Are Treasuries the Safe Bet Investors Think They Are?

Are US Treasury bonds worth owning? US Treasury debt is considered one of the safest investments in the world. The securities are issued by the US government and are backed by the full faith and credit of the US Treasury – guaranteed at the same level as the dollar bills in your wallet. These bonds are a popular investment choice for individuals, institutions, and governments in times of economic uncertainty. But, as with other investments, they are market priced by the combined wisdom of the marketplace. So the return, or what is sometimes referred to as “the risk-free rate,” may not measure up to the potential that stock market investors expect.

Why Allocate to Treasuries

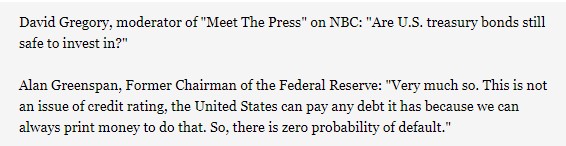

US Treasury bonds are considered a safe haven investment because they are perceived to have a low risk of default. This is because the US government has never defaulted on its debt, and it has the ability to raise taxes and print money to meet its obligations. In addition, the US dollar remains the world’s reserve currency, this makes US Treasury bonds highly liquid and easily tradable.

During periods of low economic clarity, investors that are not required to invest in low-risk investments will weigh US Treasury returns against expected returns in other markets. As interest rates approach or exceed expected inflation US Treasuries become more attractive to investors, both individual and institutional. This is because they provide a reliable source of income (semiannual interest payments) at times of market volatility, and at maturity, owners know exactly what they will receive (face value plus the last interest payment). For example, during the global financial crisis of 2008-2009, investors flocked to the safety of US Treasury bills, notes, and bonds as a safe haven. This drove down yields and pushed up bond prices.

There are three main Treasury Securities, TIPS are not included below, they are T-Notes and have unique risks, so, therefore, deserve a separate presentation.

Treasury Bills:

Maturity: Typically less than one year (usually 4, 8, 13, 26, or 52 weeks)

Yield: Discounted yield, historically lower than T-notes and T-bonds

Size: Available in denominations of $1,000 or more

Treasury Notes:

Maturity: 2 to 10 years

Yield: Par plus interest historically higher than T-bills and lower than T-bonds

Size: Avaialable in denominations of $1,000 or more

Treasury Bonds:

Maturity: 10 to 30 years

Yield: Normally higher than T-bills and T-notes

Size: Avaialable in denominations of $1,000 or more

Overall, the main difference between these securities is their maturity. T-bills have the shortest maturity and are discounted at purchase to provide the yield, while T-bonds have the longest. T-notes fall in between. Additionally, their yields are calculated on an actual number of days held over the actual number of days in the year. The US Treasury yield curve, above which other bonds are priced, depends on market conditions and economic expectations.

Can Not Avoid Risk

Despite their reputation for safety, US Treasury bonds are not without risk. In December of 2021, the 10 year US Treasury note had a market yield of 1.70%. Just ten months later the same bond sold at a yield of 4.21%. This represents an actual loss over the ten month period for those selling the bond then. For those holding until maturity, when they will receive full face value, investors would have to hold more than eight years during which they will be earning a measly 1.7%. This is interest rate risk, the time period used to explain was a recent extreme example of how Treasuries still have very real risk. This is why a good bank investment portfolio manager will do stress tests and scenario analysis of the banks portfolio using extreme conditions.

Another risk is credit rating. In 2011, for example, the credit rating agency Standard & Poor’s downgraded the US government’s credit from AAA to AA+. This was the first time and continues to be the only time the US government has been downgraded. The downgrade was based on concerns about the government’s ability to address its long-term fiscal challenges, including high levels of debt and political gridlock.

Similar conditions may be playing out now as the debt ceiling has been raised quite a bit since 2009, and large buyers such as China are seeking alternative investments for their reserve balances.

Inflation is another risk that is quite real. As in the earlier example of the USTN 10-year yielding 1.7% in December 2021, during the following year, CPI rose 6.5%. this is another recent example of how investing in a low-rate environments can erode the purchasing power of the interest income and principal payments from US Treasury bonds. If the rate of inflation exceeds the yield on the bonds, investors can actually experience a negative real return.

If the government is seen as possibly not being able to pay interest on maturing securities, as is the case during debt ceiling standoffs, US Treasuries coming due may experience illiquidity problems as bids for maturing debt that may not get paid on time will be weak.

Although US Treasury bonds are highly liquid and easily tradable, there may be periods when the market for the bonds becomes illiquid. This can make it difficult for investors to sell their bonds at a fair price, especially during times of market stress or uncertainty.

How to Invest in Treasuries

Investors can buy US Treasury bonds directly from the US government (treasurydirect.gov) or through a broker. The bonds are issued and market priced at auctions on a regular schedule. Individual investors typically will bid to own securities at the average auction price. Savvy institutions and individuals may contact their broker and bid at the auction and hope to win an allotment.

Investors can also invest in US Treasury bonds through mutual funds or exchange-traded funds (ETFs). These funds don’t offer the benefit of holding to maturity or some of the tax planning strategies that can benefit those holding a security and not a fund.

Take Away

US Treasury bonds are considered a safe haven investment in times of economic uncertainty. They are backed by the full faith and credit of the US government and are considered one of the safest investments in the world. While they are not without risk, they remain a popular choice for investors seeking a reliable source of income and capital preservation. The US government’s credit rating was downgraded once, but investors continue to have confidence in US Treasury bonds due to the idea that they may not be safe, but they are likely the safest place to store savings.

Managing Editor, Channelchek

Sources

https://www.bls.gov/opub/ted/2023/consumer-price-index-2022-in-review.htm