Noble Capital Markets Media Sector Review – Q2 2022

INTERNET AND DIGITAL MEDIA COMMENTARY

A Third Consecutive Quarter of Declines for Internet and Digital Media Stocks

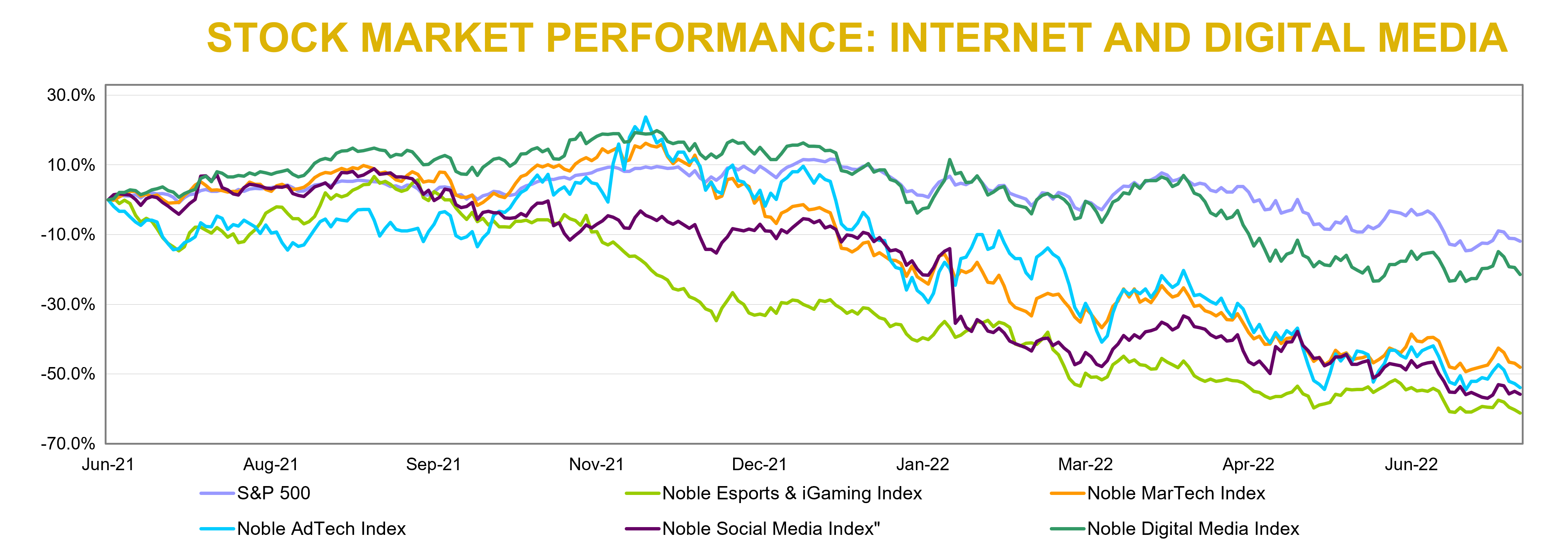

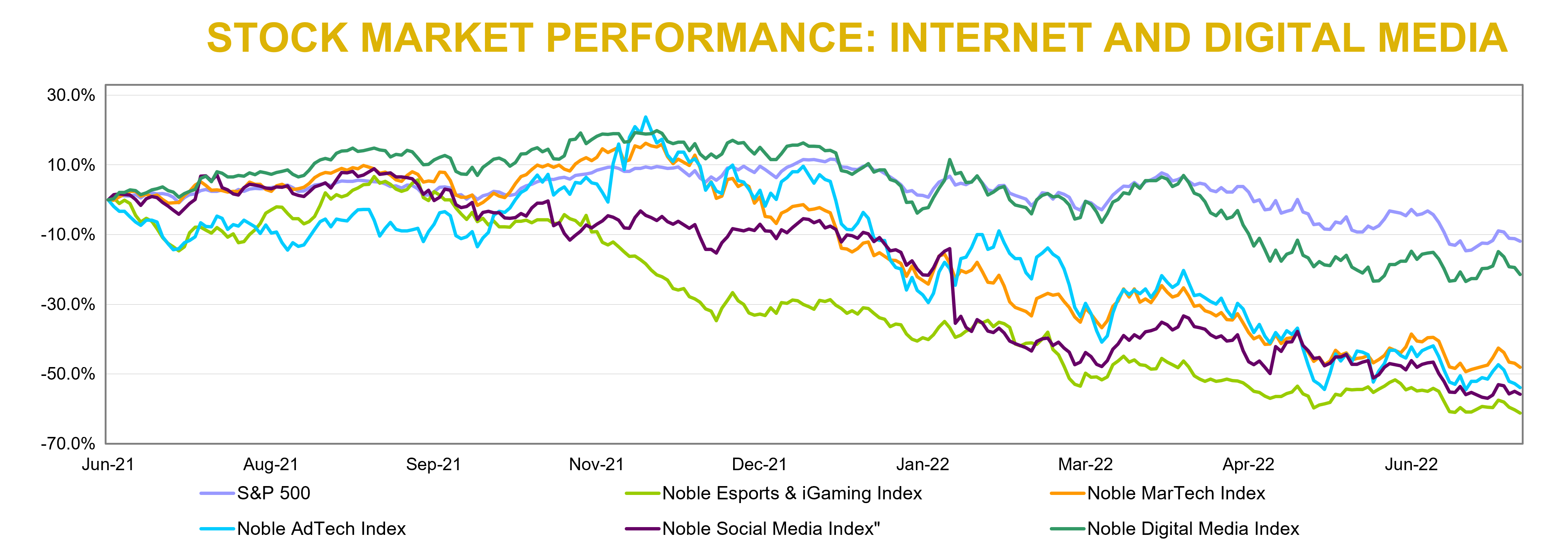

Last quarter we wrote that despite performing well overall in 2021, Internet and Digital Media stocks performed poorly in the fourth quarter of 2021 and again in the first quarter of 2022. Unfortunately, that trend continued in the second quarter of 2022. None of Noble’s Internet and Digital Media Indices outperformed the broader market, which we define as the S&P 500. The S&P 500 Index decreased by 16% in 2Q 2022, which was better than Noble’s Digital Media Index (-24%), MarTech Index (-28%), Esports & iGaming Index (-29%), Social Media Index (-30%), and AdTech Index (-39%).

The theme from last quarter was that high flying stocks got “their wings clipped”, in which we noted that the tech stocks with the highest multiples were the worst performers in the sector. What’s interesting to note this quarter is that not even the FAANG stocks were immune to this trend in 2Q 2022. Last quarter, only two of the FAANG stocks posted double digit declines. This quarter, all of them did: Google (GOOGL) was down 22%, Apple (AAPL) was down 22%, Facebook was down 27%, Amazon was down 35%, and Netflix was down 53%).

