Image Credit: CDC (Pexels)

Is Biotech’s Outperformance Reaching a New Stage of Development?

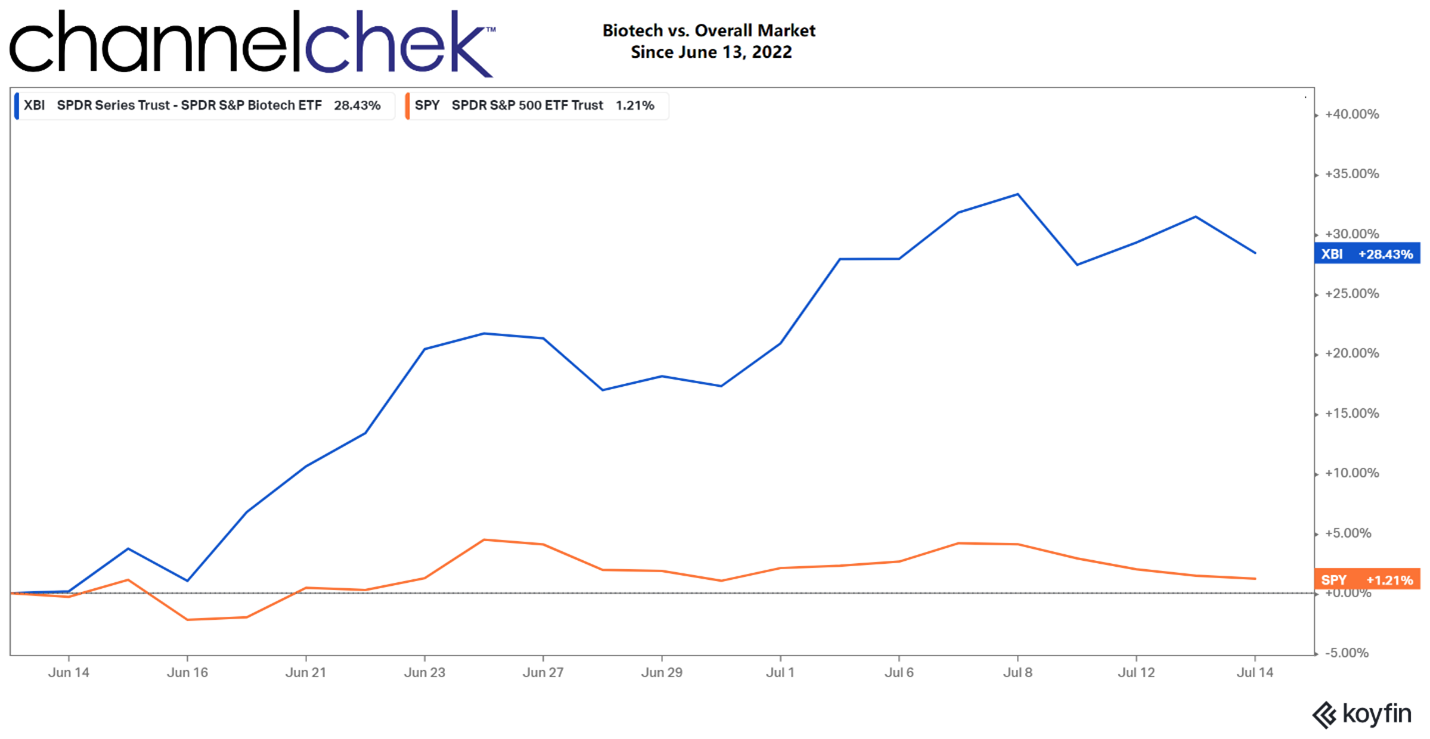

The biotech investment sector has always been its own market, very distinct from other sectors. So it was no surprise that when most sectors turned slowly upward after the pandemic-inspired crash, Biotech (XBI) rose 164%, exceeding the overall market (SPY) performance by triple digits. Then, about 11 months from biotech’s launch to the stratosphere, it took its own path downward even though the overall market continued upward for another 11 months. In recent weeks the overall market has been trading sideways after hitting a YTD low on June 16th. Over the same short period, the biotech sector has gained double-digits.

