Research News and Market Data on ARLP

October 27, 2025

2025 Quarter Highlights

- Third quarter 2025 revenue of $571.4 million, net income of $95.1 million, and Adjusted EBITDA of $185.8 million, up sequentially 4.4%, 60.1%, and 14.8%, respectively

- Coal sales and production volumes increased to 8.7 million tons sold and 8.4 million tons produced, representing year-over-year and sequential improvements, respectively

- Appalachia Segment Adjusted EBITDA Expense per ton improved 11.7% year-over-year and 12.1% sequentially

- Invested $22.1 million as part of a $25.0 million commitment in a limited partnership that indirectly owns and operates a 2.7 gigawatt coal-fired power plant

- Declares quarterly cash distribution of $0.60 per unit, or $2.40 per unit annualized

TULSA, Okla.–(BUSINESS WIRE)– Alliance Resource Partners, L.P. (NASDAQ: ARLP) (“ARLP” or the “Partnership”) today reported financial and operating results for the three and nine months ended September 30, 2025 (the “2025 Quarter” and “2025 Period,” respectively). This release includes comparisons of results to the three and nine months ended September 30, 2024 (the “2024 Quarter” and “2024 Period,” respectively) and to the quarter ended June 30, 2025 (the “Sequential Quarter”). All references in the text of this release to “net income” refer to “net income attributable to ARLP.” For a definition of Adjusted EBITDA and Segment Adjusted EBITDA Expense and related reconciliations to comparable GAAP financial measures, please see the end of this release.

