Image Credit: Image Image: Eric Ward (Flickr)

Retail Investors May Soon See More Safety Measures Including Coursework and Testing

The decline in cost, ease of use, and low cost of money have been positive for both investors and the brokerage industry. However, over the past few years, there has also been much greater use of what the regulators have referred to as “complex” investment products. These could include leveraged ETFs, options, or even structured interest rate products. It has been a while since groups of investors have been stung by derivative-based investments or others with risk that difficult to assess. Both FINRA and the SEC are considering whether the rules on availability should be reworked for both investors and those giving investment advice.

FINRA Taking Action

The Financial Industry Regulatory Authority (FINRA), is an authority working under the Securities and Exchange Commission (SEC) that writes and enforces rules that govern the activities of all registered broker-dealer firms and registered brokers in the U.S. It measures best practices, required practices, and protects the investing public against fraud and bad behavior of professionals.

FINRA recently released a regulatory notice to brokerage firms, reminding them of the risks of “complex” products and the legal obligations they have of making sure their investors are offered only suitable investment products. The notice said, “The number of accounts trading in complex products and options has increased significantly in recent years.” It went on to state that, “… important regulatory concerns arise when investors trade complex products without understanding their unique characteristics and risks.”

Not long ago, a live financial professional was the primary means of opening an account and learning of suitable investment products. Image: Campus Production (Pexels)

FINRA, which is a self-regulating entity promoting and enforcing its rules, is now seeking comments on whether the current regulatory framework is adequate to protect investors. It noted that the old rules were adopted when most financial products were bought through direct contact with financial professionals, whereas today many of these products are bought and sold through self-direct trading platforms like Robinhood or other online brokers.

Defining “Complex”

FINRA describes a complex product in its regulatory notice as “a product with features that may make it difficult for a retail investor to understand the essential characteristics of the product and its risks (including the payout structure and how the product may perform in different market and economic conditions).” These can include “Mutual funds and ETFs that offer strategies employing cryptocurrency futures.” It also lists leveraged and inverse exchange-traded products, volatility-linked ETPs, structured products, and defined outcome ETFs, which offer exposure to the performance of a market.

“We continue to believe that the features of these products are such that they may be difficult for a retail investor to understand the essential characteristics of the products and their risks and, are, therefore complex,” FINRA said.

Access to all markets has become much easier. Image Credit: Techdaily.ca

Self-Directed Brokerage Platform

“These concerns may be heightened when a retail customer is accessing these products through a self-directed platform and without the assistance of a financial professional, who may be in a position to explain the key features and risks of the product to the retail investor,” FINRA expressed.

As part of the regulatory notice, FINRA opened a comment period to ask what additional requirements may be necessary to protect investors from a much faster and easier investing environment that includes new products without enough history to fully understand, particularly at the retail investor level. FINRA specifically asked as it relates to retail investors and self-directed platforms, “are additional guardrails needed for these types of platforms?”

Tests for Retail Transactions

FINRA may also be leaning toward retail investors needing to demonstrate adequate knowledge of the products they are risking money on.

The notice asks whether retail customers should be required “to demonstrate their understanding of those common characteristics and risks of complex products by completing a knowledge check and, if the customer fails to show the requisite knowledge, requiring the completion of a learning course and additional assessment?” In other words, a test, and perhaps a class.

Standard Options Trades

Most retail investors with a brokerage account never even considered the notion of trading options. That has changed. FINRA writes that listed options trading volume has grown by 30% over 2020 and is almost 100% higher than in 2019.

“Similar to transactions in complex products, buying or selling options can be risky for retail investors who trade options without understanding their vocabulary, strategies and risks. Members should consider whether investors understand the various risks of trading options…” FINRA said.

Take-Away

Regulators, in any industry are wrestling with a rapidly changing world. The investment business has transformed rapidly with no-cost transactions, portable apps, and game-like point and execute functionality. FINRA is looking at its current safeguards and policies designed to protect the clients of those it regulates and is likely to make some adjustments after the comment period.

FINRA encourages all interested parties to comment on this request for comment. Comments must be received by May 9, 2022.

Managing Editor, Channelchek

Suggested Reading

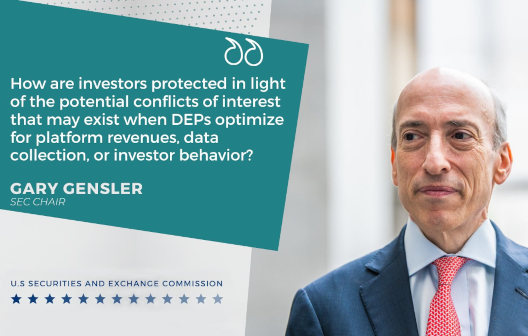

SEC Investigates Digital Engagement Practices in Broker Apps

|

SEC Climate Change Disclosure Rules and Challenges

|

Why Some are More Vulnerable to Financial Scams

|

Bitcoin ETFs Again Experience Extreme Caution from SEC

|

Sources

https://www.finra.org/rules-guidance/notices/22-08

Stay up to date. Follow us:

|