This past June 13th, the SPDR biotech ETF formed a technical double bottom (May 11/Jun 13) and has since risen near 30% in one month’s time. It was obvious what drove these stocks higher during the pandemic. The enthusiasm for modern medicine was at a peak with the news on most people’s minds each day. But what is driving this sector’s heights now, and will it continue?

What’s Happening

Since the start of the current upturn on June 13, the XBI is up 28.4%, after biotech’s period of being among the most beaten down sectors most of the year. The XBI would still have to rise by another 25% to reach breakeven on the year. Some investors think that its slide was overdone and are now allocating more to the biotech sector.

Source: Koyfin

In a note on Thursday (July 14), Piper Sandler analyst Christopher Rayment said $1.1 billion in net new money, the second-highest total this year, flowed into funds focused on healthcare and biotech for the week ended July 6. One catalyst for the increase could be reports from The Wall Street Journal that Merck (MRK) may be involved in a $40 billion purchase of the biotech Seagen (SGEN), a cancer-focused drugmaker. Also, the FDA approval scientists are less bogged down with pandemic-related entries and can begin to move forward, business as usual, with their approval studies.

The Seagen deal could further increase investor interest in the sector as the Merck name will likely keep it in the headlines. And perhaps it is time that biotechs regain attention, they are far cheaper than they have been in years.

Recent biotech deals receiving less attention are:

- La Jolla Pharmaceuticals (LJPC) on July 11, acquired by Innoviva at an 84% premium

- Epizyme (EPZM) on June 27, acquired by Ipsen at a 53% premium

- F Star Therapeutics (FSTX) on June 23, acquired by invoXPharma at a 122% premium

- TherapeuticsMD (TXMD)on May 31, acquired by EW Healthcare Partners at a 367% premium

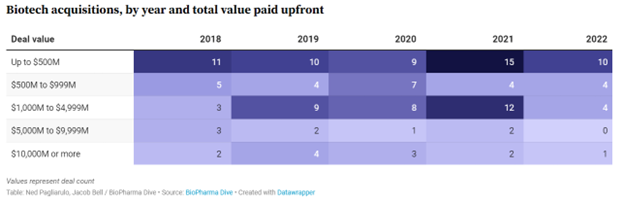

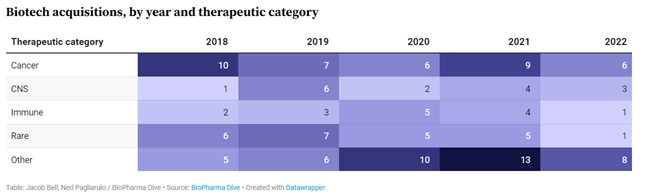

The pace of acquisitions, just past the halfway point of the year, is running above the previous four years. The category impacted most often in each of the five periods is oncology.

* The data is limited to deals valued at a minimum of $50 million upfront. Total consideration can reflect both cash and equity offered upfront in exchange for the acquired company’s shares, but deals in which the upfront payment was not specified, or was less than $50 million, are not included.

