|

|

|

|

The 2020 Investment Buzzword No one is Using Yet!

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

Today when investors say they are “in the market” or “out of the market,” they most often are using shorthand to discuss the stock market. This is understood, even though there are many other active investment markets. The others don’t get as much attention. In fact, because of current investment practices, the term “in the market” usually implies exposure to one of the major index averages.

It wasn’t always this way. Not too long ago, investors would build a portfolio working with a broker and buy a small basket of stocks. Commissions were high, but a good broker was worth the price because of the in-depth research they conducted. Back then, “in the market” didn’t mean broad exposure to 500-2000 holdings. Far fewer. The reason for the change, of course, is an evolution that gained momentum around 1980. It was then that mutual funds started to become understood throughout households, many of which had never been “in the market” before. Mutual funds allowed investors, even small ones, to benefit from what has been a cyclical but rising market, but with much lower entry fees.

The combination of the ease with which large mutual funds allowed an investor to gain or reduce exposure to equities, the comfort of being extremely diversified, the rising trend in stock prices, and the painless built-in fee made mutual funds an easy sell for fund companies.

Once invested, to determine if the fund manager was doing a good job, marketers began benchmarking their funds against major market indexes on the futures exchange (Dow, S&P, and later Russell). Investors were taught that good returns were “index” returns. Investors began to measure if their fund performed satisfactorily by how it stacked up against a broad index. When this became the standard by which investors measured success, mutual fund companies created index funds with the objective of meeting or beating a specific index. Here is where they ran into some problems.

Matching an index, which has no fees, no slippage, and no flow of assets in or out (often at the worst times), is mathematically impossible for a fund manager without taking on additional risk. Index mutual funds often fell short of their benchmark. It wasn’t their fault. When markets are rising, investors put money into the fund, this adds to the average price of the underlying holdings. When markets fall abruptly, investors often pull money out. This locks in lower performance and prevents the fund manager from buying at lower prices. Also, managing fund flows requires a cash position; this dampens fund performance. Innovative financial engineers then addressed the issues and came up with a product that was more capable of tracking a major index return. The product was exchange-traded funds, and these became more popular to people whose goal was “market” returns.

Lower Cost Options

With the goal of index investing and tracking much closer to index returns, exchange-traded funds (ETFs) made their debut in early 1993. State Street Global Advisors created the first which was the S&P 500 Trust (SPDR). This new fund type had lower fees and held a set amount of the underlying stocks. As a result, the fund trades virtually tick for tick with the S&P 500 index. SPDR gained popularity very quickly and is still the most actively traded ETF. Investment advisors have been able to lower the cost to their index fund invested clients as they moved them into this new innovation.

Today there are ETFs that cover all the major indexes. What’s better is they now also cover all the underlying sectors within an index. So if you don’t like Financials but feel Energy is undervalued, you are no longer limited to just receiving broad index returns. You can pick and choose the categories within the equity markets and focus more heavily on one sector over another. Building a custom portfolio using indexed sectors has become a more refined way to give investors above-average potential.

Sector Bifurcation

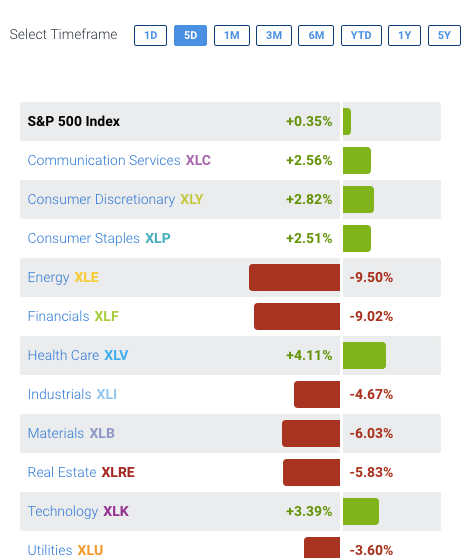

Market sector movement at the start of 2020 is a solid example why those that maintain an active investment portfolio should do more than just sit idle with broad market index funds.

