mage Source: @michaeljburry (Twitter)Michael Burry’s Advice for Companies to Become Better Values

After my morning coffee and check on stock futures, I peruse Twitter. Coffee is necessary when you may need to translate cryptic messages from tweeters like Dr. Michael Burry. This week, the hedge fund manager, famous for his foresight and creativity in shorting subprime mortgages before the mortgage crisis in 2008, has been very active on the microblogging platform. Two tweets from October 5th are newsworthy, considering their source, their insight, and the concern they convey are described below.

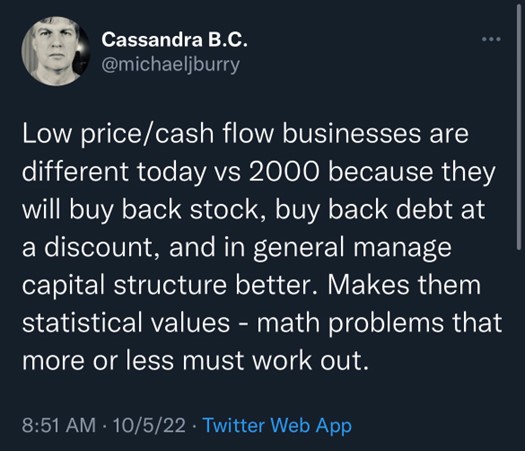

The first reads: “Low price/cash flow businesses are different today vs. 2000 because they will buy back stock, buy back debt at a discount, and in general manage capital structure better. Makes them statistical value – math problems that more or less must work out.”

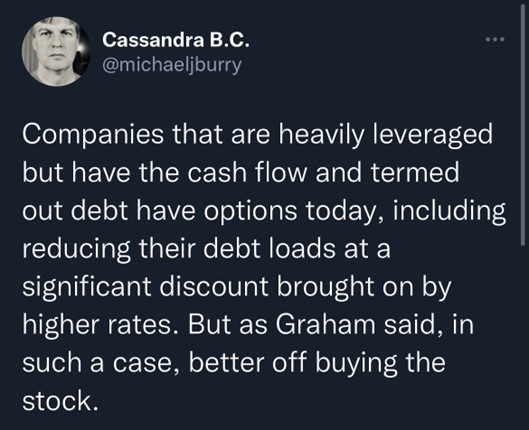

The second says, “Companies that are heavily leveraged but have the cash flow and termed out debt have options today, including reducing their debt loads at a significant discount brought on by higher rates. But as Graham said, in such a case, better off buying the stock.”

Taking these two tweets together, they make sense. Twenty years ago, interest rates were the lowest they had been since 1965; during the last week in December, plummeting 30-year mortgage rates had broken below 6%. Despite cheaper money, corporate treasurers and finance officers didn’t use the situation to shore up their capital structure and build a better base to grow on. The equity markets were weak from August 2000 until May 2009, after the financial crisis that in part came about because of how the cheap money was used.

Companies that are not stretched and are earning money today have the choice of strengthening their financial foundation by either buying their stock at today’s bearish prices. A stock buyback has the effect of reducing shares available in the market as they are now in the company’s treasury. Reduced float tends to increase the price and benefits shareholders. The company does have the option of selling these shares should an opportunity present itself where it would like to raise capital selling previously available shares.

Burry also mentions leveraged companies. Having just come off of 40-year lows in interest rates, it was, in many cases, prudent for companies to leverage themselves with cheap money. These loans, present-valued at today’s higher rates, can be negotiated and paid off at a discount. For companies with adequate cash flow, they may be able to substantially reduce debt for a fraction of the principal amount. Here is how to best get your head around this, if you are a lender and the borrower is paying you 2%, and rates are now 6%, how much less than the borrowed amount would the borrower have to give you in order for you to do better than breaking even? You can lend one-third of the money at 6% and earn the same cash amount. So the borrower is in a great negotiating position.

Michael Burry makes no secret of the fact that he is an avid reader. “Graham” refers to Benjamin Graham the “father of value investing.” Burry reminds us that, according to this historically significant, well-published value investor, investors and companies are generally better off buying back their own stock.

Take Away

There are showmen that are on TV and keep their jobs by keeping viewers glued to their TV sets, and there are others that comment on the market for less-commercial reasons. Those on TV and writing on well-read sites like Yahoo Finance are worth reading to understand what others are reading. Proven, outside the mainstream thinking is worth paying attention to in order to diversify the information your weighing as an investor.

You can even think of it this way; no one pays Burry for advertising on Twitter accounts used by Burry or some other well-followed investors. Whereas mainstream news only exists because of paid-for advertising from companies and industries that they cover. This doesn’t mean he will always be correct, but, who might be less biased?

Managing Editor, Channelchek

Source

Twitter @michaeljburry