An Executive Order to Strengthen Oversight of Large Companies, May be an Opening for Smaller Players

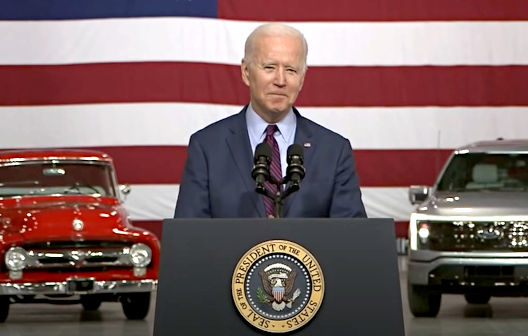

The Biden administration is said to be putting the final touches on an executive order to direct agencies to strengthen oversight of industries that are dominated by a few large companies. This would be a wide-ranging attempt to rein in big business power across affected sectors of the economy. The move could allow smaller innovative companies to be less overshadowed, while throwing a little cold water on the ever-growing giants in their sectors.

The executive order, which President Biden could sign as soon as this week, would direct oversight from regulators of a long list of industries. This could force regulators of pharmaceutical, transportation, energy, utilities, banking and other industries, to revisit their rule-making process. The goal would be to inject more competition and to give consumers, workers, and suppliers more ability to challenge large producers or providers.

Shining a Light on Potential

The order would come less than two weeks after the Russell Index

rebalancing demonstrated just how large, in terms of capitalization, many companies have become. Assuming that all companies go through a growth phase that begins near zero, the disparity between large, the comparatively small, and those that are smaller is widening. This executive order may bring what some would consider an equitable solution to the competition gap.

How This Could Impact Investors

The Securities and Exchange Commission (SEC) regulates all things related to publicly traded U.S. companies. The name Citadel Securities became a household name among investors earlier this year as online brokers banned some WallStreetBets driven “Buy” and even “Sell” orders. The reasons for the unusual restrictions on trading may include protecting large securities firms like Citadel where 47% or retail volume is transacted, or Citadel’s large trading partners. Under the President’s order the SEC may have the power to address big versus smaller firm issues like this more quickly. This is one way retail investors may find more trust in their ability to trade on an even footing with their small accounts through a small or mid-size broker.

Performance of companies categorized as small-cap are exceeding large-cap stock performance year-to-date 2021. Over a longer period, they are still lagging their historic outperformance. As many expect a return to a stable and growing economy will help the return of the long-term relative average performance of small and microcap stocks; orders such as this could dampen large companies enough to moderate their growth and provide light for deserving companies that are less well capitalized. The intentional government support, even if only regulatory, if enacted could allow regulatory approvals for projects, money for research, grants for studies, and an overall experience of more clearance for smaller company projects and products.

Investors considering that the potential is higher for smaller companies, will want to pay attention to the exact wording, and how successful any challenges to its legality may be.

Managing Editor, Channelchek

Suggested Reading:

|

|

The Future of Electric Vehicles

|

The NFL and Big Companies are Changing their Thinking on Marijuana

|

|

|

Clarence Thomas’ Statement on Half-In / Half-Out Marijuana Laws

|

How Close is the U.S. to Having a Digital Currency?

|

https://tokenist.com/citadels-1-billion-silver-bet-a-trap-for-wallstreetbets/

https://nypost.com/2021/06/30/bidens-big-business-crackdown-bad-for-wall-street-behemoths-sources/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|