Research News and Market Data on TNXP

July 31, 2023 7:00am EDT

Preliminary Data Show that Oxytocin Decreases Impulsivity and Reduces Food Intake

TNX-1900 (Intranasal Potentiated Oxytocin) May Serve as a Novel Neuroendocrine Treatment for Binge-Eating Disorder

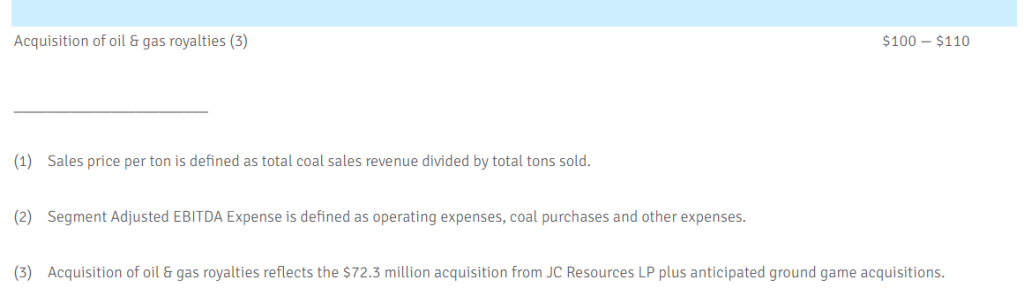

CHATHAM, N.J., July 31, 2023 (GLOBE NEWSWIRE) — Tonix Pharmaceuticals Holding Corp. (Nasdaq: TNXP) (Tonix or the Company), a clinical-stage biopharmaceutical company, today announced that the first participant was enrolled in the investigator-initiated Phase 2 Study of The Results of Oxytocin in Binge Eating ‘STROBE’ study of TNX-1900 (intranasal potentiated oxytocin) for the treatment of binge-eating disorder at the Massachusetts General Hospital (MGH). The aim of the study is to investigate the efficacy and safety of TNX-1900 as a novel therapeutic agent to reduce binge eating frequency in adults with binge-eating disorder. Tonix is supporting the STROBE study through a clinical trial agreement with MGH. MGH is the sponsor of the trial, which is being conducted under an investigator-initiated investigational new drug (IND) application.

The 8-week double-blind, placebo-controlled trial has a target enrollment of at least 60 participants 18-45 years old with binge-eating disorder.

“Binge-eating disorder is identified as a reduced ability to control behavioral impulses and formed habits, disrupting the regulation of food intake and energy balance,”1-4 said Seth Lederman, M.D., Chief Executive Officer of Tonix Pharmaceuticals. “While existing treatment options may produce remission from binge eating in some cases, up to 50% of patients continue to engage in binge eating.”5-7

Elizabeth A. Lawson, M.D., M.M.Sc., Director, Interdisciplinary Oxytocin Research Program in the Neuroendocrine Unit, Department of Medicine, Massachusetts General Hospital and principal investigator of the study added, “Individuals with binge-eating disorder experience loss of control over eating that is thought to be driven by increased hedonic drive to eat as well as impulsivity.8-10 The oxytocin system has been linked to likelihood of lifetime binge eating in women11, and our preliminary studies of intranasal oxytocin at the dose used in this trial show that oxytocin modulates areas of the brain responsible for hedonic eating and impulse control12, improves impulsivity13, and reduces caloric intake.14 The goal of the STROBE study is to assess whether 8 weeks intranasal administration of oxytocin will decrease binge eating frequency by lowering the drive to eat and improving impulse control.”

About the Phase 2 STROBE Study

The Phase 2 STROBE study is a randomized, double blind, placebo-controlled study to evaluate the efficacy and safety of TNX-1900 for the treatment of binge-eating disorder in adults. The 8-week trial has a target enrollment of at least 60 participants 18-45 years old with binge-eating disorder. Subjects will be randomized to receive TNX-1900 or placebo and will be studied at Massachusetts General Hospital. Subjects will self-administer TNX-1900 or placebo as two sprays total (one spray in each nostril) up to four times per day for 8 weeks. The primary endpoint is 8-week change from baseline in binge frequency.

