Why Oil is Moving and Why It Could Go Higher

Brent Oil prices crossed $60 per barrel for the first time since January 2020. The surge began in early November when positive vaccine test results gave the market hope that oil demand would soon return to pre-pandemic levels. But instead of returning to last March’s oil price level in the mid-fifties, a funny thing happened. Oil prices shot through pre-pandemic levels and all the way to $60. What’s more, oil prices seem poised to rise above $60 and reach levels not seen since 2018.

Why are they Increasing?

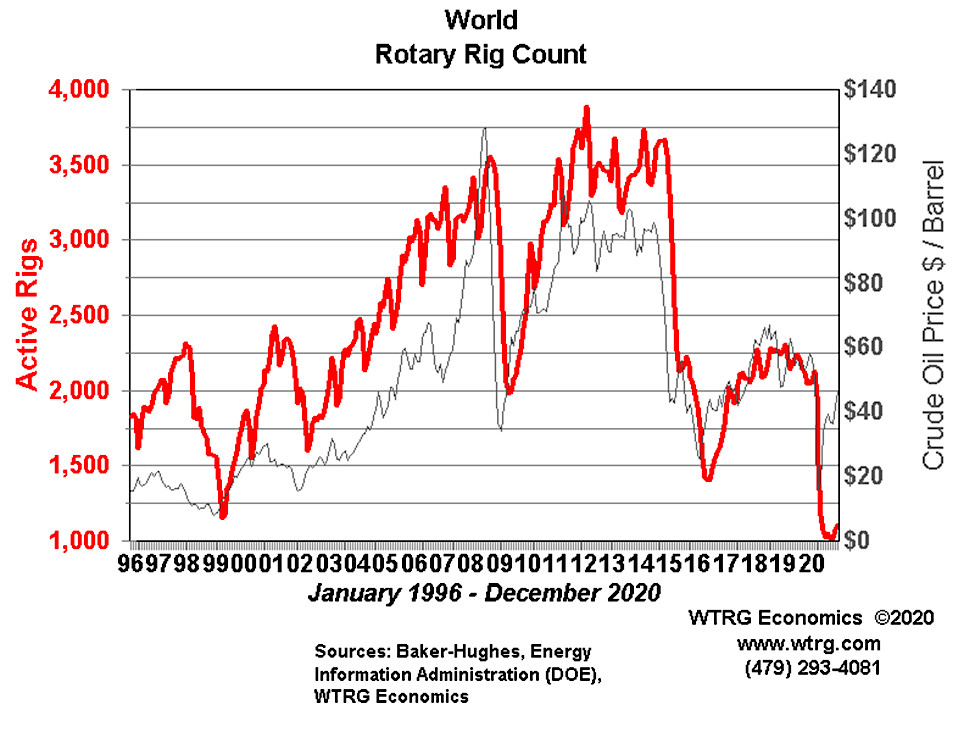

So why do energy prices continue to rise? In a nutshell … there is a lack of supply response to higher prices. Producers across the world are not increasing drilling yet. Worldwide, active rigs have fallen to a level half that of a year ago. The chart below shows the correlation between rig count and oil prices. Note that oil price rose in the last two months of last year, rig count did not. This trend has continued in 2021 with oil prices rising to $60 per barrel, but the world rig count stuck at 1183 as of the end of January. The last time Brent oil prices were at $60 in January of 2020, there were 2265 active rigs.