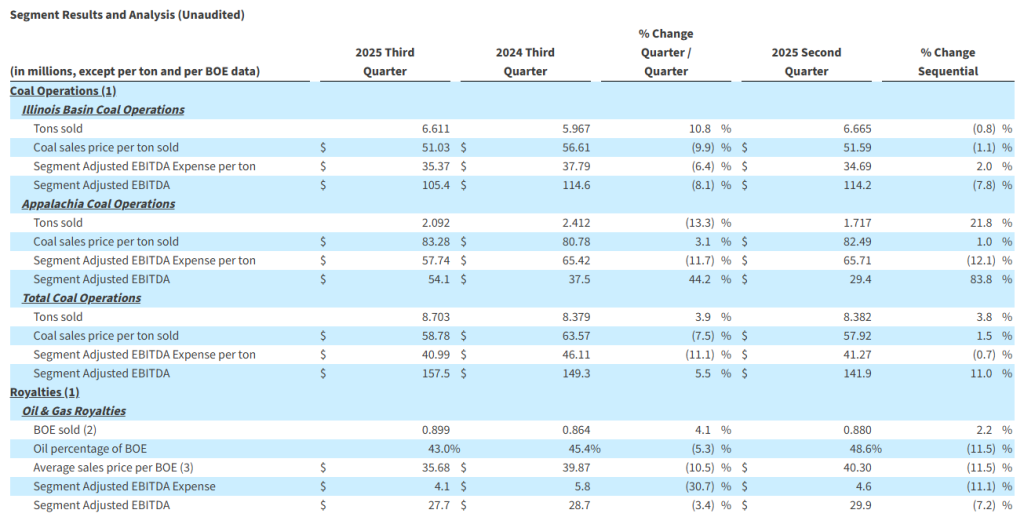

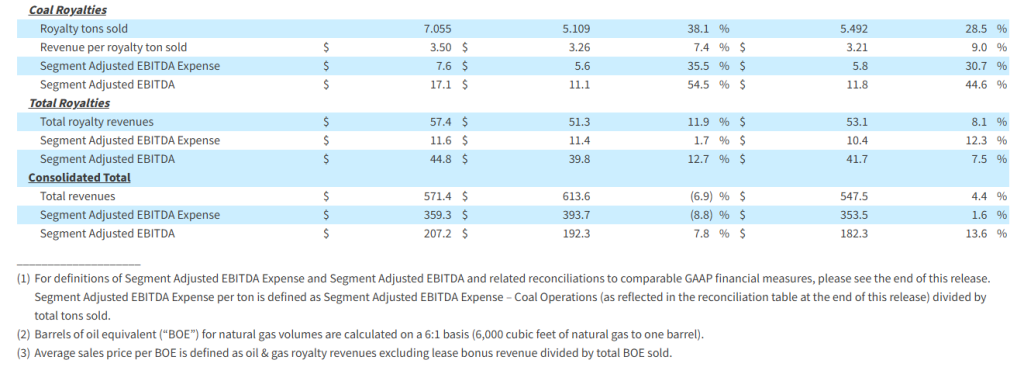

For the 2025 Quarter net income increased 10.2% to $95.1 million, or $0.73 per basic and diluted limited partner unit, compared to $86.3 million, or $0.66 per basic and diluted limited partner unit for the 2024 Quarter as a result of reduced operating expenses and higher investment income, partially offset by lower revenues. Total revenues decreased 6.9% to $571.4 million in the 2025 Quarter compared to $613.6 million for the 2024 Quarter primarily due to lower coal sales price per ton, which declined 7.5%, and reduced transportation revenues, partially offset by increased coal sales volumes, which rose 3.9% to 8.7 million tons sold in the 2025 Quarter compared to 8.4 million tons sold in the 2024 Quarter. Adjusted EBITDA increased 9.0% to $185.8 million in the 2025 Quarter compared to $170.4 million in the 2024 Quarter.

Compared to the Sequential Quarter, total revenues increased by 4.4% due to higher coal sales volumes and prices, which rose 3.8% and 1.5%, respectively. Net income jumped by 60.1% compared to the Sequential Quarter as a result of higher revenues, increased investment income and a $25.0 million impairment loss on an investment in the Sequential Quarter, partially offset by increased operating expenses and a lower increase in the fair value of our digital assets during the 2025 Quarter. Adjusted EBITDA for the 2025 Quarter increased by 14.8% compared to the Sequential Quarter.

Total revenues decreased 10.7% to $1.66 billion for the 2025 Period compared to $1.86 billion for the 2024 Period primarily due to lower coal sales and transportation revenues. Net income for the 2025 Period was $228.5 million, or $1.76 per basic and diluted limited partner unit, compared to $344.5 million, or $2.64 per basic and diluted limited partner unit, for the 2024 Period as a result of lower revenues, higher depreciation, and the $25.0 million impairment loss on an investment in the 2025 Period, partially offset by reduced operating expenses. Adjusted EBITDA for the 2025 Period was $507.7 million compared to $590.3 million for the 2024 Period.

CEO Commentary

“Alliance delivered strong operational and financial performance in the third quarter, with results tracking in-line with our expectations,” commented Joseph W. Craft III, Chairman, President and CEO. “Coal production of 8.4 million tons increased 8.5% year-over-year and 3.8% sequentially, while sales volumes of 8.7 million tons grew approximately 3.9% year-over-year and sequentially. The significant infrastructure investments we have made over the past three years are beginning to pay off. Our Illinois Basin operations’ improvements were led by Hamilton, which benefited from new equipment installed following a successful longwall move in early August. At our River View complex the Henderson County Mine achieved a key infrastructure milestone in late August with the opening of its new portal facility. Equipment and personnel transitions to better mining conditions are planned to be in place early next year when six units are expected to be operating at the Henderson County Mine with three units remaining at the River View mine. Our Appalachia operations’ improvements were led by Tunnel Ridge, which successfully transitioned to a new longwall district in the 2025 Quarter. As expected, the move has resulted in significantly improved mining conditions dropping the mine’s cost per ton sold by 8.8% compared to the 2024 Quarter and 19.3% to the Sequential Quarter. For the 2025 Quarter, Adjusted EBITDA of $185.8 million increased 9% year-over-year and 15% sequentially, reflecting higher sales volumes and lower costs per ton as our operations performed well across the board.”

Mr. Craft continued, “The domestic thermal coal market is continuing to experience strong fundamentals, supported by an unprecedented combination of federal energy and environmental policy support plus rapid demand growth. Year to date utility coal consumption escalated across MISO and PJM service areas by 15% and 16% respectively, compared to the prior year. This surge reflects not just favorable weather and natural gas pricing dynamics, but a realization of the dramatic load growth required by artificial intelligence.”

