Energy Sector’s Relative Strength Against The Market Is Looking Very Attractive

|

This article was republished with permission from Frank Talk, a CEO Blog by Frank Holmes of U.S. Global Investors (GROW). Find more of Frank’s articles here – Originally published August 29, 2022. |

The University of Texas at Austin (UT), just a couple of hours up the road from our headquarters in San Antonio, may soon unseat Harvard as the wealthiest school in the U.S. How has it managed to do this? In a word: Oil.

At a time when large sovereign wealth funds are divesting from fossil fuels, and ESG (environmental, social and corporate goverance) investing has gone mainstream, the UT System has been the longtime owner and manager of 2.1 million acres of mineral-rich land, scattered across West Texas, that it leases out to as many as 250 producers, including ConocoPhillips.

Thanks to higher oil prices, the mineral rights to the land generate roughly $6 million every day, according to Bloomberg.

The UT System’s decision to continue participating in oil is in keeping with Texas’s close ties to the fossil fuels industry. The state produces more oil and gas (and wind power) than any other, a fact that policymakers are eager to protect. Last week, Texas moved to restrict state pension funds from investing in BlackRock, UBS Group, Credit Suisse and a number of other financial institutions that have been found to be “hostile” toward the energy sector.

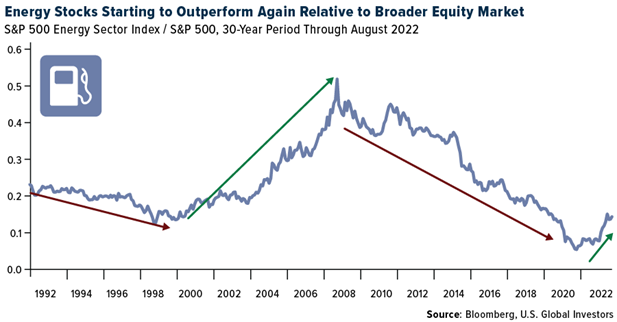

But it’s more than just tradition. UT’s oil investments have been incredibly profitable and, by most accounts, will continue to be so as long as the energy crisis deepens and inflationary pressures keep prices elevated. The S&P 500 Energy Index is by far the top performing sector for the year, up nearly 50%, compared to the broader market, which is off by 12%.

A New Cycle Of Outperformance?

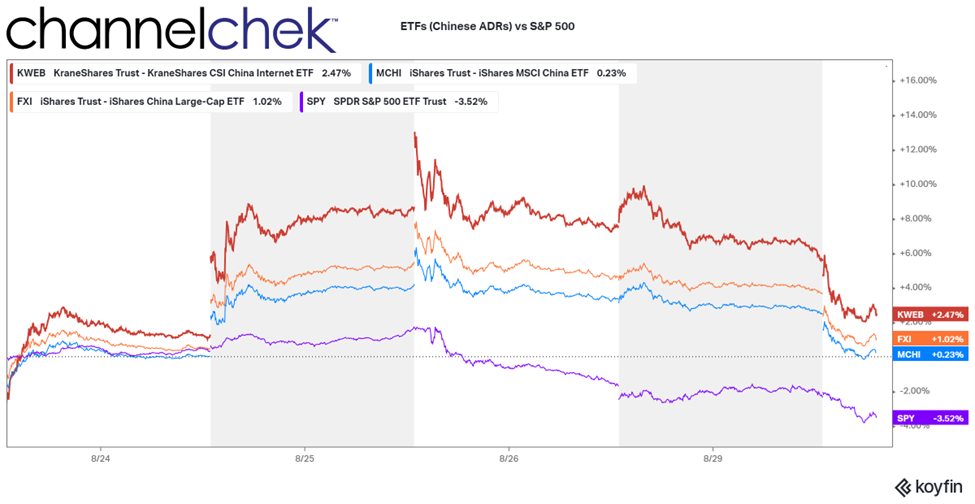

Looking ahead, energy stocks appear to be setting up for a new cycle of outperformance relative to the market. Take a look at the chart below, which shows the long-term ratio between the energy index and S&P 500. Technically, this may be the most attractive time to invest in energy since at least the beginning of the century.

Warren Buffett seems to agree. His company, Berkshire Hathaway, recently received regulatory approval to buy up to half of Houston-based Occidental Petroleum (OXY).

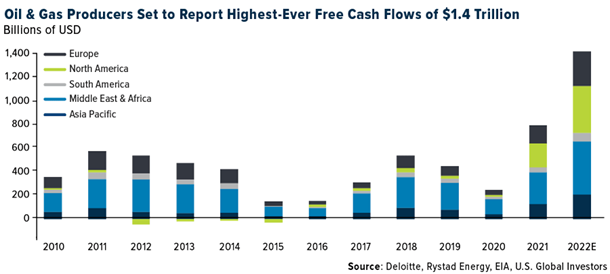

The disruptions of the past two years are believed to have triggered a readjustment in the energy market. In a just-released

report, Deloitte projects that oil and gas producers could report the highest-ever free cash flow (FCF), as much as $1.4 trillion, in 2022. The industry could also become debt-free by 2024.