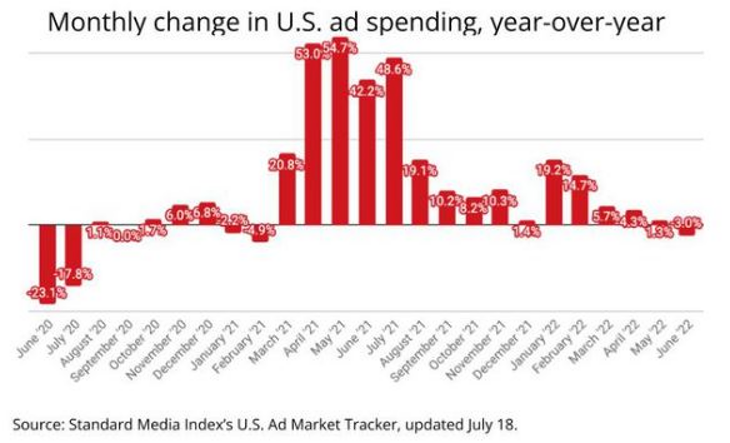

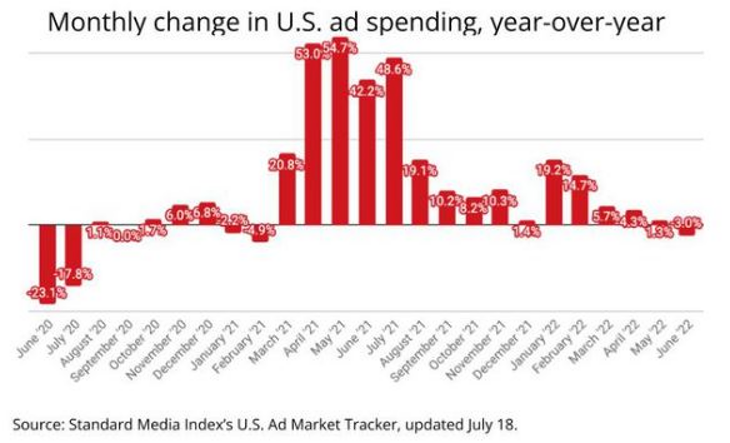

It is not surprising that AdTech stocks were the worst performers in 2Q 2002. Advertising spend is a discretionary expenditure and with the backdrop of macro headwinds that include inflation, rising interest rates, war in Ukraine and supply chain issues, investors decided to shoot first and ask questions later. We believe advertising held up well in the months of April and May but began to see a slowdown, particularly in national advertising, in June. Standard Media Index, which tracks national advertising across all media, reported that national ad spending in June decreased by 3% year-over-year, the first year-over-year decline in national ad spend since February 2021 (see the chart on the top of page 2). Again, online advertising held up relatively well, with traditional media ad spend down 17%, while digital ad spending increased 9%.

NOBLE Capital Markets, Inc. is a FINRA registered broker/dealer. Member – SIPC (Securities Investor Protection Corporation). Refer to the segment analysis part of the Newsletter to see the components of NOBLE Media Segment Indexes

Nevertheless, recent data suggests that online ad spending growth has slowed, which was confirmed by SNAP’s second quarter earnings call in which they noted that company’s revenue growth decreased from 38% in 1Q to 13% in 2Q. More concerning was that the company’s 3Q revenues are pacing flat with a year ago. Twitter’s (TWTR) 2Q results seem to have confirmed the ad spend slowdown. Twitter’s 16% revenue growth in 1Q slowed to -1% in 2Q. Twitter’s press release also noted the impact that a stronger dollar had on its revenue growth. A stronger dollar shaved 400 bps off Twitter’s 2Q revenue growth.

Perhaps more concerning for Snap and Twitter was that expense growth significantly exceeded revenue growth. Snap’s operating expenses increased by 27% resulting in a 94% decrease in adjusted EBITDA (to $7M from $117M in 2Q 2021) as margins fell from 12% in 2Q 2021 to 1% in 2Q 2022. Twitter’s results were little better: expenses increased by 26%, resulting in an adjusted EBITDA decrease of 68% (to $112M from $343M in 2Q 2021) as margins fell to 10% from 29% in 2Q 2021.

We expect more companies to report moderating revenue growth and those that rein in expense growth ought to outperform those that face significant margin compression.

2Q 2022 M&A Holds Up Well Despite Macro Headwinds

One might expect that given the very difficult macro headwinds that companies faced in the second quarter, that deal activity would have fallen off dramatically relative to the first quarter or the year ago period. However, this did not happen, and M&A held up well in the second quarter. We tracked 169 deals in the second quarter of 2022 in the TMT sectors we follow, a 5% decrease compared to the first quarter of 2022, when we tracked 177 deals, and 10% higher than 2Q 2021, when we tracked 153 transactions. We also did not see a material slowdown in deal activity within the second quarter, but rather the opposite: a pick-up in deal activity, with 49 deals announced in April, 57 in May and 63 in June. This is fairly unusual as macro headwinds typically create uncertainty, particularly with future forecasts, which tends to have a dampening effect on M&A transactions.

The dollar value of the deals we tracked in 2Q 2022 decreased sequentially (by 14% to $93.6 billion, down from $108.4 billion in 1Q 2022), but increased year-over-year (by 185% from $32.9 billion in 2Q 2021). The deal value for 2Q 2022 should come with a caveat, as the largest deal in 2Q 2022 was Elon Musk’s $46 billion acquisition of Twitter, which he subsequently backed out of. There is a chance that Mr. Musk could be forced to close on this acquisition, depending upon a judge’s decision. If we take the largest 2Q 2022 deal out of the numbers, then 2Q 2022 deal value would have fallen by 56% sequentially but still be up 43% versus the year ago period.

From a deal volume perspective, the most active sectors we tracked were Marketing Tech (49 deals), Digital Content (43 deals) and Agency & Analytics (32 deals). From a deal value perspective, the most active sectors were Social Media ($48.5B including the Twitter deal or $2.1B if you exclude it), Digital Content ($18.6B), Marketing Tech ($10.6B), and Information ($9.8B).

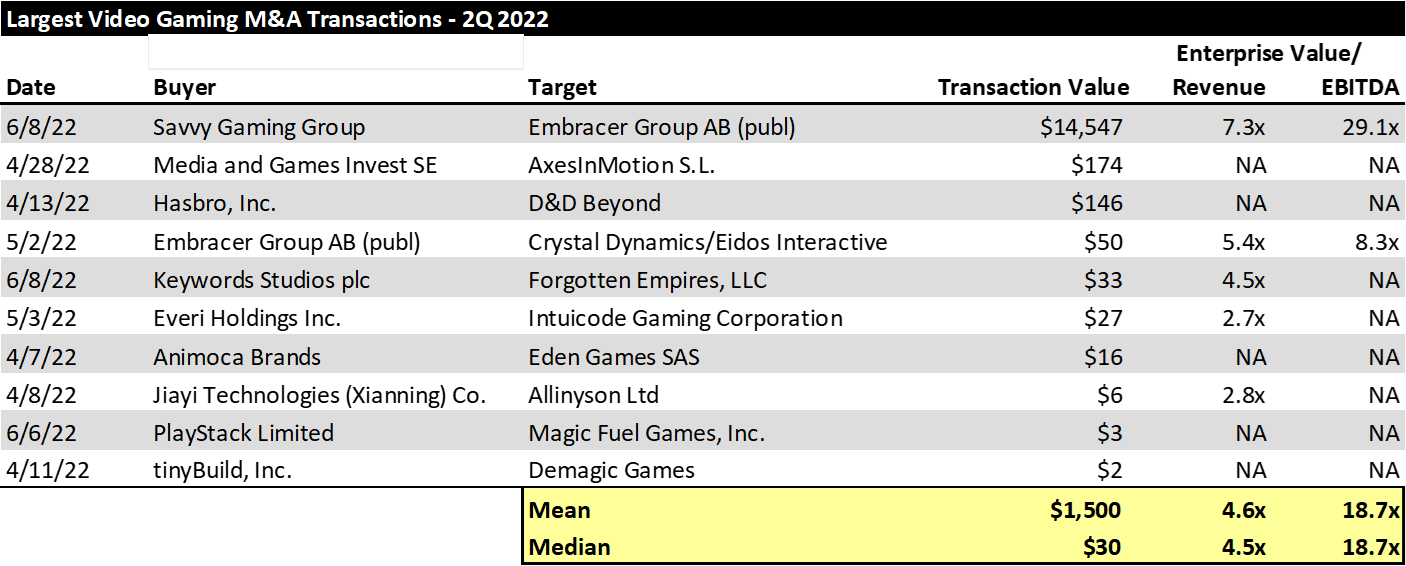

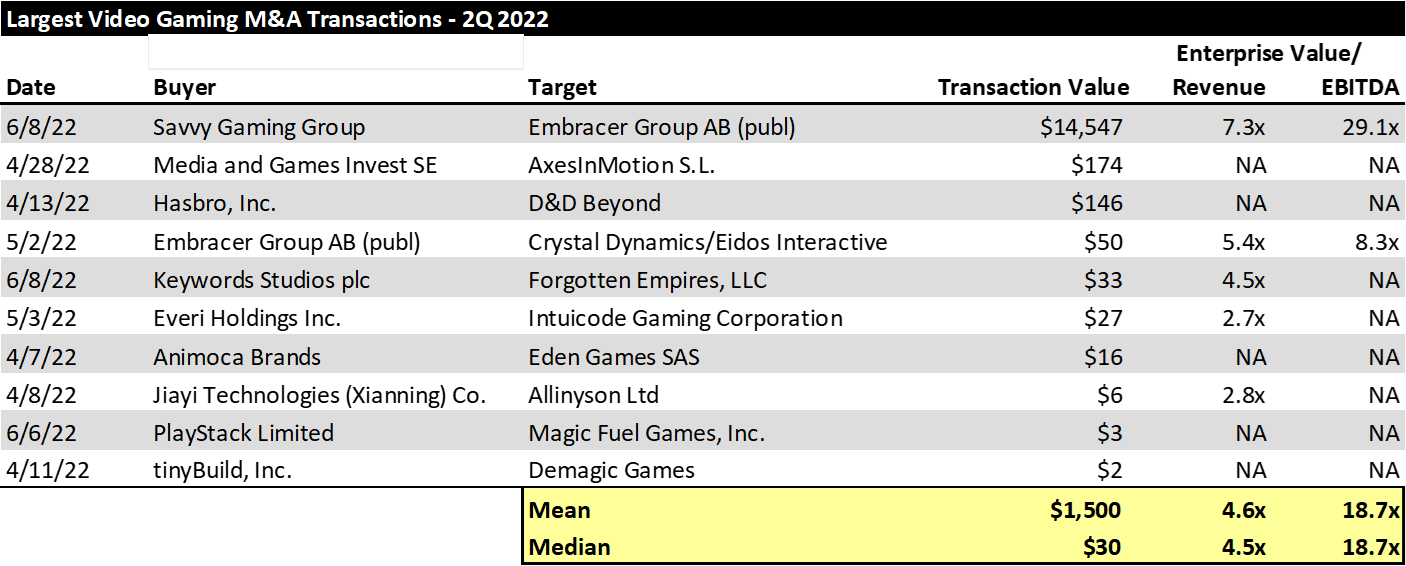

Of the $18.6B in announced transactions in the Digital Content sector, $15B of this amount was attributable to the video gaming subsector, with $15 billion of announced deals in the second quarter. The largest transaction was the $14.5B announced acquisition of serial acquirer Enbracer Group by Savvy Gaming Group, which is backed by the Public Investment Fund of Saudi Arabia. A look at the largest Gaming M&A transactions of 2Q 2022 is provided in the chart below.

On the other end of the spectrum, there were surprisingly few M&A transactions in the AdTech sector, with just 4 announced transactions, down from 15 in the first quarter of 2022. Deal value also fell dramatcially, from $1.5B in the first quarter of 2022 to just $100 million in the second quarter.

Another hot sector that has come off the boil is the podcasting space. During the second quarter of 2022, the only notable M&A transaction in podcasting was SiriusXM’s $150 million acquisition of Team Coco Digital. Despite a lack of podcast M&A transactions, audio remained a key area of focus in M&A. Examples include the reverse merger between the SPAC I2PO Societe anonyme and streaming audio company Deezer for $1.2 billion. Audio focused transactions also include Spotify’s acquisition of AI voice generation company Sonantic Ltd., and SouncCloud’s acquisition of AI enabled hit prediction software company Musiio.

We expect M&A in the Internet and Digital Media sector to moderate in the coming months given macroeconomic headwinds and the accompanying increased uncertainty around financial forecasts.

Esports & iGaming

The following is an excerpt from a recent note by Noble’s Media Equity Research Analyst Michael Kupinski

What Will The Industry Look Like?

