|

|

|

|

Red-hot Biotech Stocks Boosting Small Cap Indexes in Q4

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

Redhot Biotech

Stocks Boosting Small Cap Indexes in Q4

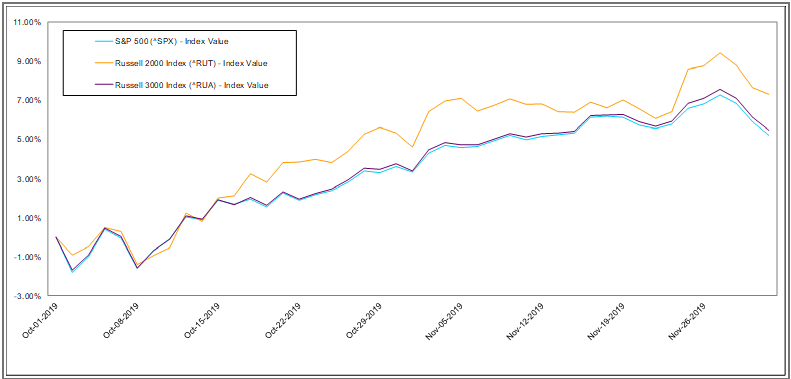

As of December 3, Russell 2000 Index (RUT, +7.3), which is a benchmark for small-cap stocks, is outperforming the S&P 500 (SP50, +5.2%) and Russell 3000 (RUA, +5.5%) benchmark indices in Q4 2019 (Exhibit 1). The Russell 2000 Index is a market-capitalization weighted index measuring the performance of approximately 2,000 small cap American companies in the Russell 3000 Index, which includes 3,000 largest cap U.S. stocks (adjusted annually).

Exhibit 1: Russell 2000 Relative Price

Performance, Q4 2019 (as of 12/3/2019)

Source: CapitalIQ

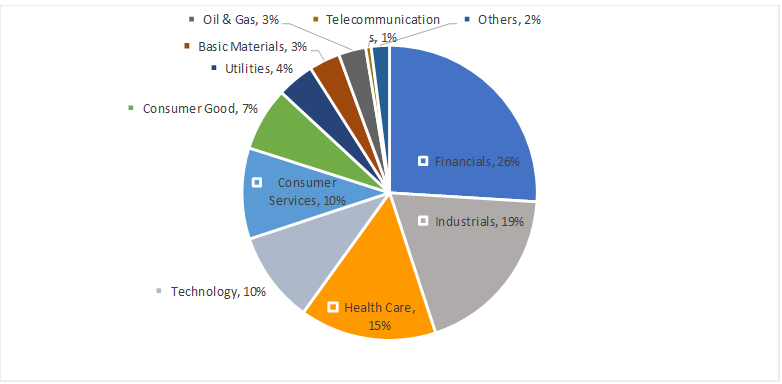

The Russell 2000 index achieved a new 52-week high on November 27 (1,634.1). The strong performance is primarily attributed to the strength in the biotechnology and financial sectors. Biotechnology is a major driver for recent gains. These sectors are heavily weighted in the Russell 2000 index with 26% for financials and 15% healthcare (Exhibit 2).

Exhibit 2: Sector

Weightings for The Russell 2000

Source: New

York University Stern School of Business, FTSE Russell

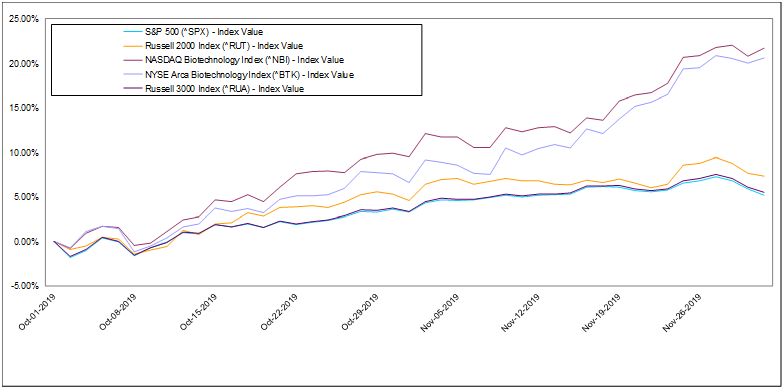

Thus far, the data demonstrates a positive change in sentiment by biotechnology investors as the sector surged in Q4, in stern contrast with the relative underperformance seen in the first three quarters of 2019. Both NYSE Arca Biotechnology (BTK, 20.6%) and NASDAQ Biotechnology (NBI, +21.7%) indices have outperformed the S&P 500 (SP50, +5.2%) and Russell 3000 (RUA, +5.5%) indices by a significant margin in Q4 2019 (as of December 3, 2019) (Exhibit 3).

Exhibit 3: Biotechnology Relative Price

Performance Q4 2019 (as of 12/3/2019)

Source: CapitalIQ

As the biotechnology sector soared and small-cap stocks outpaced the broader markets, picking the next gemstone in small/micro-cap biotechs could generate high cumulative returns for investors.