Image Credit: Wes Levitt (Theta Labs)

Stablecoin’s Giant Leap Forward Toward Global Adoption

Formal guidance on stablecoin arrangements from two international financial authorities has just been released. The guidance is largely seen as positive news for the cryptocurrencies that peg their value to more traditional monetary benchmarks. In a 22-page report that is the result of the G7, G20 and the Financial Stability Board (FSB) request from the Bank for International Settlements (BIS) and the International Organization of Securities Commissions (IOSCO), uniform principles and priorities were outlined.

Overall, the report titled, “Application of the

Principles for Financial Market Infrastructures to Stablecoin Arrangements” favors rules that follow all relevant principles that guide other monetary systems. It provides guidance on the topics of Governance, Risk Management, and Settlements.

Governance

In the category of governance, the authors of the guidance believe a stablecoin asset should consider the assets ownership structure and operation while allowing for clear and direct lines of responsibility and accountability. For example, it should be owned and operated by one or more identifiable and responsible legal entities that are ultimately controlled by individuals. The accountable individual(s) responsible for a stablecoins structure and operation will provide adherence to all rules of governance and other related functions.

Risk Management

A stablecoin asset operation should regularly review the material risks that the financial market infrastructure (FMI) could pose. It should oversee its function as well as critical entities such as, settlement banks, liquidity providers, transfer operations, and other service providers. The stablecoin should develop appropriate risk-management frameworks and tools identify and address these risks. Of particular importance, it should identify and implement appropriate risk-reductions, from an integrated and comprehensive view of the entire stablecoin environment.

Settlement Finality

An active stablecoin should provide clear and final settlement, regardless of the settlement method used. The stablecoin should clearly define the point at which a transfer on the ledger becomes irrevocable and technical settlement happens and make it transparent whether and to what extent there could be a misalignment between technical settlement and legal finality. The stablecoin should also ensure proper transparency regarding mechanisms for reconciling any misalignment between technical settlement and legal finality. Standard measures should be in place to resolve the potential losses that could be created in case of reversals stemming from misalignment between technical settlement and legal finality.

Money Settlements

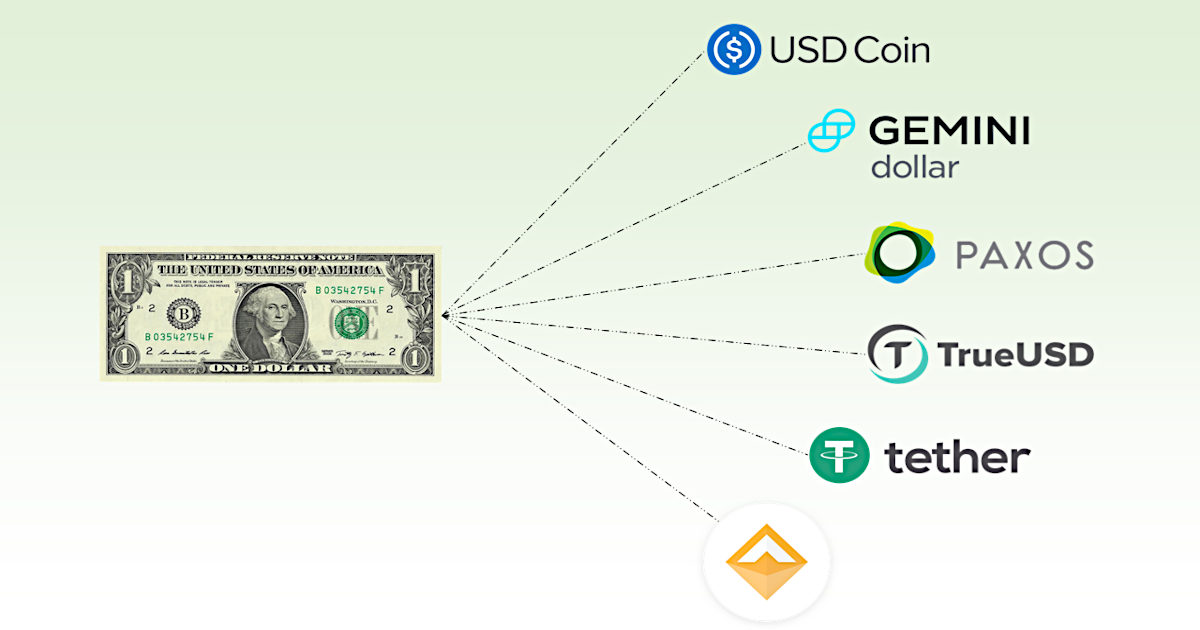

Money settlements should have little or no credit or liquidity risk. In assessing the risk presented by the stablecoin, the operator should consider whether the coin provides its holders with a direct legal claim on the issuer and/or claim on, title to or interest in the underlying reserve asset for timely convertibility at par into other liquid assets. It should have a clear process for fulfilling holders’ claims in both normal environments and those that are more stressed.

Credit and liquidity risks of the stablecoin should be controlled so its uses for money settlements are minimized and controlled so that stablecoin is an acceptable alternative to the use of central bank money.

Take-Away

The payments landscape is undergoing rapid transformation. While there is no roadmap for any new payment method, international overseers and regulators are trying to devise a workable and uniform framework so developers and operators can devise their currencies to adhere to certain principles and standards.

The consultative report, requested by powerful world groups, will allow stablecoin assets providers to have a basis for design that will assure uniformity and potentially greater acceptance.

Do You Know a Student Interested in This Year’s College

Challenge?

Suggested Reading:

SPAC Places “Hard Circle” Around Stablecoin Company

|

Crypto’s Ancillary Businesses as an Opportunity for Investors

|

Sources: