Research News and Market Data on CVGI

November 10, 2025

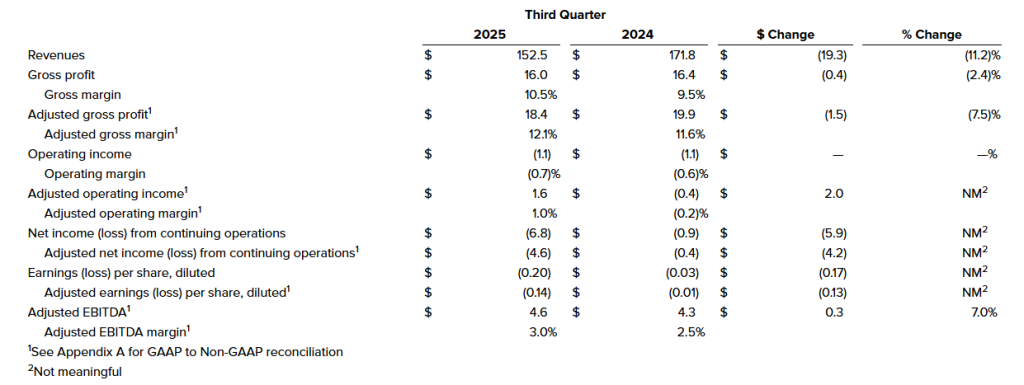

Third quarter sales of $152 million, EPS of $(0.20), Adjusted EBITDA of $4.6 million

Returns to growth in Global Electrical Solutions segment

Updates full year 2025 guidance

NEW ALBANY, Ohio, Nov. 10, 2025 (GLOBE NEWSWIRE) — CVG (NASDAQ: CVGI), a diversified industrial products and services company, today announced financial results for its third quarter ended September 30, 2025.

Third Quarter 2025 Highlights (Results from Continuing Operations; compared with prior year, where comparisons are noted)

- Revenues of $152.5 million, down 11.2%, primarily due to softening in North American demand.

- Operating loss of $1.1 million, flat compared to operating loss of $1.1 million. Adjusted operating income of $1.6 million, compared to adjusted operating loss of $0.4 million. The increase in adjusted operating income was primarily attributable to improved gross margin performance and lower SG&A expenses.

- Net loss from continuing operations of $6.8 million, or $(0.20) per diluted share and adjusted net loss of $4.6 million, or $(0.14) per diluted share, compared to net loss from continuing operations of $0.9 million, or $(0.03) per diluted share and adjusted net loss of $0.4 million, or $(0.01) per diluted share.

- Adjusted EBITDA of $4.6 million, up 7.0%, with an adjusted EBITDA margin of 3.0%, up from 2.5%.

James Ray, President and Chief Executive Officer, said, “In the face of ongoing lower demand in our key Construction, Agriculture, and Class 8 truck end markets, we were pleased with the resilience seen in our third quarter results. We continued to benefit from our operational efficiency improvement and right sizing our manufacturing footprint and enterprise structural cost, evidenced by the continued sequential expansion in our adjusted gross margin in the quarter, despite the lower demand environment. Furthermore, as part of our efforts to preserve margins and position CVG for an eventual end market recovery, we remain focused on reducing SG&A expenses, and we have made demonstrable progress with customers as it relates to mitigating tariff impacts. I want to sincerely thank every member of the CVG team for their commitment, resilience, and focus on execution.”

Mr. Ray continued, “We are encouraged by the continued improvement in Global Electrical Systems segment performance, which returned to year-over-year revenue growth in third quarter, driven by new business wins outside of the Construction and Agriculture end markets, which continue to see lower demand. This segment also saw continued margin expansion year-over-year. In addition, our Global Seating segment expanded margins, as we see the benefits of our operational efficiency improvements, even in a softer demand environment. Our North American-focused Trim Systems and Components segment continues to see weakness as Class 8 production declines year-over year. However, we are taking proactive actions to improve profitability in the face of lower production levels. As an organization, we remain laser-focused on the levers we can control to improve financial performance, drive operational efficiency, and while continuing to launch previously won new customer programs across all segments to best position CVG for the future.”

Andy Cheung, Chief Financial Officer, added, “We are encouraged by our margin performance in the quarter, particularly against a difficult demand backdrop. We continue to optimize our operations to account for individual end market outlooks, particularly in the North American Class 8 truck market. While softer orders led to an inventory increase in the third quarter, we expect to reduce working capital in the fourth quarter. We remain focused on cash generation, with an expectation to drive at least $30 million in free cash flow for the full fiscal year. Continued free cash generation and debt paydown remain our near-term focus areas as we look to drive further cost reductions and improve overall operational efficiency.”

Third Quarter Financial Results from Continuing Operations

(amounts in millions except per share data and percentages)

Consolidated Results from Continuing Operations

Third Quarter 2025 Results

- Third quarter 2025 revenues were $152.5 million, compared to $171.8 million in the prior year period, a decrease of 11.2%. The overall decrease in revenues was due to lower sales as a result of a softening in customer demand, primarily in the Global Seating and Trim Systems & Components segments.

- Operating loss in the third quarter 2025 was flat compared to the prior year period at $1.1 million. Third quarter 2025 adjusted operating income was $1.6 million, compared to loss of $0.4 million in the prior year period. The increase in adjusted operating income was primarily attributable to improved gross margin performance and lower SG&A expenses.

