Recapping the Cannabis Rally

In the U.S., Marijuana stocks have reawakened and have been enjoying investor attention. The last week in August has been one of their best since March 2020. The driver behind the surge in investor interest is the prospect of a significant shift in the regulatory landscape resulting from a potential reclassification of cannabis by the U.S. Drug Enforcement Administration (DEA). This development has provided optimism throughout the industry, causing notable gains in various cannabis stocks.

High Week for Marijuana Investors

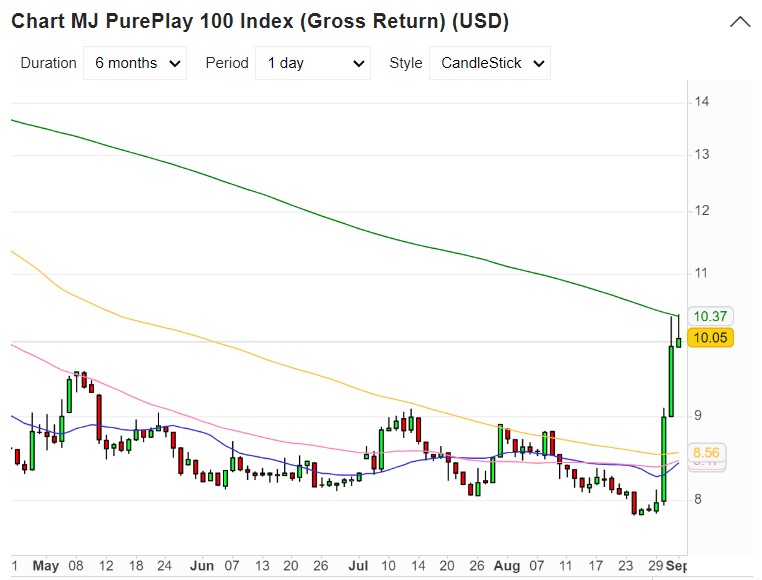

The M.J. PurePlay 100 Index soared by as much as 4.6% at the open on September 1, extending its weekly gain to an impressive 29%. This performance marks the best stretch for the index since March 2020. Similarly a benchmark Cannabis ETF, known by its ticker WEED, enjoyed an extraordinary surge, reaching an all-time high with gains of 45% for the week.

A Shifting Regulatory Landscape

The week brought unexpected excitement as the industry had begun to feel forgotten about. Then, surprisingly, Assistant Secretary for Health Rachel Levine made a groundbreaking recommendation that cannabis be reclassified as a Schedule III drug under the Controlled Substances Act. This strong support immediately drove up the industrys’ stocks as investors look to capitalize on the potential implications.

It then got even better for investors. A more pronounced turning point started when the DEA confirmed its intention to review the current classification of cannabis. This has been anticipated for years, and has not occurred.

For years, the classification of marijuana as a Schedule I drug, placing it alongside substances like heroin and LSD, has posed a significant challenge to the cannabis industry. This categorization has created hurdles for cannabis companies, particularly in their ability to access essential financial services due to conflicting federal laws.

Possible Investor Benefits

Reduced Regulatory Risk: If cannabis is reclassified as a Schedule III drug, it could significantly lower the regulatory risk associated with the industry. This shift would alleviate some of the financial obstacles that cannabis companies face under current federal law.

| Take a moment to learn more about Schwazze, a leading vertically integrated cannabis holding company with a portfolio consisting of top-tier licensed brands spanning cultivation, extraction, infused-product manufacturing, dispensary operations, consulting, and a nutrient line. Click here for company information, including equity research from Noble Capital Markets. |

Banking Services: The reclassification could incentivize more banks and financial institutions to offer traditional banking services to cannabis companies, reducing their reliance on cash transactions and enhancing financial stability.

Research Opportunities: A Schedule III rating would facilitate more comprehensive research on cannabis, potentially leading to its removal from the controlled-substance category in the future. This could open doors to groundbreaking discoveries and innovations within the cannabis sector.

Tax Benefits: A change in classification may lead to the removal of certain tax credit and deduction bans for marijuana businesses, providing financial relief and potentially boosting profitability for the industry.

However, it’s important to note that despite these positives, the cannabis industry may still require additional regulatory clarity. The SAFE Banking Act, aims to address some marijuana stumbling blocks and issues by providing legitamate cannabis businesses with access to banking services. To ensure a smooth transition, further guidance may be necessary to ensure compliance with federal anti-money laundering statutes and other applicable laws.

Take Away

The reawakening of marijuana stocks this week reflects the industry’s growing optimism surrounding the potential reclassification of cannabis by the DEA. This transformative development could have far-reaching implications, ranging from reduced regulatory risks and tax benefits to improved access to banking services and expanded research opportunities. However, investors should stay up to date and informed as the regulatory landscape evolves, keeping a close eye on legislative developments and industry trends to make informed investment decisions. Part of that vigilance could include updates from Channelchek in your email each day by obtaining a free subscription here.

Managing Editor, Channelchek

Sources

https://www.marketscreener.com/quote/index/MJ-PUREPLAY-100-INDEX-GRO-56414425/