|

|

|

|

Would Anyone be Shocked if the Market Suddenly Capsized?

Is the market’s pricing mechanism temporarily broken, or is it now forever changed? Could it be that retail traders and investors are now the “smart money,” or will they be shown to be suckers? These are the debates taking place among veteran traders at their virtual “water-coolers” and among less-seasoned retail investors in online chat rooms and Facebook groups.

We’re approaching mid-year 2020, it’s a presidential election year that began with the stock-market breaking record highs while corporations were guiding earnings expectations lower. These were expected to be headlines that set the tone in the first half. These expectations have all but been overshadowed. Since the new year opening bell on Thursday, January 2, 2020, we’ve experienced a rollercoaster record high in the S&P followed a rapid 30% drop, which rebounded in a “V-shaped” bottom to close even on the year.

Some of the most followed and admired investors, such as Warren Buffett, Stanley Druckenmiller, Jim Cramer, and others, famously missed the strongest rally in 90 years. At the same time, self-directed investors, mom and pop, and younger, less-seasoned newbies have been participating in some of Wall Street’s biggest and most unexpected moves.

Hundreds of thousands of individual investors trading small positions online and from phone apps are pushing up prices of companies that have recently filed for bankruptcy protection or teetering on the edge of default.

In a market as different as the 2020 environment, it’s not surprising that the average daily trading volumes for some of the financially unsound names have been up as much as 30 times their 2019 average. The soaring companies are, in many cases, the same firms that have seen skyrocketing interest at brokerages popular with individual investors.

The website Robintrack, which is not affiliated with the Robinhood trading application, downloads Robinhood’s trading data, then provides users with tools for analysis and allows downloads at no cost. Although Robintrack doesn’t capture data from other retail broker activity, the information can be used as a gauge of trends and popularity of the do-it-yourself investor.

Robinhood Favorites

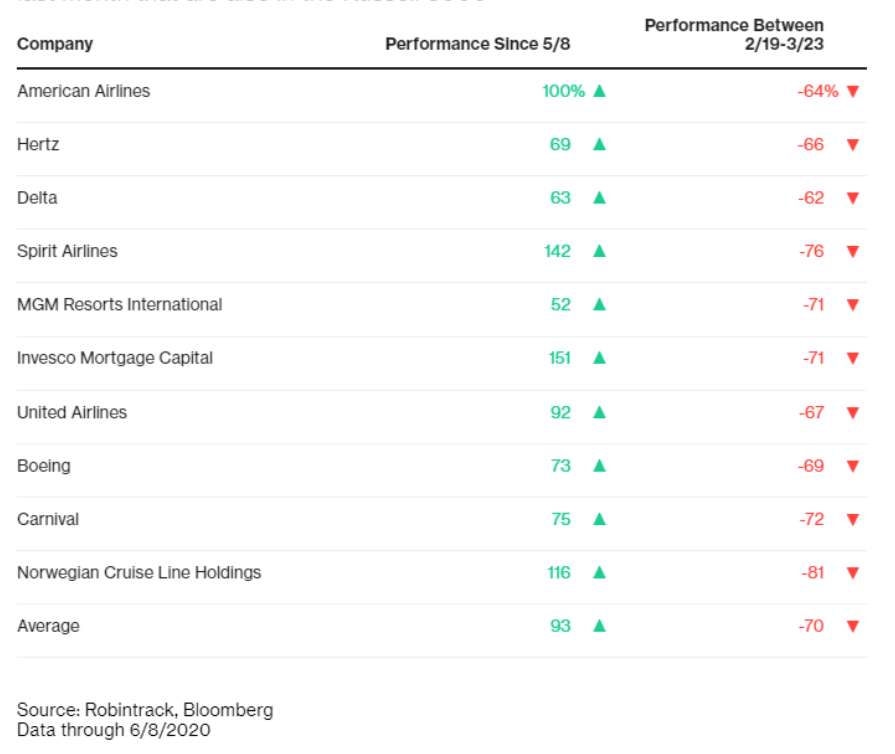

Below are the top ten stocks (out of top 3000 by market cap) that have seen the largest increase in interest on Robinhood over the last month:

Out of the “Robinhood favorites,” all are household names that most people would recognize. With the exception of Invesco, all are experiencing severe financial challenges. The first on the list, American Airlines, lost $2.2 billion in the first quarter. The second most popular, Hertz, filed for bankruptcy protection on May 22. The tenth on the list, Norwegian Cruise Lines, warned of a possible bankruptcy in late May. These three provide solid examples of retail popularity along with price movement that is helping to drive prices unpredictably.

