Continued Congressional Gridlock and Financial Market Strength

Last week’s election left the House and Senate in continued gridlock. Wall Street celebrated the outcome with large increases across major market indexes. There are two immediate reasons for the market rally despite an uncertain outcome in the presidential race. There is also cause for uncertainty considering the backdrop of a weak global economy with recovery efforts threatened by ongoing COVID-19 concerns.

Monetary Policy (Reason One)

Most members of Congress, regardless of party, agree fiscal support measures are necessary. However, settling on what specifically should be priorities has prevented any forward movement on an agreement. This elevates the reliance on monetary policy. Pre-election, an article in Barron’s suggested that Fed Chairman Powell “…is the most important person for investors in Washington,” the article continued, “this might loom even larger in a gridlocked nation’s capital.” Until a stimulus plan is decided, monetary policy remains the most significant means for guiding the economy. Without a new round of stimulus spending, one mathematical implication is that fewer issued treasuries will need to be sold to finance any stimulus. At the same time, the Fed will be buying bonds, at an equal or increased pace, to make up for lower fiscal stimulus. A lower supply of treasury bonds with the same or increased demand from the Fed should have the effect of raising prices, which reduces interest rates.

This is, of course, directly positive for bonds, while the lower rates are additionally bullish for equity investors. The strength last week indicates the markets are looking at continued Fed support with optimism. The prospect of continued low bond yields has been an important fuel that has helped maintain a bullish stock market.

Split Congress (Reason Two)

We’ve had a split Congress for years; why would it now suddenly inspire additional confidence in the markets? Going into the election, the markets had been hedged toward a Biden win. Investors may be taking relief in that some of his proposals, if he is determined to be the winner, will have difficulty passing. While campaigning, Biden had proposed increased taxes on corporations and individuals. This would be economically depressive as it leaves companies with less cash to pay dividends, make share repurchases, and manage their business for the best result. Individuals, for their part, would have fewer dollars to save, invest, and use to consume. If tax increases were to be enacted, they would be expected to weaken corporate America. Investors also are aware that Biden’s plan to increase the federal minimum wage, another campaign proposal, would be harder to implement with a Republican-led Senate.