For more information, see ClinicalTrials.gov Identifier: NCT05664516

About Binge Eating Disorder

Binge-eating disorder (BED) is a psychiatric illness characterized by frequent episodes of uncontrollable consumption of large amounts of food. It is the most common eating disorder and often leads to obesity-associated complications and later psychopathology15. BED is characterized by increased homeostatic appetite and sensitivity to reward (including food reward)16, which may lead to initiation of binge episodes, and a reduced ability to control behavioral impulses and formed habits, creating an imbalance in the sensitive interplay between these bottom-up and top-down processes governing the adaptive regulation of food intake and energy balance1-4.

About TNX-1900

TNX-1900 (intranasal potentiated oxytocin) is a proprietary formulation of oxytocin in development as a candidate for prevention of chronic migraine and other conditions. In 2020, TNX-1900 was acquired from Trigemina, Inc. who had licensed the technology underlying the composition and method from Stanford University. TNX-1900 is a drug-device combination product, based on an intranasal actuator device that delivers oxytocin into the nasal cavity. Oxytocin is a naturally occurring human peptide hormone that also acts as a neurotransmitter in the brain. Oxytocin has no recognized addiction potential. It has been observed that low oxytocin levels in the body are associated with increases in migraine headache frequency, and that increased oxytocin levels are associated with fewer migraine headaches. Certain other chronic pain conditions are also associated with decreased oxytocin levels. Migraine attacks are caused, in part, by the activity of pain-sensing trigeminal neurons which, when activated, release of calcitonin gene-related peptide (CGRP) which binds to receptors on other nerve cells and starts a cascade of events that is believed to result in headache. Oxytocin when delivered via the nasal route, concentrates in the trigeminal system17 resulting in binding of oxytocin to receptors on neurons in the trigeminal system, inhibiting the release of CGRP and transmission of pain signals returning from the site of CGRP release.18 Blocking CGRP release is a distinct mechanism compared with CGRP antagonist and anti-CGRP antibody drugs, which block the binding of CGRP to its receptor. With TNX-1900, the addition of magnesium to the oxytocin formulation enhances oxytocin receptor binding19 as well as its inhibitory effects on trigeminal neurons and resultant craniofacial analgesic effects, as demonstrated in animal models20. Intranasal oxytocin has been shown to be well tolerated in several clinical trials in both adults and children21. Targeted nasal delivery results in low systemic exposure and lower risk of non-nervous system, off-target effects, which could potentially occur with systemic CGRP antagonists such as anti-CGRP antibodies22. For example, CGRP has roles in dilating blood vessels in response to ischemia, including in the heart. The Company believes nasally targeted delivery of oxytocin could translate into selective blockade of CGRP release from neurons in the trigeminal ganglion and not throughout the body, which could be a potential safety advantage over systemic CGRP inhibition. In addition, daily dosing is more rapidly reversible, in contrast to monthly or quarterly dosing, as is the case with anti-CGRP antibodies, giving physicians and their patients greater control. In addition to chronic migraine, TNX-1900 will be developed for treatment of episodic migraine, binge eating disorder, craniofacial pain conditions, and insulin resistance. Tonix also has a license with the University of Geneva to use TNX-1900 for the treatment of insulin resistance and related conditions.

About TNX-2900

TNX-2900 is another intranasal potentiated oxytocin-based therapeutic candidate, being developed for the treatment of Prader-Willi syndrome, or PWS. The technology for TNX-2900 was licensed from the French National Institute of Health and Medical Research. PWS, an orphan condition, is a rare genetic disorder of failure to thrive in infancy, associated with uncontrolled appetite later in childhood.

1Dawe S and Loxton NJ. Neurosci Biobehav Rev. 2004; 28(3):343-351

2Giel KE, et al. Nutrients. 2017; 9(11)

3Hernandez D, et al. Obesity (Silver Spring). 2019; 27(4):629-635

4Schag K, et al. Obes Rev. 2013; 14(6):477-495

5Hilbert A, et al. Int J Eat Disord. 2020; 53(9):1353-1376

6Reas DL and Grilo CM. Expert Opin Emerg Drugs. 2014; 19(1):99-142

7Wilson GT. Psychiatr Clin North Am. 2011; 34(4):773-783

8Giel KE, et al. Nutrients. 2017. 9(11)

