Is Meta the Wrong Path for Facebook, or is it Just Ahead of its Time?

Not all ideas are good ideas, even when they come from billionaire tech start-up founders like Mark Zuckerberg.

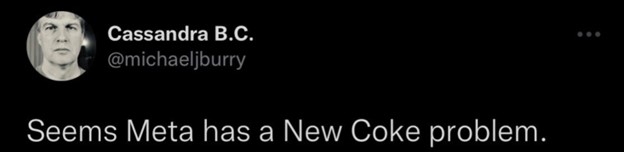

Michael Burry, the legendary investor of “Big Short” fame, has been criticizing the social media giant’s metaverse strategy. Burry joins others in questioning why Zuck would change the Facebook formula and spend billions embracing something that is far from real. Many of Zuckerberg’s critics are other successful billionaires like Elon Musk and Mark Cuban. Other critics are investors that have endured Meta share’s 62.3% ($570 billion) decline since January.

Burry founded and manages the hedge fund Scion Asset Management. Burry tweeted a message that seems to say Meta management blew it – and suggests they have blown it by historic proportions by taking a deep dive into something that may or may not have legs – the metaverse.

Image: @BurryDeleted (Twitter)

You don’t have to have been alive in the mid-1980s to know what Burry was saying when he posted, “Seems Meta has a New Coke problem.” Any business school textbook lists Coca-Cola’s changing the formula of its best-selling product as the #1 lesson in corporate blunders. It was an expensive change that failed miserably and caused the company to revert back to its original product or risk losing a lot more ground against rivals.

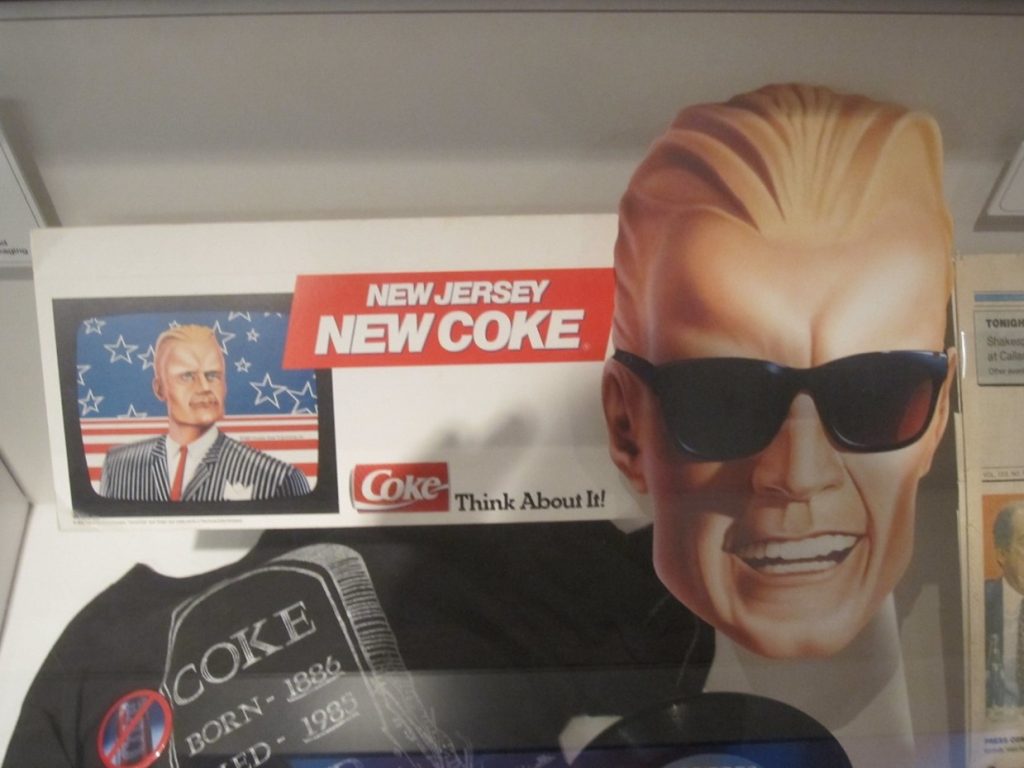

A Sweet Refresher

New Coke was a much sweeter version of the Coca-Cola people had become accustomed to using to wash down their pizza slices, or a burger and fries. It was introduced by Coca-Cola in April 1985 during the cola war Pepsi was waging.

