Washington’s Economic Playbook According to Michael Burry

One benefit to Elon Musk purchasing Twitter and ridding the platform of many of the auto posts on well-followed accounts is that the well-followed Michael Burry is no longer deleting his tweets the same day as posted. Burry, who began the new year tweeting with a very clear economic roadmap, said less than a month ago that he trusts Elon. As far as the hedge fund manager’s 2023 economic roadmap, his expectations show that he is critical of all those in Washington that have a hand on the economic steering wheel and continue to resist oversteering.

While it can be frustrating for someone like Burry or any investor to forecast missteps by those that most impact the economy, especially if the official entities continue to repeat their behaviors, there is some consolation in the idea that patient investors can use these repeated actions to enhance their account’s performance.

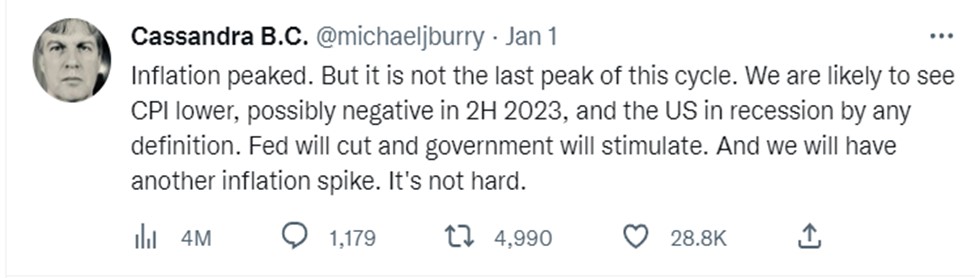

Burry’s New Year’s Message

In 50 words, Dr. Burry, the investor made famous by Christian Bale’s portrayal of him in the 2015 movie The Big Short, said that he expects that inflation for this part of the interest rate, or market cycle, has already passed its high. In fact, he expects that it will be unmistakable, as the year progresses, that the US has fallen into a recession. A recession that can’t be denied or redefined because it will be that deep.

With this economic weakness, the hedge fund manager expects that we will not only see lower CPI readings but by the second half of this year, inflation may even turn negative – deflationary readings.

Burry then goes on to say that this will cause stimulus from both the fed and fiscal policy. This stimulus will be overdone if keeping inflation at bay is the goal. He expects we will have an inflationary period that may outdo the one we are coming off., Burry tweeted. “Fed will cut and government will stimulate. And we will have another inflation spike.”

Take Away

If you ask ten experts what will happen over the next 12 months, you will get ten or more conflicting projections. The Scion Asset Management CIO is often correct on what will eventually occur but just as often as he is right, he is far off on the timing. The scenarios that seem obvious to him have in the past played out a lot slower in the economy and marketplace.

His first tweet in 2023 said that he expects more of the same from the folks in Washington, including the Federal Reserve and the US Treasury. The fed is now pushing hard on the economic brake pedal, which will could cause activity to reach recessionary levels. He expects that this will be followed by a panic move to the gas pedal that will create shortages, increased demand, and consumer price increases.

If he is correct, this means different things to investors with different time horizons. But it appears that Burry expects the tightening cycle to end soon.

Managing Editor, Channelchek

Source