9Hernandez D, et al. Obesity (Silver Spring). 2019. 27(4):629-635

10Schag K, et al. Obes Rev. 2013. 14(6):477-95

11Micali N, et al. Eur Eat Disord Rev. 2017; 25(1):19-25

12Plessow F, et al. Neuropsychopharmacology. 2018. 43(3):638-645

13Plessow F, et al. Obesity (Silver Spring), 2021. 29(1):56-61

14Lawson EA, et al. Obesity (Silver Spring). 2015; 23(5):950-956

15Field A, et al. Pediatrics. 2012; 130 (2):e289–e295

16Bulik CM, et al. Nature Neuroscience. 2022. 25(5):543-554

17Yeomans DC, et al. Transl Psychiatry. 2021. 11(1):388

18Tzabazis A, et al. Cephalalgia. 2016. 36(10):943-50

19Antoni FA and Chadio SE. Biochem J. 1989. 257(2):611-4

20Cai Q, et al. Psychiatry Clin Neurosci. 2018. 72(3):140-151

21Yeomans, DC et al. 2017. US patent US2017368095

22MaassenVanDenBrink A, et al. Trends Pharmacol Sci. 2016. 37(9):779-788

Tonix Pharmaceuticals Holding Corp.*

Tonix is a biopharmaceutical company focused on commercializing, developing, discovering and licensing therapeutics to treat and prevent human disease and alleviate suffering. Tonix markets Zembrace® SymTouch® (sumatriptan injection) 3 mg and Tosymra® (sumatriptan nasal spray) 10 mg. Zembrace SymTouch and Tosymra are each indicated for the treatment of acute migraine with or without aura in adults. Tonix’s development portfolio is composed of central nervous system (CNS), rare disease, immunology and infectious disease product candidates. Tonix’s CNS development portfolio includes both small molecules and biologics to treat pain, neurologic, psychiatric and addiction conditions. Tonix’s lead CNS candidate, TNX-102 SL (cyclobenzaprine HCl sublingual tablet), is in mid-Phase 3 development for the management of fibromyalgia, nearing complete enrollment in a potentially registration-enabling study, with topline data expected in the fourth quarter of 2023. TNX-102 SL is also being developed to treat Long COVID, a chronic post-acute COVID-19 condition. Enrollment in a Phase 2 study has been completed, and topline results are expected in the third quarter of 2023. TNX-601 ER (tianeptine hemioxalate extended-release tablets), a once-daily formulation being developed as a treatment for major depressive disorder (MDD), is nearing complete enrollment with topline results expected in the fourth quarter of 2023. TNX-4300 (estianeptine) is a small molecule oral therapeutic in preclinical development to treat MDD, Alzheimer’s disease and Parkinson’s disease. TNX-1900 (intranasal potentiated oxytocin), in development for chronic migraine, is currently enrolling with topline data expected in the fourth quarter of 2023. TNX-1300 (cocaine esterase) is a biologic designed to treat cocaine intoxication and has been granted Breakthrough Therapy designation by the FDA. A Phase 2 study of TNX-1300 is expected to be initiated in the third quarter of 2023. Tonix’s rare disease development portfolio includes TNX-2900 (intranasal potentiated oxytocin) for the treatment of Prader-Willi syndrome. TNX-2900 has been granted Orphan Drug designation by the FDA. Tonix’s immunology development portfolio includes biologics to address organ transplant rejection, autoimmunity and cancer, including TNX-1500, which is a humanized monoclonal antibody targeting CD40-ligand (CD40L or CD154) being developed for the prevention of allograft rejection and for the treatment of autoimmune diseases. A Phase 1 study of TNX-1500 is expected to be initiated in the third quarter of 2023. Tonix’s infectious disease pipeline includes TNX-801, a vaccine in development to prevent smallpox and mpox. TNX-801 also serves as the live virus vaccine platform or recombinant pox vaccine platform for other infectious diseases. The infectious disease development portfolio also includes TNX-3900 and TNX-4000, classes of broad-spectrum small molecule oral antivirals.

*Tonix’s product development candidates are investigational new drugs or biologics and have not been approved for any indication.

Tonix Medicines has contracted to acquire the Zembrace SymTouch and Tosymra registered trademarks. Intravail is a registered trademark of Aegis Therapeutics, LLC, a wholly owned subsidiary of Neurelis, Inc.

This press release and further information about Tonix can be found at www.tonixpharma.com.