At the time Coca Cola was perhaps one of the most recognized brands in the world. But, Pepsi stole customers after it ran a few Michael Jackson commercials suggesting its sugar water was the “choice of a new generation,” and also backed it up with ads showing blind taste test preferences. Between the taste test science and everyone wanting to be more like Michael Jackson, Coke lost market share. Coke reacted by reformulating its product and did its own blind side-by-side tests that indicated that consumers seemed to prefer the new sweeter taste, similar to Pepsi. The company then decided to market the reformulated recipe – New Coke was born.

Max Headroom was the spokesman for New Coke, Like the Grand Canyon (Flickr)

New Coke was introduced in April 1985, and within weeks they were receiving 5,000 angry calls a day. The number grew from there. Seventy-nine days after their initial announcement, Coca-Cola held a press conference in July 1985 to offer a mea culpa and announce the return of the original Coca-Cola “classic” formula.

Will Zuckerberg Relent?

So far, Facebook, I mean Meta, still wants to identify as a metaverse company, despite there being very few metaverse customers. The company is making sure users have accessories available and just unveiled a new virtual reality headset selling for $1,500 called the Meta Quest Pro. Zuckerberg says lower priced, presumably not “pro,” will follow ($300-$500 zone).

When one has built a business from a college dorm, a garage, or their mother’s basement, and it attains the kind of growth that Facebook, Apple, Amazon, or others have, it’s hard to keep growing at the pace investors and other onlookers have become accustomed to. This leads to a scenario where investors are exposed to a risk best described as the bigger they are, the farther they have to fall.

And Facebook has fallen, not just in dollar value, but in ranking among its peers. Does this mean Zuckerberg is not right? The game isn’t over, and there aren’t many of us that can say, with honesty, that we are more forward-looking or have more luck than Zuck.

Is Michael Burry Right?

There is a whole universe of stocks beyond metaverse investments. Huge successful companies like Facebook or even Coca-Cola have ample resources to build and grow but lose nimbleness and growth potential, unlike the potential smaller companies enjoy. Huge companies are also more likely to have a “say yes to the boss, and you’ll be rewarded” culture, rather than a small company culture which is more “show the boss you can make them money, and you’ll be rewarded” culture.

Zuckerberg and Meta may very well be moving forward with a mistake that could be enshrined in textbooks years from now. However, like Coke, they may find that if it’s a lemon, they can make lemonade. Coca-Cola emerged from the brief departure from their main product strengthened as consumers discovered what life was like without their favorite soft drink.

Take Away

Michael Burry is worth paying attention to. He thinks differently and has been correct enough to always listen. The metaverse is new; does this mean it won’t grow and become something only a visionary like Mark Zuckerberg can imagine? It has been an expensive and slow start. I suspect Facebook was much less expensive to get off the ground, and adoption also required ancillary products to be useable by the masses.

A lesson investors should remember from this is how difficult it is for large companies to grow from their current offerings and huge corporate base.

Channelchek is a platform created to help investors uncover the next Apple, the next Moderna, or the next Facebook. It’s a resource to dig deeper into these less celebrated fledgling opportunities and to leave investors with enough understanding to decide whether they should take their own action by buying stock and becoming an owner of something with greater than average potential.

Managing Editor, Channelchek

Sources

https://www.history.com/news/why-coca-cola-new-coke-flopped

https://www.thestreet.com/technology/big-short-burry-says-facebook-and-zuckerberg-are-in-big-trouble

https://www.nytimes.com/2022/10/09/technology/meta-zuckerberg-metaverse.html