|

|

|

|

Gold May Become Investors’ Favorite for Several Years

Gold investments are having a great week by any standard and a much better week than equities. The safe haven precious metal could maintain this strength for as long as the Federal Reserve Bank is intent on holding rates at zero. The Fed’s intentions were made public on Wednesday as Chairman Powell, said he expects the Fed to hold rates to near zero through 2022.

The Fed’s Outlook

Although not at their recent highs, gold futures, gold mining stocks, and physical gold traded higher after the announcement with strong follow-through Thursday as equity markets tumbled. Powell also presented the board’s forecast, which was disappointing for those expecting a sharp economic comeback. They foresee unemployment improving to only 9.3%, economic activity receding by 6.5% through 2020, and then GDP growing by 5% in 2021. The projections don’t have the U.S. at the same economic pace until sometime in 2022 when the Fed’s forecast is for an additional 3.5% increase. Through 2022 The Fed expects to keep rates near zero with no visible end to their buying Treasuries and other securities.

The Fed’s stated resolve, along with disruptions and concerns of global events, heightened additional interest in gold investments. During a phone interview with Bloomberg, Matt Weller, global head of market research at Gain Capital Group, LLC said, “You almost couldn’t come up with a better script for a strong fundamental environment for gold than what we saw from the Fed yesterday.” The quote continues, “It’s really an environment of rampant monetary stimulus, and historically that’s exactly the type of environment in which gold has thrived.” Low yields on safe harbor securities such as U.S. Treasuries eliminate the lack of passive return that has caused bond purchasers to not prefer gold. Meanwhile, the stimulus could effectively reduce the value of the US Dollar while creating an inflationary environment. All of these together could be the perfect storm for gold to continue to outperform.

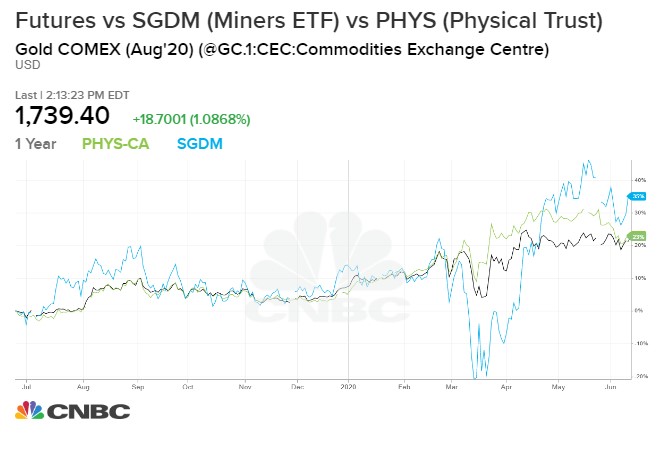

Note: Gold futures (Aug ’20), mining stocks (Sprott Miners ETF as a proxy), and physical gold (Sprott Physical Gold Trust) on the chart above indicates the three are off their highs of April and May but now trending upward in synch.

During mid-March of this year, there had been a disconnect between mining stocks, physical gold ETF’s, and gold futures. Channelchek discussed the reasons in an article which then presented silver as an alternative for safe-haven investors. The recent resumption of air travel and reopening of mines that had been affected by lockdowns have caused the three popular forms of gold investments to trade at their more historical variances. The current one-year returns of the three are, as of June 11, 2020, 35% gold futures, 23% gold miners, and 22% physical gold.

Additional Strength

Precious metals still generate additional interest each time cases, and large pockets of novel coronavirus make the news. This creates additional strength in gold. The unknown and the possibility of a second wave of cases in the U.S. bring buyers in. Small surges of new infections in states including Texas, Florida, and California have raised concern among health experts even as the nation’s overall case count has experienced its smallest increase since March.

Dominic Schnider, head of commodities and Asia Pacific currencies at UBS Group AG, told Bloomberg Television, “The conditions are here for gold still going to $1,800.” He reminded the audience that low rates and the possibility for negative real rates (interest rates less inflation) would improve gold’s attractiveness.

Take-Away

Gold is in a position to test its high of the year and perhaps go much further. The conditions now would seem ideal, with the only caution being, “why aren’t they higher already?” The answer may be, despite unprecedented economic issues, optimists have controlled the markets. In a year where equity markets reached new highs against any sense of reason and companies have rallied double-digits after declaring bankruptcy, another possibility may very well be that there were too many distractions and other opportunities. Economic optimism appears to be fading again. The stage is set for gold investments to continue to shine; time will tell if they do.

Virtually attend live: Channelchek Virtual Road Show Series presents ELY GOLD Wednesday, June 17th @ 1 pm EST (participants limited to 100).

Suggested Reading:

Where New

Savings and Investment is Coming From

Why Gold

Could Retain Its Luster

Enjoy Premium Channelchek Content at No Cost

Sources:

Gold Set for Biggest Gain in a Month

Gold Set for Biggest Gain in a Month on Fed View, Virus Concerns