American Airlines

Source: Robintrack, CNBC Data

Through 6/9/20

Despite the uncertainty in the airline sector, Robinhood users have gone from roughly zero holdings in American Airlines to almost 650,000 shares. Shares are up 57.35% over the past five trading days, along with the increased volume. Changes in data, activity, and increases in popularity on Robinhood may become additional indicators of short-term price movements for traders looking for trading plays.

Hertz

Source: Robintrack, CNBC Data Through 6/9/20

Robintrack’s data indicate that 159,000 of their users currently hold Hertz stock. That’s a record high and an increase of over 430% from 37,000 users a month ago. Over the past five trading days, the dramatic increase in volume has been accompanied by a 416% increase in stock price. Did the experts get this one wrong, or are smaller owners ignoring the risk of holding HTZ? Either way, there has been a large amount of money to be made by any standard.

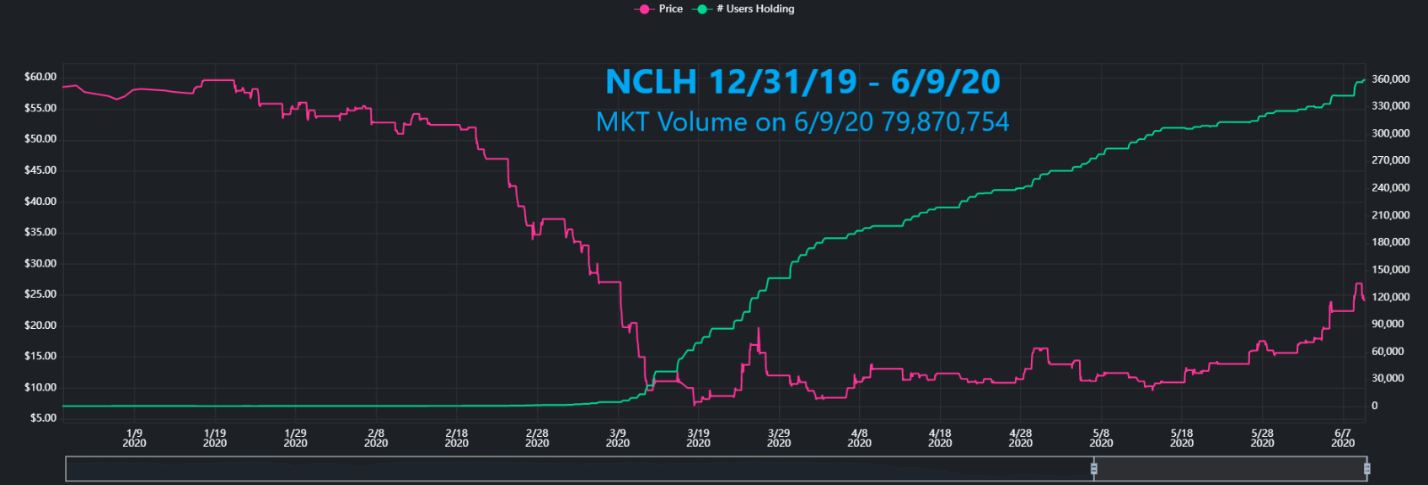

Norwegian Cruise Lines

Source: Robintrack, CNBC Data Through 6/9/20

Norwegian Cruise Line’s growth in popularity from approximately zero to now close to 360,000 holders among Robinhood users ignores many of the challenges in the hospitality industry. However, the 39.61% increase in the stock price over the past five trading days has certainly been cause for many self-directed investors to feel their purchase is justified.

Taking from the Poor and Giving to

the Rich?

Are online self-directed investors ushering in a new era of profitable contrarian investing, or will the days ahead prove to be disappointing and costly? Despite the increase in activity, the average holding per user is small, even if Individually, their positions represent significant positions. As far as Wall Street is concerned, retail is looked at as a block, despite the idea that the activity is hundreds of thousands of small investors rather than one or two institutions with billions taking a position.

The extraordinary movement in both stocks that are popular on Robinhood and in the market as a whole is still in the midst of a powerful move. Expectations among professionals are that historic unemployment and mounting corporate losses, along with a deep recession, will remove the giddiness among all market players. If the experts have it right, the upward movement across the major indexes cannot continue to attract new retail investors, and institutional investors are apt to stick with conventional valuations. These valuations suggest the market is overpriced. If these attitudes hold, it is a recipe for losses for those in the market. This may leave many retail investors battered.

Suggested

Reading:

Trading

Technology Continues to Level the Playing Field

Emotions,

Markets, and Mayhem (Faith in Cycles)

Should

the Market Be Up Double Digits?

Enjoy Premium Channelchek Content at No Cost

Source: Hundreds of Thousands of Tiny Buyers Swarm to

Insolvency Stocks

Robinhood

traders cash in on the market comeback that billionaire investors missed