|

|

|

|

Has Robinhood, the Online Brokerage Disruptor, Been Disrupted?

Stockbrokers with zero commissions may have recently become too expensive. We know that online brokers and trading apps like Robinhood, IBKR Lite, Webull, Etrade, and most discount brokers, have over time, discounted their way to zero-commission trades. The market is still getting accustomed to this money-saving win for highly active traders. The change also eliminated the commission hurdle that thinly traded companies and their would-be investors once had accumulating shares. Multiple transactions now cost the same as one, and that price is $0.00. In 2020 odd-lot transactions are an almost ancient concept as zero commissions don’t dictate blocks of 100 share round lots. No cost in and no cost out with no share or dollar minimum has opened the market to many more investors.

How Do Zero

Commission Platforms Make Money?

A significant source of income to zero- commission brokers that is invisible to the account holder is the idle cash in their accounts. This uninvested cash, per customer agreement, is “swept” into a banking arm or affiliate of the broker. The customer is compensated for the cash balances, currently below 0.5%, but the broker earns far more. The cumulative idle cash can be substantial. According to Bloomberg, during Summer 2019, Schwab held customer cash totaling $265 billion; this earned them more than $5.7 billion in revenues. TD Ameritrade’s revenue was bolstered by $1.2 billion, and E*Trade, $1.8 billion. It isn’t difficult for the broker to earn a spread to 0.5% or less and impact company earnings. The use of customer cash as their own resource to generate revenue makes it still very much worthwhile to charge customers zero. This is especially true as using no commissions to attract new business grows a broker’s account base and perhaps bottom-line.

Stockbrokers also make fees when lending money to customers with margin accounts. The more active accounts there are, the more potential there is for profit. Another business they may be involved in is securities lending. This is a profitable business that most brokerage customers don’t know about. It occurs as a result of short-sale transactions (short-selling), by providing “good” delivery to the buyer(s). These transactions are completed by lending securities from customer accounts at a rebate (interest) rate. A securities lending operation at a brokerage can turn a good profit from their accounts on fully collateralized loans.

Another meaningful addition to earnings is “payment for order flow.” This is when the broker earns fees from another firm for forwarding their clients buys and sells to computerized trading firms. These firms match buyers with sellers and earn the bid/offer spread.

What’s

Better than Free?

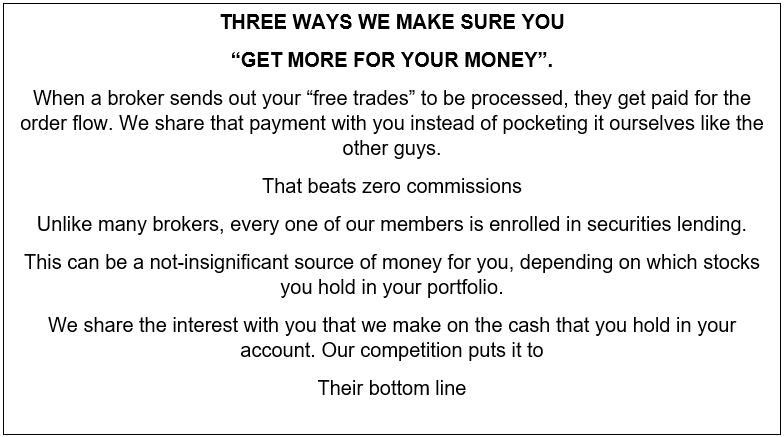

There is now a brokerage platform that has a more generous business model. They keep track of what an account has been worth to them and then discount a portion back to the customer. This is, in effect, “cheaper than free.” It’s unclear if this reinvented service will compel people to leave their broker for this new entrant, but for those counting every penny, this is something to be aware of. The broker has the kind of name that doesn’t roll off the tongue easily. It’s called “All of Us Financial.” The website is also almost decidedly, not in the mold of Wall Street brokers. Below is what their website wants you to know about All of Us Financial before they tell you anything else:

Competition

is Good for Consumers

In a recent update to their blog by CEO Alan Grujic, All of Us appears to be wedging itself against both the large Wall Street firms and newer innovative, disruptive firms like Robinhood. The big differentiators they offer are transparency and customers earning on more than just their stock trading success. This, of course, is because of the revenue sharing component of the service. In a company blog, Mr. Grujic wrote, “There is nothing wrong with Robinhood’s revenue model – in fact, it’s how many brokerages make money. But just because something isn’t wrong doesn’t mean there isn’t a better way. And just because a company disrupts the status quo doesn’t mean it shouldn’t be disrupted even more.” He finishes by saying, “For those who have grown disillusioned with Robinhood’s sleight of hand, join the movement at All of Us and help rewrite the rules by putting your rights as investors before the wants of Wall Street.”

This will be an interesting experiment as this new entrant tries to disrupt the disruptors. It will also help show how loyal investors are to their brokers in 2020. In the past, it was difficult for a new company to win business away from established brokerage businesses. That loyalty has been fading.

Take Away

In CEO Alan Grujic’s words, “My current focus is on building an investor empowerment platform, which I believe will revolutionize the way investing is done. I am convinced this is ‘the inevitable’ path down which the convergence of finance and technology will lead.” In recent years technology has provided information at no cost to self-directed investors at a level once reserved for large institutional investors. As a no-cost platform that provides top-tier research and analysis to registered users, Channelchek is also part of the empowerment movement that is leveling the playing field for all investors.

The brokerage community has proven what once seemed mathematically impossible. A

business can offer something for free and make it up in volume. This is beneficial for corporate finance and particularly helpful to smaller, more thinly traded companies and investors that now find it easier to own shares.

Suggested Reading:

Investment

Barriers Once Seen as Insurmountable are Falling Fast

Investment

Portfolios are Checked Twice as Often by Millennials

Contango,

ETFs, and Alligators

Enjoy Premium Channelchek Content at No Cost

Sources:

Brokers

Profit From You Even If They Don’t Charge for Trading

In the Race to Zero-Fee Broker Commissions, here’s who

the Big Winner is