Forward Looking Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimate,” “expect,” and “intend,” among others. These forward-looking statements are based on Tonix’s current expectations and actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks related to the failure to obtain FDA clearances or approvals and noncompliance with FDA regulations; risks related to the failure to successfully market any of our products; risks related to the timing and progress of clinical development of our product candidates; our need for additional financing; uncertainties of patent protection and litigation; uncertainties of government or third party payor reimbursement; limited research and development efforts and dependence upon third parties; and substantial competition. As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. Tonix does not undertake an obligation to update or revise any forward-looking statement. Investors should read the risk factors set forth in the Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the Securities and Exchange Commission (the “SEC”) on March 13, 2023, and periodic reports filed with the SEC on or after the date thereof. All of Tonix’s forward-looking statements are expressly qualified by all such risk factors and other cautionary statements. The information set forth herein speaks only as of the date thereof.

Investor Contact

Jessica Morris

Tonix Pharmaceuticals

investor.relations@tonixpharma.com

(862) 904-8182

Peter Vozzo

ICR Westwicke

peter.vozzo@westwicke.com

(443) 213-0505

Media Contact

Ben Shannon

ICR Westwicke

ben.shannon@westwicke.com

(919) 360-3039

Zembrace® SymTouch® (sumatriptan Injection): IMPORTANT SAFETY INFORMATION

Zembrace SymTouch (Zembrace) can cause serious side effects, including heart attack and other heart problems, which may lead to death. Stop use and get emergency help if you have any signs of a heart attack:

- discomfort in the center of your chest that lasts for more than a few minutes or goes away and comes back

- severe tightness, pain, pressure, or heaviness in your chest, throat, neck, or jaw

- pain or discomfort in your arms, back, neck, jaw or stomach

- shortness of breath with or without chest discomfort

- breaking out in a cold sweat

- nausea or vomiting

- feeling lightheaded

Zembrace is not for people with risk factors for heart disease (high blood pressure or cholesterol, smoking, overweight, diabetes, family history of heart disease) unless a heart exam shows no problem.

Do not use Zembrace if you have:

- history of heart problems

- narrowing of blood vessels to your legs, arms, stomach, or kidney (peripheral vascular disease)

- uncontrolled high blood pressure

- hemiplegic or basilar migraines. If you are not sure if you have these, ask your provider.

- had a stroke, transient ischemic attacks (TIAs), or problems with blood circulation

- severe liver problems

- taken any of the following medicines in the last 24 hours: almotriptan, eletriptan, frovatriptan, naratriptan, rizatriptan, ergotamines, dihydroergotamine.

- are taking certain antidepressants, known as monoamine oxidase (MAO)-A inhibitors or it has been 2 weeks or less since you stopped taking a MAO-A inhibitor. Ask your provider for a list of these medicines if you are not sure.

- an allergy to sumatriptan or any of the components of Zembrace

Tell your provider about all of your medical conditions and medicines you take, including vitamins and supplements.

Zembrace can cause dizziness, weakness, or drowsiness. If so, do not drive a car, use machinery, or do anything where you need to be alert.

Zembrace may cause serious side effects including:

- changes in color or sensation in your fingers and toes

- sudden or severe stomach pain, stomach pain after meals, weight loss, nausea or vomiting, constipation or diarrhea, bloody diarrhea, fever

- cramping and pain in your legs or hips; feeling of heaviness or tightness in your leg muscles; burning or aching pain in your feet or toes while resting; numbness, tingling, or weakness in your legs; cold feeling or color changes in one or both legs or feet

- increased blood pressure including a sudden severe increase even if you have no history of high blood pressure

- medication overuse headaches from using migraine medicine for 10 or more days each month. If your headaches get worse, call your provider.

- serotonin syndrome, a rare but serious problem that can happen in people using Zembrace, especially when used with anti-depressant medicines called SSRIs or SNRIs. Call your provider right away if you have: mental changes such as seeing things that are not there (hallucinations), agitation, or coma; fast heartbeat; changes in blood pressure; high body temperature; tight muscles; or trouble walking.

- hives (itchy bumps); swelling of your tongue, mouth, or throat

- seizures even in people who have never had seizures before

The most common side effects of Zembrace include: pain and redness at injection site; tingling or numbness in your fingers or toes; dizziness; warm, hot, burning feeling to your face (flushing); discomfort or stiffness in your neck; feeling weak, drowsy, or tired.

Tell your provider if you have any side effect that bothers you or does not go away. These are not all the possible side effects of Zembrace. For more information, ask your provider.

This is the most important information to know about Zembrace but is not comprehensive. For more information, talk to your provider and read the Patient Information and Instructions for Use. You can also visit www.upsher-smith.com or call 1-888-650-3789.