Mr. Craft concluded, “Market signals are validating the need to keep base-load power plants, including coal-fired power plants previously planned for decommissioning, online to meet this anticipated energy demand. The recent PJM capacity auction cleared at maximum allowable prices with every megawatt of coal capacity selected, while reserve margins fell below reliability targets, clearly demonstrating that the grid needs every available megawatt of dispatchable generation. During the quarter, to assist in extending the lives of coal plants in our marketing footprint, we invested $22.1 million as part of a $25.0 million commitment in a limited partnership that indirectly acquired a coal-fired plant in the PJM service area, positioning Alliance to directly benefit from the tightening power markets and growing demand for reliable baseload generation. This is a near-term, income-producing investment expected to generate attractive cash-on-cash returns in 2026 and beyond.”

Coal Operations

Tons sold increased by 10.8% in the Illinois Basin compared to the 2024 Quarter due primarily to increased volumes from our Hamilton and River View mines. In Appalachia, sales volumes decreased by 13.3% in the 2025 Quarter compared to the 2024 Quarter primarily as a result of timing of shipments from our Tunnel Ridge operation. Compared to the Sequential Quarter, tons sold increased by 21.8% in Appalachia due to increased sales performance across the region, particularly at Tunnel Ridge, which increased production through higher productivity and recoveries during the 2025 Quarter. Coal sales price per ton sold decreased by 9.9% in the Illinois Basin compared to the 2024 Quarter as a result of the expiration of higher priced legacy contracts across the region. In Appalachia, coal sales price per ton sold increased by 3.1% compared to the 2024 Quarter primarily due to higher domestic pricing from each operation and an increased sales mix of higher priced MC Mining and Mettiki sales volumes in the 2025 Quarter. ARLP ended the 2025 Quarter with total coal inventory of 0.9 million tons, representing decreases of 1.1 million tons and 0.2 million tons compared to the end of the 2024 Quarter and Sequential Quarter, respectively.

Segment Adjusted EBITDA Expense per ton in the Illinois Basin decreased by 6.4% compared to the 2024 Quarter due primarily to increased production in the region, improved recoveries at our River View and Hamilton mines and reduced longwall move days at Hamilton. In Appalachia, Segment Adjusted EBITDA Expense per ton for the 2025 Quarter decreased by 11.7% and 12.1% compared to the 2024 Quarter and Sequential Quarter, respectively, due to increased productivity at our Tunnel Ridge operation and higher recoveries during the 2025 Quarter. Compared to the 2024 Quarter, lower labor costs and improved mining conditions at each operation also contributed to lower per ton expenses in Appalachia.

Royalties

Segment Adjusted EBITDA for the Oil & Gas Royalties segment decreased slightly to $27.7 million in the 2025 Quarter compared to $28.7 million and $29.9 million in the 2024 Quarter and Sequential Quarter, respectively, due to lower average sales price per MBOE, which decreased 10.5% and 11.5%, respectively, partially offset by higher volumes. Oil & Gas Royalty volumes increased to 899 MBOE in the 2025 Quarter compared to 864 MBOE and 880 MBOE in the 2024 Quarter and Sequential Quarter, respectively.

Segment Adjusted EBITDA for the Coal Royalties segment increased to $17.1 million in the 2025 Quarter compared to $11.1 million and $11.8 million in the 2024 Quarter and Sequential Quarter, respectively, due to higher royalty tons sold, primarily from Tunnel Ridge and average royalty rates per ton received from the Partnership’s mining subsidiaries.

Growth Investments

During the 2025 Quarter, ARLP invested approximately $22.1 million of a $25.0 million commitment in a limited partnership that indirectly owns and operates a coal-fired power plant. This investment aligns with the Partnership’s strategy to allocate a portion of excess cash flows into investments that support the growth and development of energy and related infrastructure.

Also, during the 2025 Quarter, our other investments generated $4.5 million in investment income primarily due to an increase in the value of our share of the net assets of the companies in which we hold interests.

Balance Sheet and Liquidity

As of September 30, 2025, total debt and finance leases were outstanding in the amount of $470.6 million. The Partnership’s total and net leverage ratios were 0.75 times and 0.60 times debt to trailing twelve months Adjusted EBITDA, respectively, as of September 30, 2025. ARLP ended the 2025 Quarter with total liquidity of $541.8 million, which included $94.5 million of cash and cash equivalents and $447.3 million of borrowings available under its revolving credit and accounts receivable securitization facilities. ARLP also held 568 bitcoins valued at $64.8 million as of September 30, 2025.