Once the darlings of Wall Street the industry has taken a meaningful turn as investors shun developmental industries, like Esports. Many companies in this sector are in survival mode, shuttering money losing operations, seeking alternative financing options, and/or selling off assets. Companies that Noble provides equity research coverage on include Esports Entertainment, Engine Media and Motorsport Games. In the case of Esports Entertainment, the shares are down 92% over the past year. Motorsport Games is down 95%, and, Engine Media is down 81% in the comparable time frame.

Notably, each of those companies has a potential path to survive and create value to shareholders. In the case of Esports, there are assets that the company could sell, which generate cash flow. The risk is that it may not be able to sell them for what the company paid for them. Engine Media seems to be on a more favorable path at this point. The company quickly sold off assets and shuttered money losing businesses. As such, the company appears to have a pathway toward cash flow break even, expected by the third quarter.

We view the GAME shares as a high risk/high reward prospect. Motorsport Games appears to us to be the most intriguing speculative investment. The company has multiple pathways to create value. It could time its game releases to generate positive cash flow, which it can then use to invest in launching additional games. In addition, it could seek financing from its parent company to fund its game development through launch. As such, Motorsport is among our favored speculative investment in the space.

Finally, we recommend the shares of Codere Online Luxembourg in the iGaming space. The company has cash to develop its iGaming business in developing countries. It could back off of the development should market conditions change. As such, we believe that the company will survive and possibly become a leader in its respective markets as companies with less financial flexibility exit markets.

TRADITIONAL MEDIA COMMENTARY

The following is an excerpt from a recent note by Noble’s Media Equity Research Analyst Michael Kupinski

Overview

How Bad Will It Be?

The advertising recession may already be here. Based on Standard Media Index’s U.S. Ad Market Tracker (Ad Tracker), the U.S. advertising market contracted 3% in June, illustrated by Figure #1 Ad Trends. This was the first decline in the Index since February 2021. Notably, the contraction in advertising was felt by traditional media, which declined 16.6%, while Digital Media increased 8.6% in June. A bifurcated market? The advertising decline was among the U.S. largest, top 10 advertisers. Ad Tracker indicated that the other categories expanded a modest 1.2% in June. What does the data tell us? For one, economically sensitive National advertisers are anticipating a general economic downturn given a rising interest rate environment. National advertising was very weak, down in excess of 20% for most traditional mediums. In our view, advertising weakness will disproportionately be felt in the major U.S. markets where the economy is largely impacted. It is possible that local advertising may still growing, albeit modestly and more likely in smaller markets. Traditional mediums with a large digital component likely will perform better, if not well, compared with industry peers. We believe that advertising pacings in July are likely to be similar to that of the weak advertising environment in June, driven by continued weak National advertising.

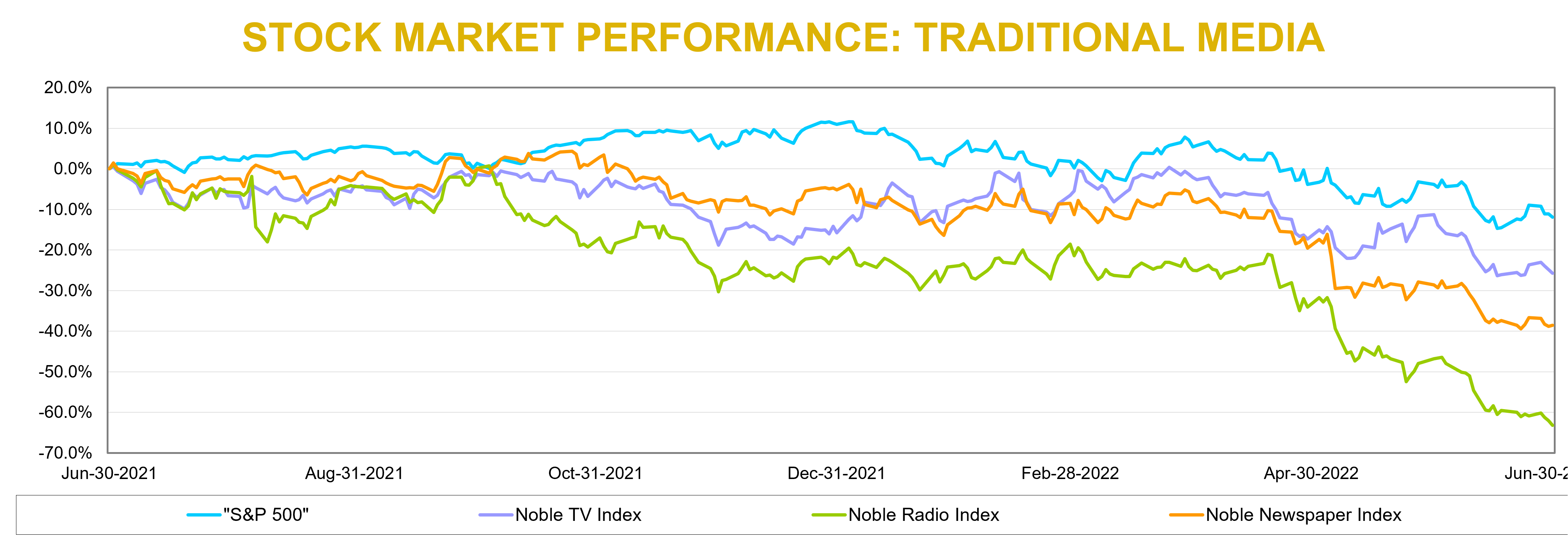

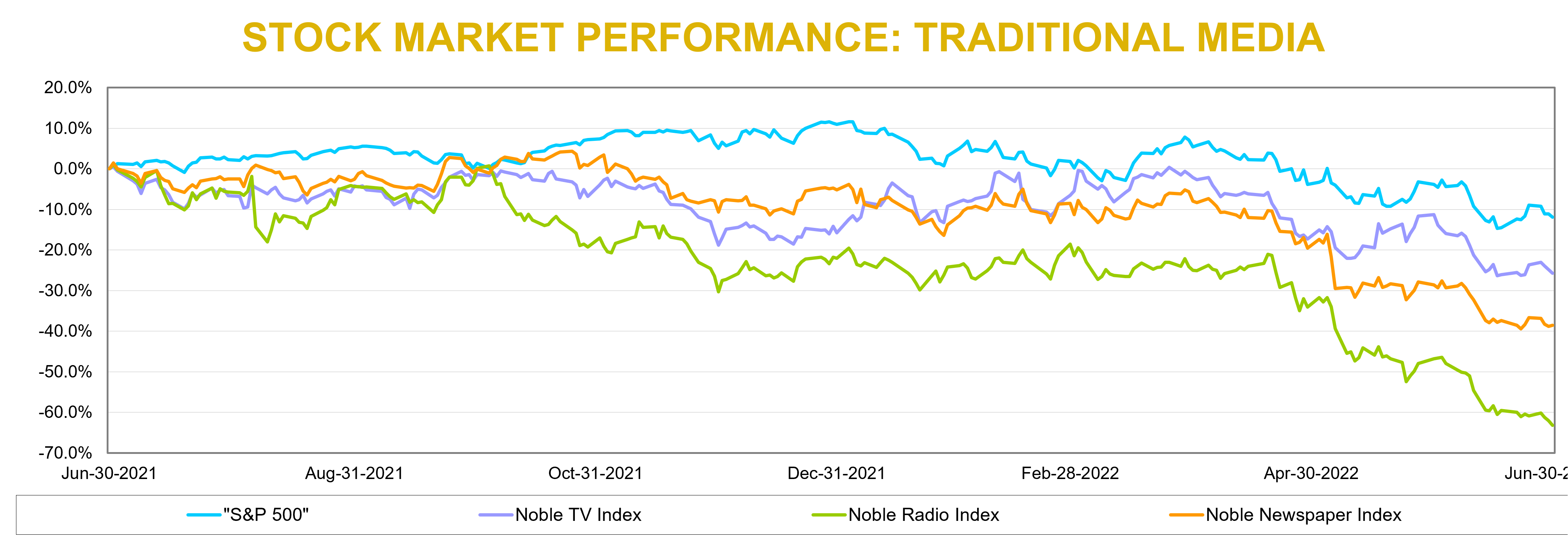

The media stocks seem to have already anticipated the somber news. Media stocks as a group over the past 12 months are down 30% to 40%, significantly under performing the general market decline of 20.4% as measured by the S&P 500 Index in the comparable time frame. While Digital fundamentals appear more favorable, the digital stocks did not fare well. The average Digital Media stock, which includes Digital Ad Tech, is down 35% over the past 12 months.