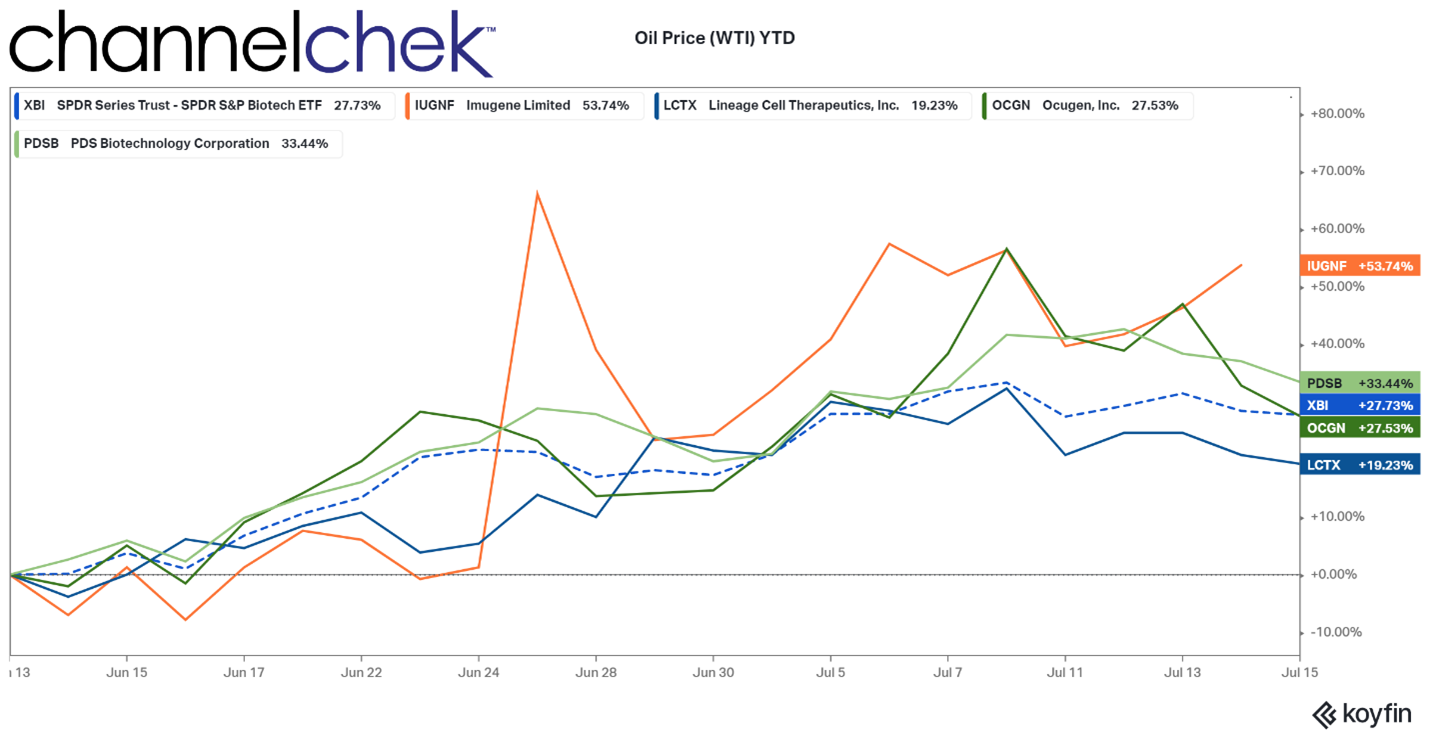

Since the June 13 turn upward, other companies in this space that generated double-digit returns for shareholders, near or above XBI are:

- Imugene (IUGNF) up 53.7%

- PDS Biotechnology (PDSB) up 33.4%

- Ocugen (OCGN) up 27.5%

- Lineage Cell Therapeutics (LCTX)up 19.2%

Source: Koyfin

Take Away

The biotech sector is not highly correlated with the overall market. During periods of market weakness, it is a good idea to look at less-correlated sectors to determine if there is relative strength and opportunity.

Biotech investors often look to a company’s pipeline to determine where it may be in developmental stages to determine if a valuation-changing breakthrough could be near. Astute investors also try to find gains by investing in companies with the potential of being acquired. The current scenario where huge pharmaceutical companies are sitting with cash at very high valuations, and biotech firms have been beaten down, creates a recipe for increased mergers and acquisitions. Also, many biotechs that rely on capital raises to get them through the long R&D or approval stage find it more difficult to raise capital when their stock trades very low. These companies with a worthwhile pipeline are now very attractive to large better-capitalized companies. For the small biotech companies, they may be more willing than ever to be acquired to keep their treatment development on track.

In the business of drug development, deals are as important as medical breakthroughs. Many of today’s most influential medicines might not have made it to the finish line without a timely partnership or acquisition.

Managing Editor, Channelchek

Suggested Content

Lineage Cell Therapeutics (LCTX) NobleCon18 Presentation Rebroadcast

|

Ocugen (OCGN) NobleCon18 Presentation Rebroadcast

|

Genprex (GNPX) NobleCon18 Presentation Rebroadcast

|

Pasithea Therapeutics (KTTA) NobleCon18 Presentation Rebroadcast

|

Sources

https://app.koyfin.com/share/dd2a65e582

https://www.thestreet.com/investing/cathie-wood-ark-buys-biotech

https://www.wsj.com/articles/merck-is-in-advanced-talks-to-buy-seagen-11657160827

https://www.wsj.com/articles/merck-eyes-purchase-of-biotech-seagen-11655476223?mod=article_inlin

https://www.pipersandler.com/2col.aspx?id=7&analystid=2284

Stay up to date. Follow us:

|