You are encouraged to report adverse effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch, or call 1-800-FDA-1088.

INDICATION AND USAGE

Zembrace is a prescription medicine used to treat acute migraine headaches with or without aura in adults who have been diagnosed with migraine.

Zembrace is not used to prevent migraines. It is not known if it is safe and effective in children under 18 years of age.

Tosymra® (sumatriptan nasal spray): IMPORTANT SAFETY INFORMATION

Tosymra can cause serious side effects, including heart attack and other heart problems, which may lead to death. Stop Tosymra and get emergency medical help if you have any signs of heart attack:

- discomfort in the center of your chest that lasts for more than a few minutes or goes away and comes back

- severe tightness, pain, pressure, or heaviness in your chest, throat, neck, or jaw

- pain or discomfort in your arms, back, neck, jaw, or stomach

- shortness of breath with or without chest discomfort

- breaking out in a cold sweat

- nausea or vomiting

- feeling lightheaded

Tosymra is not for people with risk factors for heart disease (high blood pressure or cholesterol, smoking, overweight, diabetes, family history of heart disease) unless a heart exam is done and shows no problem.

Do not use Tosymra if you have:

- history of heart problems

- narrowing of blood vessels to your legs, arms, stomach, or kidney (peripheral vascular disease)

- uncontrolled high blood pressure

- severe liver problems

- hemiplegic or basilar migraines. If you are not sure if you have these, ask your healthcare provider.

- had a stroke, transient ischemic attacks (TIAs), or problems with blood circulation

- taken any of the following medicines in the last 24 hours: almotriptan, eletriptan, frovatriptan, naratriptan, rizatriptan, ergotamines, or dihydroergotamine. Ask your provider if you are not sure if your medicine is listed above.

- are taking certain antidepressants, known as monoamine oxidase (MAO)-A inhibitors or it has been 2 weeks or less since you stopped taking a MAO-A inhibitor. Ask your provider for a list of these medicines if you are not sure.

- an allergy to sumatriptan or any ingredient in Tosymra

Tell your provider about all of your medical conditions and medicines you take, including vitamins and supplements.

Tosymra can cause dizziness, weakness, or drowsiness. If so, do not drive a car, use machinery, or do anything where you need to be alert.

Tosymra may cause serious side effects including:

- changes in color or sensation in your fingers and toes

- sudden or severe stomach pain, stomach pain after meals, weight loss, nausea or vomiting, constipation or diarrhea, bloody diarrhea, fever

- cramping and pain in your legs or hips, feeling of heaviness or tightness in your leg muscles, burning or aching pain in your feet or toes while resting, numbness, tingling, or weakness in your legs, cold feeling or color changes in one or both legs or feet

- increased blood pressure including a sudden severe increase even if you have no history of high blood pressure

- medication overuse headaches from using migraine medicine for 10 or more days each month. If your headaches get worse, call your provider.

- serotonin syndrome, a rare but serious problem that can happen in people using Tosymra, especially when used with anti-depressant medicines called SSRIs or SNRIs. Call your provider right away if you have: mental changes such as seeing things that are not there (hallucinations), agitation, or coma; fast heartbeat; changes in blood pressure; high body temperature; tight muscles; or trouble walking.

- hives (itchy bumps); swelling of your tongue, mouth, or throat

- seizures even in people who have never had seizures before

The most common side effects of Tosymra include: tingling, dizziness, feeling warm or hot, burning feeling, feeling of heaviness, feeling of pressure, flushing, feeling of tightness, numbness, application site (nasal) reactions, abnormal taste, and throat irritation.

Tell your provider if you have any side effect that bothers you or does not go away. These are not all the possible side effects of Tosymra. For more information, ask your provider.

This is the most important information to know about Tosymra but is not comprehensive. For more information, talk to your provider and read the Patient Information and Instructions for Use. You can also visit www.upsher-smith.com or call 1-888-650-3789.

You are encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch, or call 1-800-FDA-1088.

INDICATION AND USAGE

Tosymra is a prescription medicine used to treat acute migraine headaches with or without aura in adults.

Tosymra is not used to treat other types of headaches such as hemiplegic or basilar migraines or cluster headaches.

Tosymra is not used to prevent migraines. It is not known if Tosymra is safe and effective in children under 18 years of age.

Source: Tonix Pharmaceuticals Holding Corp.

Released July 31, 2023