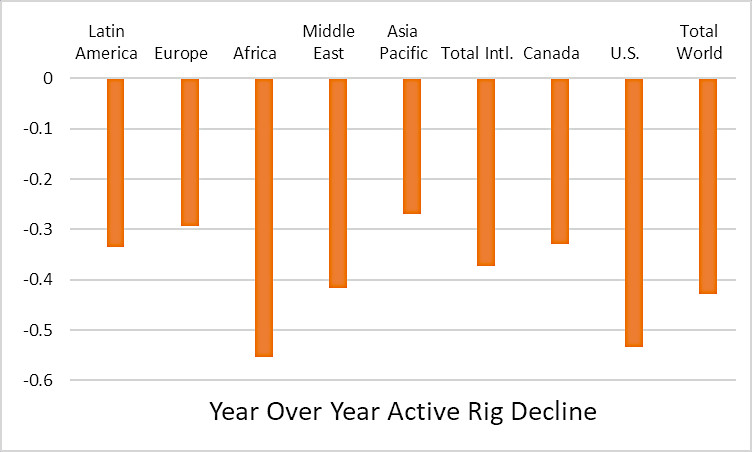

In total, world active rigs are 43% below January 2020 levels. The declines have been the sharpest in the United States (down 53%) and Africa (down 55%). Other regions such as Asia (down 27%), Europe (down 29%), and Canada (down 33%) have seen smaller declines. The Middle East, once again establishing its position as a price setter, reports a 42% year-over-year decline in active rigs, very much in line with the world’s average.

OPEC’s Hand in the Situation

An analysis of rig declines by region seems to suggest that OPEC’s overall strategy is working. Recall that OPEC, led by Saudi Arabia, flooded the market with oil in the spring allowing oil prices to fall sharply. West Texas Intermediate oil prices even dropped below zero temporarily as traders were caught with excess oil and no room to put the oil in storage. OPEC’s intent was manyfold. First, it wanted to punish Russia for not going along with production cuts and remind them of the potential impact on nonconformance. Second, it wanted to counter the rise in U.S. production coming from increased shale production. Technological advances have made U.S. shale production profitable at prices in the forties leading to the U.S. becoming a net exporter of oil. When oil prices fell last year, U.S. producers responded by cutting back drilling, as evidenced by the chart above.

Will Trend Continue

So why aren’t U.S. oil producers responding to higher oil prices by increasing drilling? Most likely, producers have been snake bitten by last year and wary of raising production only to be forced to halt production or shut-in production if oil prices fall. A second explanation may be that producers are first focusing on well completions from last year before ramping up drilling. If that is the case, we would expect to see drilling begin to rise as the inventory of well completions dries up.

Take-Away

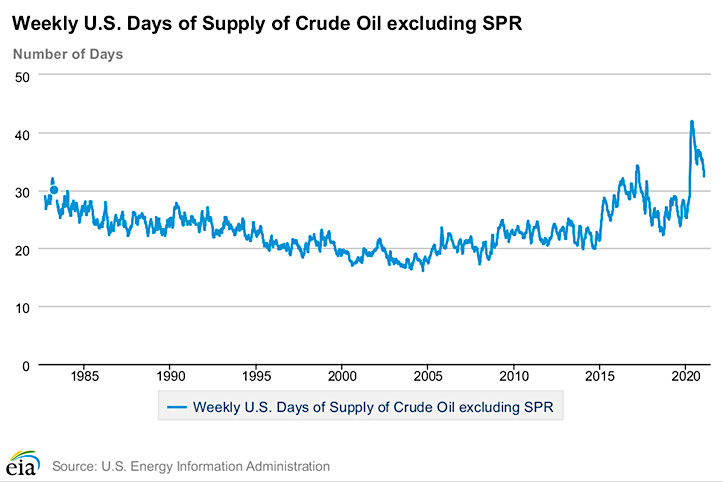

Whatever the reason for the current low rig count, the implication for oil prices is positive. There has not been a supply response to higher prices, and oil inventories are falling. The chart above shows that crude oil inventories rose sharply last March but have been falling in recent months. Inventories are now approaching pre-pandemic levels. Unless producers accelerate drilling, inventories may continue to fall as the global economy expands. The result could be that oil prices continue to rise even as we have crossed $60 per barrel.

Suggested Reading:

Will the US Continue to Subsidize Renewable Energy?

What Should the Price Range be for Oil and Natural Gas

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Sources: