|

|

|

|

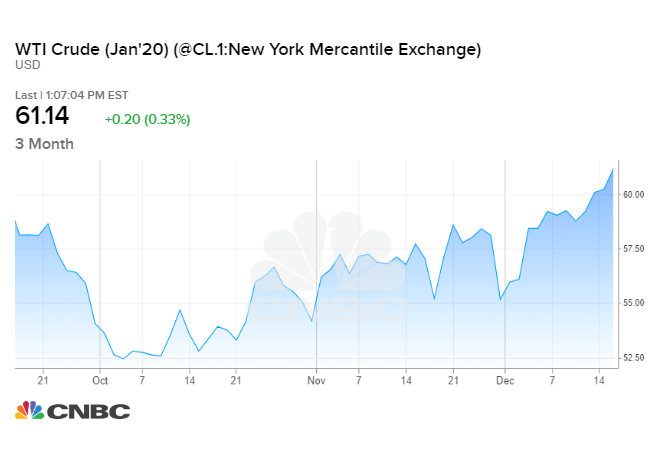

Improving Economy with Production Cuts are Pushing Oil Prices Higher

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

WTI Crude prices have mounted a rally over the last 80 days, slowly rising from a price of $53 per barrel at the end of September to a current price above $60 per BBL. There are many reasons for recent strength, some supply related and some demand related. However, oil prices are not simply a function of supply and demand. Note that the rise in oil prices has occurred at the same time oil inventories have also risen. Instead, oil prices are set by investors who are speculating about future demand and future supply, and investor sentiment is not always easy to measure. Does the rise in oil prices support the bull’s arguments for further increases in oil prices? Or, is the rise based on temporary factors that support the bear’s argument that the rise in prices will be short-lived?