Distributions

ARLP also announced today that the Board of Directors of its general partner (the “Board”) approved a cash distribution to unitholders for the 2025 Quarter of $0.60 per unit (an annualized rate of $2.40 per unit), payable on November 14, 2025, to all unitholders of record as of the close of trading on November 7, 2025.

Concurrent with this announcement we are providing qualified notice to brokers and nominees that hold ARLP units on behalf of non-U.S. investors under Treasury Regulation Section 1.1446-4(b) and (d) and Treasury Regulation Section 1.1446(f)-4(c)(2)(iii). Brokers and nominees should treat one hundred percent (100%) of ARLP’s distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. In addition, brokers and nominees should treat one hundred percent (100%) of the distribution as being in excess of cumulative net income for purposes of determining the amount to withhold. Accordingly, ARLP’s distributions to non-U.S. investors are subject to federal income tax withholding at a rate equal to the highest applicable effective tax rate plus ten percent (10%). Nominees, and not ARLP, are treated as the withholding agents responsible for withholding on the distributions received by them on behalf of non-U.S. investors.

Outlook

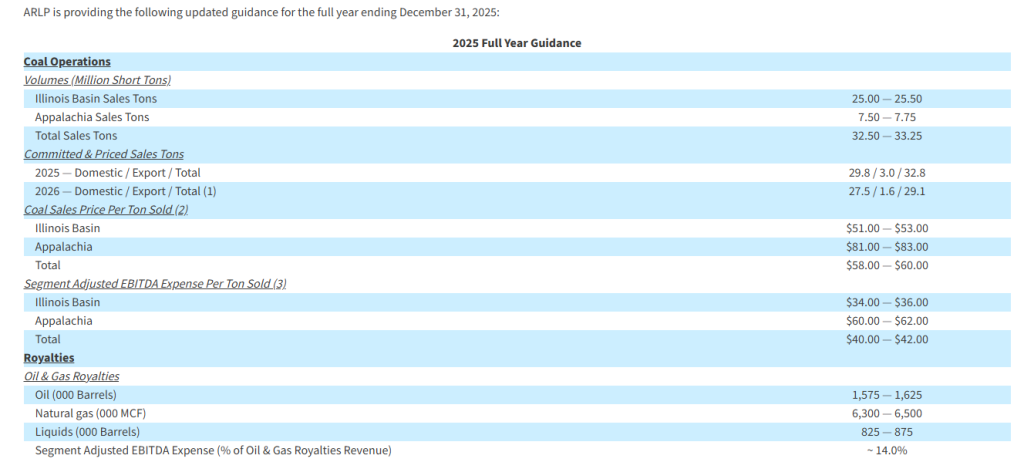

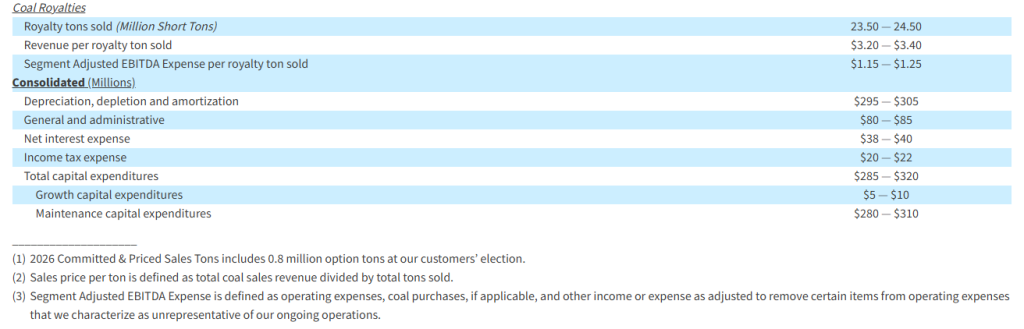

“We expect the operating and financial results for the fourth quarter to equal our outstanding 2025 Quarter results. Therefore, we are tightening our guidance ranges for coal sales volumes and per ton expenses, reflecting steady operational execution and continued cost improvements across our mines,” commented Mr. Craft. “In our Oil & Gas Royalties segment, we are adjusting our BOE volume guidance to reflect the timing of a multi-well pad in the Delaware Basin of the Permian, which is now expected to come online in early 2026.”

