Oil Storage Numbers are Worth Watching

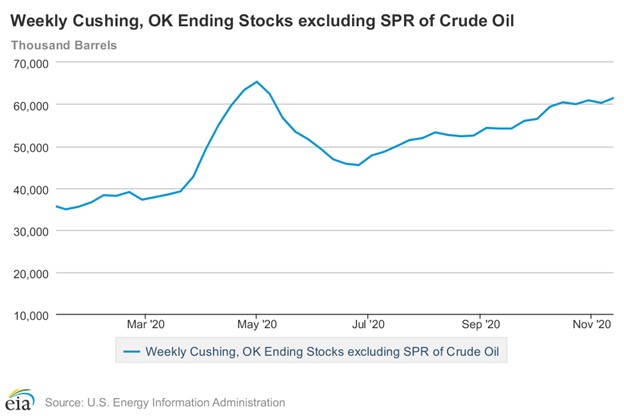

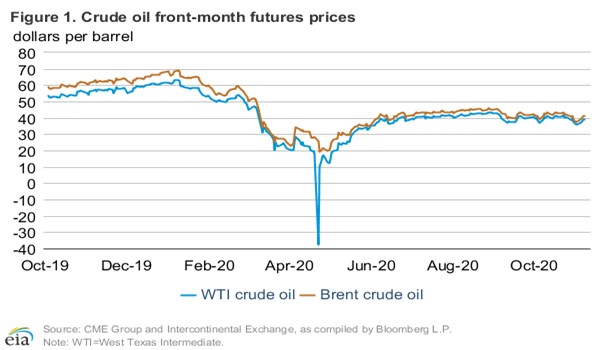

Cushing, Oklahoma is a major trading hub for crude oil and a price settlement point for West Texas Intermediate (WTI) oil prices. It is located at the intersection of many pipelines and has 91 million barrels (MMbbls) of oil storage capacity. As such, most of the oil that is produced in the Permian Basin flows through Cushing, with 6.5 MMbbls of oil flowing in and out of Cushing each day. An estimated ten MMbbls of new storage and 1.6 MMbbls of exit capacity is being considered to address current bottlenecks. Those bottlenecks became clear at the end of April when traders were caught with long oil positions at Cushing and no place to store or transport the positions. WTI oil prices turned negative briefly as traders scrambled out of positions. In hindsight, the issues seen in April seem obvious if one was tracking the rise in storage levels that occurred in March and April as the pandemic sapped demand, but producers kept on producing. With COVID-19 cases growing again, we see a similar story unfold as Cushing oil inventories approach levels seen last April. Are we headed to another oil price meltdown? Or, has the market learned its lesson?

The Reasons Why Oil Prices May Be Headed for A Crash

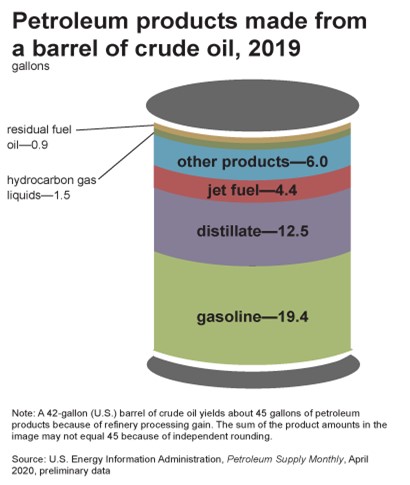

The current situation is looking eerily like last spring. COVID-19 cases are rising, and government officials are putting new restrictions in place. People are driving less as they work out of their homes and stop going out to restaurants and theaters. Gasoline represents 44% of the output of a crude oil barrel. Distillate fuel oil (28% of crude oil) is turned into diesel fuel and heating oil, which are also affected by pandemic mitigation. Jet fuel (10%) has also been negatively affected as recreation and business travel has decreased. The result is that refineries are running at low capacity with decreased demand for its products, which means it has less demand for crude oil.

With the number of COVID-19 cases growing, there is little indication that crude oil demand will return in the foreseeable future. On the demand side, producers have not shown signs of reducing production. With wells taking several months to drill, a supply response generally does not come in response to one month’s rise in storage. Shutting in existing production is a possibility, but shutting in and restarting production is expensive, and companies are unlikely to take such drastic steps if the drop in price is viewed as a temporary event.

The reason why oil prices are not headed to a crash

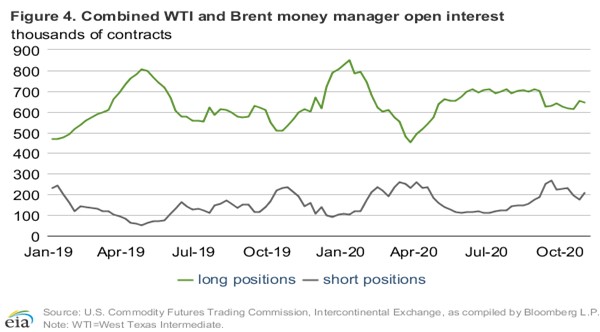

The crash of last spring was due to traders being caught in long oil contracts with no place to store the product. As recently as January, money managers had large open oil positions. They began exiting these positions in February and March, but it wasn’t until April that they were forced to exit positions at a loss. Turning to the current situation, we do not see the same involvement in the market by money managers. Long positions have held steady. There is less speculation in the oil market today than there was last spring, and speculation leads to price volatility. It is reasonable to assume, then, that the traders currently taking long positions in the market are doing so to meet demand and not because they are betting on oil prices.

It is also important to remember that WTI prices do not represent the entire oil market. When WTI prices crashed last spring, it’s worth noting that Brent oil price did not. That may come as little comfort for energy companies operating in the Permian Basin, but it should provide some comfort for energy companies in other operating areas.

It is too early to say whether we are headed to a repeat of last spring. Higher storage levels are a concern but not a condemnation of current price levels. With the expiration of the December future’s contract less than two weeks away, the number bears watching.

Suggested Reading:

Contango and the Known Risk to ETFs

Tesla Car Batteries and Virtual Power Plants

Do You Know a College Student?

Tell them about the College Challenge!

Source:

https://finance.yahoo.com/news/america-biggest-oil-storage-hub-005607002.html, Lucia Kassai and Andrew Guerra Luz, Bloomberg, November 20, 2020

https://en.wikipedia.org/wiki/Cushing,_Oklahoma, Wikipedia

http://www.okenergytoday.com/2020/10/cushing-oil-hub-isnt-following-national-trend-of-crude-oil-storage/, OK Energy Today, October 3, 2020

https://rbnenergy.com/that-was-then-this-is-now-part-2-new-crude-pipeline-capacity-out-of-the-cushing-hub, Housley Carr, RBN Energy LLC