The graphic below demonstrates how the Spyder defined sectors deviate drastically from each other. The economy is going through a period where the markets are bifurcated. There are sectors that are strong and rising while there are sectors that are weak and sinking. This is different from recent experiences where we saw all sectors generally moving in the same upward direction. The markets are likely to remain bifurcated and volatile until the pandemic crisis is history.

For investors looking to “pick their spots” in what is a more difficult market, they now have the ability to target sectors they deem superior and avoid those with low probability of satisfaction. The six-month chart below (Red is S&P 500, SPDR) shows that back in November Healthcare began outperforming the major index while Energy was falling off quite a bit. That trend continued and accelerated during the pandemic. Investors in the Healthcare ETF are up 10% over the past six months, Energy sector investors are down over 40%.

Investors should consider a bias in their holding toward sectors with a more positive outlook and away from those with more negative using targeted ETFs.

Further Bifurcation

Within investment categories, especially during the current crisis, there is further bifurcation. Investing strictly in ETFs, even sector ETFs, means still accepting the bad with the good. The pandemic has clearly altered the direction of individual company earnings. Sector funds don’t take this into account. Here is an extreme example: Midway through last quarter investors began to flee from the category of hospitality. This was wise, the sector includes hotels, travel, restaurants, and event services. Poor performance within this sector was all but guaranteed.

Avoiding an ETF focused on hospitality certainly turned out wise as forecasted. But what was also easy to forecast is that within the sector there would be opportunities in meal-kit companies like Blue Apron (APRN). The conclusion from this is, not only should investors no-longer just “buy the market” they should not just buy sector funds either. Having a core in the broader market is fine, weighing that more heavily with some sector funds is also good, but stock-picking is becoming more important than ever.

Here’s another example, Energy was one of the worst beaten down sectors. Even within the energy sector there were huge gains to be found in companies like COG. Fortunately, investing in individual positions is no longer as expensive per transaction. Picking targeted companies makes more sense than ever.

ETF investing is still a low-cost way for a small investor to benefit from overall market growth without experiencing brokerage fees cutting into their results. They have had their reign and are now just another option to keep in the mix. This has become extremely apparent over the past few weeks, and it appears it will be an issue for a while. Investors may now be entering a new investment cycle where a wider variety of vehicles are implemented.

Just like with other cycles, we seem to be moving back toward where we started, individual stocks.

Finding Opportunity

Looking back since the beginning of the year and looking forward to the foreseeable future, we are seeing some sectors of the market doing substantially better than others. The market is bifurcated and no longer finds most industries, sectors, or even segments within sectors moving in-synch. The differences within each category and within each company will impact a portfolios performance more than it did just nine months ago.

The low and no cost of trading today all but eliminates the cost of commissions from things investors worry about. This cost was a big reason that investors moved to funds, to begin with. The other concern was expertise. As mentioned earlier, investors moved to funds in part to not have to rely on a broker and their research. Today, the internet has brought the cost of quality research down to approximately zero. Just logging on to your computer can put any level investor in touch with more information than any full-service broker ever had in 1980. It also can flood you with bad information and pseudo- research and even schemes to artificially pump stocks. Make sure you can trust where you’re getting your information from. Providers of quality research such as Morningstar,

Channelchek, or Standard &

Poor’s are either partially or completely no cost to subscribers. These, along with information from an online broker, should be plenty for most self-directed investors or even advisors. Sites that promise the next hot stock should be viewed with caution.

Take Away

There are more investment vehicles, low-cost options of transacting, and choice than ever before. Investors that lazily place money in the overall market are not trying to enjoy the best possible returns. The bifurcated market of today is likely to continue. Sectors that will win are often being spelled out for us as we listen to how various stimulus packages are being created. Individual stocks can have extreme performance if they have a unique characteristic that puts their product or service in high demand in changing times. The various research companies offering top-tier information on equities is indispensable as you look for potential opportunity.

Suggested Reading:

Where

Investors Found Double-Digit Growth in Q1

There’s

Opportunity When Market Indexes are Adjusted

Michael

Burry Says Covid-19 Cure Worse that the Disease

Channelchek Community:

Unlimited, no cost subscription to company

research and premium features

Sources:

SPDR Sector Tracker