Image Credit: Daniel Mennerich (Flickr)

A Close Look at Michael Burry’s Plane Crash Comments

Michael Burry tweeted, “Fads today (#BTC, #EV, SAAS #memestocks) are like housing in 2007,” in March of this year. For almost a year now, the famed hedge fund manager has been predicting market tragedy, as he correctly did before the great recession. On Tuesday (May 24) he again warned that his feelings about the economy and various markets are the same as they were in 2008. He indicated he isn’t cheering for it, but he’s warning that people should prepare for it.

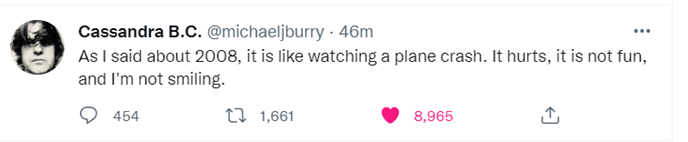

Image: Michael Burry’s May 24 Tweet

While Burry is regularly warning others to run for cover and prepare for doom, there is little in his company’s filing of public investment

positions that would indicate that he has any doomsday positions. In fact, he had added long positions in energy (OVV) which could weaken during a receding economy, and consumer discretionary goods (SPWH, STLA), which are by definition an area where households can cut back in hard times. One of these may have been a temporary dividend play, not a longer holding. His hedge fund held puts on one large technology company (AAPL) and was long two others (GOOGL, FB).

The assets reported on form 13F to the SEC is not necessarily his entire portfolio. After all, when he used credit default swaps as part of his “big short” they were not at the time overseen by the SEC. His company may be employing another method that is off the regulatory radar. The SEC has not yet regulated pure cryptocurrency.

The Big Question

The Scion Asset Management founder posted his tweet this week (then

deleted it) after data for new single family home sales for April were released. The report showed home sales fell an unexpected 26.9% over the previous April.— well off the consensus forecast. On the same day, the S&P 500 index tumbled 2.5%, bringing its YTD slide to -18%.

If Michael Burry is so perturbed by his own forecast of economic problems and markets like housing, stocks, and credit instruments, why is he warning people? Burry is famous for his prediction and his ability to capitalize on having been right in 2007-2008. This fame attracted many followers. His public tweets of warning could become an impetus to weaken asset prices. He could become part of the fuel that brings his prediction of doom to reality.

To say he is brilliant economically is an understatement, he must know the power of his words. And his words can serve to alter investor actions. (Share your thoughts under this article on Twitter).

Take-Away

Burry has predicted the next market crash will dwarf the 2008 bust, That event sparked a global financial crisis. He seldom gives interviews and when he does it is typically through a Bloomberg terminal with Bloomberg News.

As head of Scion Capital Management Burry became one of the most followed hedge-fund managers after predicting and making his clients a fortune betting on the housing-market crash in 2007/2008. He has repeatedly drawn parallels between the run-up in asset prices during the COVID-19 pandemic and the bubble that made him famous. The warnings he now is giving don’t seem to add up with his portfolio positions, unless he is involved in non-securities like real estate, cryptocurrency, or some other asset type.

Managing Editor, Channelchek

Suggested Content

Michael Burry’s Latest Portfolio Brings the FAANGS Out

|

Michael Burry vs Cathie Wood is Not an Even Competition

|

What Investors Haven’t Yet Noticed About the Value in Some Biotechs

|

Market Bifurcation Can Confuse Investors

|

Sources

https://www.thestreet.com/technology/is-the-financial-crash-of-2008-about-to-repeat

https://www.sec.gov/opa/Article/press-release-2012-67—related-materials.html

https://mobile.twitter.com/burrydeleted?lang=en

Stay up to date. Follow us:

|