Are the stocks oversold? We think so. In our view, while second quarter results may miss expectations, given the softness in advertising in June, we believe that the results may be better than most investors fear. Most companies guided toward a softer second quarter from the first quarter. As such, most investors expected moderation in revenue in the quarter. With the 30% to 40% decline in stocks over the past year, we believe that investors have factored in a severe economic downturn. The second quarter advertising environment does not appear to reflect that type of situation. While the third quarter is likely to start off weak, a follow through from June into July and August, we believe that advertising should improve in August. Media fundamentals in the second half of the year should be buoyed by the influx of Political advertising, which has already begun in some markets. In addition, Digital advertising appears to be doing well. And, to some degree, advertisers may be pushing budgets toward the important Holiday season. Macro economic trends may even force advertisers to advertise more heavily into back to school and the important Holiday seasons. In addition, the Fed typically is not as aggressive in raising rates in advance of elections.

It is possible that the Fed will read the recent economic weakness as a signal to be less aggressive on rate increases. Such a move would buoy the general stock market, in our view. Consequently, there may even be an improvement in advertising toward the end of the third quarter and into the fourth quarter. This scenario would suggest that there could be a tradeable bounce in media stocks.

What should investors do? In our view, media investors should take an accumulation approach. Historically, the best time to buy media stocks has been in the midst of an economic downturn. The mid-point of that downturn is difficult to predict. As such, investors should be selective and take an accumulation approach. We encourage investors to focus on companies that have large digital segments, have diversified revenue streams that are not advertising sensitive, and on companies that have the financial capability to weather an economic downturn. Some of our favorites include: Entravision (EVC), E.W. Scripps (SSP), and Townsquare Media (TSQ). Additional companies are highlighted later in this report. 7

Broadcast Television

Will Television Fare Better This Time?