Mr. Craft continued, “Our contracting momentum continues to strengthen, with our 2026 book now including 29.1 million tons committed and priced, up 9% from last quarter. Domestic customer engagement on multi-year agreements has intensified as utilities seek reliable supply from financially strong counterparties. This environment, combined with utility stockpiles normalizing at approximately 78 days of burn coverage, supports robust term contracting activity and greater demand visibility than we’ve experienced in several years. Looking to the export markets, we have 1.6 million tons committed and priced for 2026 and anticipate approximately 0.3-0.6 million additional tons of metallurgical coal to be sold in 2026 that is currently uncommitted.”

Mr. Craft concluded, “We believe the combination of improving fundamentals, our completed capital program driving cost reductions, and our strong balance sheet puts Alliance in a favorable position to meet market demand. While declining oil prices may impact volumes and oil and gas royalty revenue in the short term, improved natural gas forward curves supported by growing LNG export capacity and increased utility demand are expected to partially offset the decline in oil revenue and benefit coal demand next year. Due to normalized utility inventories, and unprecedented demand growth from data centers, analysts we follow are projecting 4-6% annual growth in electricity demand in PJM and other markets we serve. As a result, we believe Alliance has the opportunity and is well-positioned to increase production at Tunnel Ridge and the Illinois Basin operations in 2026.”

Conference Call

A conference call regarding ARLP’s 2025 Quarter financial results and updated 2025 guidance is scheduled for today at 10:00 a.m. Eastern. To participate in the conference call, dial (877) 407-0784 and request to be connected to the Alliance Resource Partners, L.P. earnings conference call. International callers should dial (201) 689-8560 and request to be connected to the same call. Investors may also listen to the call via the “Investors” section of ARLP’s website at www.arlp.com.

An audio replay of the conference call will be available for approximately one week. To access the audio replay, dial U.S. Toll Free (844) 512-2921; International Toll (412) 317-6671 and request to be connected to replay using access code 13756408.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the second largest coal producer in the eastern United States, supplying reliable, affordable energy domestically and internationally to major utilities, metallurgical and industrial users. ARLP also generates operating and royalty income from mineral interests it owns in strategic coal and oil & gas producing regions in the United States. In addition, ARLP is positioning itself as a reliable energy partner for the future by pursuing opportunities that support the growth and development of energy and related infrastructure.

News, unit prices and additional information about ARLP, including filings with the Securities and Exchange Commission (“SEC”), are available at www.arlp.com. For more information, contact the investor relations department of ARLP at (918) 295-7673 or via e-mail at investorrelations@arlp.com.

The statements and projections used throughout this release are based on current expectations. These statements and projections are forward-looking, and actual results may differ materially. These projections do not include the potential impact of any mergers, acquisitions or other business combinations that may occur after the date of this release. We have included more information below regarding business risks that could affect our results.

