The Drop In Canadian Oil Production Will Have Long-term Effects

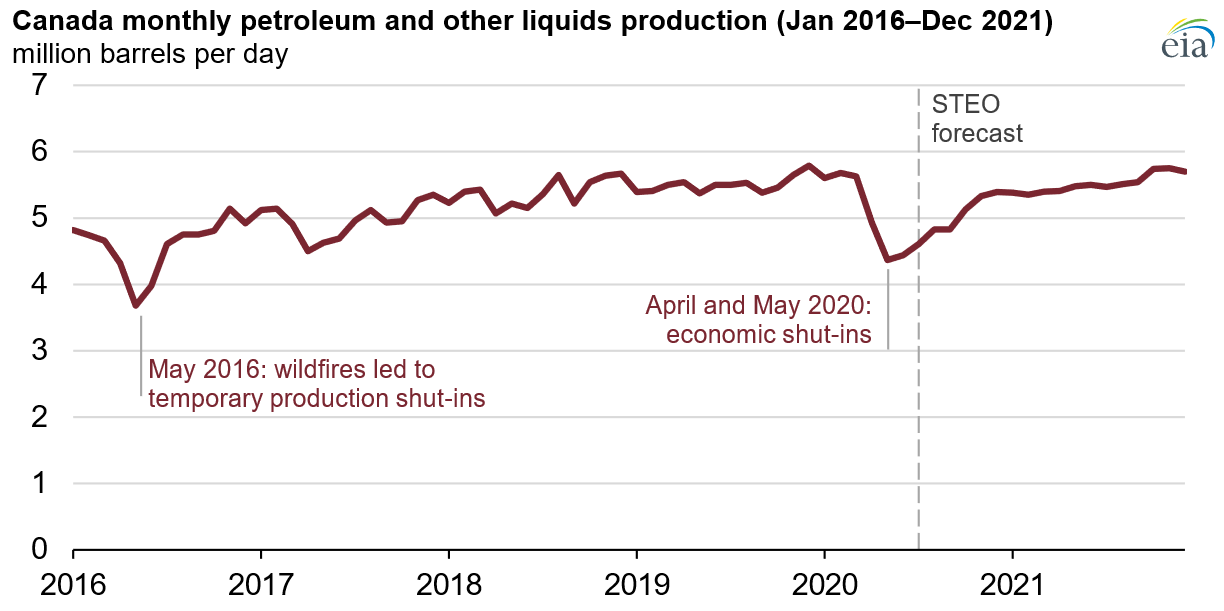

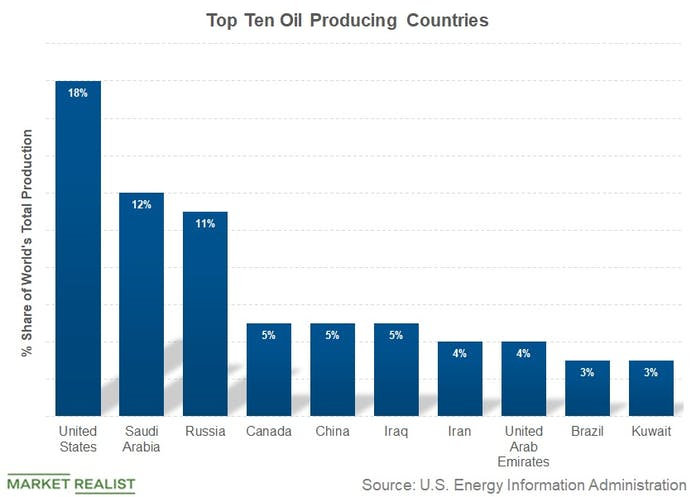

The drop in oil prices in April has not been kind to Canadian producers. That, combined with imposed production curtailments by the government of Alberta has led to a 20% decline in daily production versus the 2019 average. This decline is twice the output decline of OPEC countries and the third largest overall decline after Russia and the United States. The decline for the fourth-largest producer of oil amounts to 1 million barrels of oil per day or 1.3% of the world’s daily supply.