As a group, Broadcast TV stocks dropped 22.6% in Q2, in what was a reversal from Q1 when the industry climbed a solid 10%. It appears the broad economic implications of prolonged supply chain disruptions, rising inflation, and concerns over an economic downturn in a rising interest rate environment curbed investor appetite. Larger cap stocks, such as Nexstar (NXST) performed better, down 14%, while the shares of E.W. Scripps (SSP) underperformed, down 40%, in the latest quarter. It is not surprising that the stocks are underperforming, but the level of decline is notable. It is typical that advertising driven media stocks underperform in a rising interest rate environment due to the adverse impact on economically sensitive advertising. But, television has diversified revenue streams, with retransmission revenue accounting for a large portion of revenue. We believe that investors have not differentiated among the TV stocks. In the case of E.W. Scripps, the company is expected to benefit from strong political advertising in the second half of this year. In addition, 75% of its subscribers in 2023 come up for renewal. Some of those subscribers are at very low rates. Based on our estimates, roughly 2.5 million Comcast subscribers are at $2.20 per sub. Based on current market prices, we expect Scripp’s rates will rise comfortably above $3.00 per sub. We believe that the high margin political advertising and the lift from retrans next year will allow the company to pare down debt leverage, which appears to be a key concern for investors.

But, one stock stands out to us, Entravision. This company has completely transformed from a traditional broadcast company to a Digital Media powerhouse. Digital now represents roughly 80% of total company revenues. While it is lower margin business, it is rapidly growing. The company represents Facebook, Spotify and TikTok is some of the fastest growing markets. Notably, the company recently announced that it has expanded its relationship with Meta to be the Facebook rep in Honduras and El Salvador, now representing 11 countries in Latin America. We believe that the company will report better than consensus estimates for the second quarter and recently raised our full year 2022 adj. EBITDA expectations. With the shares trading slightly above 4 times cash flow, we believe that there is limited downside risk and a favorable risk/reward relationship.

Broadcast Radio

All Is Not Lost

Similar to the TV industry, radio stocks reversed course in Q2, falling 34% after modest 2% gains in Q1. While all media stocks struggled in the latest quarter, none have performed more poorly than the Radio sector. Noble’s Radio index is down 63% over the past 12 months, as shown in the chart at the bottom of page 13. This market cap weighted index reflected the performance of the largest cap companies, including Audacy and iHeart Media, which are down 81% and 69%, respectively. Much of the pain in those stocks was delivered in the latest quarter, with Audacy down 67% and iHeart down 58%. Both of those stocks were adversely affected by a downgrade by a Wall Street firm, given the unfavorable outlook for national advertising, and relatively high debt leverage, heading into a possible economic downturn. As investors shunned radio stocks, they did not appear to differentiate among the players in the industry. Outside of Audacy and iHeart Media, the rest of the radio stocks did not fare well either. The rest of the radio stocks were in the range of down 22% (Cumulus Media) to down 27% (Beasley Broadcast) on the low end to down 36% (Townsquare Media) and down 37% (Salem Media) on the high end.

Investors should take note. Townsquare Media is largely a digital media company, with 51% of its revenues derived from its fast- growing digital media businesses. The company demonstrated that this business is largely recession resistant, growing revenues through the depths of the Covid pandemic. In addition, the company operates in small market radio, which tends not to suffer from the vagaries of the economic cycle. Salem Media is somewhat similar in that it has a diversified revenue stream as well. In addition, over 30% of its radio business is from a very stable block programming business. Finally, Beasley Broadcasting has recently bolstered its digital development with an acquisition that allows the company to scale its digital business. Management recently indicated that it plans for digital to account for 40% of its total company revenues in a short 2 years. Figure #10 Radio Comparables highlight the recession type valuations that many of the stocks currently trade.

DOWNLOAD THE FULL REPORT (PDF)

View the PDF version for segment analysis, M&A activity, and more…

Noble Capital Markets Media Newsletter Q2 2022

This newsletter was prepared and provided by Noble Capital Markets, Inc. For any questions and/or requests regarding this news letter, please contact >Chris Ensley

DISCLAIMER

All statements or opinions contained herein that include the words “ we”,“ or “ are solely the responsibility of NOBLE Capital Markets, Inc and do not necessarily reflect statements or opinions expressed by any person or party affiliated with companies mentioned in this report Any opinions expressed herein are subject to change without notice All information provided herein is based on public and non public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on their own appraisal of the implications and risks of such decision This publication is intended for information purposes only and shall not constitute an offer to buy/ sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice Past performance is not indicative of future results.

Please refer to the above PDF for a complete list of disclaimers pertaining to this newsletter