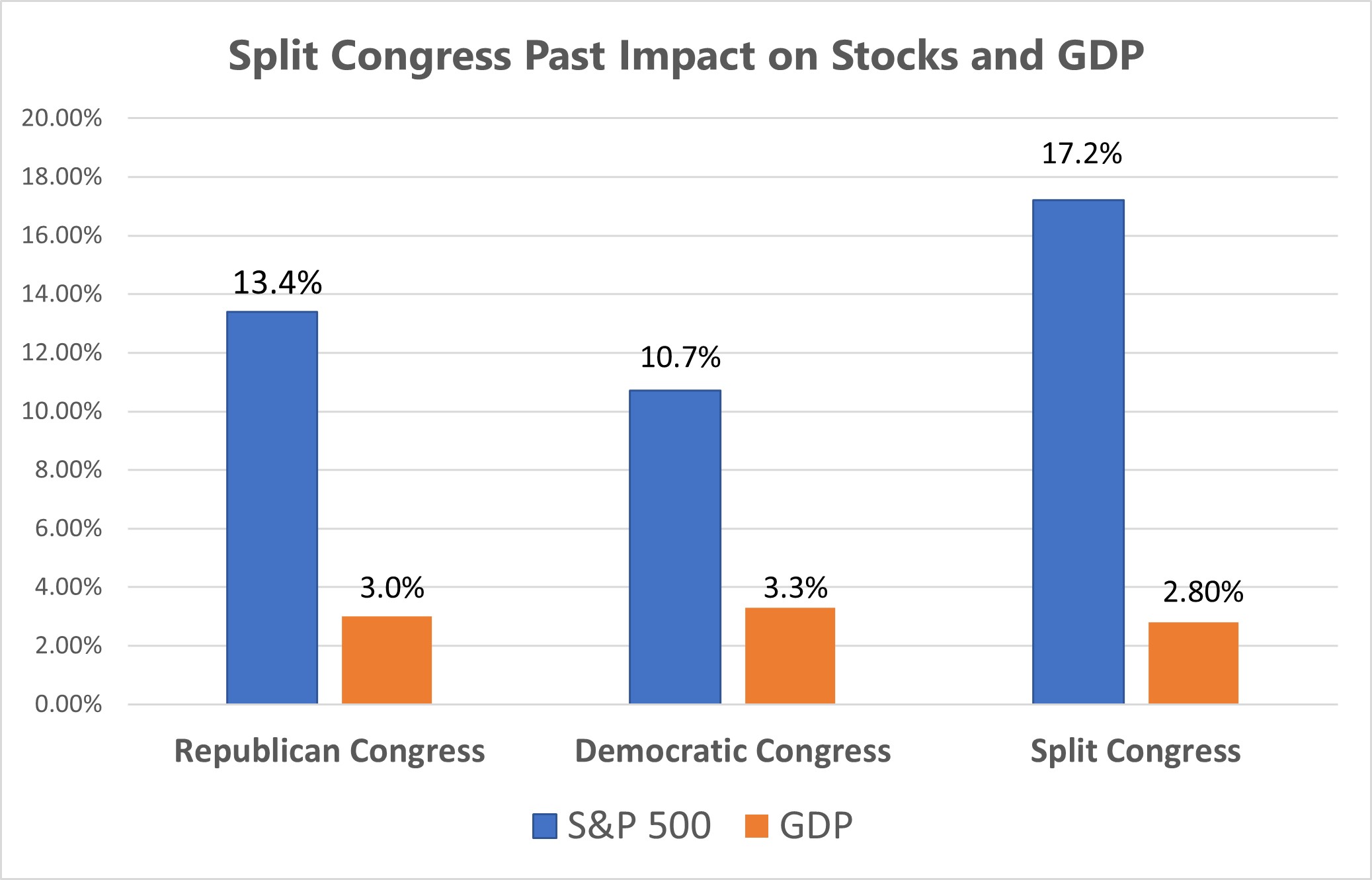

Historically the stock market performs better with a split Congress delivering a historical average annual return of 17.2% between 1950 and 2019.

GDP and S&P 500 (S&P 90) Under Same Party and Split-Party Since 1950

In a broad sense, the market reaction to the unfolding election news suggests that financial markets would prefer to see continued constraint in Washington rather than either presidential hopeful given the mandate to deliver the strongest version of their plans.

Take-Away

Equity markets usually have relief rallies after anticipated risk events. This important election was no different. Investors that had taken a defensive position as they approached November 3rd now sense less opportunity for drastic changes in policy, regardless of who actually secures the executive branch. Investors are putting precautionary cash balances back to work and unwinding pre-election hedges.

There is remaining uncertainty related to who will fill the oval office next year. A continued split-by-party Congress tempers the possibility of any dramatic change in laws impacting comanies. Once the electoral votes are finalized the market will have even less mystery as to what to expect in Washington going forward.

Ongoing COVID-19 concerns still are weighing on markets. Economists have been cutting forecasts for fourth-quarter growth in Europe because of increased reported cases of COVID-19. The U.S. has its own concerns related to the virus as physical distancing rules continue to hinder plans to fully reopen businesses.

Suggested Reading:

Smart Money May Have Less Data to Work With

Is There a

Perfect Stock Price

Which Media Companies Will Benefit From Election Ad Spending

Do You Know a College Student?

Let them know about the College Challenge!

Sources

Why Fed Chairman Powell is the Winner No Matter The Election Results

The Stock Market Doesn’t Care Who the President Is

The Fed Will Need Help to Prop up The Economy As DC Gridlock Looms

Why Investors Have Suddenly Turned Bullish on a Split Government