FORWARD-LOOKING STATEMENTS: With the exception of historical matters, any matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. Those forward-looking statements include expectations with respect to our future financial and operational performance, coal and oil & gas consumption and expected future prices, our ability to increase or maintain unitholder distributions in future quarters, business plans and potential growth with respect to our energy and infrastructure transition investments, optimizing cash flows, reducing operating and capital expenditures, infrastructure projects at our existing properties, growth in domestic electricity demand, preserving liquidity and maintaining financial flexibility, our future repurchases of units, and the impact of recently announced tax legislation. These risks to our ability to achieve these outcomes include, but are not limited to, the following: decline in the coal industry’s share of electricity generation, including as a result of environmental concerns related to coal mining and combustion, the cost and perceived benefits of other sources of electricity and fuels, such as oil & gas, nuclear energy, and renewable fuels and the planned retirement of coal-fired power plants in the U.S.; our ability to provide fuel for growth in domestic energy demand, should it materialize; changes in macroeconomic and market conditions and market volatility, and the impact of such changes and volatility on our financial position; changes in global economic and geo-political conditions or changes in industries in which our customers operate; changes in commodity prices, demand and availability which could affect our operating results and cash flows; impacts of geopolitical events, including the conflicts in Ukraine and in the Middle East; the severity, magnitude and duration of any future pandemics and impacts of such pandemics and of businesses’ and governments’ responses to such pandemics on our operations and personnel, and on demand for coal, oil, and natural gas, the financial condition of our customers and suppliers and operators, available liquidity and capital sources and broader economic disruptions; actions of the major oil-producing countries with respect to oil production volumes and prices and the direct and indirect impacts over the near and long term on oil & gas exploration and production operations at the properties in which we hold mineral interests; changes in competition in domestic and international coal markets and our ability to respond to such changes; potential shut-ins of production by the operators of the properties in which we hold oil & gas mineral interests due to low commodity prices or the lack of downstream demand or storage capacity; risks associated with the expansion of and investments into the infrastructure of our operations and properties, including the timing of such investments coming online; our ability to identify and complete acquisitions and to successfully integrate such acquisitions into our business and achieve the anticipated benefits therefrom; our ability to identify and invest in new energy and infrastructure transition ventures; the success of our development plans for our wholly owned subsidiary, Matrix Design Group, LLC, and our investments in emerging and other infrastructure and technology companies; dependence on significant customer contracts, including renewing existing contracts upon expiration; adjustments made in price, volume, or terms to existing coal supply agreements; the effects of and changes in trade, monetary and fiscal policies and laws, and the results of central bank policy actions including interest rates, bank failures, and associated liquidity risks; the effects of and changes in taxes or tariffs and other trade measures adopted by the United States and foreign governments, including the imposition of or increase in tariffs on steel and/or other raw materials; legislation, regulations, and court decisions and interpretations thereof, both domestic and foreign, including those relating to the environment and the release of greenhouse gases, such as the Environmental Protection Agency’s emissions regulations for coal-fired power plants, and state legislation seeking to impose liability on a wide range of energy companies under greenhouse gas “superfund” laws, mining, miner health and safety, hydraulic fracturing, and health care; deregulation of the electric utility industry or the effects of any adverse change in the coal industry, electric utility industry, or general economic conditions; investors’ and other stakeholders’ attention to environmental, social, and governance matters; liquidity constraints, including those resulting from any future unavailability of financing; customer bankruptcies, cancellations or breaches to existing contracts, or other failures to perform; customer delays, failure to take coal under contracts or defaults in making payments; our productivity levels and margins earned on our coal sales; disruptions to oil & gas exploration and production operations at the properties in which we hold mineral interests; changes in equipment, raw material, service or labor costs or availability, including due to inflationary pressures; changes in our ability to recruit, hire and maintain labor; our ability to maintain satisfactory relations with our employees; increases in labor costs, adverse changes in work rules, or cash payments or projections associated with workers’ compensation claims; increases in transportation costs and risk of transportation delays or interruptions; operational interruptions due to geologic, permitting, labor, weather, supply chain shortage of equipment or mine supplies, or other factors; risks associated with major mine-related accidents, mine fires, mine floods or other interruptions; results of litigation, including claims not yet asserted; foreign currency fluctuations that could adversely affect the competitiveness of our coal abroad; difficulty maintaining our surety bonds for mine reclamation as well as workers’ compensation and black lung benefits; difficulty in making accurate assumptions and projections regarding post-mine reclamation as well as pension, black lung benefits, and other post-retirement benefit liabilities; uncertainties in estimating and replacing our coal mineral reserves and resources; uncertainties in estimating and replacing our oil & gas reserves; uncertainties in the amount of oil & gas production due to the level of drilling and completion activity by the operators of our oil & gas properties; uncertainties in the future of the electric vehicle industry and the market for EV charging stations; the impact of current and potential changes to federal or state tax rules and regulations, including a loss or reduction of benefits from certain tax deductions and credits; difficulty obtaining commercial property insurance, and risks associated with our participation in the commercial insurance property program; evolving cybersecurity risks, such as those involving unauthorized access, denial-of-service attacks, malicious software, data privacy breaches by employees, insiders or others with authorized access, cyber or phishing attacks, ransomware, malware, social engineering, physical breaches, or other actions; and difficulty in making accurate assumptions and projections regarding future revenues and costs associated with equity investments in companies we do not control.

Additional information concerning these, and other factors can be found in ARLP’s public periodic filings with the SEC, including ARLP’s Annual Report on Form 10-K for the year ended December 31, 2024, filed on February 27, 2025, and ARLP’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, filed on May 9, 2025 and August 7, 2025, respectively. Except as required by applicable securities laws, ARLP does not intend to update its forward-looking statements.

View the full press release here.

Investor Relations Contact

Cary P. Marshall

Senior Vice President and Chief Financial Officer

918-295-7673

investorrelations@arlp.comSource: Alliance Resource Partners, L.P.