Crypto Mining can Retire Fossil Fuels for Good. Here’s How

To many, cryptocurrency may be considered the antithesis to ESG. Bitcoin, for instance, it consumes more energy per year than countries such as Finland and Belgium. However, new regulations and approaches to cryptocurrency and cryptocurrency mining could reduce carbon emissions as the industry turns to renewable energy and innovative solutions. Karen Jones, a Space Economist at The Center for Space Policy and Strategy, examines how ESG concerns from investors, the financial sector and governments are changing cryptocurrency and how, in turn, cryptocurrency could become a catalyst for renewable energy projects.

The future of blockchain is bright, but first we need to bring our expectations back to earth. To realize its full potential, the decentralized finance (DeFi) market must operate within regulatory guard rails — to protect both investors and the planet.

- Cryptocurrency mining using proof of work calculations is very energy-intensive, but it isn’t the only option.

- New regulations and new approaches to mining cryptocurrencies could also see reduced carbon emissions as the crypto industry turns to renewable energy and innovative solutions.

- And looking long term, could space-based solar power one day fuel a space-based blockchain revolution?

Since the great cryptocurrency meltdown of May 2022, DeFi has been in the spotlight. Regulators are considering new ways to protect investors and discourage fraudulent activities after hundreds of billions of dollars in value were wiped out and entire currencies became essentially worthless, nearly overnight.

The Cost to the Planet

Now the market faces another challenge. Regulators and Environmental, Social, and Governance (ESG) motivated investors are applying pressure to reduce carbon footprints across many industries — especially the relatively new cryptocurrency market.

Even after this year’s major hit to the market, the global market capitalization for cryptocurrency is still approximately $1.04 trillion. And these companies — this technology, as it stands — is built on the mass consumption of energy.

Senior US politicians have warned that the seven largest crypto companies expect to increase their computing capacity to 2.4 gigawatts. That is a 230 percent increase from current levels, and enough energy to power 1.9 million homes. They called the miners’ energy consumption “disturbing.”

In early May this year, researchers at Columbia University estimated that global mining for Bitcoin alone, just the most popular among hundreds of cryptocurrencies, consumed more energy than the entirety of Argentina and emitted roughly 65 megatons of carbon dioxide into the atmosphere every year.

Cryptocurrency Legislation is Ramping Up

Blockchain-based currency is still in its wild west days, but policymakers are taking notice.

United States legislators have proposed a bill that aims to establish a framework for regulating cryptocurrency, including provisions directing the Federal Energy Regulatory Commission to study the energy impact of the cryptocurrency industry.

The crypto market currently involves energy-intensive mining to solve cryptographic problems, a key component of the blockchain for proof of work, the calculation computers complete to create a new Bitcoin. To reduce power needs, many blockchain applications are shifting from the energy-intensive proof of work consensus to proof of stake, which still validates entries onto the shared ledger, but emits far fewer greenhouse gas (GHG) emissions in doing so.

Despite the huge emissions caused by parts of the industry, not all crypto mining efforts have such large carbon footprints, even when they use proof of work. Mining can rely upon solar, wind, hydroelectric and geothermal renewable energy systems. To discourage carbon-intensive crypto mining operations, New York legislators have proposed a moratorium to partially limit cryptocurrency mining operations that use proof of work authentication methods to validate blockchain transactions. The moratorium would not apply to mining operations that utilize renewable energy.

The Paris Climate Agreement’s goal of Net Zero 2050 is ushering in an era of self-scrutiny, as industries examine their own industrial processes and carbon footprints. One way to do this is to evaluate the cradle to grave lifecycle assessment of a crypto transaction. Sometimes referred to as an environmental lifecycle analysis (E-LCA), this framework provides a structure for conducting an inventory and assessment of a product’s environmental footprint.

Moving towards a lifecycle assessment will also help companies produce data driven ESG statements. As ESG standards guide investors to green products and services, more industries, including crypto companies, will conduct a self-analysis of their own carbon footprints and environmental lifecycles. And good actors will be motivated to assess and broadcast their virtuous carbon-free lifecycles.

Although most environmental lifecycle-related disclosures are currently voluntary, this could change. The United States Securities and Exchange Commission (SEC) has proposed rules for registrant companies to conduct Scope 1, 2, and 3 emissions inventories. If these proposed rules become law, publicly traded cryptocurrencies would need to understand their life cycle emissions intensity, from direct operations (Scope 1), electricity purchases (Scope 2), and indirect upstream and downstream activities (Scope 3) emissions.

Crypto Mining as a Catalyst for Renewable Energy Projects

While there is always a fear that conducting an environmental assessment might reveal “inconvenient details,” it also represents a unique opportunity.

Crypto mining companies are often located near power sources to feed their power-hungry computers. As a result, crypto mining can be a catalyst or market driver for new renewable energy projects. For instance, Digital Power Optimization, in New York, now runs 400 mining computers from spare electricity produced by a hydroelectric dam in Hatfield, Wisconsin. There are many remote geographic areas where the energy demand market is not large enough to support a utility scale renewable energy site.

It is this symbiosis of crypto computer farms and remote green energy projects which offers the potential for mutual benefits — and it may not stop with rural projects.

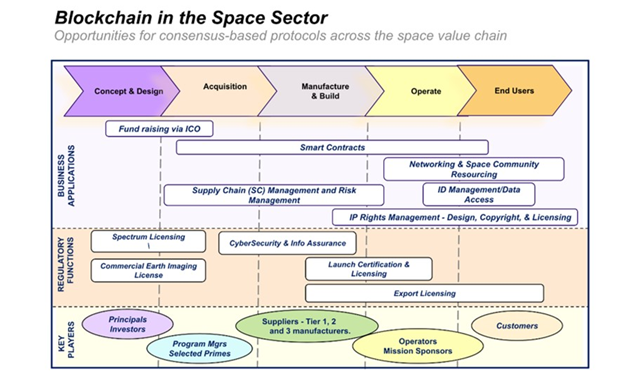

Many cryptocurrency stakeholders and enthusiasts expect the DeFi market to expand its reach into near space, the moon and beyond — and this idea is not far from being realized. A range of distributed ledger technologies are already being considered for the space domain.

A multi-signature Bitcoin transaction has been demonstrated on the International Space Station. Other companies are moving forward with various space applications, including fundraising, smart contracts, autonomous satellite communications and blockchain applications for managing a range of satellite assets in a decentralized and accountable way.

Perhaps one day in the future an orbiting space-based solar power plant could generate several gigawatts of clean energy and power a range of blockchain applications in space.

Image: The Center for Space Policy and Strategy

Several countries, including China, India and the UK are seriously considering space based solar power. As the world seeks decentralized, accountable and carbon free technical solutions, it is this type of cooperative partnership between clean energy providers and blockchain applications that can answer the call.

About the Author:

Karen L. Jones is a Space Economist at The Center for Space Policy and Strategy.

This article first appeared on the World Economic Forum website in August 2022.