Although oil prices in 2022 have been equivalent to those in 2013 and 2014, cash flows are currently three times higher thanks to capital expenditure discipline after years of underinvestment, Deloitte analysts say. U.S. shale producers, which generated negative cash flows in nine out of the last 10 years, are expected to report record FCF of $600 billion.

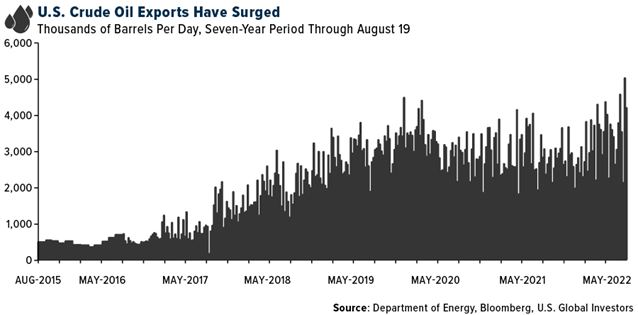

This comes as the U.S. is set to export a record amount of crude oil this year and next as the country captures market share away from Russia. Since Congress lifted the 40-year-old oil export ban in 2015, weekly exports have steadily risen above 4 million barrels a day, but earlier this month, exports exceeded 5 million barrels for the first time. According to Bloomberg, U.S. suppliers will likely be able to hold on to the increased market share since producers in other regions, including those in the North Sea and West Africa, have not been growing output as rapidly as American companies have.

California Bans Gas-Powered Vehicles By 2035. Will The

Infrastructure Be Ready By Then?

The backdrop to all of this, of course, is the expansion of ESG-minded investing and global financing of alternative fuels and renewable energy sources. Last week, California became the first state to approve a ban on the sale of new gas-powered vehicles by 2035 in favor of electric vehicles (EVs). This is a huge opportunity, as investment in the state’s notoriously spotty power grid will need to increase significantly.

New, more reliable EV charging stations will also need to be installed. Earlier this month, J.D. Power announced that Americans’ satisfaction in charging infrastructure is declining due to a growing number of “

inadequate”

and “non-functioning stations.”

“This lack of progress points to the need for improvement as EVs gain wider consumer acceptance because the shortage of public charging availability is the number one reason vehicle shoppers reject EVs,” the report reads.

Airlines And Shipping Companies Seeking Alternative Fuels

The airlines and container shipping industries are also seeking ways to achieve net-zero carbon emissions by 2050. One method being used by airlines is sustainable aviation fuel (SAF), which reportedly reduces CO2 emissions by as much as 80%. The liquid fuel is normally produced from a number of sources, including waste oil and fats, municipal waste and non-food crops.

SAF is currently much more expensive to make than traditional jet fuel, but several companies and groups are leading the effort to scale up the technology. Boeing is establishing a facility in Japan to begin researching and developing SAF, while World Energy, a Boston-based low-carbon solutions provider, is planning to convert a refinery in Houston to an SAF plant. Earlier this month, Alaska Airlines announced it had finalized an agreement to buy 185 million gallons of SAF from biofuel company Gevo over five years starting in 2026. Alaska also has announced a collaboration between Microsoft and start-up firm Twelve to advance production of E-Jet, an even more sustainable fuel that’s made from carbon dioxide.

As for shipping, wind propulsion is being touted as the “most impactful emissions reduction technology.” Today, 21 large ocean-going vessels already have wind-assist systems installed, according to the International Windship Association (IWSA), and by the end of 2023, this number could jump to nearly 50. Some of the biggest names in maritime shipping are involved in investing millions of dollars into wind

propulsion technology, including Cargill, Maersk and Mitsui. The IWSA calls the 2020s the “Decade of Wind Propulsion.”

Suggested Content

Many Reasons to Remain Bullish on the Energy Sector

|

Energy and Global Fundamentals Make a Good Case for Owning Western Uranium Stocks

|

Is the Strong Dollar Creating a Buying Opportunity for Gold?

|

Natural Gas Prices May Continue to Explode Through Winter

|

Source

Energy

Sector’s Relative Strength Against The Market Is Looking Very Attractive

US

Global Investors Disclaimer

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/22): ConocoPhillips, Occidental Petroleum Corp., The Boeing Group Co., Alaska Air Group Inc., AP Moller-Maersk A/S, Mitsui OSK Lines Ltd.

The S&P 500 Energy Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Stay up to date. Follow us:

|