- Interest associated with debt and other expenses was $4.1 million and $2.4 million for the third quarter 2025 and 2024, respectively, due to higher interest rates.

- Net loss from continuing operations was $6.8 million, or $(0.20) per diluted share, for the third quarter 2025 compared to net loss of $0.9 million, or $(0.03) per diluted share, in the prior year period. Third quarter 2025 adjusted net loss from continuing operations was $4.6 million, or $(0.14) per diluted share, compared to adjusted net loss of $0.4 million, or $(0.01) per diluted share.

On September 30, 2025, the Company had $20.2 million of outstanding borrowings on its U.S. revolving credit facility and $4.2 million outstanding borrowings on its China credit facility, $31.3 million of cash and $96.5 million of availability from the credit facilities (subject to customary borrowing base and other conditions), resulting in total liquidity of $127.8 million.

Third Quarter 2025 Segment Results

Global Seating Segment

- Revenues were $68.7 million compared to $76.6 million for the prior year period, a decrease of 10.4%, due to lower sales volume as a result of decreased customer demand.

- Operating income was $1.4 million, compared to loss of $1.5 million in the prior year period, an increase of $2.9 million, driven by improved gross margin performance and lower SG&A expenses. Third quarter 2025 adjusted operating income was $2.9 million compared to loss of $0.8 million in the prior year period.

Global Electrical Systems Segment

- Revenues were $49.5 million compared to $46.7 million in the prior year period, an increase of 5.9%, primarily as a result of ramping new business wins.

- Operating income was $0.8 million compared to loss of $1.5 million in the prior year period, an increase of $2.3 million. The increase in operating income was primarily attributable to higher sales volumes. Third quarter 2025 adjusted operating income was $1.4 million compared to loss of $0.2 million in the prior year period.

Trim Systems and Components Segment

- Revenues were $34.3 million compared to $48.4 million in the prior year period, a decrease of 29.2%, primarily due to lower sales volume.

- Operating loss was $0.9 million compared to an operating income of $5.4 million in the prior year period. The decrease in operating income was primarily attributable to lower demand and a gain on a facility sale in the prior period. Third quarter 2025 adjusted operating loss was $0.3 million compared to income of $4.1 million in the prior year period.

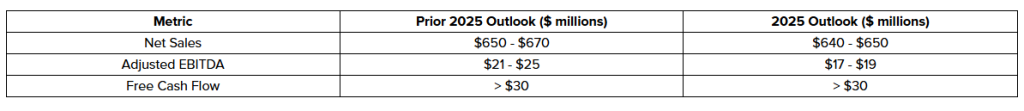

Outlook

CVG updated the Company’s outlook for the full year 2025, based on current market conditions:

This outlook reflects, among others, current industry forecasts for North America Class 8 truck builds. According to ACT Research, 2025 North American Class 8 truck production levels are expected to be at 239,000 units, down 28% versus the 2024 actual Class 8 truck builds of 332,372 units and down 5% from the time of our second quarter 2025 earnings release, when ACT Research was forecasting 252,000 units for 2025 North American Class 8 truck production.

Construction and Agriculture end markets are projected to decline approximately 5-15% in 2025. However, we expect the contribution from new business wins outside of Construction and Agriculture end markets in Electrical Systems to soften this decline.

GAAP to Non-GAAP Reconciliation

A reconciliation of GAAP to non-GAAP financial measures referenced in this release is included as Appendix A to this release.

Conference Call

A conference call to discuss this press release is scheduled for Tuesday, November 11, 2025, at 8:30 a.m. ET. Management intends to reference the Q3 2025 Earnings Call Presentation during the conference call. To participate, dial (800) 549-8228 using conference code 19689. International participants dial (289) 819-1520 using conference code 19689.

This call is being webcast and can be accessed through the “Investors” section of CVG’s website at ir.cvgrp.com, where it will be archived for one year.

A telephonic replay of the conference call will be available for a period of two weeks following the call. To access the replay, dial (888) 660-6264 using access code 19689#.

Company Contact

Andy Cheung

Chief Financial Officer

CVG

IR@cvgrp.com

Investor Relations Contact

Ross Collins or Nathan Skown

Alpha IR Group

CVGI@alpha-ir.com

About CVG

CVG is a global provider of systems, assemblies and components to the global commercial vehicle market and the electric vehicle market. We deliver real solutions to complex design, engineering and manufacturing problems while creating positive change for our customers, industries and communities we serve. Information about the Company and its products is available on the internet at www.cvgrp.com.

Forward-Looking Statements

This press release contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about the Company’s expectations for future periods with respect to its plans to improve financial results, the future of the Company’s end markets, changes in the Class 8 and Class 5-7 North America truck build rates, performance of the global construction and agricultural equipment business, the Company’s prospects in the wire harness and electric vehicle markets, the Company’s initiatives to address customer needs, organic growth, the Company’s strategic plans and plans to focus on certain segments, competition faced by the Company, volatility in and disruption to the global economic environment including global supply chain constraints, inflation and labor shortages, tariffs and counter-measures, financial covenant compliance, anticipated effects of acquisitions, production of new products, plans for capital expenditures, and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including those included in the Company’s filings with the SEC. There can be no assurance that statements made in this press release relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements.

Other Information

Throughout this document, certain numbers in the tables or elsewhere may not sum due to rounding. Rounding may have also impacted the presentation of certain year-on-year percentage changes.

Source: Commercial Vehicle Group, Inc.