, “Subsequent annualized three-year returns from three-year entry points of less than 5% have been positive 99% of the time—that is, in 75 out of 76 three-year annualized periods—averaging 16.1% since the Russell 2000s 12/31/78 inception.”

Stretching the investment period out to five years had even higher probabilities and positive outcomes. “The Russell 2000 also had positive annualized five-year returns 100% of the time—that is, in all 81 five-year periods—and averaged an impressive 14.9% following five-year periods with annualized returns of 5% or less. We think this is especially relevant now because the respective three- and five-year annualized returns for the Russell 2000 as of 12/31/22 were 3.1% and 4.1%.”

On the subject of inflation, the Royce review was also positive. “Small-cap has beaten inflation in every decade going back to the 1930s—and is the only equity class to have done so.” Details of how this and other numbers are derived can be found in the article (available here).

Take-Away

While Royce Investment Partners, a fund company that holds small-cap stocks as its specialty, is not affiliated with Channelchek, or Noble Capital Markets, the monthly and quarterly newsletter/blog is always looked forward to. New readers should be ready for numbers and details backing up their stated positions. This is something not always found in public forecasts by other investment officers or portfolio managers. It’s more longwinded than some, but this is good because sound bites are not very helpful when one investor is trying to understand the thoughts of another.

To find data on ‘less-followed’ stocks, sign- up here for Channelchek and get immediate, no-cost access to information on over 6,000 small and microcap companies.

Managing Editor, Channelchek

Sources