Source: U.S. Energy Information Administration (EIA)

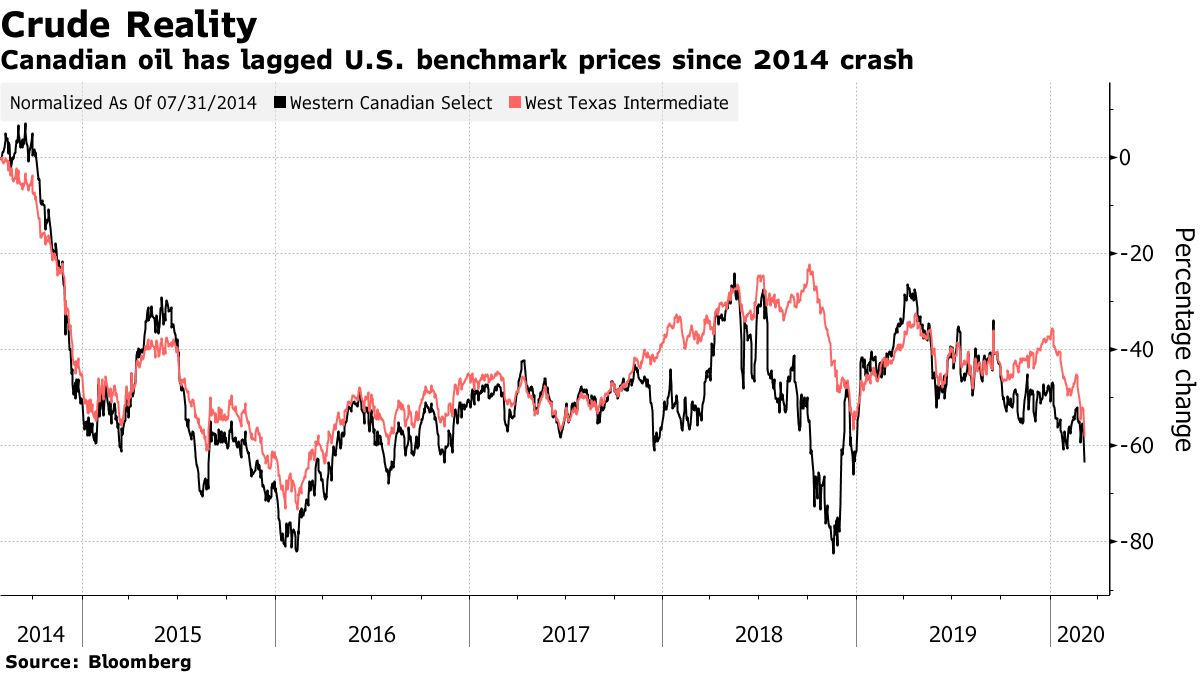

Canadian producers are especially hard hit by declines in oil prices. Oil sand production is among the higher cost production. Production costs have been dropping from a level of US$65 but are still believed to be in the mid-forties. Canadian production may be the first to be shut in when oil prices drop. What’s more, Western Canada typically receives a lower oil price than other areas due to pipeline constraints. This has been especially true in recent years because western Canadian oil prices have fallen sharper than the West Texas Intermediate oil price. This disparity is unlikely to abate in the near future due to delays in construction of the Keystone Pipeline. It’s no wonder, then, that major producers such as ExxonMobil, Shell, ConocoPhillips and Marathon Oil Corporation have all reduced or withdrawn their investments in oil sands in recent years.

Some producers, including Canada’s largest producer Suncor, view the decline as temporary. Suncor Chief Executive Mark Little said on a quarterly call with analysts that “By the end of the year, if we don’t have this upset with a second COVID outbreak, we expect essentially all crude in Western Canada to be back online.” Others believe the problems faced by Western Canada producers precede COVID or OPEC production level issues. Ricochet points out that major oil companies have more debt than revenues, estimated at $250 billion coming due in the next five years. With electric vehicles eating into the largest component of oil demand, it is unlikely that oil producers will be bailed out by higher oil prices.

Source: U.S. Energy Information Administration

In many ways, the perils facing Canadian producers are not different than that of U.S. producers. However, higher production costs and tighter pipeline capacity make the situation a more immediate concern.

Suggested Reading:

Is M&A Picking up

in Energy Sector

Exploration and

Production Second Quarter Review and Outlook

Is $40 the Sweet Spot for Sweet Crude?

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you here.

Sources:

https://www.eia.gov/todayinenergy/detail.php?id=44396&src=email, U.S. Energy Information Administration, July 16, 2020

https://www.yahoo.com/news/canadian-oil-companies-moving-restore-144252160.html, Rod Nickel, Reuters, July 23, 2020

https://www.bloomberg.com/news/articles/2020-03-09/oil-rout-tests-canadian-energy-producers-cost-cutting-drive, Kevin Orland and Robert Tuttle, Bloomberg, March 9, 2020

https://ricochet.media/en/3116/oil-was-doomed-before-the-pandemic, Will Dubitsky, Ricochet, May 14, 2020

https://boereport.com/2019/05/01/costs-of-canadian-oil-sands-projects-fell-dramatically-in-recent-years-but-pipeline-constraints-and-other-factors-will-moderate-future-production-growth-ihs-markit-analysis-says/, BOE Report, May 1, 2019